Camera Accessories Market Size

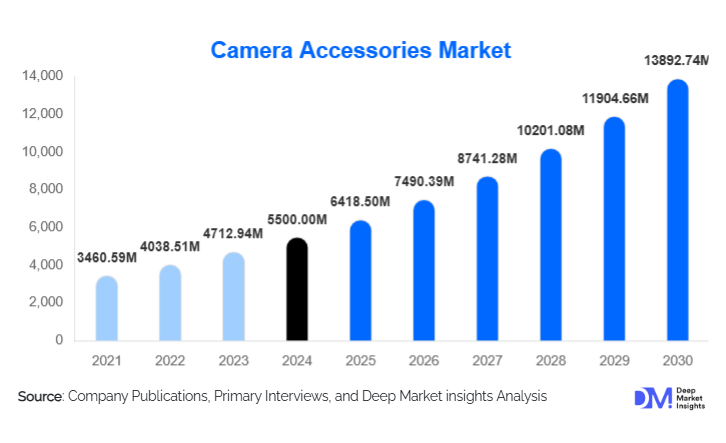

According to Deep Market Insights, the global Camera Accessories Market size was valued at USD 5,500 million in 2024 and is projected to grow from USD 6,418.5 million in 2025 to reach USD 13,892.74 million by 2030, expanding at a CAGR of 16.70% during the forecast period (2025–2030). The camera accessories market growth is primarily driven by the rising popularity of digital content creation, growing penetration of mirrorless cameras, and the expanding ecosystem of online retail and e-commerce platforms offering specialized camera gear worldwide.

Key Market Insights

- Camera accessories are evolving toward connected and hybrid ecosystems, integrating wireless control, modularity, and smart compatibility across devices such as cameras, drones, and smartphones.

- Lenses and filters dominate the market, accounting for roughly 25% of total revenue in 2024, driven by demand for enhanced image quality and brand-specific lens ecosystems.

- Asia-Pacific is the fastest-growing regional market, with an estimated 30% global share in 2024 and strong growth in China, India, and Japan due to the expanding creator economy.

- Online retail channels now contribute over 40% of global accessory sales, propelled by influencer marketing, product reviews, and direct brand-to-consumer models.

- Professional and content creator segments are driving premiumization, demanding durable, lightweight, and portable accessories for multi-platform content production.

- Technological integration, including AI-assisted gimbals, wireless power systems, and carbon-fiber builds, is reshaping the competitive landscape and user expectations.

What are the latest trends in the camera accessories market?

Creator Economy and Content-Driven Accessory Demand

The explosive rise of the global creator economy has significantly influenced the camera accessories landscape. Vloggers, live-streamers, and social media influencers now represent a substantial share of end-users, demanding high-quality, compact accessories that support mobile workflows. Accessories such as portable lighting kits, smartphone-compatible rigs, and travel-friendly gimbals are witnessing rapid adoption. Brands are increasingly targeting this segment with modular systems that integrate seamlessly between smartphones, mirrorless cameras, and drones. This trend has broadened the market beyond professional photographers, positioning accessories as lifestyle and productivity tools for digital creators.

Technological Integration and Smart Accessories

Manufacturers are embedding AI, wireless communication, and automation into accessories to enhance functionality and ease of use. Smart gimbals with subject tracking, Bluetooth-enabled remotes, and automated lighting systems are entering mainstream adoption. The convergence of photography and videography is driving innovations in power accessories, lighting, and stabilization solutions. Carbon-fiber tripods, magnetic mounting systems, and adaptive lens filters exemplify how technology is being applied to increase portability and performance. These innovations not only appeal to professionals but also open new segments among advanced hobbyists and travel photographers.

What are the key drivers in the camera accessories market?

Rising Demand for High-Quality Imaging and Versatility

With the rapid evolution of mirrorless and hybrid camera systems, photographers and videographers are investing in lenses, stabilization gear, and lighting solutions that expand the creative potential of their devices. Enhanced optical performance, better mobility, and cross-platform usability are prompting accessory purchases across both professional and consumer tiers. Continuous product launches from brands like Canon, Sony, and Nikon are sustaining growth in this category.

Expansion of Online Retail Channels

Online retail platforms have revolutionized the camera accessories market by improving accessibility and visibility. E-commerce platforms and brand-owned web stores allow users to compare specifications, reviews, and prices across regions. Subscription-based and D2C (direct-to-consumer) models are gaining popularity, particularly for emerging brands offering niche products. The convenience of online availability is accelerating accessory sales globally, particularly in emerging markets.

Growth of Content Creation and Hybrid Media Applications

The shift toward short-form video, streaming, and influencer-led media is fueling accessory demand for diverse camera types, from DSLRs to smartphones. The popularity of platforms like YouTube, TikTok, and Instagram Reels has transformed cameras into multi-purpose content tools, creating opportunities for brands to offer integrated kits, lighting systems, and portable rigs designed for these workflows.

What are the restraints for the global market?

Substitution by Smartphone Ecosystems

The increasing sophistication of smartphone cameras, offering advanced stabilization, AI-driven image correction, and built-in lenses, has reduced the necessity for some dedicated camera accessories among casual users. This substitution effect has slowed demand in the entry-level accessory segment and intensified competition across mid-tier price brackets.

