Birdwatching Tourism Market Size

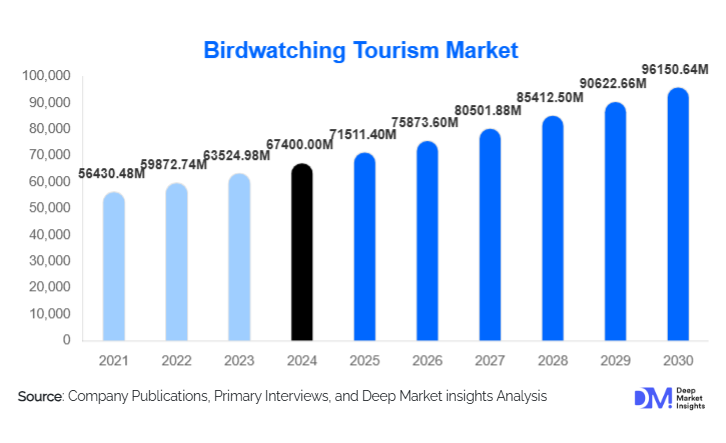

According to Deep Market Insights, the global birdwatching tourism market size was valued at USD 67,400.00 million in 2024 and is projected to grow from USD 71,511.40 million in 2025 to reach USD 96,150.64 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The expansion of this market is driven by growing environmental consciousness, increased global interest in eco-and experiential travel, and the rise of technology-enabled birding experiences.

Key Market Insights

- Birdwatching is becoming more mainstream and conservation-oriented, with travelers seeking low-impact, meaningful nature experiences rather than simple sightseeing.

- Small-group, expert-led birding tours dominate, as enthusiasts and serious birders prefer curated itineraries, local ornithological knowledge, and high guide-to-guest ratios.

- Asia-Pacific is among the fastest-growing regions, backed by strong biodiversity, increasing middle-class wealth, and growing domestic and inbound eco-tourism infrastructure.

- Technological tools like bird-identification apps, eBird integration, and real-time species tracking are being increasingly adopted by tour operators, enhancing the customer experience and conservation data collection.

- Conservation partnerships and sustainable tourism models are shaping product differentiation, with many operators reinvesting in habitat protection and community engagement.

- Growth in academic and citizen-science birding travel is fueling a niche for tours that offer research participation, bird counts, and data collection as part of the travel experience.

What are the Latest Trends in the Birdwatching Tourism Market?

Conservation-Integrated Birding Tours

Tour operators are increasingly combining birdwatching with conservation efforts. Many packages now include participation in citizen-science projects, species monitoring, or habitat restoration. These tours allow travelers to contribute financially and experientially to bird conservation, aligning their travel with ecological impact. Such models are attractive to eco-conscious birders and help operators form partnerships with NGOs, governments, and local communities. These initiatives also strengthen the social license for tourism in fragile bird habitats.

Digital & Data-Driven Birding Experiences

Technology is reshaping the birding-tourism experience. Leading birding tour operators are integrating real-time eBird data to optimize itineraries so that travelers are more likely to encounter target species. Mobile apps now help with species identification, trip journaling, and social sharing. Some tours use AI-powered bird ID tools, and guides and guests can instantly identify birds via smartphone. This data-driven approach not only elevates the guest experience but also supports conservation research through aggregated bird-sighting data.

What are the Key Drivers in the Birdwatching Tourism Market?

Growing Environmental Awareness & Sustainable Travel Demand

Increasing global concern around biodiversity loss and climate change is driving more travelers toward eco-tourism. Birdwatching tourism, which inherently emphasizes minimal environmental impact, aligns strongly with these values. Travelers are no longer satisfied with passive nature viewing; they want experiences that support conservation and local communities, pushing tour operators to design more responsible and value-driven packages.

Improving Infrastructure & Access to Remote Birding Destinations

Improvements in transport, lodging, and sustainable infrastructure are making previously remote birding hotspots more accessible. Better road networks, regional air connectivity, and eco-lodges in rural or biodiversity-rich areas are enabling more birdwatchers, especially enthusiasts, to reach high-potential birding sites. This expansion of access is opening up new markets and increasing the feasibility of longer, more immersive birding tours.

