Bluetooth Mouse Market Size

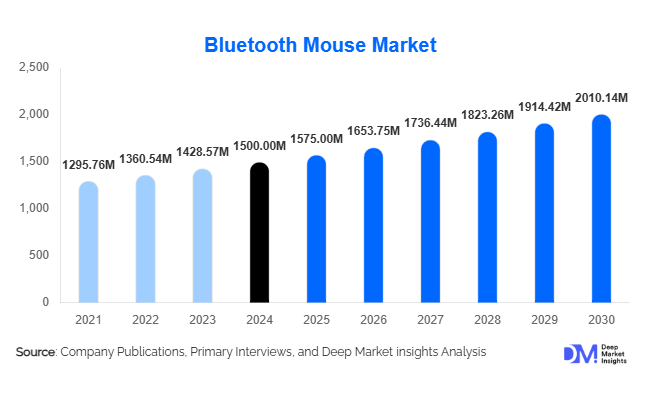

According to Deep Market Insights, the global Bluetooth mouse market size was valued at USD 1,500 million in 2024 and is projected to grow from USD 1,575 million in 2025 to reach USD 2,010.14 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is primarily driven by rising adoption of portable computing devices, increasing focus on ergonomics, and growing demand for high-performance and multi-device-compatible mice across consumer, corporate, and gaming segments.

Key Market Insights

- Ergonomic and gaming-focused designs are gaining prominence, catering to professional users, gamers, and health-conscious consumers seeking comfort and precision.

- North America dominates the Bluetooth mouse market, with strong demand from the U.S. and Canada, fueled by high laptop adoption, corporate use, and the gaming industry.

- Asia-Pacific is emerging as the fastest-growing region, led by China and India, due to rising middle-class affluence, mobile device adoption, and a growing gaming ecosystem.

- Corporate and educational sectors continue to drive demand, as hybrid work and digital learning increase peripheral requirements.

- Technological integration, including multi-device pairing, AI-assisted precision, and energy-efficient Bluetooth modules, is shaping market competitiveness.

- Sustainable and eco-friendly designs using recycled plastics and long-life batteries are increasingly influencing consumer purchasing decisions.

Latest Market Trends

Ergonomics and Health-Conscious Designs

Manufacturers are focusing on ergonomic Bluetooth mice to reduce wrist strain and repetitive stress injuries among office professionals and gamers. Vertical mice, contoured shapes, and lightweight designs are becoming standard, particularly in North America and Europe. Ergonomic innovation not only enhances user comfort but also positions brands as health-conscious and premium in the market, driving repeat purchases and loyalty.

High-Performance Gaming Mice Adoption

The gaming and eSports industry has fueled demand for Bluetooth mice with high DPI, programmable buttons, customizable RGB lighting, and low-latency performance. Gaming peripherals are now targeting both amateur and professional gamers, with growth concentrated in APAC and North America. Integration with PC gaming platforms and gaming consoles has further expanded the addressable market.

Eco-Friendly and Sustainable Products

Consumers increasingly prefer products made from recycled plastics, energy-efficient Bluetooth modules, and long-lasting rechargeable batteries. Manufacturers leveraging eco-friendly certifications and sustainability-focused marketing are gaining competitive advantages. These initiatives align with broader environmental regulations and evolving consumer values globally, especially in Europe and APAC.

Bluetooth Mouse Market Drivers

Rising Laptop and Portable Device Adoption

The increasing global use of laptops, ultrabooks, and tablets across corporate, educational, and home environments has been a key driver. Portability and wireless connectivity simplify remote work setups and mobile computing, boosting Bluetooth mouse adoption. Corporate IT upgrades and BYOD (bring-your-own-device) initiatives further support peripheral demand.

Growth of Gaming and eSports

High-performance Bluetooth mice are increasingly adopted in professional and casual gaming setups. Features such as programmable keys, ultra-precise tracking, and low-latency connectivity attract gamers. The expanding eSports ecosystem, content creation, and live streaming have accelerated demand, particularly in APAC and North America.

Focus on Ergonomics and User Health

Growing awareness of repetitive strain injuries (RSI) and carpal tunnel syndrome has encouraged investment in ergonomic mice. Both corporate IT procurement and individual consumer preferences are shifting toward designs that offer prolonged comfort and reduced health risks, further stimulating market growth.

Market Restraints

Higher Cost Compared to Wired Mice

Bluetooth mice are generally more expensive than traditional wired alternatives. In price-sensitive markets, this limits penetration, particularly in parts of LATAM and MEA. Budget-conscious consumers often opt for wired peripherals, slowing overall market growth.

Connectivity and Battery Limitations

While convenient, Bluetooth mice are dependent on battery life and can face interference in dense device environments. Users may encounter latency or pairing issues, which can restrict adoption among professional users requiring seamless performance.

Bluetooth Mouse Market Opportunities

Integration with IoT and Smart Devices

The rise of hybrid workspaces and smart device ecosystems has created opportunities for multi-device Bluetooth mice. Devices capable of seamless switching between laptops, tablets, and smart TVs offer convenience, attracting tech-savvy consumers and office professionals.

Emerging Regional Demand

Untapped markets in India, Southeast Asia, and Latin America are witnessing growing laptop penetration and gaming adoption. Government initiatives promoting digital literacy and remote education further increase peripheral device demand, creating expansion opportunities for new entrants and existing players.

Sustainable and Eco-Friendly Innovations

Eco-conscious consumers are influencing the market toward sustainable products. Manufacturers introducing recycled plastics, low-power modules, and long-life rechargeable batteries can differentiate their offerings. This aligns with global environmental regulations and enhances brand perception, particularly in Europe and APAC.

