Bounce House Market Size

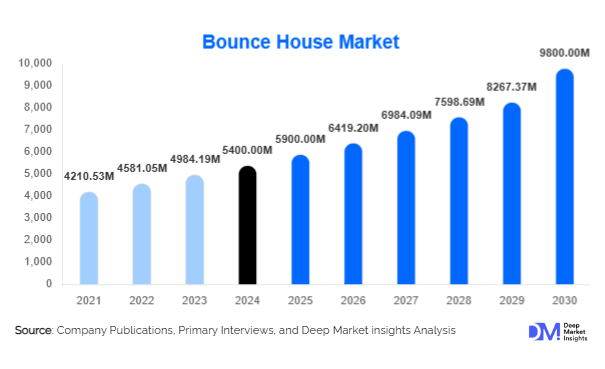

According to Deep Market Insights, the global bounce house market size was valued at USD 5,400 million in 2024 and is projected to grow from USD 5,900 million in 2025 to reach USD 9,800 million by 2030, expanding at a CAGR of 8.8% during the forecast period (2025-2030). The bounce house market growth is being fueled by rising demand for inflatable entertainment in residential and commercial spaces, increasing popularity of themed parties and festivals, and expanding adoption of safe, durable, and eco-friendly inflatable materials. Rental companies, amusement operators, and online sales platforms are significantly contributing to global expansion, while technology integration and innovative designs are widening consumer appeal.

Key Market Insights

- Themed and customizable bounce houses are gaining traction, with parents and event planners demanding licensed characters and branded inflatables for children’s events.

- Commercial rental companies dominate market share, supported by growing demand for community festivals, school events, and amusement activities.

- North America leads the market, accounting for nearly 35% of global demand in 2024, due to high disposable incomes and a well-developed event rental industry.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, expanding middle-class families, and increasing adoption of inflatables in schools and entertainment parks.

- Material innovations such as eco-friendly PVC blends and fire-retardant vinyl are improving the durability, safety, and sustainability of bounce houses.

- Online retail channels are expanding rapidly, driven by e-commerce penetration, direct-to-consumer sales, and easy comparison of product features.

What are the latest trends in the bounce house market?

Themed Bounce Houses Driving Customization

Demand for themed bounce houses featuring popular cartoon characters, superheroes, and seasonal motifs is growing, especially in the U.S., Europe, and Asia. Parents and event planners are increasingly willing to pay a premium for personalized experiences at birthdays, school fairs, and festivals. Manufacturers are partnering with entertainment franchises to launch officially licensed inflatables, boosting product appeal and brand recognition. This trend has also extended to corporate events, where custom-branded inflatables are being used for promotions and experiential marketing campaigns.

Eco-Friendly and Safer Materials

Safety and sustainability are shaping consumer preferences in the bounce house market. Manufacturers are adopting PVC-free and lead-free materials, as well as hybrid vinyl fabrics that are fire-retardant and UV-resistant. These innovations extend the product lifecycle and reduce environmental impact. Additionally, government safety regulations across North America and Europe are encouraging the adoption of eco-certified bounce houses, making this a long-term industry trend.

Technology-Enhanced Bounce Houses

Integration of interactive features such as LED lighting, sound systems, and augmented reality elements is gaining momentum. Rental operators are adding value through inflatables that combine physical activity with immersive entertainment, such as digital scoring systems in obstacle courses. These enhancements not only differentiate offerings but also increase repeat bookings for rental businesses.

What are the key drivers in the bounce house market?

Growing Demand for Event Rentals

Community events, school programs, and festivals are driving commercial bounce house rentals worldwide. Rental companies are investing in large-capacity inflatables to meet rising demand from corporate parties, holiday events, and cultural celebrations. This driver is particularly strong in North America and Europe, where the event management industry is well-established and growing steadily.

Rising Popularity of Family-Oriented Entertainment

Parents are increasingly prioritizing active, safe, and engaging entertainment for children’s parties. Bounce houses provide an affordable and convenient solution compared to more expensive entertainment options. This trend is boosting direct-to-consumer purchases, especially among middle-income households in the U.S., UK, China, and India.

Expansion of Amusement and Theme Parks

Global amusement parks and indoor play centers are adopting bounce houses as a core attraction, especially in developing countries where affordable leisure options are in demand. The integration of inflatables with obstacle courses, slides, and interactive games enhances customer experience and increases repeat visits.

What are the restraints for the global market?

Durability and Maintenance Challenges

Despite material innovations, bounce houses require frequent cleaning, repair, and monitoring to ensure safety. Punctures, leaks, and wear-and-tear remain major concerns, especially in high-volume rental businesses. These maintenance requirements add operational costs and can deter new entrants.

