Body Contouring Devices Market Size

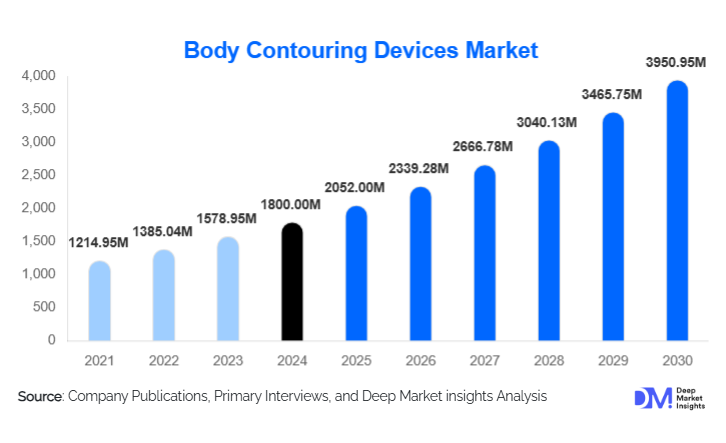

According to Deep Market Insights, the global body contouring devices market size was valued at USD 1,800 million in 2024 and is projected to grow from USD 2,052.00 million in 2025 to reach USD 3,950.95 million by 2030, expanding at a CAGR of 14% during the forecast period (2025–2030). The growth of the body contouring devices market is primarily driven by increasing demand for non-invasive and minimally invasive aesthetic procedures, technological advancements in hybrid energy devices, rising consumer awareness of body aesthetics, and the expansion of aesthetic clinics and medical spas globally.

Key Market Insights

- Non-invasive and hybrid devices are increasingly preferred for fat reduction, skin tightening, and muscle sculpting, reflecting a shift away from traditional invasive procedures such as liposuction.

- Medical tourism is accelerating market growth, particularly in emerging regions like Asia-Pacific and Latin America, as patients seek cost-effective and high-quality aesthetic treatments.

- North America dominates the market, driven by high disposable income, advanced aesthetic infrastructure, and early adoption of cutting-edge technologies.

- Asia-Pacific is the fastest-growing region, fueled by rising beauty consciousness, expanding clinic networks, and increased access to advanced technologies in China, India, and South Korea.

- Technological integration, including AI-driven treatment planning, hybrid energy systems, and modular multi-functional platforms, is enhancing treatment efficacy and clinic operational efficiency.

- Hospitals and aesthetic clinics remain the largest end users, reflecting strong capital investment in equipment and adoption of both non-invasive and surgical devices for diverse patient needs.

What are the latest trends in the body contouring devices market?

Hybrid and Multi-Modal Devices

Hybrid systems combining multiple technologies, such as radiofrequency, ultrasound, and electromagnetic stimulation, are gaining traction. These platforms allow clinics to offer combined treatments, fat reduction, skin tightening, and muscle toning, using a single device. The multi-modal approach enhances patient satisfaction, reduces treatment time, and provides a higher return on investment for clinics. Manufacturers are increasingly adopting modular designs that enable easy upgrades and integration of new technologies, expanding device longevity and market appeal.

AI-Driven Personalized Treatments

Artificial intelligence and 3D imaging are transforming body contouring procedures. AI-enabled devices can assess patient body composition, predict optimal treatment settings, and customize protocols for better outcomes. Clinics leveraging AI-based solutions can deliver consistent results, enhance patient confidence, and attract tech-savvy clientele. Predictive analytics also supports operational efficiency by reducing treatment errors and minimizing energy wastage, making clinics more competitive.

What are the key drivers in the body contouring devices market?

Growing Preference for Non-Invasive Aesthetic Procedures

Patients increasingly prefer non-surgical treatments due to minimal downtime, lower risk, and convenience. Procedures such as cryolipolysis, high-intensity focused ultrasound (HIFU), and radiofrequency treatments are gaining popularity globally. This shift is particularly strong among millennials and working professionals seeking aesthetic improvements without significant recovery periods.

Technological Advancements and Innovation

Continuous innovation in device technologies, including hybrid energy systems and high-precision non-invasive platforms, drives adoption. Devices with multiple functionalities, such as fat reduction combined with skin tightening, provide more value to clinics and attract a broader patient base. Integration of smart sensors and AI capabilities further enhances treatment safety and outcomes, solidifying market growth.

