Bowfishing Bow Market Size

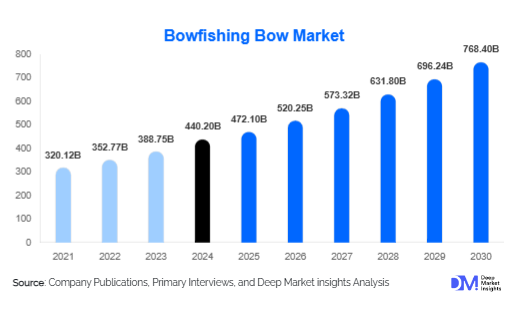

According to Deep Market Insights, the global bowfishing bow market size was valued at USD 440.2 million in 2024 and is projected to grow from USD 472.1 million in 2025 to reach USD 768.4 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025-2030). The bowfishing bow market growth is primarily driven by increasing recreational fishing participation, rising awareness of invasive fish species control, and advancements in compound and hybrid bowfishing technologies that enhance accuracy and ease of use.

Key Market Insights

- Compound bowfishing bows dominate the market, accounting for more than 45% of total 2024 revenues, driven by their superior performance, ease of use, and broad consumer adoption.

- North America remains the largest market, contributing nearly 52% of global revenues in 2024, supported by a strong recreational fishing culture in the U.S. and Canada.

- APAC is the fastest-growing region, expanding at over 12% CAGR, fueled by increasing sports fishing popularity in China, India, and Southeast Asia.

- Online distribution channels are gaining traction, as consumers shift toward e-commerce platforms and direct-to-consumer brand websites for equipment purchases.

- Rising ecological awareness about invasive fish species such as Asian carp is encouraging bowfishing activities for population management.

- Technology adoption, including lightweight carbon composite bows, adjustable draw systems, and integrated reel innovations, is reshaping competitive advantage in the industry.

What are the latest trends in the bowfishing bow market?

Eco-Conscious Bowfishing Practices

Environmental agencies and local governments are encouraging bowfishing as a sustainable fishing practice to control invasive species. Programs incentivizing recreational anglers to target species like carp, gar, and tilapia are gaining traction, aligning bowfishing with conservation efforts. Manufacturers are marketing their bows as eco-friendly tools, highlighting responsible disposal and recycling of captured fish. This trend positions bowfishing as not only a sport but also a conservation-driven outdoor activity.

Customization and Lightweight Materials

Manufacturers are increasingly focusing on lightweight carbon fiber and hybrid material construction for enhanced portability and comfort. Adjustable draw weights and modular bow designs are gaining popularity among younger participants and beginners. Customizable grip designs, reel systems, and arrow rest configurations appeal strongly to enthusiasts who value personalized equipment. These innovations are making bowfishing more accessible while driving repeat purchases and upgrades in premium segments.

Digital Engagement and Online Retail Growth

Social media platforms, fishing forums, and live-streaming communities are accelerating bowfishing’s popularity among younger demographics. Online tournaments and digital sharing of bowfishing experiences are building global interest. At the same time, e-commerce platforms are rapidly expanding distribution, enabling manufacturers to bypass traditional retail barriers. Direct-to-consumer models, influencer marketing, and virtual try-on tools for bows are increasing online sales penetration in the market.

What are the key drivers in the bowfishing bow market?

Growing Popularity of Recreational Fishing

The rising number of outdoor sports enthusiasts globally is driving demand for bowfishing equipment. Recreational fishing licenses and events are expanding annually, especially in North America and APAC, creating new opportunities for bowfishing as a niche but fast-growing sport. Families and youth programs are further boosting participation.

Technological Advancements in Bowfishing Equipment

Bowfishing bows are increasingly equipped with modern technologies such as adjustable cams, laser sights, and reel integration systems that enhance accuracy and user experience. These innovations are broadening the sport’s appeal and encouraging higher spending among enthusiasts, with compound and hybrid bows seeing robust adoption rates.

Governmental Support for Invasive Species Control

Authorities in regions facing ecological imbalances caused by invasive fish species are actively supporting bowfishing tournaments and events. For instance, state-level programs in the U.S. promote bowfishing as a method of population control for Asian carp, boosting market visibility and equipment demand.

What are the restraints for the global market?

Seasonal and Regional Limitations

Bowfishing is highly seasonal and geographically dependent, limiting consistent demand across all regions. In colder climates, participation drops significantly during winter months, restricting year-round revenue generation for manufacturers.

