Bulletproof Jacket Market Size

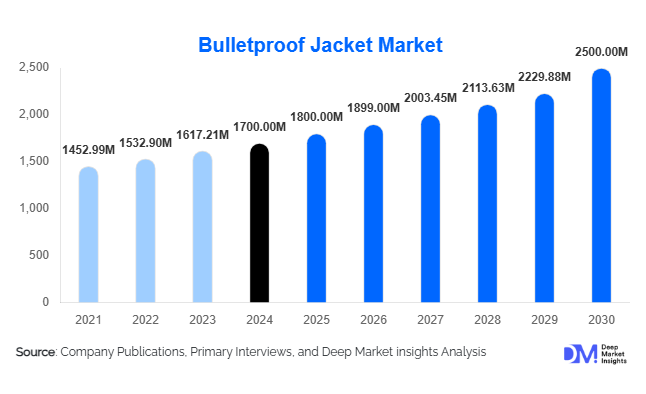

According to Deep Market Insights, the global bulletproof jacket market size was valued at USD 1,700 million in 2024 and is projected to grow from USD 1,800 million in 2025 to reach USD 2,500 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing global security concerns, rising defense and law enforcement expenditure, and advancements in lightweight, high-strength protective materials for personal safety and military applications.

Key Market Insights

- Military and law enforcement dominate demand, driven by modernization programs, counter-terrorism initiatives, and urban security requirements.

- Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth, fueled by increased defense budgets and rising security threats.

- Material innovation and technological integration, such as UHMWPE fibers, aramid composites, biometric sensors, and GPS-enabled jackets, are transforming product offerings.

- Private security and civilian applications are expanding, particularly for journalists, VIPs, and high-risk professionals, creating niche opportunities.

- Government initiatives like “Make in India” and “Made in China 2025” are promoting local manufacturing and reducing dependency on imports.

- Lightweight and ergonomic designs are increasing adoption among personnel requiring mobility and extended wearability.

Latest Market Trends

Smart and Lightweight Protective Gear

Advanced bulletproof jackets increasingly incorporate smart features such as biometric health monitoring, GPS tracking, and communication modules, enhancing operational safety and situational awareness. Lightweight materials like UHMWPE and hybrid aramid composites reduce weight while maintaining ballistic protection, improving comfort and mobility for personnel during extended operations.

Emerging Civilian and Niche Markets

Civilian adoption is growing among journalists, corporate executives, and private security personnel in high-risk regions. Manufacturers are offering modular, climate-adapted designs and ergonomic solutions to appeal to these segments, while military and law enforcement remain the core market. The trend toward personalization and feature-rich jackets is driving higher-value sales and fostering brand differentiation.

Bulletproof Jacket Market Drivers

Rising Global Security Threats

Escalating armed conflicts, terrorism, and organized crime are driving demand for personal protective equipment. Militaries and security forces increasingly procure high-performance bulletproof jackets to safeguard personnel, particularly in high-risk urban and conflict zones.

Increased Defense and Law Enforcement Spending

Government budgets for defense modernization, counter-terrorism, and security infrastructure are expanding globally. Procurement of advanced protective gear supports strategic objectives and operational readiness, ensuring a steady demand pipeline for bulletproof jackets.

Technological Advancements in Materials

Innovations in UHMWPE, aramid fibers, and hybrid composites have enabled lighter, more flexible, and multi-hit-resistant jackets. These technological improvements enhance wearability, operational efficiency, and user comfort, particularly for prolonged deployment and mobility-intensive tasks.

Market Restraints

High Production Costs

Advanced bulletproof jackets involve costly raw materials and sophisticated manufacturing processes, limiting affordability in price-sensitive regions. This restricts market penetration among smaller security agencies and civilian users.

Regulatory and Compliance Challenges

Strict ballistic standards, certification procedures, and export regulations increase operational complexity and costs for manufacturers, slowing entry into new markets and limiting flexibility in product design and distribution.

Bulletproof Jacket Market Opportunities

Integration of Smart Technologies

IoT-enabled jackets with biometric monitoring, GPS, and communication systems provide enhanced situational awareness and operational efficiency. These products cater to military, law enforcement, and high-risk private security sectors, creating opportunities for differentiation and premium pricing.

Expansion in Emerging Markets

Rising defense budgets, urban security investments, and private security demand in Asia-Pacific and Latin America present significant growth opportunities. Local manufacturing partnerships and region-specific product adaptations can drive market penetration.

Customization and Ergonomic Designs

Demand for lightweight, climate-adapted, and modular bulletproof jackets is increasing. Manufacturers offering ergonomic solutions for extended wear, high mobility, and specialized operational needs can capture niche segments in both civilian and professional markets.

Product Type Insights

Hard armor vests dominate the market, representing approximately 84% of 2024 sales due to their superior protection against high-caliber rounds. Soft armor vests are gaining popularity for everyday law enforcement and civilian use due to comfort and mobility. Hybrid vests combining hard and soft panels are emerging for tactical flexibility and multi-threat protection.

Material Insights

Aramid fibers like Kevlar hold the largest share, while UHMWPE is rapidly growing due to its lightweight and high-strength properties. Hybrid materials combining aramid and UHMWPE provide enhanced ballistic resistance with reduced weight, supporting prolonged wear and operational efficiency.

Protection Level Insights

Level IIIA jackets dominate, offering protection against most handgun threats. Demand for Level IV jackets, capable of stopping armor-piercing rounds, is increasing among military and tactical units due to evolving threats and stricter safety requirements.

End-Use Insights

Military applications account for the largest demand segment, followed by law enforcement. Civilian use is rising among journalists, corporate security personnel, and private contractors. Export-driven demand from the U.S. and Europe to Asia-Pacific and Latin America is significant, supported by government programs and defense modernization projects.

| By Product Type | By Material Type | By Protection Level | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, with the U.S. representing nearly 40% of the global market in 2024. High defense spending, law enforcement budgets, and private security requirements drive demand. Canada also contributes significantly due to modernization programs and cross-border security initiatives.

Europe

Europe holds approximately 25% of the 2024 market, with major demand from the U.K., Germany, and France. Counter-terrorism efforts, military modernization, and the adoption of lightweight, technology-integrated jackets support growth. Level IIIA and IV jackets are increasingly preferred in the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Japan. Rising defense budgets, urban security spending, and government initiatives like “Made in China 2025” and “Make in India” accelerate market adoption. Civilian and private security demand also contributes to regional growth.

Middle East & Africa

High-risk operational environments in Saudi Arabia, UAE, Israel, South Africa, Nigeria, and Kenya drive steady demand. Military and security personnel require advanced protection for tactical and counter-terrorism operations.

Latin America

Brazil and Mexico are emerging markets, driven by urban security challenges and private security adoption. Government and corporate procurement are expected to increase, creating moderate growth potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bulletproof Jacket Market

- DuPont

- Point Blank Enterprises

- Safariland

- Armor Express

- BAE Systems

- Teijin Aramid

- American Body Armor

- KR2

- SafeGuard Armor

- Honeywell International

- IBC Technologies

- Protective Apparel

- IBC Armor

- Desautel

- DragonSkin Ballistic

Recent Developments

- March 2025: Point Blank Enterprises launched a UHMWPE-based lightweight jacket for tactical units, enhancing mobility without compromising ballistic protection.

- February 2025: DuPont introduced an advanced aramid fiber with multi-hit resistance for military and law enforcement applications.

- January 2025: Safariland expanded North American production capacity for modular armor systems to meet rising demand from government and private security sectors.