Boxing Equipment Market Size

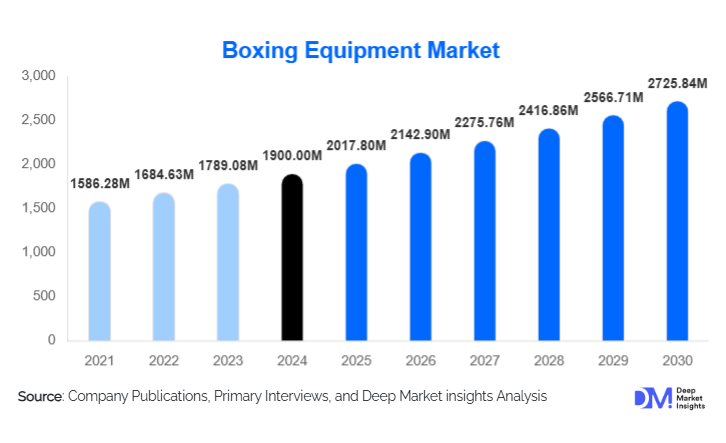

According to Deep Market Insights, the global boxing equipment market size was valued at USD 1,900.00 million in 2024 and is projected to grow from USD 2,017.80 million in 2025 to reach USD 2,725.84 million by 2030, expanding at a CAGR of 6.20% during the forecast period (2025–2030). This growth is driven by rising participation in boxing-inspired fitness programs, increasing investments in connected and sensor-enabled boxing gear, and the rapid expansion of e-commerce channels that make boxing equipment more accessible globally.

Key Market Insights

- Boxing gloves remain the largest product category, accounting for around 45% of total global market revenue in 2024.

- Fitness and home-use segments are driving market growth, representing nearly one-third of total demand.

- North America dominates the market with an estimated 34% share, supported by professional boxing culture and strong retail distribution networks.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes and expanding gym infrastructure in India and China.

- Smart and connected boxing equipment is emerging as a key innovation trend, integrating sensors, IoT, and performance analytics.

- Online retail and D2C channels now contribute more than 25% of total global sales, reshaping traditional distribution structures.

What are the latest trends in the boxing equipment market?

Smart and Sensor-Enabled Boxing Gear

Boxing is undergoing a digital transformation with the introduction of smart gloves, connected punching bags, and AI-driven training apps. These products capture metrics such as punch speed, impact force, and workout intensity, providing real-time feedback and performance analytics for athletes and fitness enthusiasts alike. This integration of technology is transforming boxing into a data-driven sport while enabling remote coaching and virtual competition platforms. As consumer demand for interactive fitness experiences grows, smart boxing equipment is expected to become a mainstream category by 2030.

Rise of Fitness Boxing and Boutique Studios

Fitness boxing classes, boutique studios, and home boxing workouts have broadened the market beyond professional athletes. Boxing is now recognized as a high-intensity cardio workout that enhances strength, endurance, and coordination. This trend, accelerated by pandemic-era home fitness adoption, continues to shape demand for lightweight gloves, freestanding bags, and reflex training kits. Major fitness brands and studios are launching “boxing-for-fitness” programs, fostering partnerships with equipment manufacturers to develop co-branded gear lines.

What are the key drivers in the boxing equipment market?

Growing Global Participation in Combat Sports

A surge in global interest in combat sports, spanning boxing, MMA, and fitness boxing, has expanded the consumer base dramatically. This cultural shift is visible across gyms, schools, and home-fitness communities worldwide. Participation growth among both men and women, particularly millennials and Gen Z, is boosting demand for accessible, affordable, and stylish equipment suitable for both training and casual workouts.

Expansion of E-commerce and D2C Retail Models

Online retail has become a critical sales channel for boxing equipment. Direct-to-consumer (D2C) brands leverage social media, influencer marketing, and online marketplaces to reach global audiences. Consumers now enjoy the convenience of comparing prices, reading reviews, and purchasing directly from manufacturers. This shift reduces distribution costs while increasing profitability for premium and mid-tier brands.

