Business Jet Market Size

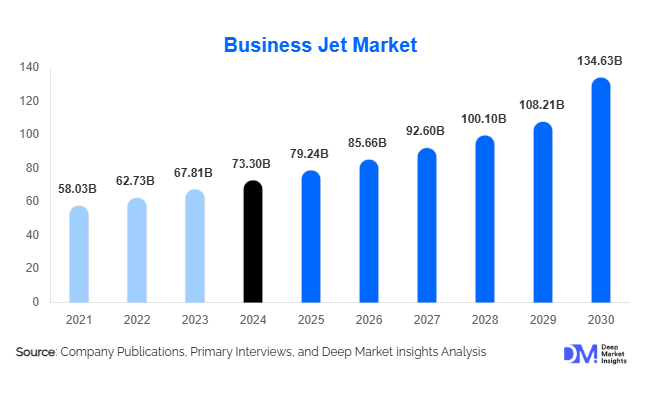

According to Deep Market Insights, the global business jet market size was valued at USD 73.3 billion in 2024 and is projected to grow from USD 79.244 billion in 2025 to reach USD 134.634 billion by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). Market growth is driven by the expanding population of high-net-worth individuals (HNWIs), corporate mobility needs, rising demand for fractional ownership and charter programs, and technological advancements in aircraft efficiency and connectivity. Emerging regional demand from Asia-Pacific, the Middle East, and Latin America further underpins long-term market expansion.

Key Market Insights

- Large and ultra-long-range jets dominate global revenues, accounting for approximately 48 % of total market share in 2024, driven by intercontinental corporate and VIP travel demand.

- North America leads the market with nearly 38 % share in 2024, supported by mature infrastructure, corporate fleets, and fractional ownership programs.

- Asia-Pacific is the fastest-growing region, projected to expand at 8–10 % CAGR through 2030 as wealth accumulation accelerates in India, China, and Southeast Asia.

- Fractional ownership and on-demand charter models are democratizing access to private aviation, broadening the customer base beyond traditional ultra-high-net-worth clients.

- OEMs are investing heavily in sustainable aviation technologies, including hybrid propulsion, lightweight composites, and AI-driven avionics.

- Aftermarket upgrades and refurbishments are emerging as a high-margin growth avenue, with many aircraft fleets exceeding 10 years in service.

Latest Market Trends

Technology-Driven Jet Modernization

Manufacturers are integrating advanced avionics, lightweight composite materials, and hybrid propulsion systems into next-generation business jets. Enhanced cabin connectivity, fly-by-wire controls, and AI-assisted maintenance systems are reshaping operational efficiency and passenger experience. Real-time diagnostics and predictive maintenance solutions are reducing aircraft downtime, while in-flight high-speed broadband is redefining cabin productivity and luxury. These trends collectively reinforce customer preference for technologically advanced, cost-efficient, and eco-friendly aircraft models.

Shift Toward Fractional and Charter Ownership Models

Fractional ownership and jet-card programs are revolutionizing market accessibility by lowering capital barriers. Operators offering flexible usage-based programs appeal to businesses and individuals seeking private aviation without the costs of full ownership. This shift is enhancing aircraft utilization rates and generating recurring revenue streams for operators. Digital booking platforms and AI-powered fleet management systems are streamlining scheduling and maintenance, further boosting charter demand and operator profitability.

Business Jet Market Drivers

Rising Global Wealth and Corporate Travel Needs

The expanding base of HNWIs and multinational corporations is fueling demand for private aviation. Business jets enable executives to maximize productivity, reduce travel time, and access remote destinations efficiently. The growing number of global business hubs and remote industrial operations supports sustained demand for corporate fleets and private charters, especially in regions where commercial connectivity remains limited.

Fleet Modernization and Aircraft Replacement

Nearly 40 % of the global business jet fleet is over 10 years old, driving strong replacement demand. Operators are upgrading to fuel-efficient, long-range aircraft equipped with digital cockpit systems, noise reduction, and enhanced safety features. Fleet modernization is not only boosting OEM revenues but also expanding aftermarket opportunities for refurbishments and avionics retrofits, creating a dual-revenue stream for manufacturers and service providers.