Technology Adoption & Data Utilization

The use of technology, such as eBird integration, smartphone identification tools, and data-driven tour planning, is significantly enhancing the birding experience. These tools give birders confidence in spotting target species, make tours more efficient, and help operators design itineraries based on real-time bird movements. At the same time, data generated helps conservationists monitor populations and habitats, creating a virtuous cycle of travel and ecological value.

What are the Restraints for the Global Market?

High Seasonality & Weather Dependencies

Birdwatching is heavily dependent on migratory cycles, breeding seasons, and favorable weather. This seasonality limits consistent year-round demand, forcing tour operators to manage fluctuating occupancy and earnings. In many regions, peak birding seasons are short, and operating costs remain high during off-peak months, affecting profitability and scalability.

Regulatory & Ecological Risks

Birdwatching tourism often occurs in fragile ecosystems, and without proper management, it can lead to habitat disturbance, nesting disruption, and degradation. Operators face complex regulatory frameworks involving permits, protected-area access, and community rights. In regions with poor regulation or insufficient infrastructure, there is a risk that tourism could undermine conservation goals rather than support them.

What are the Key Opportunities in the Birdwatching Tourism Industry?

Emerging Birding Destinations in Under-Exploited Regions

Many biodiverse regions, such as Latin America, Southeast Asia, and parts of Africa, are still under-penetrated for birdwatching tourism. Developing infrastructure, eco-lodges, and guided birding routes in these regions represents a major growth opportunity. Operators partnering with local communities can build sustainable tourism models that benefit conservation and regional economies. Such expansion not only diversifies destination portfolios but also attracts new segments of international birders.

Tech-Enabled Citizen Science & Research Tourism

Creating birding-tourism products that integrate citizen science and research, e.g., bird-count trips, data-collection tours, and academic partnerships, can appeal to a niche of educational and conservation-minded travelers. This approach helps tour operators differentiate their service, generate additional revenue through grants or NGO partnerships, and contribute valuable data for ornithological research.

Youth Engagement & Educational Birding Programs

Many operators are increasingly tailoring tours for young birders and students. Programs such as “young birder” initiatives, birding internships, university credit tours, and discounted educational trips can cultivate the next generation of nature travelers. This not only drives demand but builds a loyal customer base and promotes long-term conservation awareness.

Product Type Insights

Birdwatching tourism offerings can be broadly categorized into: luxury birding tours (high-end, bespoke itineraries, often including rare species, remote locations, expert guides, and premium lodging); mid-range birding packages (small-group tours, semi-luxury lodging, familiar birding destinations, and balanced cost); and budget birding adventures (shared transportation, simpler accommodations, group departures, and basic guide services). There is also a growing niche in citizen-science / research birding, where travelers pay to participate in scientific observation and conservation activities, and photo-birding tours, focused on wildlife photography with specialized photography hides and longer stays to capture rare species.

Application Insights

The primary application of birdwatching tourism is simply wildlife-observation travel, where birders travel to see and identify species in their natural habitats. Within this, photographic birding is gaining momentum, driven by social media, content creators, and professional photographers. Another important application is research/citizen science, where tourists actively contribute to data collection for ornithological studies. There are also educational birding programs for students, youth, or academic groups that blend learning with travel. Finally, voluntourism birding is rising: participants engage in bird counts, habitat restoration, or conservation projects as part of their trip.

Distribution Channel Insights

Birdwatching tourism is increasingly booked through online travel agencies (OTAs) and tour-operator websites, where travelers can compare itineraries, see guide profiles, read reviews, and check conservation credentials. Specialist birding agencies remain crucial, especially for serious birders who demand expert guides, small-group logistics, and custom trip design. Direct booking with birding lodges or tour operators is also rising, aided by strong digital presence and tailored communications. Additionally, partnerships with conservation NGOs, universities, and citizen-science platforms are creating new channels; for instance, educational institutions may collaborate with birding tour operators to offer campus credit or research-based trips.

Traveler Type Insights

The birdwatching tourism market is dominated by enthusiastic birders, who travel specifically for birding, invest in high-quality guided tours, and engage deeply with their birding experience. This segment drives more than half of global birding tourism revenue. Hard-core birders also play a significant role: their trips tend to be longer, more remote, and centered on rare species, making their per-trip spending substantial. On the other hand, casual birders, tourists who include birdwatching as part of broader nature or eco-tourism vacations, form a growing base, especially in emerging birding regions and for shorter tours.