Material Innovation and Sustainable Manufacturing

Manufacturers are introducing new lightweight foams, vegan leathers, and high-durability synthetics that improve product comfort and sustainability. Eco-conscious consumers are increasingly drawn to equipment made with recyclable or non-animal materials. These innovations lower production costs, enhance brand appeal, and align with global sustainability trends.

What are the restraints for the global boxing equipment market?

High Price of Premium and Smart Equipment

While smart and connected boxing gear adds value, it remains expensive for mass adoption. Advanced products featuring sensors, Bluetooth connectivity, and mobile app integration are typically priced significantly higher than conventional equipment. This pricing gap, particularly in emerging economies, may restrict penetration among cost-sensitive buyers.

Market Saturation in Mature Economies

Regions such as North America and Western Europe face market saturation, with well-established gym networks and stable participation rates. Intense competition among brands has led to margin pressures and slower growth in these markets. New entrants must rely on differentiation through design, sustainability, or digital integration to capture attention.

What are the key opportunities in the boxing equipment industry?

Technology Integration and Connected Ecosystems

Integrating IoT technology and data analytics into boxing gear opens new revenue streams through subscription-based digital platforms. Brands can offer performance tracking, virtual coaching, and gamified training experiences, creating ongoing customer engagement. Partnerships between tech startups and traditional equipment manufacturers are likely to accelerate this trend.

Emerging Market Expansion

Asia-Pacific and Latin America present massive untapped potential due to rising middle-class income, growing gym penetration, and increasing youth interest in combat sports. Localized production and targeted marketing campaigns are helping brands offer affordable, high-quality products tailored to regional preferences. Countries such as India, China, and Brazil are expected to contribute significantly to future volume growth.

Fitness and Home-Gym Integration

Home fitness remains a strong post-pandemic trend, with boxing seen as an accessible, space-efficient workout. Manufacturers are innovating compact, portable punching systems and all-in-one home kits that combine equipment with virtual training access. Collaborations between fitness-tech platforms and boxing brands can further enhance consumer adoption.

Product Type Insights

Boxing gloves remain the cornerstone of the global boxing equipment market, commanding an estimated 45% share of total revenue in 2024. Their indispensable role across professional bouts, amateur training, and fitness boxing programs underpins sustained demand. Gloves also benefit from repeat purchase cycles due to wear and hygiene factors, which contribute to stable long-term sales. Product innovation is a defining growth driver, with brands introducing breathable microfiber fabrics, antimicrobial interiors, ergonomic padding structures, and smart gloves equipped with impact sensors for performance analytics. Increasing consumer preference for vegan and synthetic leather alternatives is also accelerating product differentiation within this category.

Punching bags form the second-largest segment, driven by the rapid expansion of commercial fitness centers and home workout setups. The rising popularity of hybrid fitness formats that blend boxing with strength and HIIT training has made punching bags a mainstream fitness accessory. Advancements in shock absorption, base stability, and adjustable-height freestanding models are further supporting demand.

End-User Insights

The fitness and home-use segment dominates global demand, representing roughly 30% of total market revenue in 2024. This growth stems from the global fitness boom and the integration of boxing-based cardio routines in boutique gyms and online workout programs. The surge in home fitness equipment post-pandemic continues to sustain demand for compact, user-friendly gloves and punching bags. Social media influencers and fitness trainers promoting boxing workouts as high-intensity fat-burning exercises have also expanded consumer reach.

Gyms and fitness centers remain key institutional buyers, particularly in North America and Europe, where fitness chains are adding boxing zones as part of their premium membership offerings. Equipment replacement cycles and multi-unit orders from franchised fitness clubs support steady B2B sales.

Professional boxing, while accounting for a smaller revenue portion, drives the premium end of the market. Demand for handcrafted, genuine leather gloves, advanced protective gear, and customized equipment is consistent among elite athletes and training academies. Sponsorship-driven visibility and high-profile matches continue to reinforce the aspirational appeal of professional-grade products, indirectly boosting retail sales among enthusiasts.

Distribution Channel Insights

Online retail has emerged as the fastest-growing distribution channel, capturing about 25% of total global market revenue in 2024. The rise of e-commerce giants and direct-to-consumer (D2C) brand platforms is improving global accessibility, offering customers price transparency and broader product ranges. The integration of augmented reality (AR) fitting tools and user-generated reviews is reshaping digital buyer experiences. Social media marketing and influencer collaborations are further driving online conversions, especially among younger demographics.