Emerging Market Infrastructure Development

Rapid investments in private aviation infrastructure, such as FBOs (Fixed Base Operators), dedicated terminals, hangars, and regional airports across Asia-Pacific, the Middle East, and Latin America, are improving access for business aviation. Government-led initiatives to promote domestic manufacturing, like “Make in India” and “Made in China 2025,” are attracting OEM partnerships and local assembly ventures, strengthening regional supply chains and encouraging market penetration.

Market Restraints

High Acquisition and Operational Costs

Business jets entail substantial upfront capital investments and high fixed operational costs, including crew salaries, maintenance, and fuel. These costs restrict accessibility for small and medium enterprises, limiting adoption in cost-sensitive markets. Rising fuel prices and inflationary pressures in the aerospace supply chain further increase total ownership costs, challenging profitability for operators and charter providers.

Regulatory and Environmental Challenges

Stringent aviation regulations, certification delays, and growing environmental scrutiny pose notable challenges. Noise restrictions and carbon emission standards are pushing manufacturers to invest heavily in research and development. Supply-chain disruptions and long lead times for aircraft certification can delay deliveries, affecting fleet expansion timelines and customer satisfaction.

Business Jet Market Opportunities

Emerging Regional Demand & Fleet Expansion

Asia-Pacific, the Middle East, and Latin America present substantial untapped potential for business jet adoption. Economic growth, rising executive mobility, and expanding HNWI populations in India, China, and the UAE are expected to fuel strong aircraft procurement over the next decade. Manufacturers and charter operators targeting localized service centers and region-specific fleet configurations can leverage this opportunity for market entry and expansion.

Integration of Sustainable Aviation Technologies

The industry’s transition toward sustainability through hybrid propulsion, sustainable aviation fuel (SAF), and recyclable composite materials is opening new avenues for differentiation. OEMs investing in carbon-neutral operations and green-certified aircraft will gain early-mover advantages. Partnerships between manufacturers, energy providers, and regulatory bodies are fostering the adoption of clean aviation technologies, aligning with global ESG mandates.

Growth of Flexible Ownership and Mobility Models

Fractional ownership, jet-sharing, and on-demand charter networks are driving a paradigm shift in private aviation access. The proliferation of digital platforms allows real-time scheduling, route optimization, and transparent pricing. These new business models are expected to expand the customer base by 20–30 % through 2030, particularly among mid-tier corporations and high-income professionals seeking flexibility without asset ownership.

Product Type Insights

Large and ultra-long-range business jets dominate the global market, accounting for approximately 48% of revenue in 2024. Their popularity is driven by luxury and comfort. High-end amenities, spacious cabins, and advanced in-flight technologies make them highly attractive to affluent travelers seeking long-haul comfort. These jets are ideal for intercontinental corporate travel, private charters, and VIP transport, which explains their premium valuation and robust demand. Models such as the Bombardier Global 7500 and Gulfstream G700 continue to outpace production capacity due to their unmatched range, performance, and technological sophistication.

Meanwhile, mid-size and super mid-size jets are favored for regional and short-to-medium haul missions, offering a versatile balance of range, capacity, and operational efficiency. Their adaptability appeals to a broad spectrum of corporate clients and charter operators, making them a critical growth segment globally.

Light and very light jets cater to private owners and charter services operating on domestic or short-range routes. Their cost-effectiveness and lower operational overhead make them appealing for frequent short-haul travel, making them a strategic choice for budget-conscious corporate travelers or regional service providers.

Pre-owned aircraft are increasingly popular due to affordability and quicker availability, allowing buyers to enter the market without incurring the high acquisition costs of new aircraft. In contrast, new aircraft remain highly sought-after for their advanced features, fuel efficiency, safety upgrades, and cabin customization options, making them attractive for premium and technologically focused buyers.

