Boxspring Market Size

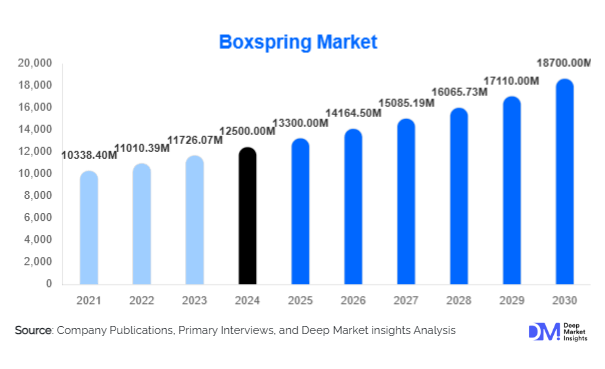

According to Deep Market Insights, the global boxspring market size was valued at USD 12,500 million in 2024 and is projected to grow from USD 13,300 million in 2025 to reach USD 18,700 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Growth in this market is primarily driven by the rising demand for premium sleep solutions, increasing consumer awareness about sleep quality, and the integration of advanced materials and adjustable designs in modern bedding systems.

Key Market Insights

- Adjustable boxsprings dominate product demand, holding 35% of the market share in 2024, driven by ergonomic and comfort-oriented features.

- Wooden frame boxsprings lead material preferences, capturing 40% share, as consumers favor durability and aesthetics in residential and hospitality sectors.

- Residential use accounts for nearly 70% of demand, fueled by urban housing growth and lifestyle upgrades.

- Offline retail remains the primary sales channel (60% market share), though e-commerce penetration is growing rapidly with the shift to online furniture shopping.

- North America leads the global market with a 35% share in 2024, followed by Europe at 30%, while Asia-Pacific is the fastest-growing region.

- Premium boxspring sales are accelerating, particularly in luxury hotels and high-income households in APAC, MEA, and LATAM.

Latest Market Trends

Rising Popularity of Adjustable and Hybrid Designs

Adjustable and hybrid boxsprings are gaining strong traction, offering customizable support and enhanced comfort. These products align with the growing consumer focus on wellness and sleep ergonomics. Hybrid models combining springs with foam or latex are also expanding into the premium segment, targeting consumers who demand versatility and durability. This trend is most pronounced in North America and Europe, where aging populations and health-focused consumers seek advanced sleep solutions.

Shift Toward Sustainable and Eco-Friendly Materials

Environmental awareness is shaping the market, with manufacturers adopting recycled wood, sustainably sourced fabrics, and metal frames. Premium brands are marketing eco-friendly boxsprings to appeal to eco-conscious consumers, especially in Europe and North America. Certifications for sustainable furniture production are expected to become a differentiator in competitive positioning over the next five years.

Boxspring Market Drivers

Premiumization of Sleep Products

Consumers are increasingly investing in premium bedding solutions, viewing sleep quality as a health priority. Boxsprings designed to extend mattress lifespan and enhance comfort are becoming mainstream, particularly among high-income demographics. Premium and luxury boxsprings priced above USD 700 are recording the fastest growth globally.

Urbanization and Housing Growth

Rapid residential and hospitality construction in Asia-Pacific and the Middle East is boosting demand. Developers are partnering with furniture brands to equip new housing and hotels with premium bedding solutions, directly increasing boxspring adoption in these markets.

Technological Innovation in Bedding

Innovations such as remote-controlled adjustability, integration with smart home devices, and ergonomic support technologies are attracting younger and tech-savvy consumers. This segment is expected to account for a rising share of premium demand by 2030.

Market Restraints

High Cost of Premium Products

The price barrier for luxury boxsprings limits accessibility for middle-income consumers. While demand in developed economies remains steady, developing markets often opt for budget alternatives, slowing penetration of advanced designs.

Volatility in Raw Material Supply

Fluctuations in steel, wood, and upholstery fabric prices increase production costs and pressure margins. Supply chain disruptions, particularly in APAC, have led to higher lead times and pricing instability for manufacturers.