Age Group Insights

The largest share of birdwatching tourists falls in the 35–54 years bracket, combining sufficient disposable income with a strong interest in experiential and eco-tourism. The 55–64 and 65+ age groups are also significant, especially in premium and guided birding tours where comfort, expertise, and a slower pace matter. Meanwhile, younger birders (18–34 years) are an emerging segment, targeted by “young birder” programs, student birding expeditions, and citizen-science travel experiences, helping operators build future customer cohorts.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America (particularly the U.S. and Canada) remains a leading source of birdwatching tourists. With strong birding culture, established eco-tourism infrastructure, and high disposable incomes, birders from this region tend to take long, specialist trips, both domestically and internationally. The region’s share in 2024 is about 20–25 % of global birding tourism spend, fueled by migration hotspot tours, national park birding, and community-led conservation travel.

Europe

European travelers, especially from Western Europe (UK, Germany, France), are key players in outbound birding tourism, drawn by both ethical travel and biodiversity. Europe’s strong conservation network, combined with growing demand for small-group, eco-focused tours, positions it as a stable but growing market. Demand for remote birding destinations (like South America or Africa) is rising, backed by European birders’ interest in rare and endemic species.

Asia-Pacific

Asia-Pacific is among the fastest-growing birdwatching tourism markets, with rich bird biodiversity in countries such as India, China, Indonesia, and Southeast Asia. The region accounted for about 20–22% of total birdwatching tourism in 2024, supported by improving infrastructure, rising middle-class eco-tourism demand, and domestic birding interest. Countries like India and Indonesia are drawing both domestic and international enthusiasts, while mature markets like Japan and Australia are focused on premium birding experiences and photographic tourism.

Latin America

Latin America is increasingly recognized as a birding hotspot, with countries such as Colombia, Ecuador, and Brazil offering exceptional avian diversity. This region is seeing growing inbound birding tourism from North America and Europe. Local operators are developing sustainable lodges, community-based birding routes, and endemic-species–focused itineraries. As biodiversity conservation aligns with tourism, Latin America is building a strong export-driven birding-tourism economy.

Middle East & Africa

Africa, with its wetland reserves, endemic species, and migration flyways, remains a core region for birdwatching tourism. Countries like South Africa, Kenya, Tanzania, and Madagascar are key destinations for global birders. Meanwhile, some Middle Eastern countries are beginning to tap into birding tourism by offering desert and oasis birding, particularly for migratory species. In Africa, the combination of conservation tourism and birding is helping expand capacity and local participation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Birdwatching Tourism Market

- Rockjumper Birding Tours

- Birdquest

- Victor Emanuel Nature Tours (VENT)

- Naturetrek

- Birding Ecotours

- WINGS Birding Tours Worldwide

- Field Guides Incorporated

- Eagle-Eye Tours

- Cheesemans’ Ecology Safaris

- Naturalist Journeys

- Tropical Birding Tours

- Hurtigruten Group (Audubon Voyages)

- High Lonesome Bird Tours

- Sabrewing Nature Tours

- Birding Africa

Recent Developments

- In July 2024, Hurtigruten Expeditions launched a specialized birdwatching cruise concept in partnership with the National Audubon Society, expanding into key birding regions such as Iceland and the Arctic.

- In September 2024, Rockjumper Birding Tours integrated real-time eBird data into its itinerary planning in collaboration with the Cornell Lab of Ornithology, optimizing species-encounter likelihood.

- In June 2024, Field Guides Incorporated launched a “Carbon-Neutral Birding” initiative by offsetting emissions from its tours via Gold Standard–certified projects.

- In March 2024, WINGS Birding Tours Worldwide expanded its Latin American operations through a partnership with local conservation groups in Colombia, dedicating part of its tour revenues to habitat protection.

- In January 2024, Victor Emanuel Nature Tours adopted AI-powered bird identification (in partnership with Merlin Bird ID), enhancing guest experience and reducing guide workload.

- In late 2023, Tropical Birding launched a “Young Birders Program,” offering discounts to participants under 25 and academic partnerships with universities to grant course credit for birding tours.