Body Odor Remover Market Size

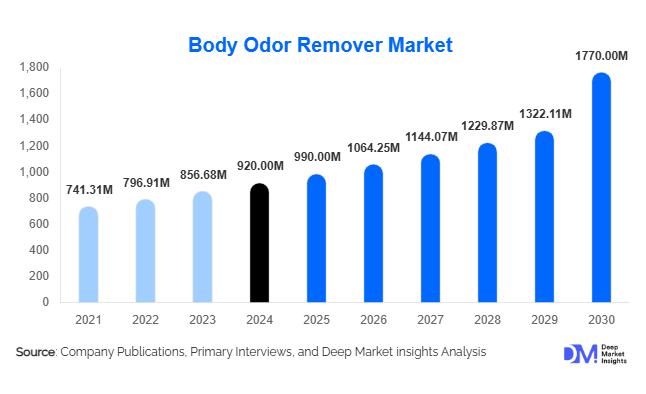

According to Deep Market Insights, the global body odor remover market size was valued at USD 920 million in 2024 and is projected to grow from USD 990 million in 2025 to reach USD 1,770 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness regarding personal hygiene, increasing adoption of natural and organic formulations, and the rapid expansion of fitness and wellness-oriented lifestyles globally.

Key Market Insights

- Sprays and aerosols dominate product formats, owing to convenience, fast coverage, and strong consumer preference for long-lasting underarm odor control.

- Natural and organic formulations are witnessing high growth, driven by consumer demand for aluminum-free, clean-label, and sustainable products.

- North America remains the largest market, accounting for approximately 33% of global revenue in 2024, supported by high disposable income and strong personal care awareness.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, middle-class expansion, and increasing exposure to global personal care trends.

- Online and e-commerce channels are rapidly gaining traction, enabling niche, premium, and natural product lines to reach broader audiences efficiently.

- Technological innovations, including enzyme-based odor neutralizers, fragrance microcapsules, and microbiome-friendly formulations, are reshaping product efficacy and consumer engagement.

What are the latest trends in the body odor remover market?

Rising Demand for Natural and Organic Formulations

Consumers are increasingly shifting toward products free from aluminum, parabens, and synthetic fragrances. Botanical extracts, enzyme-based odor neutralizers, and microbiome-friendly formulations are gaining popularity. Manufacturers are investing in R&D to improve efficacy and sensory appeal, catering to health-conscious consumers. The premium pricing of natural products allows higher margins, and environmentally conscious packaging reinforces brand value. This trend is particularly strong in North America and Europe and is gradually expanding in the Asia-Pacific.

Innovative Formats and Specialty Applications

Beyond traditional sprays, alternative formats such as wipes, creams, sticks, gels, and foot or intimate area-specific products are emerging rapidly. Travel-sized products, sport-focused deodorants, and on-the-go wipes are gaining popularity among active and fitness-oriented users. Advanced delivery systems, fragrance microcapsules, and moisture-activated formulations are enhancing product differentiation. Manufacturers are also exploring multi-functional formats that combine deodorizing with skin-care benefits, tapping into premium and niche consumer segments.

What are the key drivers in the body odor remover market?

Growing Personal Hygiene Awareness and Active Lifestyles

Increasing participation in fitness, sports, outdoor recreation, and frequent travel is fueling demand for effective odor control products. Rising social interactions, urbanization, and climate-related sweat challenges reinforce the need for reliable, long-lasting body odor removers. Consumers are willing to invest in products that deliver performance, comfort, and fragrance longevity, particularly in developed regions such as North America and Europe.

Expansion of Natural and Sustainable Products

The rising preference for clean-label, natural, and environmentally friendly products is a significant market driver. Consumers are opting for aluminum-free, plant-based, and cruelty-free formulations. Sustainable packaging solutions, such as refillable or biodegradable containers, enhance brand appeal and loyalty. Companies integrating sustainability into their product design benefit from premium pricing and improved consumer trust.

Growth of E-commerce and Digital Marketing

Online sales channels, including e-commerce marketplaces, direct-to-consumer platforms, and subscription models, have expanded market reach. Social media, influencer-led campaigns, and digital promotions are driving brand awareness and consumer engagement. E-commerce allows niche and premium products to penetrate smaller markets efficiently, facilitating faster adoption of innovative and natural formulations globally.

What are the restraints for the global market?

Regulatory and Compliance Challenges

Strict regulations on ingredient safety, labeling claims, and aerosol emissions can limit product innovation and increase manufacturing costs. Compliance with multi-regional standards, particularly in the EU, U.S., and Asia-Pacific, requires continuous reformulation, quality control, and documentation, which can be a barrier to entry for smaller players.

Raw Material Price Volatility and Packaging Costs

Fluctuating prices of essential oils, propellants, botanicals, and aluminum salts impact production costs. Sustainable and eco-friendly packaging options, while increasingly demanded by consumers, often cost more than traditional materials. Supply chain disruptions and logistical challenges can further pressure margins and influence retail pricing, particularly in emerging markets.

