Global Body Jewelry Market Size

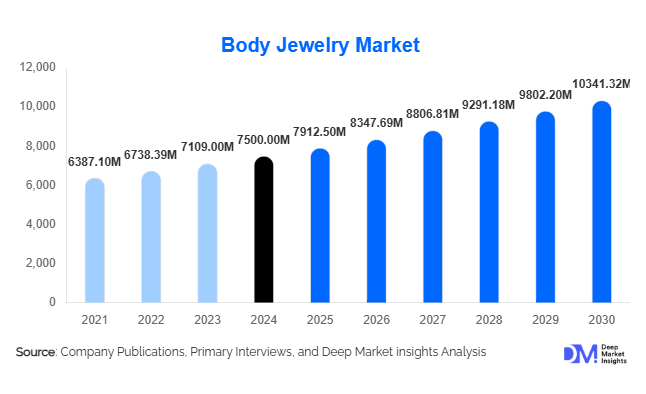

According to Deep Market Insights, the global body jewelry market size was valued at USD 7,500 million in 2024 and is projected to grow from USD 7,912.50 million in 2025 to reach USD 10,341.32 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market’s growth is driven by increasing acceptance of body piercings across mainstream fashion, rising disposable incomes, and the surge in e-commerce and digital customization platforms. Premiumization through the use of implant-grade materials, such as titanium and gold, along with hypoallergenic offerings, is further bolstering global demand.

Key Market Insights

- Body jewelry is becoming mainstream across cultures and demographics, shifting from niche subcultures to a fashion-forward accessory that emphasizes personal expression.

- Premium and hypoallergenic materials, including surgical stainless steel, titanium, and gold, are driving higher-margin segments as consumers seek safe, long-lasting, and stylish pieces.

- Online retail dominates distribution, leveraging D2C websites, marketplaces, and social media to expand reach and drive adoption among younger demographics.

- Emerging markets in Asia-Pacific, particularly India and China, represent the fastest-growing regions due to rising middle-class wealth, urbanization, and cultural integration of body piercings into modern fashion.

- Customization and digital integration, including 3D printing, AR try-on tools, and social media-led design trends, are reshaping product development and consumer engagement.

Latest Market Trends

Premiumization and Safety Awareness

Consumers increasingly prioritize biocompatible, hypoallergenic, and implant-grade materials, driving the adoption of high-quality products. This trend is fueled by awareness of allergic reactions and infections associated with low-grade metals. Premiumization also encompasses design differentiation, with bespoke pieces, modular ear stacks, and personalized nose or lip rings gaining popularity. Social media influencers and celebrities further endorse these premium and safe jewelry lines, shaping consumer expectations and encouraging repeat purchases.

Customization and Digital Engagement

Technological advancements are revolutionizing the body jewelry market. Digital configurators and AR-based virtual try-on tools allow consumers to visualize and customize their pieces before purchase. 3D printing supports rapid prototyping of unique designs. Social media platforms, including Instagram and TikTok, facilitate community engagement, trend-sharing, and influencer collaborations, which drive sales and brand loyalty. E-commerce platforms enable direct-to-consumer sales, bypassing traditional retail channels and enhancing access to niche products worldwide.

Body Jewelry Market Drivers

Fashion-Driven Personal Expression

Body jewelry is increasingly viewed as a form of self-expression and fashion statement. Multiple ear piercings, nose rings, lip and tongue piercings, and belly-button adornments have become mainstream among Millennials and Gen Z. Social media and celebrity trends accelerate this adoption. Younger consumers often purchase multiple pieces, favoring stacking and layering, which contributes to increased sales volume and revenue growth.

Online Retail Penetration

E-commerce has enabled global access to body jewelry. Consumers can compare products, read reviews, and purchase niche or premium items not available locally. Omnichannel strategies combining online and offline stores further enhance market penetration. Online platforms account for approximately 55% of global sales in 2024, highlighting their central role in driving growth.

Material and Safety Awareness

Health-conscious consumers demand safe, hypoallergenic, and long-lasting materials. Implant-grade titanium, niobium, and high-quality gold are increasingly preferred. This trend supports premium pricing, higher margins, and repeat purchases. Awareness campaigns and certification standards strengthen consumer confidence in high-value offerings, contributing to sustained growth.

Market Restraints

Regulatory and Safety Challenges

Strict regulations related to materials, hygiene standards in piercing studios, and health compliance can restrict market expansion. Variations in international standards, including nickel content limits and implant-grade certification requirements, add operational complexities for manufacturers and retailers, particularly for exports.

Market Fragmentation and Competitive Pressure

The market remains highly fragmented, with numerous small-scale players, local piercing studios, and fashion accessory brands. Price competition, particularly in lower-cost stainless steel segments, creates margin pressure. New entrants must differentiate through branding, quality, or online reach to succeed in this competitive environment.

