Body Shapewear Market Size

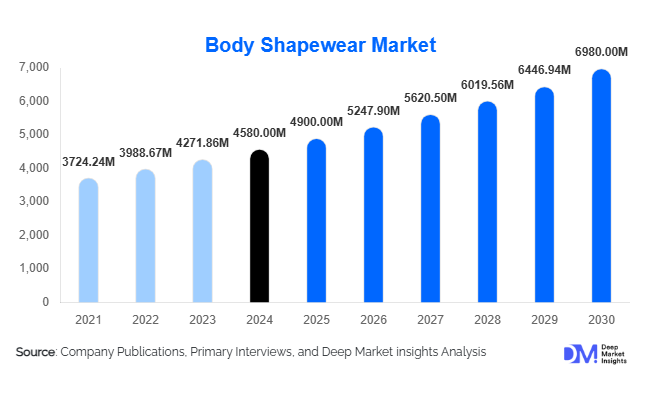

According to Deep Market Insights, the global body shapewear market size was valued at USD 4,580 million in 2024 and is projected to grow from USD 4,900 million in 2025 to reach USD 6,980 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing fashion consciousness, rising demand for comfortable and functional shapewear, the emergence of male shapewear, and technological innovations in fabric design.

Key Market Insights

- Women continue to dominate the shapewear market, accounting for approximately 88% of global demand in 2024, driven by daily wear, formal attire, and fitness applications.

- Bodysuits and full-body shapers lead product adoption, representing 35% of the 2024 market due to their versatility and post-surgical utility.

- Online retail channels dominate distribution, contributing 50% of the global market as e-commerce platforms enhance accessibility and direct-to-consumer brand engagement.

- Asia-Pacific is the fastest-growing region, driven by rising urbanization, social media influence, and westernized fashion adoption in countries such as China and India.

- Technological integration in fabrics, including seamless knitting, moisture-wicking, and smart compression materials, is enhancing comfort and expanding application segments such as fitness and post-surgical use.

- Sustainability trends, including eco-friendly fabrics and ethical production, are gaining traction among conscious consumers, creating premium market opportunities.

Latest Market Trends

Innovation in Materials and Comfort

Body shapewear manufacturers are increasingly focusing on innovative materials that enhance comfort and performance. Nylon and spandex blends, which represent 45% of the market, provide flexibility, durability, and seamless contouring. Advanced features such as moisture-wicking, anti-bacterial treatment, and breathability are now standard in premium products. Additionally, seamless knitting technologies are enabling full-body shapers and bodysuits to offer all-day comfort without compromising aesthetic appeal, fueling increased adoption in daily and fitness wear applications.

Expansion of the Male Shapewear Segment

The male shapewear segment is gaining attention due to rising fitness awareness, aesthetic-focused trends, and health-conscious lifestyles. Although still a smaller portion of the market, growth in compression shirts, waist trainers, and thigh shapers for men is accelerating. Brands are launching dedicated product lines and marketing campaigns targeting male consumers, leveraging social media influencers and e-commerce platforms to expand visibility. This diversification is widening the market base and driving incremental revenue growth globally.

Body Shapewear Market Drivers

Rising Fashion and Fitness Consciousness

Consumers’ increasing interest in body aesthetics, fitness, and fashionable clothing is driving the adoption of shapewear. Social media and influencer campaigns promote immediate body contouring solutions, particularly among young women aged 18–40. The trend toward slimmer silhouettes in professional, casual, and formal settings has strengthened demand for bodysuits, waist trainers, and thigh shapers.

Technological Advancements in Fabric and Design

Innovation in fabrics and seamless garment construction is enhancing comfort, durability, and overall appeal. Shapewear now integrates features such as temperature regulation, lightweight compression, and odor-resistant textiles. Smart textiles and 3D knitting are enabling more functional, adaptive garments, increasing acceptance in daily, fitness, and post-surgical applications.

Healthcare and Post-Surgical Demand

Medical-grade compression shapewear for post-surgical recovery is a growing driver in developed regions. Hospitals, clinics, and physiotherapy centers recommend shapewear for procedures such as abdominoplasty and liposuction. The high-margin, medical-grade segment also provides a stable revenue stream for manufacturers alongside fashion-driven sales.

Market Restraints

High Price Points of Premium Shapewear

Advanced shapewear using high-tech fabrics or tailored designs remains expensive, limiting penetration in price-sensitive markets. Consumers in emerging economies may find premium products inaccessible, restricting market growth despite rising awareness.

Discomfort Perception and Body Positivity Movement

Some consumers perceive shapewear as restrictive or uncomfortable, particularly during extended wear. Additionally, the growing body positivity movement in certain regions discourages the adoption of contouring garments, which can slow market expansion.

Body Shapewear Market Opportunities

Emerging Markets Expansion

Asia-Pacific, Latin America, and parts of the Middle East represent untapped opportunities. Rising urbanization, western fashion adoption, and increased online retail penetration are driving demand in China, India, Brazil, and Mexico. Localized product designs tailored to regional body types and climate conditions can enhance market entry for both existing and new players.

Integration of Smart and Functional Fabrics

Incorporating wearable technology and functional textiles such as temperature-regulating, posture-correcting, or moisture-wicking fabrics offers a unique market edge. Early adopters of these innovations can differentiate themselves, cater to health-conscious and fitness-focused consumers, and justify premium pricing.

Growth of Healthcare and Post-Surgical Applications

The demand for post-surgical shapewear is increasing in tandem with rising cosmetic procedures and awareness of recovery care. Partnerships with hospitals and clinics, and inclusion in post-operative care programs, provide high-margin opportunities for manufacturers targeting medical and therapeutic end-users.