Product Type Insights

Standard Bluetooth mice continue to dominate the market due to their affordability, wide availability, and compatibility with a broad range of devices. Corporate and consumer adoption of these models remains strong, particularly in office and home setups. Gaming Bluetooth mice, however, are the fastest-growing sub-segment, driven by high-performance features such as ultra-precise sensors, customizable DPI settings, macro buttons, and RGB lighting. The rise of online gaming and eSports communities is fueling this growth, particularly in APAC and North America. Ergonomic Bluetooth mice cater to a premium niche, increasingly preferred by office professionals and health-conscious users seeking to prevent wrist strain and repetitive stress injuries. Portable and travel-focused Bluetooth mice are expanding in line with mobility trends, supporting laptop and tablet users in remote work, educational, and travel contexts, with high adoption observed in APAC and North America.

Application Insights

Consumer and corporate applications account for the largest market share for Bluetooth mice. On the consumer side, demand is bolstered by gaming, personal computing, and creative applications, while corporate environments are standardizing peripherals for uniformity and ease of use, enhancing adoption rates. Gaming and eSports applications are seeing rapid growth, driven by competitive gaming and streaming trends. Educational institutions are emerging as an important end-use segment due to the proliferation of remote learning, hybrid classrooms, and digital education tools. Additionally, Bluetooth mice are increasingly integrated into professional and creative workflows, including graphic design, video editing, and content creation, reflecting diversification in end-use demand and creating opportunities for high-precision, multi-device models.

Distribution Channel Insights

Online platforms remain the dominant sales channel, providing extensive e-commerce reach, price comparisons, and direct-to-consumer engagement. Offline retail channels, including electronics stores, specialty stores, and department stores, remain significant in emerging markets where consumers prefer to physically test devices before purchase. Direct brand sales via D2C websites are rising, allowing manufacturers to offer customizations, bundled offerings, and subscription-based services tailored for premium users. The combination of online convenience and offline experiential sales is supporting the broad adoption of Bluetooth mice across regions.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (32% in 2024), driven by strong adoption of laptops, gaming peripherals, and corporate standardization of office devices. The shift toward remote and hybrid work models has significantly increased the demand for ergonomic and portable peripherals, including Bluetooth mice. Gaming and eSports communities in the U.S. and Canada further contribute to market expansion, particularly in high-performance and gaming-specific models. Multi-device compatibility and ergonomic design are leading drivers for this region, reflecting a preference for efficiency, comfort, and high productivity in both personal and professional environments.

Europe

Europe accounts for 28% of the global market, with Germany, the UK, and France leading adoption. Regional growth is driven by environmental concerns, as consumers increasingly prefer rechargeable Bluetooth mice to reduce disposable battery usage. Sustainability initiatives, coupled with ergonomic awareness in office environments, are encouraging widespread adoption. Multi-device functionality and eco-friendly designs are particularly attractive to corporate buyers and home users. Additionally, regulatory emphasis on energy efficiency and environmental standards is stimulating the shift toward premium, sustainable peripherals across European markets.

Asia-Pacific

APAC is the fastest-growing region, led by China, India, Japan, and South Korea. Rapid urbanization, increasing digital literacy, and tech-savvy consumers are driving the adoption of advanced Bluetooth peripherals. Remote learning, mobile device usage, and gaming adoption further accelerate market growth. Gaming Bluetooth mice are especially popular, reflecting the strong eSports culture in China and India. Rising middle-class affluence, coupled with demand for ergonomic and portable devices in urban workplaces, is sustaining long-term growth in both consumer and corporate segments. Multi-device support and high-performance features are key segment drivers in this region.

Latin America

Latin America shows gradual adoption, led by Brazil, Mexico, and Argentina. Growth is primarily observed in consumer and gaming segments, driven by increasing digital literacy and rising gaming popularity. Premium products have limited reach due to cost sensitivity, but mid-range and gaming-focused Bluetooth mice are gaining traction among urban consumers. Corporate and educational adoption is slowly increasing, particularly in larger enterprises and universities embracing hybrid work and learning models. Gaming enthusiasts and tech-savvy students are key segment drivers in Latin America.

Middle East & Africa

MEA demand is focused on corporate and consumer applications, with high-income populations in the UAE, Saudi Arabia, and South Africa driving adoption of premium and ergonomic models. Africa’s growth is emerging through corporate and educational demand, where standardized peripherals enhance productivity. Regional drivers include rising corporate IT spending, digital transformation initiatives, and the adoption of ergonomic and portable devices to support hybrid work. Consumer demand for high-performance and gaming peripherals is increasing in urban areas, particularly among young, tech-focused populations. Multi-device compatibility, ergonomic design, and premium quality remain key drivers for this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bluetooth Mouse Market

- Logitech

- Microsoft

- HP

- Razer

- Dell

- Lenovo

- ASUS

- Apple

- SteelSeries

- Glorious PC Gaming Race

- Rapoo

- VicTsing

- Jelly Comb

- Perixx

- Elecom

Recent Developments

- In March 2025, Logitech launched a new multi-device Bluetooth mouse series with ultra-low latency and extended battery life, targeting professional users and gamers.

- In January 2025, Razer introduced the eco-friendly ergonomic gaming mouse, made with recycled plastics and energy-efficient components for the APAC and North America markets.

- In July 2024, Microsoft expanded its ergonomic Bluetooth mouse lineup, integrating AI-assisted precision and customizable buttons for corporate and creative professionals.