Rising Aesthetic Awareness and Medical Tourism

Increasing consumer awareness about body aesthetics, coupled with affordable aesthetic treatments in emerging markets, boosts the demand for body contouring devices. Medical tourism is a key enabler, with patients from developed regions traveling to countries in the Asia-Pacific, Latin America, and the Middle East for high-quality yet cost-effective treatments.

What are the restraints for the global market?

High Cost of Devices and Procedures

High upfront costs of advanced body contouring devices, particularly hybrid or multi-modal platforms, pose adoption challenges, especially for smaller clinics in emerging markets. Leasing and subscription models are helping reduce financial barriers, but price sensitivity remains a limiting factor for broader market penetration.

Regulatory Challenges and Lack of Reimbursement

Stringent regulatory requirements and varying approval timelines across regions can delay product launches. Additionally, body contouring procedures are mostly elective and fall outside reimbursable medical services, limiting affordability and constraining market growth in some countries.

What are the key opportunities in the body contouring devices industry?

Expansion into Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant growth potential. Rising disposable incomes, expanding clinic infrastructure, and increasing consumer interest in aesthetic procedures make these markets attractive for device manufacturers. Local partnerships and targeted marketing strategies can accelerate penetration.

AI-Enabled and Personalized Treatment Platforms

Integration of AI and 3D imaging allows devices to provide personalized treatment plans tailored to individual patient anatomy. These smart devices improve treatment outcomes, patient satisfaction, and repeat business, creating competitive differentiation for early adopters.

Multi-Function and Hybrid Energy Systems

Devices offering combined capabilities, fat reduction, skin tightening, and muscle sculpting, meet growing clinic demand for cost-effective, high-value platforms. Subscription-based models for these multi-functional devices enable smaller clinics to access advanced technology without heavy capital investment, expanding market reach.

Product Type Insights

Non-invasive body contouring devices remain the dominant product category, accounting for approximately 58.5% of the global market share in 2024. The demand for technologies such as cryolipolysis, radiofrequency (RF), high-intensity focused ultrasound (HIFU), and hybrid-energy systems continues to rise due to their safety profile, minimal downtime, and high patient acceptance. These systems appeal to both first-time aesthetic consumers and working professionals who prefer treatments that do not interrupt daily schedules.

Minimally invasive devices, such as laser-assisted lipolysis and RF-assisted lipolysis, serve clinics offering more advanced interventions while avoiding the surgical complexity of traditional liposuction. These solutions bridge the gap between non-invasive procedures and surgical outcomes, appealing to patients seeking moderate yet visible body contouring improvements.

Application Insights

Fat reduction remains the leading application across all device categories, driven by rising global obesity rates, increased focus on body aesthetics, and strong clinical evidence supporting non-invasive fat reduction modalities. Skin tightening and cellulite reduction represent the next largest segments, together comprising approximately 42.5% of the market in 2024. These applications benefit from the increasing popularity of combination treatments, where devices simultaneously target fat, skin laxity, and textural irregularities.

Muscle sculpting and post-bariatric contouring are rapidly emerging segments. The surge in hybrid devices that combine electromagnetic stimulation with RF technology has significantly boosted the adoption of non-invasive muscle toning procedures. Additionally, the growing number of bariatric surgeries worldwide is driving demand for contouring solutions that address loose skin and residual fat following major weight loss.

Distribution Channel Insights

Hospitals and specialty aesthetic centers remain the dominant distribution channel, accounting for approximately 65.2% of total market share in 2024. Hospitals benefit from larger capital budgets, integrated surgical departments, and the ability to offer a full spectrum of non-invasive, minimally invasive, and surgical procedures. Their access to trained surgeons and post-operative care systems strengthens demand for advanced contouring platforms.

Aesthetic clinics and medical spas represent the fastest-growing distribution channel globally. Their rise is propelled by the widespread transition toward non-invasive treatments, flexible business models, and strong consumer demand for wellness-oriented cosmetic procedures. Many med-spas utilize subscription-based treatment plans, significantly driving recurring revenue and accelerating device adoption.

End-User Insights

The primary end-users of body contouring devices include aesthetic clinics, hospitals, ambulatory surgical centers (ASCs), and medical spas. Aesthetic clinics continue to be the key growth engine due to their treatment versatility, ability to adopt innovative technologies quickly, and high-volume patient traffic. Clinics increasingly invest in multi-functional devices that offer fat reduction, skin tightening, and muscle sculpting through a single platform, optimizing ROI.