Safety Concerns and Regulatory Compliance

Accidents and injuries related to improper installation, overcrowding, or lack of supervision present risks to market growth. Stricter government safety regulations across North America and Europe increase compliance costs for manufacturers and rental operators, creating barriers for small businesses.

What are the key opportunities in the bounce house industry?

Integration of Digital Entertainment

The convergence of physical play with digital features, such as interactive LED displays, gaming integration, and AR-based obstacle courses, presents a major growth opportunity. This can significantly enhance consumer engagement and create premium pricing opportunities for manufacturers and rental providers.

Expansion into Emerging Markets

Rapid urbanization and increasing disposable incomes in APAC and Latin America are opening new demand for bounce houses in both residential and commercial spaces. Schools, community centers, and local event organizers in these regions are emerging as strong growth drivers, offering new opportunities for international players.

Eco-Sustainable Product Innovation

As sustainability becomes a global priority, bounce houses made from recyclable, biodegradable, or non-toxic materials will appeal strongly to environmentally conscious consumers. Manufacturers who innovate in this direction can gain a competitive advantage and tap into premium market segments.

Product Type Insights

Inflatable castles and forts dominate the market, accounting for nearly 32% of the global share in 2024. Their widespread popularity stems from strong demand for birthday parties and school fairs. Themed versions of castles, such as princess and superhero designs, are especially popular in the U.S., UK, and Japan. Slides and obstacle courses are growing segments but remain secondary to castles, which continue to lead due to their versatility and appeal across age groups.

Application Insights

Commercial rental companies hold the largest application share at 41% of the global bounce house market in 2024. Their dominance is attributed to repeat demand from schools, festivals, and corporate events. Residential use is also growing steadily, particularly in North America and Asia-Pacific, supported by e-commerce availability and affordable small-sized inflatables designed for household backyards. Amusement parks represent another high-growth application, projected to expand at double-digit CAGR through 2030.

Distribution Channel Insights

Online retail leads the distribution landscape with a 46% share in 2024, driven by rapid e-commerce penetration and consumer preference for home delivery and digital comparison shopping. Direct B2B sales to event companies and schools remain strong but are increasingly complemented by marketplaces and direct brand websites offering seasonal discounts and customization options.

| By Product Type | By Material | By Size / Capacity | By Power Source | By End-Use / Application | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounted for 35% of the global bounce house market in 2024, led by the U.S. with a dominant rental and amusement park industry. High disposable incomes and a preference for themed events support strong residential and commercial adoption. Canada is witnessing steady growth, while Mexico’s market expansion is tied to festivals and local entertainment events.

Europe

Europe remains a mature but growing market, with the UK, Germany, and France leading demand. Strict safety regulations encourage the adoption of premium-quality inflatables. The region is experiencing strong traction in community events and festivals, with Germany alone contributing nearly 6% of the global share in 2024.

Asia-Pacific

APAC is the fastest-growing region, expected to expand at a CAGR above 10%. China, India, and Japan are major demand hubs, with rising disposable incomes and booming urban event industries. India is emerging as a hotspot for community rentals and school adoption, while Japan shows strong demand for licensed character-themed inflatables.

Latin America

Brazil and Argentina dominate bounce house demand in LATAM, with local rental operators driving market penetration. Increasing affordability and urban festivals are helping the market gain momentum, particularly among middle-income families.

Middle East & Africa

The UAE and Saudi Arabia lead MEA demand, primarily through luxury events and entertainment investments. South Africa is emerging as a key market with growing adoption in schools and community spaces. MEA’s market is projected to grow steadily due to rising family entertainment spending.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bounce House Market

- Blast Zone

- Happy Jump, Inc.

- Inflatable Depot

- Yolloy Inflatable

- Channal Inflatables

- General Inflatables

- EZ Inflatables

- Bounce Time Inflatables

- Airquee Inflatables

- Big Top Inflatables

- Magic Jump Inflatables

- JumpOrange

- Inflatable Factory

- Cutie Inflatable

- Barry Inflatables

Recent Developments

- In July 2025, Channal Inflatables announced the launch of a new line of eco-friendly PVC-free bounce houses designed for European and U.S. markets, meeting enhanced safety and sustainability standards.

- In May 2025, Blast Zone expanded its online direct-to-consumer platform, integrating customization options for themed residential inflatables.

- In March 2025, Yolloy Inflatables partnered with an event rental chain in India to expand large-capacity bounce house rentals for festivals and school fairs.