Ownership Model Insights

Full and fractional ownership collectively account for approximately 60–65% of the global business jet market. Full ownership remains dominant among ultra-high-net-worth individuals (UHNWIs) who value exclusive access, customization, and long-term asset retention. Fractional ownership, time-share, and jet-card models are rapidly expanding as corporate clients and mid-tier businesses seek flexible access to private aviation with lower upfront capital investment. Growth in these models is supported by digital booking platforms, mobile scheduling tools, and AI-driven fleet management systems, which simplify utilization, reduce administrative overhead, and increase aircraft operational efficiency.

| By Aircraft Type | By Range | By End Use | By System | By Ownership Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest business jet market, holding nearly 37.8% share in 2024 ( USD 26.5 billion). The United States leads globally in aircraft ownership, fleet size, and charter operations. Growth in the region is underpinned by several factors: established airport infrastructure and maintenance networks ensure operational efficiency and fleet readiness, while a high concentration of multinational corporations fuels strong corporate travel demand. Furthermore, supportive regulatory frameworks, business aviation-friendly policies, and robust availability of fractional ownership programs contribute to continued market resilience. Fleet modernization and long-haul travel requirements are expected to maintain steady expansion in North America through 2030.

Europe

Europe accounted for roughly 27% of global demand in 2024, with the U.K., Germany, and France representing the largest submarkets. Regulatory support for sustainable aviation is a major growth driver, incentivizing the adoption of aircraft equipped with sustainable aviation fuels (SAF), hybrid systems, and low-emission technologies. Additionally, high levels of intra-European corporate mobility and cross-border business operations drive demand for mid-size and large jets. Expansion of charter services and fleet replacement programs further support market growth, while regional infrastructure improvements, including FBOs and maintenance hubs, enhance operational efficiency.

Asia-Pacific

Asia-Pacific is projected to be the fastest-growing region, expanding at an 8–10% CAGR through 2030. Key drivers include emerging markets, rising wealth, and increasing numbers of high-net-worth individuals (HNWI) in countries such as India, China, and Japan. Government initiatives supporting general aviation infrastructure, such as airport expansions, FBO development, and simplified regulatory frameworks, are improving market accessibility. Corporate globalization and industrial growth further increase demand for business aviation, while luxury and ultra-long-range jets are gaining traction among executives and VIP travelers seeking intercontinental connectivity. India’s business jet market alone, valued at USD 650 million in 2024, is expected to more than double by 2033, highlighting the region’s significant growth potential.

Middle East & Africa

The Middle East holds approximately 8–10% of the market share, led by the UAE, Saudi Arabia, and Qatar. Growth is driven by high-income populations, luxury travel culture, and increasing government investments in aviation infrastructure. Demand for large cabin and ultra-long-range jets is strong for both corporate and private VIP transport. In Africa, markets such as South Africa and Nigeria are witnessing growth in charter operations, government fleet modernization, and mining or natural-resource sector-related travel, which together are driving market adoption across the continent.

Latin America

Latin America contributes roughly 6–8% of global revenues, dominated by Brazil and Mexico. Growth in the region is driven by executive mobility requirements in natural-resource and energy sectors and increasing corporate adoption of business aviation. Domestic OEM production, notably by Embraer, enhances regional supply capability and supports exports to North America and Europe. In addition, increasing access to fractional ownership and charter services is making business aviation more attractive to mid-sized enterprises and high-net-worth individuals, further stimulating market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Business Jet Market

- Bombardier Inc.

- Gulfstream Aerospace Corporation (General Dynamics)

- Dassault Aviation SA

- Textron Inc. (Cessna Aircraft Company)

- Embraer S.A.

- Honda Aircraft Company Ltd.

- Airbus Corporate Jets

- Boeing Business Jets

- Pilatus Aircraft Ltd.

- Cirrus Aircraft

- Nextant Aerospace

- SyberJet Aircraft

- Beechcraft Corporation

- Aerion Supersonic (under revival projects)

- Eclipse Aerospace Inc.

Recent Developments

- In June 2025, Bombardier announced the delivery of its first Global 8000 business jet, setting new benchmarks in range (8,000 nautical miles) and fuel efficiency.

- In April 2025, Gulfstream completed flight testing for its G700 program and expanded its MRO facilities in Dallas and Geneva to meet global service demand.

- In March 2025, Embraer unveiled its Phenom 300E “eco-efficiency upgrade,” featuring hybrid-electric auxiliary systems and improved avionics for reduced emissions.