Boucle Chair Market Size

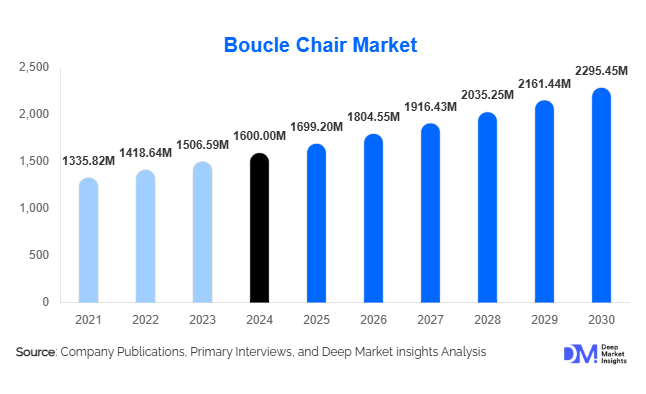

According to Deep Market Insights, the global Boucle Chair market size was valued at USD 1,600 million in 2024 and is projected to grow from USD 1,699.2 million in 2025 to reach USD 2,295.45 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The boucle chair market growth is primarily driven by the rising popularity of Scandinavian and mid-century modern interior design trends, increasing residential renovation and home office setups, and the growing penetration of e-commerce platforms offering premium furniture at accessible price points.

Key Market Insights

- Wool bouclé fabric dominates the material segment, accounting for over 40% of global revenue in 2024 due to its luxury appeal, durability, and comfort.

- Accent and armchairs lead product demand, making up nearly 35–40% of sales, fueled by their versatility in residential and commercial applications.

- Online channels drive over half of global sales, as AR/VR integration and influencer marketing reshape furniture shopping behavior.

- Residential use remains the largest end-use sector, contributing around 70% of total demand, but commercial and hospitality applications are the fastest-growing.

- Europe leads with more than 40% market share in 2024, while Asia-Pacific is the fastest-growing region with projected double-digit growth.

- Premium and mid-range price tiers hold the majority share, reflecting bouclé’s positioning as an aspirational, design-driven furniture choice.

What are the latest trends in the boucle chair market?

Sustainability and Eco-Friendly Materials

Consumers are increasingly seeking eco-friendly furniture, creating demand for bouclé chairs made from organic wool, recycled fibers, and sustainable frames. Certifications such as FSC and OEKO-TEX are influencing purchase decisions. Manufacturers focusing on recyclable designs and ethical sourcing are gaining a competitive edge.

Omnichannel and Digital Integration

E-commerce platforms dominate bouclé chair sales, supported by AR/VR tools that allow buyers to visualize furniture in their homes. Social media and influencer campaigns are particularly effective in marketing bouclé textures. Hybrid retail strategies combining online experiences with physical showrooms are also gaining traction.

Commercial and Hospitality Adoption

Bouclé chairs are increasingly being used in boutique hotels, cafés, luxury offices, and co-working spaces. Their tactile appeal and premium look align with design-driven commercial interiors. Hospitality buyers are demanding chairs with enhanced stain resistance and durability, expanding the product’s use beyond residential applications.

What are the key drivers in the boucle chair market?

Rising Popularity of Scandinavian and Mid-Century Aesthetics

Design movements favoring minimalism and tactile materials have fueled bouclé’s resurgence. Platforms like Pinterest and Instagram amplify these trends, making bouclé chairs aspirational décor items for global consumers.

Growth of Remote Work and Home Renovation

With remote and hybrid work models here to stay, consumers are investing in stylish yet comfortable seating. Bouclé chairs serve as both statement décor and functional seating in living rooms, bedrooms, and home offices.

Expanding Middle Class in Emerging Markets

Rising disposable incomes in China, India, and Southeast Asia are boosting demand for premium furniture. Smaller apartments and urban housing also increase demand for accent chairs over bulkier furniture, aligning with bouclé’s product strengths.

