Bird Repellent Market Size

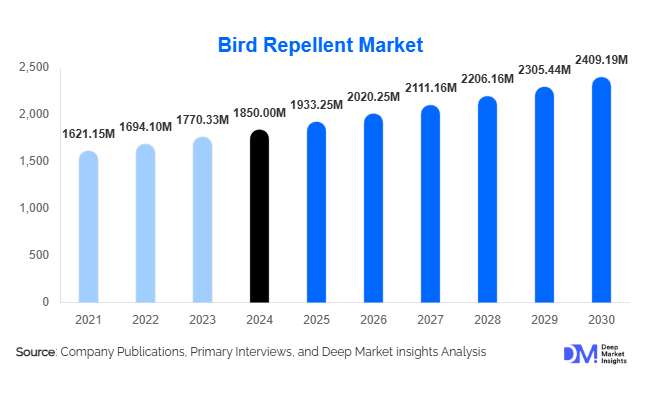

According to Deep Market Insights, the global bird repellent market size was valued at USD 1,850 million in 2024 and is projected to grow from USD 1,933.25 million in 2025 to reach USD 2,409.18 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). Market expansion is primarily driven by rising awareness of bird-related damages across agriculture, aviation, and commercial infrastructure, alongside growing demand for eco-friendly, non-lethal deterrent solutions and the integration of smart technologies such as ultrasonic, laser, and IoT-enabled systems.

Key Market Insights

- Global demand is shifting toward humane and eco-friendly bird control solutions, reducing chemical dependence and promoting natural repellents and physical barriers.

- Smart and connected bird deterrent devices, including ultrasonic systems, laser deterrents, and IoT-based monitoring, are transforming the market landscape.

- North America dominates the global bird repellent market, driven by mature infrastructure, strict aviation and hygiene regulations, and the adoption of advanced deterrent technologies.

- Asia-Pacific is the fastest-growing region, with increasing adoption across agriculture and commercial infrastructure amid rapid urbanization.

- Agriculture and horticulture applications lead the market, accounting for more than half of total global demand in 2024, owing to high crop-loss prevention requirements.

- Device-based and natural repellents are expected to see the highest growth rates, driven by regulatory pressure on chemical formulations and demand for sustainable alternatives.

What are the latest trends in the bird repellent market?

Eco-Friendly and Humane Bird Control Solutions

Growing environmental awareness and stricter regulatory norms against toxic chemicals are driving a shift toward biodegradable, non-lethal repellents. Manufacturers are introducing plant-based, organic, and food-grade formulations that deter birds without harming them. Physical exclusion systems such as nets, wires, and reflective deterrents are gaining traction, particularly in heritage and urban sites where chemical usage is restricted. The humane control trend is reinforced by public campaigns promoting coexistence and sustainable pest management, encouraging widespread adoption of natural and mechanical repellents.

Technological Integration and Smart Deterrent Systems

Technology is redefining bird control through automation, precision, and data analytics. Smart ultrasonic systems, radar-based bird detection, laser deterrents, and IoT-connected devices now allow real-time monitoring and adaptive response. Airports, factories, and commercial facilities are integrating bird deterrent technologies with security and facility-management networks, enhancing operational efficiency. The trend toward AI-driven detection and predictive analytics is further elevating system effectiveness. This convergence of technology and pest management is expected to expand the premium segment and establish new service-based business models.

What are the key drivers in the bird repellent market?

Agricultural Yield Protection

Bird damage leads to billions of dollars in global agricultural losses annually. Farmers are increasingly investing in cost-effective repellents to protect high-value crops such as grains, fruits, and nuts. As agricultural exports grow, maintaining product quality through effective bird control becomes essential, especially for organic and high-standard export markets. The integration of repellents with precision agriculture tools is further amplifying their effectiveness and adoption.

Infrastructure and Urbanization Growth

Rapid urban development, increased construction of airports, food-processing plants, warehouses, and commercial complexes have amplified demand for bird deterrents. Bird nesting and droppings can damage infrastructure, pose health hazards, and cause safety risks, particularly in aviation. As a result, governments and industries are mandating preventive installations, driving market expansion across developed and developing economies.

Innovation in Eco-Friendly and Technological Solutions

Product innovation remains a pivotal growth catalyst. From solar-powered ultrasonic systems to AI-based detection devices, companies are investing heavily in R&D. The growing popularity of environmentally friendly repellents is also driving portfolio diversification toward biodegradable chemicals and multi-sensory deterrent systems that combine sound, light, and motion cues for improved results.

What are the restraints for the global market?

