Bulletproof Glass Market Size

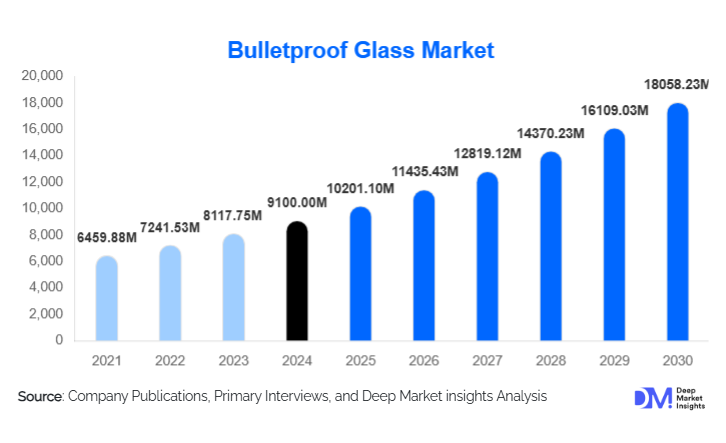

According to Deep Market Insights, the global Bulletproof Glass Market size was valued at USD 9,100 million in 2024 and is projected to grow from USD 10,201.1 million in 2025 to reach USD 18,058.23 million by 2030, expanding at a CAGR of 12.10% during the forecast period (2025–2030). Market growth is primarily driven by rising global security threats, increasing defense and infrastructure spending, and the widespread adoption of lightweight and hybrid ballistic materials in automotive, military, and commercial construction applications.

Key Market Insights

- Bulletproof glass adoption is expanding beyond military and defense into commercial buildings, banking, and luxury automotive segments due to heightened security awareness.

- Technological innovation in hybrid glass materials, such as glass-clad polycarbonate and polymer-ceramic composites, is driving product diversification and reducing weight and cost.

- North America dominates the global market with around 34% share, supported by strong defense budgets and high safety standards.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising defense investments, and rapid infrastructure development in China and India.

- Polycarbonate and glass-clad materials are emerging as preferred solutions in next-generation armored vehicles and architectural applications.

- Smart-glass integration, including sensor-enabled and IoT-connected transparent armor systems, is reshaping security design in high-risk buildings and vehicles.

What are the latest trends in the bulletproof glass market?

Integration of Smart and Multifunctional Materials

Manufacturers are integrating smart technologies into bulletproof glass systems, including embedded sensors, thermal control coatings, and alarm-linked glazing. These innovations improve both protection and situational awareness, enabling real-time threat detection. Transparent armor solutions combining ballistic resistance with UV filtration, glare reduction, and energy efficiency are gaining traction in high-end construction and defense applications. The trend toward “intelligent transparent security systems” marks a major shift from passive to active protection technologies.

Lightweight and Hybrid Glass Innovations

Technological advances in polycarbonate composites and glass-clad materials are driving the development of thinner, lighter bulletproof glass that maintains ballistic strength while improving design flexibility. These innovations reduce installation costs and enable use in curved or large architectural panels. Hybrid systems combining glass, polymers, and ceramics are also emerging for high-threat protection in military and VIP vehicles, allowing for improved vehicle agility and reduced fuel consumption.

What are the key drivers in the bulletproof glass market?

Rising Global Security Concerns

Escalating geopolitical tensions, terrorism, and urban crime are propelling demand for ballistic-resistant glass across defense, government, and civilian sectors. Governments worldwide are investing heavily in protective infrastructure such as embassies, police stations, and public transportation hubs. The rise in private armoring of vehicles for VIPs, executives, and political figures further reinforces market growth, especially in emerging economies and conflict-prone regions.

Infrastructure Development and Urban Security Upgrades

Massive infrastructure investments in developing regions are generating strong demand for security glazing in airports, metro stations, and commercial complexes. As urbanization accelerates, cities are prioritizing safety in public spaces and high-value assets, fostering large-scale adoption of bulletproof glass in architectural façades, teller stations, and public buildings. This expanding commercial and infrastructure application base is expected to remain a major growth driver through 2030.

What are the restraints for the global market?

High Production and Installation Costs

Bulletproof glass manufacturing requires multiple lamination layers of glass and polymer interlayers, driving up costs compared to standard glazing. The need for specialized framing systems and complex installation processes further elevates total project expenses. These high costs remain a significant barrier to mass adoption in cost-sensitive markets, particularly across developing economies.

