Biometric Locks Market Size

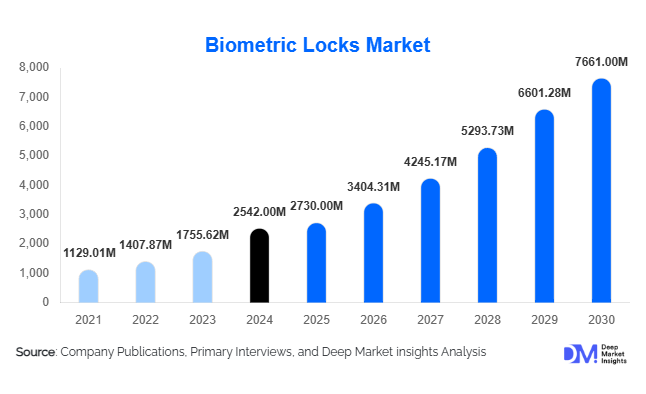

According to Deep Market Insights, the global biometric locks market size was valued at USD 2,542 million in 2024 and is projected to grow from USD 2,730 million in 2025 to reach USD 7,661 million by 2030, expanding at a CAGR of 24.7% during the forecast period (2025–2030). The biometric locks market growth is primarily driven by increasing adoption of smart-home systems, rising demand for secure access solutions across residential, commercial, and enterprise sectors, and technological advancements such as UWB, Matter, and multispectral fingerprint sensors, which enhance convenience, security, and interoperability.

Key Market Insights

- Fingerprint-based deadbolt locks dominate the market, offering reliable, cost-effective security solutions suitable for both retrofit and new-build applications, accounting for the largest share of global demand.

- Residential applications represent the majority of unit sales, driven by retrofit projects in multi-family homes, short-term rentals, and urban residential growth in APAC and North America.

- Enterprise and hospitality sectors are increasingly integrating biometric locks with identity management and cloud-based access control, fueling demand for premium and high-security models.

- APAC is the fastest-growing regional market, led by China and India, due to rising urbanization, middle-class expansion, and low-cost OEM supply chains.

- North America holds the largest revenue share, driven by high smart-home adoption, retrofitting of existing infrastructure, and strong enterprise demand.

- Technological innovation, including on-device authentication, UWB proximity unlocking, multispectral fingerprint recognition, and Matter protocol compatibility, is transforming the user experience and expanding market potential.

Latest Market Trends

Integration with Smart-Home and IoT Platforms

Biometric locks are increasingly integrated with smart-home ecosystems, including voice assistants, smart hubs, and home automation platforms. Consumers prioritize locks that seamlessly connect with existing systems, enabling features like remote access, automation routines, and mobile notifications. Standards such as Matter and UWB facilitate interoperability across devices, allowing users to unlock doors hands-free while maintaining high security. This trend also supports the adoption of hybrid authentication models, combining biometric verification with mobile or PIN credentials for enhanced convenience.

Cloud-Enabled Access Management

Enterprise and hospitality segments are adopting cloud-assisted biometric locks that offer centralized user management, temporary access provisioning, and audit logging. Cloud platforms allow administrators to grant and revoke access remotely, monitor entry events in real time, and integrate with broader identity and access management systems. Subscription-based services for cloud management and analytics are emerging as recurring revenue streams for vendors, creating opportunities for platform differentiation and long-term customer engagement.

Biometric Locks Market Drivers

Rapid Smart-Home Adoption

The proliferation of smart-home devices and IoT integration has significantly boosted demand for biometric locks. Consumers increasingly seek seamless security solutions compatible with mobile apps, voice assistants, and home automation routines. Mature markets, particularly in North America and Europe, demonstrate high adoption rates due to advanced infrastructure and consumer awareness, driving both unit sales and revenue growth.

Falling Sensor Costs and Enhanced Performance

Advancements in multispectral fingerprint sensors and facial recognition technologies have improved reliability, reduced false acceptance rates, and lowered costs. These improvements have made biometric locks more accessible across mid-range and premium consumer segments, while also encouraging enterprise adoption in commercial, healthcare, and data center applications.

Enterprise & Hospitality Demand for Auditable Access

Businesses and hotels are adopting biometric locks for secure, auditable access, enabling temporary credentials for contractors, staff, and guests. Audit trails, tamper detection, and remote management capabilities enhance security while simplifying operational workflows, increasing the attractiveness of biometric solutions in commercial and institutional environments.

Market Restraints

Privacy and Data Sovereignty Concerns

Biometric data is highly sensitive, and regulatory frameworks such as GDPR impose strict rules on data storage, consent, and template management. Buyers in healthcare, government, and enterprise sectors often demand on-device template storage, increasing product complexity and compliance costs. Vendors relying heavily on cloud storage face procurement hurdles, which may slow adoption in regulated markets.