Boxspring Market Opportunities

Expansion in Emerging Markets

Countries like India, China, Brazil, and Indonesia are witnessing rising disposable incomes and urbanization. Localized manufacturing and affordable product ranges present opportunities for brands to capture market share in these high-growth economies.

E-Commerce and Direct-to-Consumer Growth

Furniture e-commerce is expanding rapidly, with consumers increasingly comfortable buying boxsprings online. Direct-to-consumer (D2C) brands can benefit from streamlined supply chains, digital marketing, and subscription-based sales models, particularly in North America and Europe.

Integration of Smart and Wellness Features

Manufacturers are embedding wellness-driven technology such as sleep trackers, posture support systems, and adjustable firmness into boxsprings. These innovations appeal to health-conscious and tech-savvy demographics, creating premium growth opportunities.

Product Type Insights

Adjustable boxsprings lead the market with a 35% share in 2024, supported by demand for personalized comfort and compatibility with modern mattresses. Standard and low-profile boxsprings continue to serve the budget and mid-range categories, but innovation is concentrated in adjustable and hybrid models.

Material Insights

Wooden frame boxsprings dominate with a 40% share of global revenues in 2024. Their durability, design versatility, and consumer familiarity make them a leading choice in both residential and hospitality segments. Metal frames serve budget-conscious buyers, while upholstered variants are gaining attention in premium categories.

Distribution Channel Insights

Offline retail remains the largest channel with 60% of global sales in 2024, reflecting consumer preference for physical inspection before purchase. However, online sales are expanding quickly, especially in APAC and North America, where younger demographics rely on digital platforms and reviews for purchase decisions.

End-Use Insights

Residential applications account for 70% of demand in 2024, driven by new housing projects and lifestyle upgrades. The hospitality sector is a growing end-use industry, supported by post-pandemic hotel renovations and global tourism recovery. Healthcare and wellness centers, though smaller in share, represent a niche growth avenue for ergonomic and specialized bedding solutions.

| By Product Type | By Material Type | By Distribution Channel | By Price Range | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 35% share in 2024. The U.S. dominates due to high consumer spending power, strong e-commerce adoption, and demand for adjustable boxsprings. Canada is witnessing steady growth, driven by urban housing projects.

Europe

Europe represents 30% of the global market, with Germany, the U.K., and France as top contributors. Consumers prioritize wellness and sustainability, boosting demand for eco-certified and premium designs. Germany holds the highest share in adjustable boxsprings within Europe (40% of regional demand).

Asia-Pacific

APAC is the fastest-growing region, projected to expand at 8% CAGR through 2030. China and India account for the majority of regional demand, supported by rising middle-class income, urban housing growth, and the shift toward premium sleep products. APAC is expected to increase its global market share substantially by 2030.

Latin America

Brazilians and Mexicans are driving regional demand, supported by expanding urban housing and hotel investments. While LATAM accounts for a smaller share globally, it is a growing market for mid-range and premium boxsprings.

Middle East & Africa

MEA demand is concentrated in the Gulf region, with the UAE and Saudi Arabia investing heavily in luxury hotels and premium residential projects. Africa’s demand is more niche but growing, particularly in South Africa, where tourism-related investments drive hospitality segment adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Boxspring Market

- Tempur Sealy International

- Serta Simmons Bedding

- Leggett & Platt

- Hästens

- Restonic

- Hilding Anders

- King Koil

- Auping

- Simmons

- Aireloom

- Saatva

- Dorelan

- PerDormire

- Magniflex

- Sealy

Recent Developments

- In March 2025, Tempur Sealy announced investments in automated manufacturing facilities in North America to expand production capacity for premium boxsprings.

- In February 2025, Saatva introduced an eco-friendly upholstered boxspring line, emphasizing sustainable wood and fabric sourcing.

- In January 2025, Hästens launched an adjustable hybrid boxspring range in Europe, integrating ergonomic designs with wellness-focused materials.