What are the key opportunities in the body odor remover industry?

Innovation in Natural and Clean-Label Products

The growing consumer shift toward health-conscious and environmentally responsible products presents a significant opportunity. Manufacturers investing in organic, aluminum-free, and plant-based odor removers can target premium pricing segments. Integration of microbiome-friendly ingredients and enzyme-based formulations provides differentiation while addressing emerging consumer concerns about skin health and chemical exposure.

Expansion in Specialty Formats and Applications

Emerging formats such as body wipes, foot odor removers, intimate area products, and multi-functional creams are creating new market segments. Products tailored for fitness enthusiasts, travelers, and occupational use (e.g., outdoor workers) are gaining traction. Packaging innovation, including travel-friendly, refillable, and biodegradable containers, further strengthens market opportunities.

Rapid Growth in Emerging Markets and E-commerce Channels

Asia-Pacific, the Middle East, and Africa offer significant growth potential due to rising urbanization, increasing disposable income, and exposure to global hygiene trends. E-commerce channels allow new entrants to reach niche consumers, introduce premium products, and capitalize on online marketing. Subscription-based and direct-to-consumer models also provide recurring revenue streams and enhanced customer loyalty.

Product Type Insights

Sprays and aerosols dominate the product segment, accounting for approximately 55–60% of the market revenue in 2024, due to convenience and perceived efficacy. Roll-ons, sticks, creams, and wipes are experiencing rapid growth, particularly in natural and specialty segments. Foot and intimate area products, while smaller in share, are growing fastest in emerging markets. Multi-functional and premium formulations are increasingly preferred for their added value in odor control, skin care, and sustainability.

Application Insights

Underarm/axillary applications account for the largest share (65–70%) of the market, reflecting habitual daily use. Foot odor removers, body wipes, and intimate care products are emerging applications showing above-average growth. Travel-friendly and on-the-go products are expanding, especially among urban, active, and fitness-conscious consumers. The rise of specialty applications is driving innovation in delivery formats, formulation, and packaging.

Distribution Channel Insights

Traditional retail (supermarkets, hypermarkets, pharmacies) represents the largest channel (65–70% of 2024 market revenue), driven by convenience, product visibility, and consumer trust. Online and direct-to-consumer channels are rapidly expanding, particularly for niche, premium, and natural products. Specialty stores, subscription models, and e-commerce marketplaces facilitate consumer access to innovative formats and sustainable products. Social media and influencer marketing further support digital engagement and brand awareness.

End-User Insights

Men represent the largest end-user segment (55–60%), reflecting increased male grooming awareness. Women and unisex products are also growing, particularly in natural and sensitive-skin formulations. Active and sports users drive demand for long-lasting, performance-oriented products. Age-wise, consumers aged 31–50 account for the largest share, balancing disposable income with lifestyle and hygiene priorities. Younger consumers (18–30) are driving growth in niche, natural, and online-purchased products.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (33%), with the U.S. leading, supported by high disposable income, strong hygiene awareness, and established retail infrastructure. Demand is particularly strong for sprays, premium, and natural products. E-commerce adoption is driving penetration in niche segments.

Europe

Europe accounts for 28% of the global market, led by Germany, the UK, and France. Consumers prioritize sustainability, natural ingredients, and ethical claims. Growth is strongest in premium and organic formulations, with younger demographics favoring eco-friendly and innovative products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Southeast Asia. Rapid urbanization, rising disposable incomes, and growing exposure to global hygiene trends are fueling demand for both conventional and natural products. E-commerce adoption accelerates growth in tier 2–3 cities.

Latin America

Latin America contributes 8–10% of the market, with Brazil, Mexico, and Argentina as key countries. Growth is driven by adventure and fitness-oriented consumers, with mid-tier products dominating. Online retail adoption supports premium and niche product sales.

Middle East & Africa

The Middle East & Africa hold 7–8% of the market. Hot climates and urbanization increase product demand. GCC countries (UAE, Saudi Arabia) are high-value consumers, and intra-regional African demand is rising due to increased awareness and e-commerce penetration. Premium and specialty products show above-average growth rates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Body Odor Remover Market

- Procter & Gamble

- Unilever

- L’Oréal Group

- Beiersdorf AG

- Colgate-Palmolive

- Johnson & Johnson

- Henkel AG & Co.

- Edgewell Personal Care

- Kao Corporation

- Godrej Consumer Products

- Reckitt Benckiser

- Shiseido

- Natura &Co

- Amorepacific

- Schmidt’s Naturals

Recent Developments

- In March 2025, Unilever launched a new line of aluminum-free body odor removers in the U.S., targeting eco-conscious consumers with refillable packaging.

- In February 2025, Beiersdorf AG expanded its NIVEA deodorant portfolio in Europe with enzyme-based formulations for sensitive skin.

- In January 2025, Procter & Gamble introduced a subscription-based direct-to-consumer model for its premium antiperspirant sprays in North America and Asia-Pacific.