Bike Roller Trainers Market Size

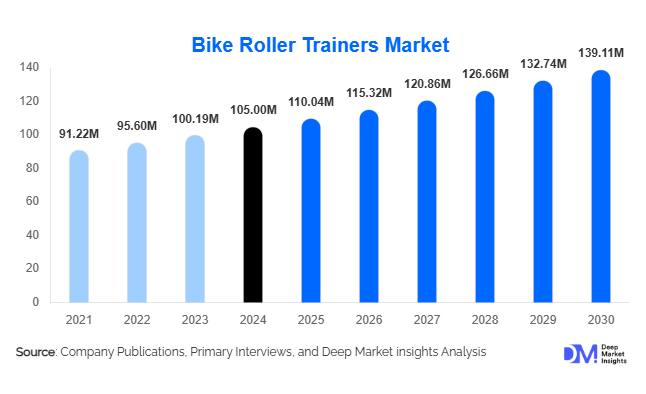

According to Deep Market Insights, the global bike roller trainers market size was valued at USD 105 million in 2024 and is projected to grow from USD 110.04 million in 2025 to reach USD 139.11 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). Market growth is driven by rising global adoption of indoor fitness equipment, increasing popularity of connected and smart training devices, and expanding demand from residential users seeking space-efficient home workout solutions.

Key Market Insights

- Classic roller trainers continue to dominate the market, accounting for over 60% of the global value share in 2024, supported by affordability and simplicity.

- Smart and connected roller trainers are the fastest-growing product type, driven by integration with virtual training apps and fitness ecosystems.

- Residential applications lead demand, contributing nearly 70% of the global market in 2024 as home gym ownership continues to expand.

- North America holds the largest regional share (38%), while Asia-Pacific is the fastest-growing region, projected to record a double-digit CAGR through 2030.

- The top five companies control around 55% of the global market, indicating moderate concentration with strong competition in mid-range and premium segments.

Latest Market Trends

Smart Connectivity and Virtual Training Integration

Smart roller trainers equipped with Bluetooth, ANT+, and app-based control interfaces are reshaping the indoor cycling experience. Integration with virtual training platforms such as Zwift and Rouvy enables real-time resistance simulation, power metrics tracking, and global competition. This connectivity trend is particularly popular among professional cyclists and tech-savvy fitness enthusiasts, allowing seamless transition between indoor and outdoor cycling performance metrics. Manufacturers are investing in software partnerships and subscription-based ecosystems to enhance long-term customer engagement and create recurring revenue streams.

Compact and Space-Efficient Product Designs

The global shift toward urban living has increased demand for compact, foldable, and low-noise roller trainers. Manufacturers are emphasizing portability, lightweight aluminum construction, and ergonomic design to target apartment-based users. Hybrid roller trainers that combine power resistance with mobility convenience are gaining traction, particularly in Asia and Europe, where living spaces are smaller. This design evolution is not only improving usability but also expanding adoption among entry-level consumers who previously avoided bulky exercise equipment.

Bike Roller Trainers Market Drivers

Growing Health Awareness and Indoor Fitness Adoption

A surge in global health consciousness and demand for indoor training equipment continues to fuel market expansion. Consumers increasingly view roller trainers as essential tools for cardiovascular fitness, cycling technique enhancement, and year-round training convenience. Post-pandemic shifts toward home fitness and weather-independent exercise options have significantly strengthened this demand base, especially across North America and Europe.

Technological Advancements and Smart Integration

The introduction of smart roller trainers capable of performance tracking, interactive resistance adjustment, and virtual reality integration has modernized the market. These innovations enhance user engagement and appeal to a growing segment of connected consumers. Enhanced digital interfaces also allow manufacturers to target premium customers willing to pay higher prices for integrated performance analytics and immersive experiences.

Residential Fitness and Home-Gym Expansion

The global home-gym equipment market’s expansion directly correlates with increasing sales of roller trainers. Consumers are prioritizing multi-functional, compact equipment suitable for home environments. Affordable pricing, online availability, and ease of assembly have made bike rollers a preferred choice for urban and suburban households seeking daily fitness routines without commuting to gyms.

Market Restraints

High Cost of Premium Smart Trainers

While demand for smart and connected models is rising, the high cost of advanced trainers limits their accessibility in price-sensitive markets. Premium models equipped with automated resistance systems and app connectivity often retail at several times the price of basic mechanical rollers, creating affordability challenges for emerging economies and casual users.

Substitution by Direct-Drive Trainers and Smart Bikes

Competition from alternative indoor cycling solutions such as direct-drive trainers, stationary smart bikes, and integrated fitness systems poses a restraint. These substitutes offer enhanced stability and simplified setups, diverting some demand away from traditional roller-based systems, especially in the professional training segment.