Fragmented Standards and Interoperability Challenges

The rapid evolution of connectivity protocols BLE, Wi-Fi, Zigbee, Matter, and UWB, creates interoperability concerns and potential obsolescence for legacy devices. Customers often delay purchases pending adoption of standardized, long-term solutions. Vendors must invest in open-standard compliance and cross-platform compatibility to overcome this restraint and maintain market share.

Biometric Locks Market Opportunities

Enterprise Identity Management Integration

Governments, healthcare institutions, and large enterprises are consolidating access control under centralized digital identity platforms. Biometric locks integrated with identity and access management systems offer role-based access, audit logging, and time-bound credentials. This presents opportunities for vendors to bundle hardware with cloud services, driving recurring revenue and differentiation in compliance-focused verticals.

Regional Retrofit Growth in APAC and LATAM

Asia-Pacific, led by China and India, and Latin America are experiencing high growth in residential and commercial retrofit projects. Cost-competitive OEMs and expanding e-commerce channels facilitate adoption. Vendors can capitalize on this by offering localized, affordable solutions and building strong distribution networks in emerging urban centers.

Advanced Technology Integration

Incorporating UWB proximity unlocking, edge AI for liveness detection, and Matter protocol compatibility allows vendors to differentiate premium offerings. Enterprises and premium consumers increasingly prefer hands-free, secure, and privacy-compliant biometric solutions. Licensing platforms and SDKs for developers also offer recurring revenue streams and ecosystem lock-in opportunities.

Product Type Insights

Deadbolt biometric locks dominate the market due to their compatibility with retrofit and new-build applications. Fingerprint sensors, particularly multispectral, are the leading modality, offering cost-effective security and rapid user verification. Mid-range models attract mainstream consumers, while enterprise and commercial-grade locks command higher margins, integrating advanced authentication features and cloud management capabilities.

Application Insights

Door entry applications remain the primary use case, followed by cabinets, lockers, safes, and gates. Residential installations account for the largest share, driven by retrofitting projects and rental property upgrades. Enterprise, hospitality, and industrial applications are growing rapidly due to requirements for audit trails, temporary access, and enhanced security compliance.

Distribution Channel Insights

Online platforms, including direct-to-consumer websites and e-commerce marketplaces, dominate sales, providing comparison tools, reviews, and real-time pricing. System integrators and value-added resellers facilitate enterprise and commercial deployments, while OEMs supply components to global brands. Subscription-based cloud management models are emerging as additional channels for recurring revenue.

End-User Insights

Residential end-users represent the largest segment by units, while enterprise, hospitality, and healthcare applications drive higher-value sales. Growth in short-term rentals, co-living, and coworking spaces is expanding demand for secure, auditable access. Industrial lockers, secure cabinets, and controlled drug storage in healthcare offer additional growth opportunities for biometric lock applications.

Age Group Insights

Consumers aged 31–50 account for the largest market share, balancing disposable income with interest in smart-home technology. The 18–30 age group drives adoption of budget and mid-range solutions, particularly in urban retrofit and rental properties. Older demographics, especially 51–65 years, show strong demand for premium, secure, and user-friendly locks, emphasizing reliability and accessibility.

| By Product Type | By Technology | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market by revenue (37% of the 2024 market), driven by high smart-home adoption, retrofit opportunities, and enterprise demand. The U.S. leads in unit sales, supported by strong infrastructure and consumer willingness to invest in security-enhancing technologies.

Europe

Europe (20% of the 2024 market) is growing steadily, with Germany, the U.K., and France driving demand for residential and commercial installations. Strong privacy regulations and high awareness of security standards encourage the adoption of certified biometric locks.

Asia-Pacific

APAC (33% of the 2024 market) is the fastest-growing region, led by China and India. Urbanization, rising middle-class wealth, and cost-competitive OEM production drive volume growth. Japan and South Korea show steady demand for premium and enterprise solutions.

Latin America

Brazil and Mexico are leading LATAM demand, focusing on retrofit projects and mid-range consumer solutions. Affluent consumers are increasingly purchasing biometric locks for enhanced security in urban residential properties.

Middle East & Africa

High-income countries in the Middle East, including the UAE and Saudi Arabia, are driving premium product adoption, while Africa remains the primary source for iconic industrial and government installations. Intra-regional travel and development projects further stimulate demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Biometric Locks Market

- ASSA ABLOY

- Allegion PLC

- dormakaba Group

- Samsung Electronics

- Xiaomi

- ZKTeco

- Hikvision

- Dahua Technology

- U-tec / ULTRALOQ

- Suprema

- Honeywell International

- Bosch Security Systems

- Panasonic

- IDEMIA

- Anviz Global

Recent Developments

- In May 2025, ASSA ABLOY launched a new series of UWB-enabled biometric deadbolt locks for enterprise and residential applications, enhancing hands-free access and Matter protocol compatibility.

- In April 2025, Xiaomi expanded its smart lock product portfolio in India, offering BLE and fingerprint-enabled retrofit solutions targeting mid-range urban housing.

- In February 2025, ULTRALOQ introduced a cloud-managed subscription service for hotels and property managers, enabling centralized credential management and audit logging.