Body Jewelry Market Opportunities

Emerging Regional Demand

Asia-Pacific, Latin America, and parts of the Middle East represent high-growth regions due to cultural integration of piercings, rising disposable incomes, and e-commerce adoption. Tailored product designs, local influencer collaborations, and digital marketing campaigns can effectively tap into these markets. Regulatory relaxations and urbanization trends support increased adoption.

Premiumization and Hypoallergenic Materials

High-value segments, including titanium, niobium, and gold, offer opportunities for existing players and new entrants to differentiate and enhance profitability. Safety certifications, customization, and premium branding resonate with affluent consumers and those with sensitive skin, driving both repeat purchases and brand loyalty.

Customization and Digital Platforms

Advances in AR, 3D printing, and digital configurators enable personalized jewelry experiences. Direct-to-consumer e-commerce models reduce reliance on intermediaries, offering higher margins. Social media and influencer-driven campaigns amplify reach, enabling brands to engage younger demographics and cultivate niche communities around bespoke body jewelry.

Product Type Insights

Ear jewelry remains the leading segment, accounting for approximately 50% of the global market in 2024. Multiple lobe and cartilage piercings are increasingly popular across all genders. Nose and facial jewelry, including septum rings, nostril studs, and lip rings, are gaining adoption due to fashion and cultural integration. Navel and body jewelry, particularly dermal anchors and belly-button studs, appeal to younger consumers seeking expressive and aesthetic piercings. Specialty industrial piercing jewelry is a smaller but growing segment driven by unique piercing trends and customization.

Material Insights

Surgical stainless steel dominates material usage globally, accounting for 40–45% of the market in 2024 due to affordability and suitability for initial piercings. Premium materials such as titanium, niobium, and gold are growing rapidly, supported by rising health awareness, hypoallergenic demand, and fashion-forward consumer behavior.

Distribution Channel Insights

Online retail leads global distribution, with a 55% market share in 2024. Direct-to-consumer websites, e-commerce marketplaces, and social media channels drive sales. Offline retail, including jewelry boutiques and piercing studios, remains significant for in-person purchase and initial piercing services. Wholesale/OEM distribution supports bulk supply to studios and fashion retailers.

End-Use Insights

Personal fashion and self-expression remain the largest end-use segment, followed by piercing and tattoo studios. Export-driven demand from manufacturing hubs in India and China supports global supply chains. Emerging applications include medical-grade implantable jewelry and gender-neutral designs, fueling growth beyond traditional fashion channels.

| By Product Type | By Material Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the global market in 2024, led by the U.S. and Canada. Strong fashion adoption, high disposable income, and online retail penetration drive demand. Consumers prioritize premium materials and customization options, particularly among Millennials and Gen Z.

Europe

Europe holds 35–40% of the global market, with the UK, Germany, France, and Italy as key demand centers. Adoption is driven by high disposable incomes, fashion-forward trends, and a mature piercing culture. Eco-conscious consumers favor sustainable and ethical jewelry lines, while online retail facilitates global product access.

Asia-Pacific

Asia-Pacific is the fastest-growing region. India and China lead expansion due to rising middle-class wealth, urbanization, and acceptance of piercings in mainstream fashion. Japan and South Korea are mature markets with steady adoption, focused on premium and aesthetic products.

Latin America

Latin America accounts for 5–7% of the market, with Brazil and Mexico showing growth in urban fashion trends and outbound purchases of premium jewelry. Niche operators are promoting conservation-themed and custom designs to attract younger consumers.

Middle East & Africa

MEA represents 5–8% of the market. GCC countries such as the UAE, Saudi Arabia, and Qatar show high adoption of premium and luxury body jewelry. Intra-African travel supports regional demand, particularly in South Africa, Kenya, and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Body Jewelry Market

- Anatometal

- Body Vision Los Angeles (BVLA)

- NeoMetal

- LeRoi

- Salamander Jewelry Factory

- ZeSen Jewellery

- Changan Tanaer Jewelry Factory

- Industrial Strength

- BodyCandy

- Titanium Jewellery

- Kuber Industries

- Holly’s Body Jewelry

- Body Art Forms

- Wildcat

- True Body Jewelry

Recent Developments

- May 2025: Wilderness Safaris announced expansion into Botswana with solar-powered camps and community-led conservation projects.

- April 2025: Intrepid Travel launched small-group tours in Tanzania, integrating carbon offset programs and Maasai cultural exchanges.

- February 2025: Singita introduced a wellness-focused lodge in South Africa, combining wildlife encounters with yoga and holistic therapies.