High Initial Equipment Costs

High-quality compound or hybrid bowfishing bows often cost between USD 400 and USD 800, creating entry barriers for beginners. Coupled with the additional costs of reels, arrows, and accessories, this restrains wider adoption among price-sensitive consumers.

What are the key opportunities in the bowfishing bow industry?

Expansion in Asia-Pacific Sports Fishing Markets

Growing middle-class wealth and rising demand for outdoor recreational sports in countries such as China, India, and Thailand are creating a substantial opportunity for bowfishing. Regional tournaments, adventure tourism, and government promotion of outdoor activities can unlock untapped consumer bases.

Integration of Smart Technologies

Opportunities exist for manufacturers to integrate IoT-enabled reels, mobile app connectivity, and performance tracking features into bowfishing equipment. Tech-driven innovation can attract younger, tech-savvy anglers and differentiate brands in a competitive market.

Tourism-Driven Bowfishing Experiences

Fishing charters, eco-tourism companies, and recreational travel agencies are increasingly incorporating bowfishing into their service offerings. This creates opportunities for equipment suppliers to partner with tourism operators and expand product visibility in adventure travel markets.

Product Type Insights

Compound bowfishing bows lead the global market with 45.3% share in 2024, owing to their precision, adjustability, and popularity among both beginners and professionals. Recurve bows hold 28.7% share, primarily driven by affordability and simplicity, while hybrid bows are witnessing double-digit growth as they combine the benefits of both compound and recurve systems. Traditional bows remain a niche segment, catering to purists and heritage-focused anglers.

Application Insights

Recreational bowfishing dominates with over 61% market share in 2024, reflecting the strong cultural integration of fishing as a leisure activity in North America and Europe. Commercial bowfishing holds a 25.5% share, primarily in regions dealing with invasive fish species. Competitive bowfishing, though small at 13.5%, is growing rapidly with rising global tournaments and sponsorships.

Distribution Channel Insights

Offline retail still accounts for 58% of the market in 2024, supported by specialty archery stores and large sporting goods retailers. However, online sales are growing at over 13% CAGR, expected to surpass offline by 2030. E-commerce platforms like Amazon and Bass Pro Shops, coupled with direct-to-consumer brand websites, are reshaping distribution models for manufacturers.

End-Use Insights

Individual consumers represent the largest demand segment at 66.4% in 2024, followed by fishing charters and tour operators at 18.2%. Sports clubs and associations contribute 10.5%, while government/environmental agencies account for 4.9%, primarily in ecological control programs. The rapid expansion of fishing tourism is expected to drive end-use diversification by 2030.

| By Product Type | By Draw Weight Range | By Material | By Application | By Distribution Channel | By End-User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market with a 52% share in 2024. The U.S. leads global demand, supported by recreational fishing culture, competitive tournaments, and government programs for invasive fish control. Canada contributes significantly to eco-tourism-driven demand.

Europe

Europe holds a 17.5% share in 2024, with Germany, the UK, and France as leading contributors. Growth is supported by strong sports fishing traditions and rising consumer interest in eco-friendly recreational activities.

Asia-Pacific

APAC is the fastest-growing region with a projected CAGR of 12.1% during 2025-2030. China and India are key growth drivers, with increasing disposable incomes, expanding sports participation, and government support for outdoor activities. Australia and Japan contribute a stable, mature demand.

Latin America

LATAM accounts for a 6.8% share in 2024, with Brazil and Argentina leading regional demand. Bowfishing is emerging within eco-tourism activities and recreational fishing clubs, though adoption remains nascent compared to North America.

Middle East & Africa

MEA holds a 6.7% share in 2024, led by South Africa and GCC countries. Adventure tourism initiatives in the Middle East and freshwater fishing traditions in Africa are gradually fueling regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bowfishing Bow Market

- AMS Bowfishing

- Oneida Eagle Bows

- PSE Archery

- Bowtech Archery

- Mathews Archery

- Hoyt Archery

- Bear Archery

- Fin-Finder

- Cajun Bowfishing

- Martin Archery

- Darton Archery

- G5 Outdoors

- Parker Bows

- Diamond Archery

- Obsession Bows

Recent Developments

- In June 2025, AMS Bowfishing launched a new carbon composite compound bowfishing model featuring an integrated reel seat for enhanced accuracy and durability.

- In April 2025, Oneida Eagle Bows introduced a hybrid bow design targeted at competitive bowfishing tournaments, focusing on adjustable draw weight ranges.

- In February 2025, PSE Archery announced expansion into Asia-Pacific markets through direct online distribution partnerships with local e-commerce platforms.