Hospitals and ASCs dominate the surgical device segment, particularly for liposuction and post-bariatric contouring procedures. Their demand is driven by expanding obesity-related surgeries, medical-grade safety requirements, and advanced surgical teams.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for the largest share of the global body contouring devices market (39.8%), supported by high disposable income, strong consumer willingness to spend on aesthetic procedures, and early adoption of cutting-edge non-invasive technologies. The U.S. leads the region due to its well-established aesthetic clinic infrastructure, robust presence of medical device manufacturers, and continuous innovation in radiofrequency, cryolipolysis, and hybrid energy platforms.

Growth is further driven by increasing demand for minimally invasive treatments, expanding medical spa networks, and rising prevalence of obesity, which fuels interest in fat reduction and skin tightening solutions. Favorable reimbursement trends for certain post-bariatric procedures and a strong culture of elective cosmetic treatments also contribute significantly to regional expansion.

Europe

Europe holds a substantial market share, with Germany, the U.K., France, and Italy acting as major contributors. The region demonstrates a strong preference for non-invasive and hybrid contouring technologies, supported by high patient awareness, advanced clinical standards, and regulatory frameworks that emphasize device safety and efficacy.

Key growth drivers include increasing adoption of aesthetic procedures among aging populations, rising demand for combination therapies (fat reduction + skin tightening), and the expansion of aesthetic clinics and medical spas in metropolitan areas. Growth is reinforced by strong medical tourism in countries like Turkey and Spain, as well as a rising focus on body sculpting solutions within premium wellness centers.

Asia-Pacific

APAC represents the fastest-growing region in the global body contouring devices market, led by China, India, South Korea, and Japan. Rapid growth is fueled by rising middle-class income levels, urbanization, and growing acceptance of cosmetic and wellness procedures among younger populations. Strong medical tourism hubs such as South Korea and Thailand attract international patients seeking advanced body sculpting procedures at competitive costs.

Additional drivers include rapid clinic expansion, aggressive adoption of hybrid devices combining RF, ultrasound, and cryolipolysis, and increasing investments by global manufacturers to penetrate price-sensitive markets. Subscription-based device procurement models and government support for healthcare modernization also significantly enhance market scalability.

Latin America

Latin America, with Brazil and Mexico at the forefront, is emerging as a high-opportunity market for body contouring devices. Rising disposable incomes, an expanding aesthetic-conscious population, and strong medical tourism, particularly in Brazil, drive demand for fat reduction, cellulite treatment, and body sculpting procedures.

Cost-effective availability of skilled cosmetic practitioners, increasing adoption of non-invasive systems in clinics, and a cultural preference for body enhancement procedures strengthen regional growth. Expanding private aesthetic centers and growing interest in minimally invasive treatments among younger demographics further accelerate market penetration.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, demonstrates a growing demand for premium body contouring technologies, driven by high-income populations, strong cosmetic procedure acceptance, and the rapid expansion of luxury medical spas and wellness centers. Adoption of advanced RF, laser-assisted lipolysis, and hybrid platforms is rising, supported by significant healthcare investments and the presence of international aesthetic brands.

In Africa, the market remains niche but growing, primarily driven by private aesthetic clinics in South Africa, Egypt, and Kenya. Expanding urban populations, increasing awareness of non-invasive treatments, and gradual improvements in healthcare infrastructure are contributing to early-stage market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Body Contouring Devices Market

- AbbVie / Allergan

- InMode Ltd.

- Hologic / Cynosure

- Lumenis

- Merz Pharma

- Candela Medical

- Alma Lasers

- BTL Industries

- Cutera

- Venus Concept

- Lutronic

- Sciton

- EndyMed

- Sofwave

- Fotona

Recent Developments

- In May 2025, InMode launched a new hybrid platform combining HIFEM and RF for simultaneous fat reduction and muscle toning, targeting aesthetic clinics globally.

- In April 2025, Allergan expanded CoolSculpting adoption programs across Asia-Pacific, partnering with major aesthetic clinic chains in China and India.

- In February 2025, Lumenis introduced AI-enabled RF devices for personalised skin tightening treatments in North America and Europe, enhancing treatment accuracy and patient satisfaction.