High Installation and Maintenance Costs

Advanced electronic and laser-based deterrent systems often involve significant initial investment, installation complexity, and periodic maintenance. For small-scale farms or municipal users with limited budgets, these costs can deter adoption. This pricing challenge restricts market penetration of high-tech systems in developing regions, where cost-sensitive buyers prefer traditional repellents or low-cost physical barriers.

Lack of Awareness and Fragmented Implementation

In several emerging economies, awareness of professional bird control systems remains limited. Many users continue to rely on makeshift solutions such as scarecrows, reflective tapes, or netting without standardized installation. The absence of formal training, local distribution networks, and clear return-on-investment metrics limits widespread adoption, particularly in rural and small-scale sectors.

What are the key opportunities in the bird repellent market?

Emerging Market Demand and Infrastructure Expansion

Rapid development of airports, industrial facilities, and agribusinesses in Asia-Pacific, Latin America, and the Middle East presents significant untapped opportunities. Government infrastructure programs, such as “Make in India” and “Saudi Vision 2030”, are creating new installation demand for bird deterrent systems in the construction and aviation sectors. Companies that localize production and service networks in these regions can capture high-growth opportunities.

Smart, Connected, and Service-Based Solutions

IoT-enabled devices and predictive bird-behavior analytics are unlocking new recurring-revenue models for suppliers. Integrated cloud-based monitoring and subscription-based maintenance services are gaining traction among airports, food facilities, and industrial plants seeking long-term performance assurance. Partnerships with AI and sensor-technology firms can enhance competitiveness for new entrants targeting the premium market.

Regulatory Push for Sustainable Alternatives

Growing restrictions on harmful chemical repellents and public preference for humane bird control solutions are catalyzing R&D in plant-derived and biodegradable repellents. Companies aligning with green-certified standards and transparent sustainability reporting will gain a competitive advantage, especially in Europe and North America. These regulations simultaneously open new niches for certified organic repellents in agriculture and urban management.

Product Type Insights

Chemical repellents accounted for approximately 54% of the global bird repellent market in 2024, maintaining their dominance owing to low cost, wide availability, and straightforward application across agriculture, industrial, and residential sectors. These repellents remain particularly effective for large-scale outdoor use and provide rapid results, making them indispensable for crop protection and pest management. However, the market is witnessing a notable transition toward natural and organic repellents formulated from plant-based oils, capsaicin, and biodegradable carriers. This shift is primarily driven by the tightening of environmental compliance norms, bans on certain toxic chemicals, and growing end-user preference for sustainable and humane pest control solutions.

Meanwhile, electronic deterrent systems, including ultrasonic, bio-acoustic, and laser-based devices, represent the fastest-growing product segment, projected to grow at nearly twice the overall market CAGR (around 15–16%) through 2030. Adoption is rising among airports, food processing facilities, and solar farms where automated, maintenance-free systems reduce operational risk and enhance safety compliance. Physical barriers (nets, spikes, and shock tracks) and visual deterrents (reflective tapes, scare balloons, and predator replicas) continue to serve niche but essential roles in heritage structures and logistics hubs, where permanent exclusion or aesthetic integration is required.

Application Insights

Agriculture and horticulture remain the largest application segment, representing approximately 52% of the total global market value in 2024. Bird repellents are critical in preventing crop losses, improving yield protection, and ensuring compliance with export-grade produce standards. Increasing damage to grain, fruit, and seed crops caused by invasive avian species, particularly in Asia-Pacific and North America, continues to stimulate strong product uptake. Modern farms are increasingly integrating drone-assisted repellent systems and IoT-enabled monitoring tools to optimize coverage and reduce manual labor costs.

The industrial and infrastructure segment, which includes airports, manufacturing plants, logistics centers, and storage facilities, is expanding rapidly due to the enforcement of stringent hygiene and safety standards. Bird strikes and contamination risks in aviation and food logistics have prompted higher investments in advanced deterrents and smart surveillance. Additionally, residential and commercial applications are gaining ground, supported by urban population growth, hygiene awareness, and rising maintenance budgets in public infrastructure. Increasing installation of spikes, nets, and ultrasonic systems in city centers underscores a broadening end-user base beyond traditional agricultural and industrial markets.

End-Use Industry Insights

The agriculture sector continues to dominate the bird repellent market by volume, driven by consistent demand from both subsistence and export-oriented farming operations. However, the aviation and food-processing industries lead in value terms due to their preference for high-efficiency, technology-integrated deterrent systems. Export-oriented farms across Europe, the U.S., and Asia rely heavily on certified, humane bird-control products to meet international quality and sustainability standards.