What are the restraints for the global market?

High Material and Manufacturing Costs

Bouclé fabric requires specialized weaving and skilled labor, increasing production costs. This positions bouclé chairs in premium and luxury price tiers, limiting affordability in cost-sensitive markets.

Maintenance and Durability Concerns

Bouclé fabric is prone to snagging, dust accumulation, and staining. These maintenance challenges reduce adoption in high-traffic commercial spaces unless stain-resistant or performance fabrics are used.

What are the key opportunities in the bouclé chair industry?

Sustainable Product Development

Eco-conscious consumers present an opportunity for chairs made with organic fabrics, recyclable frames, and low-impact finishes. Brands investing in green certifications can command premium pricing.

Emerging Market Expansion

Asia-Pacific, the Middle East, and Latin America are underserved but growing rapidly. Localized product lines, adapted designs, and competitive pricing could unlock new demand segments in these regions.

Product Innovation and Smart Features

Developing ergonomic, modular, and multifunctional bouclé chairs (e.g., with adjustable bases, storage, or smart charging options) presents new revenue streams, appealing to tech-savvy and space-constrained consumers.

Product Type Insights

Accent chairs and armchairs dominate, holding around 37% of the global share in 2024. Their versatility and role as statement pieces make them popular across residential and commercial buyers. Lounge chairs and swivel chairs are niche but growing as younger consumers explore alternative seating formats.

Application Insights

Residential use represents 70% of demand, led by living rooms, bedrooms, and home offices. Commercial and hospitality end-use, though smaller, is expanding quickly with boutique hotels, restaurants, and co-working spaces incorporating bouclé chairs for their aesthetic value. Export-driven demand is strong from Asia to Europe and North America.

Distribution Channel Insights

Online sales lead with a 55–60% share, driven by improved logistics, digital visualization tools, and growing consumer comfort with big-ticket e-commerce. Offline retail remains relevant for premium and luxury buyers who prefer tactile evaluation before purchase.

End-Use Insights

While residential demand dominates, commercial applications are the fastest-growing. Hotels, restaurants, and luxury offices are increasingly specifying bouclé chairs for ambiance and branding purposes. The institutional and contract furniture sector is also seeing higher inquiries for bouclé chairs with compliance certifications.

| By Product | By Material | By End-use | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads with over 40% of market share in 2024, driven by strong design culture and consumer appetite for Scandinavian and mid-century styles. The U.K., Germany, and Nordic countries are the top demand centers.

North America

North America holds a 28% share, led by the U.S., where home improvement and e-commerce adoption drive strong sales. Premium and luxury price tiers are performing particularly well in urban markets.

Asia-Pacific

APAC accounts for a 23% share but is the fastest-growing region with a projected CAGR above 8%. China, India, and Southeast Asia are driving demand, supported by rising disposable incomes and urban housing growth.

Latin America

Latin America holds a 5–8% share. Brazil and Mexico lead demand, with increasing adoption of imported bouclé chairs among the urban upper-middle class.

Middle East & Africa

MEA accounts for a 7% share of the global market. Growth is fueled by luxury demand in the UAE and Saudi Arabia, while South Africa supports regional sales in high-end residential and hospitality markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Boucle Chair Market

- CB2

- West Elm

- Ligne Roset

- Crate & Barrel

- Joybird

- Mitchell Gold + Bob Williams

- Anthropologie

- Article

- Room & Board

- Made.com

- IKEA

- Muuto

- Ashley Furniture

- Roche Bobois

- Design Within Reach

Recent Developments

- In June 2025, West Elm launched a new sustainable bouclé chair line made with recycled fibers and FSC-certified frames, targeting eco-conscious consumers in North America.

- In May 2025, Ligne Roset introduced a modular bouclé armchair series in Europe, blending luxury fabrics with ergonomic design.

- In March 2025, Article expanded its bouclé furniture collection into APAC markets, leveraging localized e-commerce platforms for direct-to-consumer sales.