Product Type Insights

Bodysuits and full-body shapers dominate the product segment, capturing 35% of the 2024 market. Their popularity is largely driven by their versatility, allowing use across casual, formal, and medical applications. Consumers increasingly prefer these products for multi-functional purposes, including daily wear, waist shaping, posture support, and post-surgical recovery. Waist shapers and thigh shapers follow in popularity, with strong adoption in fitness and waist-training applications, particularly among younger, body-conscious consumers. Bras and bust shapers are gaining traction in premium female shapewear lines, driven by the desire for enhanced body contouring without compromising comfort. Post-surgical products continue to expand steadily, supported by growing awareness among healthcare providers and increasing post-operative cosmetic procedures.

Material Type Insights

Nylon and Spandex blends lead the material segment with a 45% market share, favored for their elasticity, comfort, and durability, particularly in premium shapewear. Spandex/Lycra-based shapewear drives growth in high-end segments due to superior fit and stretchability. Cotton blends are increasingly preferred for casual wear, offering breathability and everyday comfort. Microfiber and polyester blends are widely adopted in seamless, lightweight shapewear designed to remain invisible under clothing. Latex-based shapewear, while niche, continues to maintain demand for waist-training and high-compression applications.

Distribution Channel Insights

Online retail is the leading distribution channel, representing 50% of the market. Growth is fueled by convenience, a wider product variety, influencer marketing, and direct-to-consumer brand engagement. Offline retail, including specialty stores, department stores, and multi-brand outlets, remains critical for premium product visibility and tactile consumer experience. Brands are increasingly integrating omnichannel strategies, combining online and offline touchpoints to enhance engagement, loyalty, and personalized shopping experiences. The rising penetration of e-commerce, particularly in North America and the Asia-Pacific region, is a key driver for regional expansion.

End-Use Insights

Daily wear and casual applications dominate the shapewear market with a 40% share, reflecting growing demand for comfort-oriented, seamless garments suitable for all-day wear. Formal wear, fitness, and post-surgical applications are experiencing faster growth, driven by increasing health-conscious lifestyles, rising cosmetic procedures, and higher disposable income. Post-surgical shapewear represents a high-margin opportunity, especially in North America and Europe, where healthcare infrastructure and awareness are well-established. Fitness-focused shapewear is expanding among younger consumers in Asia-Pacific and Latin America, reflecting growing interest in body aesthetics and active lifestyles. Export-driven demand from these regions is projected to reach approximately USD 1,150 million by 2030, highlighting the global growth potential.

| By Product Type | By Material Type | By Gender | By Distribution Channel | By End-Use / Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global market (USD 1,603 million in 2024), led by the U.S. High disposable income, fashion awareness, and extensive online retail penetration are the primary drivers of regional growth. Consumers increasingly purchase premium shapewear through e-commerce, leveraging convenience, a wide variety, and brand accessibility. The dominance of bodysuits and full-body shapers is particularly evident in this region due to their multifunctional use in daily, formal, and post-surgical applications. Rising awareness of fitness and wellness, coupled with the availability of advanced fabrics like Spandex/Lycra blends, further fuels demand.

Europe

Europe represents 30% of the market (USD 1,374 million), with Germany, France, and the U.K. as leading contributors. The fashion-forward consumer base and high preference for premium and designer shapewear are significant growth drivers. Sustainability and ethical production influence purchasing decisions, with consumers increasingly favoring eco-friendly and high-quality materials. Bodysuits and full-body shapers, along with Spandex-based fabrics, are particularly popular due to comfort, style, and versatility across formal and casual wear. Rising fitness awareness and adoption of post-surgical garments also contribute to the robust market performance in Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of 9%, driven by rapid urbanization, rising disposable income, and western fashion adoption, particularly in China, India, and Japan. Increasing exposure to social media and influencer-driven fashion trends has accelerated shapewear adoption among young urban consumers. Bodysuits and full-body shapers dominate product preference due to multi-functional use, while Spandex/Lycra-based materials are favored for their comfort and elasticity. Growing fitness consciousness and post-surgical recovery awareness further stimulate market demand, making Asia-Pacific a critical growth hub for both domestic and exported shapewear products.

Latin America

Brazil and Mexico are the leading markets in Latin America. Regional growth is driven by increasing awareness of body aesthetics, fitness trends, and rising disposable income among younger consumers. Bodysuits and full-body shapers are widely preferred for their multifunctionality, while Spandex/Lycra-based garments are gaining popularity in mid-range and premium segments. Online retail penetration is growing, supported by cross-border e-commerce and the import of established brands from North America and Europe, enabling wider access to quality shapewear. Fitness-oriented and daily-wear applications are particularly strong in urban centers.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, is witnessing rising demand for modern fashion trends and body-shaping apparel among women, while Africa remains a smaller but emerging market. High disposable income, premium fashion adoption, and exposure to international styles are key drivers in the Middle East. Bodysuits, full-body shapers, and Spandex/Lycra-based products dominate due to their versatility and comfort. Growing social media influence and online retail adoption are further boosting market penetration, particularly in urban regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Body Shapewear Market

- Spanx

- Shapermint

- Maidenform

- Yummie

- Wacoal

- Leonisa

- Jockey International

- Commando

- Hanesbrands

- Sassa

- Bali

- Cosabella

- Triumph International

- Skims

- Body Wrap

Recent Developments

- In May 2025, Spanx launched a premium line of smart shapewear integrating posture correction and temperature-regulating fabrics for North American consumers.

- In April 2025, Shapermint expanded its e-commerce presence in Asia-Pacific, introducing localized designs for the Indian and Chinese markets.

- In February 2025, Wacoal introduced a post-surgical shapewear range in Europe with hospital collaborations to promote medical-grade compression products.