Bulk Container Packaging Market Size

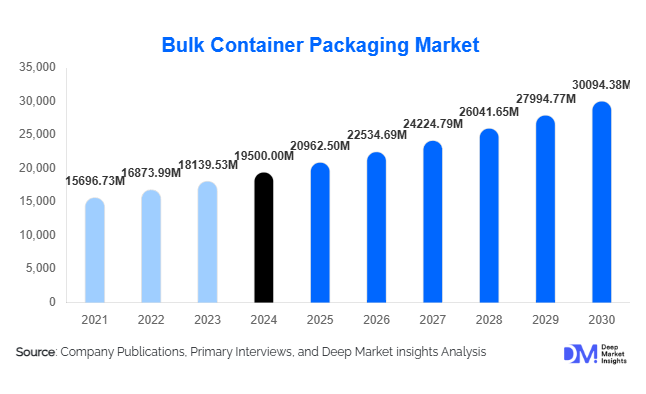

According to Deep Market Insights, the global bulk container packaging market size was valued at USD 19,500 million in 2024 and is projected to grow from USD 20,962.50 million in 2025 to reach USD 30,094.38 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is driven by increasing international trade volumes, expansion of the food, chemical, and agriculture industries, and growing emphasis on sustainable and reusable packaging solutions for bulk logistics and transport.

Key Market Insights

- Intermediate Bulk Containers (IBCs) dominate the market, accounting for approximately 40% of global revenue in 2024 due to their versatility, reusability, and suitability for liquids and granules.

- Plastic materials lead the market with around 45% share, driven by lightweight properties, cost efficiency, and recyclability improvements.

- Asia-Pacific is the largest and fastest-growing region, contributing about 30% of the total market value in 2024, with China and India showing robust demand from the industrial and export sectors.

- Demand from the food & beverage and agriculture industries is accelerating as global trade of edible oils, grains, and concentrates expands.

- Technological integration, including IoT-enabled tracking, smart container systems, and logistics analytics, is reshaping the future of bulk packaging operations.

Latest Market Trends

Reusable and Sustainable Packaging Solutions

The shift toward circular economy principles is driving rapid adoption of reusable and returnable bulk containers. Manufacturers are investing in recyclable materials such as HDPE and polypropylene, alongside offering reconditioning services for IBCs and drums. Regulations across Europe and North America encouraging waste minimization are accelerating this transition. Sustainability-conscious buyers increasingly prefer returnable packaging contracts and eco-labeled containers to align with carbon reduction goals.

Digitalization and Smart Logistics Monitoring

IoT integration and connected container systems are emerging as key differentiators. Smart sensors embedded within IBCs and flexitanks provide real-time monitoring of temperature, pressure, and fill levels, enabling predictive maintenance and improved supply-chain visibility. Logistics providers use data analytics to optimize return flows and utilization rates, enhancing both efficiency and profitability.

Bulk Container Packaging Market Drivers

Rising Global Trade and Bulk Transportation

The rapid globalization of industrial supply chains has amplified demand for cost-effective and scalable packaging for bulk materials such as chemicals, lubricants, and agricultural products. Bulk containers enable high payload capacity and lower per-unit transport cost, aligning with sustainability targets by reducing packaging waste.

Expansion of Food, Beverage, and Agricultural Exports

Strong export growth in edible oils, juices, fertilizers, and grains from Asia-Pacific and Latin America is driving the need for high-capacity hygienic containers like flexitanks and bulk bags. These packaging solutions enhance transport safety and minimize contamination risks, supporting growing international demand for processed and raw food commodities.

Regulatory Push Toward Eco-Friendly Packaging

Global regulatory mandates emphasizing recycling, packaging waste reduction, and hazardous goods transport standards are compelling manufacturers to innovate. The introduction of reusable IBCs, lightweight composite drums, and multilayer barrier films reflects compliance-driven technological evolution within the industry.

Market Restraints

Raw Material Cost Volatility

Prices of key raw materials such as polyethylene, polypropylene, and steel are highly volatile, impacting manufacturing costs and profit margins. Supply chain disruptions and freight cost fluctuations since 2020 have further intensified cost pressures on producers.