Emerging industries, such as solar power generation, heritage restoration, and smart city infrastructure, are introducing new, non-traditional application avenues. Solar farms, in particular, have become a fast-expanding end-use area, as bird droppings can reduce panel efficiency and necessitate frequent maintenance. Additionally, the growing role of facility management and environmental service providers in deploying and maintaining bird deterrents is reshaping market dynamics, fostering recurring revenue streams through service-based contracts and subscription maintenance models.

| How big is the global bird repellent market? By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global bird repellent market, accounting for about 33% of total revenue in 2024. The United States dominates regional demand, supported by a highly industrialized agricultural base, stringent aviation safety regulations (FAA and USDA compliance), and widespread deployment in urban infrastructure and warehousing. Growth is further bolstered by technological adoption; airports and logistics operators are integrating AI-based laser deterrents and autonomous drones for wildlife management. In Canada, emphasis on humane and non-lethal wildlife control policies has accelerated the adoption of natural and ultrasonic repellents, aligning with the country’s broader sustainability goals.

Europe

Europe accounts for approximately 22% of the global market share, characterized by an early shift toward sustainable and certified eco-friendly repellents. The region’s growth is strongly driven by the European Green Deal, EU Wildlife Protection Directives, and government bans on toxic chemical formulations. The U.K., Germany, and France remain key markets, focusing on high-end natural repellents, netting systems, and AI-integrated deterrents for smart agriculture and heritage conservation. The driver for regional growth is a strong regulatory push toward biodiversity preservation, supported by the rapid modernization of farm operations and the increasing adoption of organic farming practices.

Asia-Pacific (APAC)

Asia-Pacific is the fastest-growing region, holding around 28% market share in 2024 and projected to expand at a CAGR of 10–13% through 2030. China and India lead agricultural consumption, driven by large-scale crop production, rising farmer awareness, and government-backed programs promoting loss reduction in staple crops. Japan, South Korea, and Australia are at the forefront of adopting smart deterrent technologies, including AI-guided monitoring systems and solar-powered ultrasonic devices. Key growth drivers in APAC include rapid infrastructure expansion, urbanization, and government incentives for agricultural modernization. Increasing bird-related damage to solar farms and food processing plants is also creating a strong pull for automated solutions across emerging economies.

Latin America

Latin America contributes approximately 9% of global market revenue, with Brazil and Mexico leading adoption. The region’s vast agricultural base, especially in grains, fruits, and sugarcane, drives consistent demand for cost-effective repellents. Market growth is supported by agribusiness modernization, expanding export activity, and increasing focus on aviation safety and food hygiene. Brazil’s government-backed agricultural research initiatives and Mexico’s investments in food export compliance standards are major regional growth drivers. Adoption of natural and organic deterrents is also increasing as part of efforts to align with international environmental standards and sustainable production goals.

Middle East & Africa (MEA)

MEA accounts for roughly 8% of the global market. In the Gulf Cooperation Council (GCC) nations, airport expansion projects under Vision 2030 initiatives in Saudi Arabia and the UAE are spurring strong demand for bird deterrent installations. Rapid urban infrastructure development, including shopping complexes, logistics centers, and sports facilities, continues to drive the deployment of ultrasonic and visual systems. In South Africa, agriculture remains the largest end-use sector, particularly in fruit and vineyard regions where avian damage control is critical. The region’s growth is primarily driven by public-sector investments in urban sanitation and increasing awareness of zoonotic disease prevention, which are fueling adoption across commercial and municipal segments.

Public infrastructure spending, particularly in airports, railways, and logistics hubs, is driving steady CapEx inflows for bird control solutions. Governments are integrating bird-strike prevention into aviation safety budgets, while private industry is investing in advanced deterrent devices as part of hygiene and compliance upgrades. Initiatives such as “Make in India” and “Made in China 2025” are catalyzing domestic manufacturing of deterrent equipment. Increasing automation investments in industrial and agricultural sectors will further accelerate long-term capital deployment in bird-control infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bird Repellent Market

- Bird-X Inc.

- Rentokil Initial plc

- Bird Control Group BV

- Pelsis Group Limited

- Bird Barrier America Inc.

- Bird B Gone Inc.

- Bird Gard LLC

- Avian Enterprises LLC

- Nixalite of America Inc.

- Leaven Enterprise Co., Ltd.

- Flock Free Bird Control Systems & Services

- Scarecrow Group Limited

- Weitech (STV International) Ltd.

- Ecolab Inc.

- BASF SE

Recent Developments

- In June 2025, Bird Control Group BV launched a next-generation AI-enabled laser deterrent for industrial and airport applications, enhancing automated detection accuracy by 30%.

- In April 2025, Rentokil Initial plc expanded its pest-control technology portfolio by acquiring a European ultrasonic-repellent manufacturer to strengthen its non-chemical product line.

- In February 2025, Bird-X Inc. introduced an eco-certified, plant-based repellent targeting organic farms, compliant with new EU agricultural regulations promoting non-toxic pest management.