Bike Roller Trainers Market Opportunities

Integration with Virtual Training and Fitness Platforms

The fastest-growing opportunity lies in integrating roller trainers with virtual fitness ecosystems. Partnerships between hardware manufacturers and digital platforms such as Zwift, TrainerRoad, and Peloton can significantly enhance user engagement. Offering subscription-based models for data analytics, coaching, and multiplayer sessions provides new recurring revenue opportunities and long-term customer retention.

Expansion Across Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and the Middle East present untapped growth potential. Rising disposable incomes, urbanization, and government-backed wellness initiatives are encouraging fitness infrastructure investments. Companies entering these markets with affordable, locally manufactured, and modular roller trainers can rapidly gain market share.

Innovation in Design and Materials

Space-saving innovations and noise-reduction technologies represent major product development opportunities. The introduction of carbon-fiber frames, magnetic resistance systems, and compact foldable designs caters to urban consumers. Additionally, eco-friendly materials and energy-efficient smart features appeal to environmentally conscious buyers, providing further differentiation in a competitive market.

Product Type Insights

Classic roller trainers lead the global market, representing approximately 63% of total revenue in 2024 due to affordability, ease of use, and wide accessibility. However, smart roller trainers, currently comprising around 15% of market value, are expanding rapidly at a double-digit growth rate as consumers embrace digital training tools. Magnetic and fluid resistance models hold moderate shares, serving mid-range users who seek better performance control without full smart integration.

Application Insights

Residential applications dominate the global landscape, accounting for nearly 70% of total market value in 2024. This dominance stems from increasing adoption of home-based exercise setups and lifestyle shifts toward personalized fitness. The commercial segment, including gyms and cycling studios, contributes approximately 25%, while professional sports centers represent the remaining 5%. Growth is especially notable in residential settings across Asia-Pacific and Europe, where home-gym culture is accelerating post-pandemic.

Distribution Channel Insights

Online direct-to-consumer (D2C) sales channels command approximately 45% of the global market in 2024, driven by the convenience of e-commerce and digital marketing. E-commerce platforms such as Amazon, Decathlon, and brand-owned websites dominate this segment. Offline specialty stores remain crucial for high-end buyers and professional users, offering personalized demos and after-sales service. The online channel is expected to surpass 55% share by 2030 as digital adoption continues to rise.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, holding about 38% share in 2024 (USD 40 million). The U.S. dominates due to high disposable income, advanced fitness technology adoption, and a robust home-gym culture. Demand for smart trainers integrated with apps and wearables continues to grow, making North America a key hub for premium roller trainer sales.

Europe

Europe accounts for roughly 29% of the global market (USD 30 million) in 2024, led by Germany, the U.K., and France. Strong cycling traditions and widespread interest in indoor training drive consistent demand. European consumers emphasize sustainability and quality, fostering growth in mid-range and premium segments.

Asia-Pacific

Asia-Pacific holds around a 25% share (USD 26 million) but is the fastest-growing region, projected to record the highest CAGR through 2030. China, Japan, and India are major contributors, with increasing urbanization, expanding middle-class income, and growing online sales channels fueling demand. Local manufacturing initiatives such as “Make in India” are further supporting domestic production and reducing import dependence.

Latin America

Latin America accounts for approximately 5–6% of the global market share. Brazil and Argentina lead demand, supported by increasing health awareness and the expansion of online retail platforms. Economic recovery and growing urban fitness trends may further enhance regional adoption.

Middle East & Africa

The Middle East & Africa region represents about 2–3% of global demand, primarily concentrated in affluent GCC countries such as the UAE, Saudi Arabia, and Qatar. Luxury home-gym installations and fitness club investments are key growth drivers, while African markets are in nascent stages of adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bike Roller Trainers Market

- Garmin Ltd.

- Wahoo Fitness LLC

- Elite S.r.l.

- Minoura Co., Ltd.

- Saris Cycling Group

- Kinetic by Kurt LLC

- JetBlack Limited

- BKOOL S.L.

- Feedback Sports Inc.

- Cyclops

- Tacx (Garmin brand)

- Elite Qubo

- SportCrafters

- Sunlite Sports

- Bell Sports

Recent Developments

- In May 2025, Wahoo Fitness announced the launch of a next-generation smart roller trainer with adaptive resistance control and app-based diagnostics to enhance real-time feedback for professional cyclists.

- In April 2025, Garmin introduced new firmware updates enabling seamless integration between Tacx smart rollers and third-party fitness apps for performance data synchronization.

- In February 2025, Elite S.r.l. unveiled a foldable magnetic roller series targeting home users, featuring enhanced portability and noise-reduction technologies.