High Initial Investment for Reusable Systems

Reusable container systems require significant capital for production, tracking infrastructure, and reverse logistics. Inadequate recovery and cleaning networks in developing regions often discourage adoption, slowing penetration of high-value reusable models.

Bulk Container Packaging Market Opportunities

Regional Export Growth in Emerging Economies

Asia-Pacific, Latin America, and Africa are witnessing rising exports of chemicals, agricultural goods, and food ingredients. Establishing local manufacturing units and service centers in these regions allows companies to tap into growing intra-regional trade and reduce shipping costs.

Integration of Smart Technologies

IoT, RFID, and telematics offer significant opportunities for differentiation. Real-time asset tracking enhances efficiency, ensures regulatory compliance, and builds customer trust. Smart container management platforms also create recurring revenue streams through data services.

Sustainable and Circular Packaging Models

With circular economy frameworks becoming mainstream, firms investing in reusable container fleets and closed-loop collection systems can secure long-term contracts with large industrial clients. Government incentives supporting recyclable and biodegradable packaging will further catalyze adoption.

Product Type Insights

Intermediate Bulk Containers (IBCs) lead the market with a 40% share, valued at approximately USD 7.8 billion in 2024. Their modularity, ease of handling, and compatibility with automated filling systems make them the preferred option across industries. Flexitanks and bulk bags follow, supported by growing demand for liquid and dry bulk transport efficiency.

Material Insights

Plastic-based containers account for around 45% of total market revenue, primarily due to lightweight construction, corrosion resistance, and reusability. Increasing adoption of recycled content plastics and composite designs enhances sustainability and performance.

End-Use Industry Insights

Chemicals and petrochemicals dominate with nearly 37% share of the global market in 2024 (USD 7.2 billion). The sector’s reliance on robust, compliant packaging for hazardous and non-hazardous liquids ensures continued demand. Food & beverage and agriculture are the fastest-growing end uses, driven by export expansion and stricter food safety standards.

| By Product Type | By Material Type | By Capacity | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a substantial market, estimated at over USD 5 billion in 2024. The U.S. leads due to its strong chemical and food manufacturing industries. Emphasis on sustainability and advanced logistics technologies drives the adoption of reusable container systems.

Europe

Europe contributes about 24% of the global share (USD 4.7 billion). Countries like Germany and France lead in high-performance packaging for chemicals and pharmaceuticals. Stringent EU recycling directives are propelling investment in eco-friendly bulk packaging solutions.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing market, holding a 30% share (USD 5.9 billion) in 2024. China and India are major contributors, benefiting from industrial expansion, agricultural exports, and government initiatives promoting manufacturing and trade logistics.

Latin America

Latin America represents 6–7% of the market (USD 1.3 billion), with Brazil and Mexico leading. Growth is supported by rising food and fertilizer exports, though infrastructure constraints moderate the pace.

Middle East & Africa

The Middle East & Africa account for about 5% (USD 1 billion) in 2024. Demand stems primarily from the oil, gas, and fertilizer sectors in GCC nations and the mining in South Africa. Investments in port and logistics infrastructure are enhancing regional competitiveness.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bulk Container Packaging Market

- Greif Inc.

- Mauser Packaging Solutions

- SCHÜTZ GmbH & Co. KGaA

- Myers Industries, Inc.

- Hoover CS

- Berry Global Inc.

- Time Technoplast Ltd.

- Braid Logistics

- Environmental Packaging Technologies Inc.

- SIA Flexitanks Ltd.

- Shandong Anthente New Materials Technology Co., Ltd.

- BLT Flexitank Industrial Co., Ltd.

- Trust Flexitanks

- K Tank Supply Limited

- Bulk Liquid Solutions Pvt. Ltd.

Recent Developments

- May 2025: SCHÜTZ GmbH launched a new line of IoT-enabled IBCs for chemical transport, improving asset traceability.

- April 2025: Greif Inc. invested in an advanced recycling facility in the U.S. to enhance closed-loop IBC reconditioning capacity.

- February 2025: Mauser Packaging Solutions announced the expansion of its reusable container services in India and Southeast Asia, targeting food and agriculture clients.