Price Pressure and Short Product Life Cycles

With fast-paced innovation and growing competition from low-cost manufacturers, especially in Asia, profit margins are under pressure. Accessory makers must continuously update product lines to stay compatible with new camera systems, leading to shorter lifecycles and higher R&D costs. These factors pose challenges for smaller firms competing with established brands that maintain proprietary ecosystems.

What are the key opportunities in the camera accessories industry?

Emerging Markets and Local Manufacturing

Rapid digital adoption in countries like India, Indonesia, and Vietnam presents a major opportunity. Rising disposable incomes and government initiatives such as “Make in India” are encouraging domestic production and reducing import dependency. Local assembly of accessories like tripods, bags, and lighting systems provides cost advantages and export potential. Companies expanding distribution networks in these regions can capture significant market share.

Integration of Smart and Sustainable Technologies

There is growing demand for accessories built from sustainable, lightweight materials like recycled plastics and carbon composites. Additionally, integrating wireless power transmission, smart controls, and AI-assisted automation creates differentiation in premium segments. Smart accessories capable of real-time environmental sensing, automatic lighting adjustment, and app-based configuration are expected to drive the next phase of innovation.

Growth in Professional and Institutional Demand

Studios, broadcasters, and educational institutions upgrading to high-resolution and hybrid setups are purchasing accessories for extended applications such as live streaming, virtual production, and training. The professional segment’s need for reliable, durable, and brand-compatible gear creates high-value opportunities for manufacturers offering bundled solutions and service contracts.

Product Type Insights

Lenses and filters lead the market with approximately 25% share in 2024, as photographers prioritize optical upgrades to enhance image quality. The tripods and stabilization systems segment is growing rapidly, fueled by demand for gimbals and portable rigs among vloggers. Lighting accessories, especially compact LED systems, are also expanding as hybrid shooting gains momentum. Power accessories such as batteries and chargers remain essential, particularly with longer shooting sessions and location-based production. Modular and eco-friendly product designs are emerging across all categories, meeting consumer expectations for sustainability and portability.

Distribution Channel Insights

Online retail dominates the distribution landscape, accounting for roughly 40% of sales in 2024. E-commerce platforms like Amazon, B&H Photo, and Adorama, along with brand-specific web stores, enable direct engagement with consumers. Offline retail remains vital for premium purchases, offering experiential buying and technical consultations. Meanwhile, institutional channels, targeting professional studios, rental houses, and corporate clients, represent a smaller yet high-value portion of total revenue.

End-User Insights

Content creators and influencers represent the fastest-growing end-user segment, contributing nearly 20% of the market in 2024. Their demand for portable, user-friendly, and affordable gear is reshaping product development strategies. Professional photographers and videographers remain the largest revenue contributors, particularly in the premium accessory segment. Hobbyists and travelers also drive consistent demand for entry-level and mid-range products, while rental houses and educational institutions support steady replacement cycles in the professional ecosystem.

| By Product Type | By Camera Type Compatibility | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, commanding approximately 35% of global revenue in 2024. The United States leads due to a strong professional photography base, growing influencer culture, and robust retail infrastructure. Demand for high-end accessories such as lenses, lighting systems, and stabilization rigs is sustained by professionals and prosumers alike.

Europe

Europe holds around a 25% share in 2024, with Germany, the U.K., and France as major markets. The region exhibits high adoption of premium accessories and a growing inclination toward sustainability and modular designs. Online platforms and boutique photography stores are expanding across the continent, supporting steady growth of 7–9% annually.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for roughly 30% of the global market in 2024. China dominates regional production and consumption, while India and Japan show strong demand growth fueled by rising content creation and tourism. Increasing penetration of e-commerce and local manufacturing initiatives is propelling double-digit growth rates through 2030.

Latin America

Latin America represents about 6–7% of the market, with Brazil and Mexico driving growth. Expansion of online retail, affordability initiatives, and increasing social-media usage are stimulating demand for mid-range and entry-level accessories among young photographers and creators.

Middle East & Africa

This region accounts for around 3–5% of global revenue in 2024. GCC countries, especially the UAE and Saudi Arabia, are witnessing demand growth from luxury buyers and media professionals. South Africa remains a key hub for both professional and hobbyist users. Government investments in creative industries are expected to stimulate further market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camera Accessories Market

- Canon Inc.

- Nikon Corporation

- Sony Corporation

- Panasonic Corporation

- Fujifilm Holdings Corporation

- Olympus Corporation

- Sigma Corporation

- Tamron Co., Ltd.

- GoPro, Inc.

- Samsung Electronics Co., Ltd.

- Peak Design

- Godox Photo Equipment Co., Ltd.

- Manfrotto (Videndum plc)

- Yongnuo Photographic Equipment Co., Ltd.

- Lowepro (Bag Specialist Brand)

Recent Developments

- In May 2025, Sony introduced its next-generation wireless flash system featuring AI-assisted light metering, improving consistency for mirrorless camera setups.

- In March 2025, Canon launched eco-friendly camera bags made from 100% recycled materials under its sustainability program.

- In February 2025, Peak Design announced new carbon-fiber travel tripods optimized for hybrid photo-video workflows, targeting the creator market segment.

- In January 2025, Godox unveiled a portable LED lighting system with smartphone app integration for real-time brightness and color control, expanding into the smart accessories space.