Specialty sports stores continue to dominate the professional and high-performance segment, catering to athletes who prefer personalized product fitting and expert consultation. Department stores and hypermarkets capture the casual and first-time buyer demographic, offering entry-level gear at competitive prices. Meanwhile, direct institutional sales to gyms, schools, military organizations, and sports academies form a stable, recurring business channel, often supported by long-term supply contracts and brand partnerships.

| By Product Type | By End-User | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global boxing equipment market, accounting for approximately 34% of total revenue in 2024 (USD 646 million). The region’s dominance is supported by a well-established professional boxing ecosystem, high gym penetration, and a robust consumer fitness culture. The United States remains the single largest contributor, benefiting from celebrity endorsements, televised boxing events, and the rising popularity of boxing-inspired group fitness programs. Technological integration, such as smart gloves and fitness tracking platforms, is gaining traction, while Canada’s growing participation in amateur and women’s boxing is fueling incremental demand. Strong consumer spending on fitness equipment, rising e-commerce adoption, and increasing interest in boxing-based fitness training among urban populations are propelling market expansion across the U.S. and Canada.

Europe

Europe represents around 29% of global revenue in 2024 (USD 551 million). The U.K. leads the regional market, supported by a vibrant boxing tradition, a growing base of women athletes, and a thriving network of boutique boxing studios. Germany and France follow, with high demand for sustainable and premium-grade equipment. European consumers are highly receptive to eco-friendly and ethically sourced products, influencing global material trends. Additionally, the popularity of white-collar boxing and fitness boxing programs in metropolitan areas is fostering consistent market growth. Strong consumer focus on sustainability, government support for grassroots sports participation, and high per-capita spending on premium fitness gear are driving Europe’s market trajectory.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing region, accounting for approximately 25% of the market (USD 475 million in 2024) and projected to outpace all regions through 2030. Growth is being fueled by rising disposable incomes, rapid urbanization, and expanding gym networks across China, India, Japan, and Australia. Increasing youth interest in combat sports and government-led initiatives to promote sports participation further accelerate demand. The region’s manufacturing strength, especially in China, Pakistan, and Thailand, provides a cost advantage, enabling both domestic consumption and large-scale exports to Europe and North America. Rapid gym expansion, digital retail adoption, and cost-competitive local manufacturing are collectively driving APAC’s leadership in production and consumption.

Latin America

Latin America contributes around 7–8% of global revenue, led by Brazil, Argentina, and Mexico. Boxing’s deep cultural roots, growing youth participation, and rising middle-class fitness awareness are spurring equipment sales. Demand for affordable gloves and home punching bags is increasing, supported by online retail penetration and local training initiatives. Several regional manufacturers are exploring export opportunities to North America and Europe due to proximity and cost advantages. Expanding fitness culture, cost-efficient local production, and export-oriented manufacturing policies are catalyzing Latin American market growth.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) market currently accounts for 5–6% of global value but is displaying strong upward potential. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, are witnessing a surge in boxing clubs and fitness centers as part of national health and sports initiatives such as Vision 2030. South Africa remains the dominant market in Africa, supported by a long-standing boxing culture and local manufacturing capabilities. Government-backed investments in sports infrastructure, increasing female participation in fitness boxing, and the growing popularity of combat sports in the GCC are major accelerators of MEA’s market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Boxing Equipment Market

- Everlast

- Adidas

- Venum

- Hayabusa

- Ringside

- Cleto Reyes

- Title Boxing

- Sanabul

- Yokkao

- Twins Special

- RDX Sports

- Top King

- Fairtex

- Leone 1947

- Century

Recent Developments

- In June 2025, Everlast announced the launch of its first AI-powered “Smart Glove” integrated with punch analytics and mobile coaching features.

- In April 2025, Venum opened a new manufacturing facility in Thailand focused on sustainable synthetic leather production.

- In February 2025, Adidas expanded its combat-sports line with eco-friendly boxing apparel designed from recycled materials.