Weight and Design Limitations

Despite improvements in material science, bulletproof glass remains heavier and thicker than conventional alternatives. In automotive and architectural applications, added weight can limit design flexibility, fuel efficiency, and structural compatibility. Manufacturers continue to face challenges balancing protection levels with optical clarity, light transmission, and aesthetic appeal, particularly in luxury vehicle and high-end construction projects.

What are the key opportunities in the bulletproof glass industry?

Emerging Markets and Public Infrastructure Investments

Rapid economic growth in Asia-Pacific, the Middle East, and Africa presents major opportunities for bulletproof glass manufacturers. Governments in these regions are investing in security upgrades for airports, embassies, and commercial facilities, often through large-scale public infrastructure projects. Establishing localized production and partnerships in these markets will enable global manufacturers to capture untapped demand and reduce import dependency.

Expansion in the Private and Luxury Vehicle Segment

The global rise in high-net-worth individuals has created strong demand for armored luxury vehicles and VIP transport. Premium car manufacturers are collaborating with ballistic glass suppliers to integrate lightweight transparent armor into vehicles without compromising aesthetics or performance. This segment offers high profit margins and is expected to grow rapidly in regions with elevated security risks and luxury spending power.

Product Type Insights

Solid acrylic bulletproof glass leads the market with approximately 45% share in 2024 due to its balance of performance and cost-effectiveness, making it suitable for banks, ATMs, and moderate-threat environments. However, glass-clad polycarbonate and other hybrid composites are the fastest-growing product types, driven by their superior strength-to-weight ratio and suitability for advanced automotive and defense applications.

Application Insights

Defense and VIP vehicles account for roughly one-third of the global bulletproof glass market. Armored transport remains a major consumer, including military combat vehicles and high-security personnel carriers. The commercial and banking sector is another significant segment, with increasing installations in teller stations, ATM booths, and government buildings. Meanwhile, architectural applications in high-rise commercial and residential buildings are expanding rapidly due to urban safety regulations and insurance mandates.

End-Use Industry Insights

The military sector remains the largest end-use industry, representing about 42% of global revenue in 2024, owing to sustained defense investments and modernization programs. The automotive industry is the fastest-growing end-user segment, with increasing adoption of ballistic glass in armored passenger cars and luxury vehicles. Construction and infrastructure also present growing opportunities, as public and private developers integrate ballistic-resistant glazing into modern security designs.

| By Material Type | By Security Level | By Application | By End-Use Industry | By Sales Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global bulletproof glass market, holding around 34% share in 2024. The region benefits from robust defense spending, established manufacturing infrastructure, and stringent safety standards. The U.S. continues to be the largest consumer, driven by military modernization, law enforcement applications, and rising private sector armoring demand.

Europe

Europe remains a key market, accounting for approximately 25–30% of the global share. Countries such as Germany, the U.K., and France are major consumers, supported by advanced automotive industries and high adoption of security glazing in public buildings. Stringent European Union safety regulations further drive innovation in ballistic glass for architectural and transportation applications.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, with projected CAGRs exceeding 12% during 2025–2030. Rapid urbanization, infrastructure expansion, and increasing defense budgets in China and India are boosting regional demand. Government initiatives like “Make in India” and “Made in China 2025” are fostering domestic production of ballistic materials, creating both supply and demand momentum.

Middle East & Africa

The Middle East & Africa region shows strong growth potential, driven by high security concerns and rising investments in embassies, VIP transport, and luxury real estate. Countries such as Saudi Arabia, the UAE, and Qatar are deploying bulletproof glass in major infrastructure and defense projects. Africa’s growing urban hubs also represent untapped markets for security glazing systems.

Latin America

Latin America holds a modest yet growing share of the global market, led by Brazil and Mexico. Increasing crime rates and demand for armored vehicles are key growth drivers. Governments and private enterprises are investing in secure financial and commercial facilities, supporting long-term adoption of ballistic glazing across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bulletproof Glass Market

- Saint-Gobain

- AGC Inc.

- Asahi Glass Co., Ltd.

- SCHOTT AG

- PPG Industries, Inc.

- Guardian Industries

- NSG Group

- Armortex, Inc.

- Total Security Solutions (TSS)

- Apogee Enterprises, Inc.

Recent Developments

- In July 2025, Saint-Gobain announced the launch of its next-generation lightweight ballistic glass-clad polycarbonate line, improving clarity and reducing product weight by 25% for defense and automotive use.

- In May 2025, AGC Inc. partnered with an Indian defense supplier under the “Make in India” initiative to produce locally manufactured transparent armor for military vehicles and embassies.

- In March 2025, SCHOTT AG introduced a hybrid transparent armor technology combining ceramic and polymer composites, offering multi-hit resistance with reduced thickness for architectural protection systems.