Bifold Doors Market Size

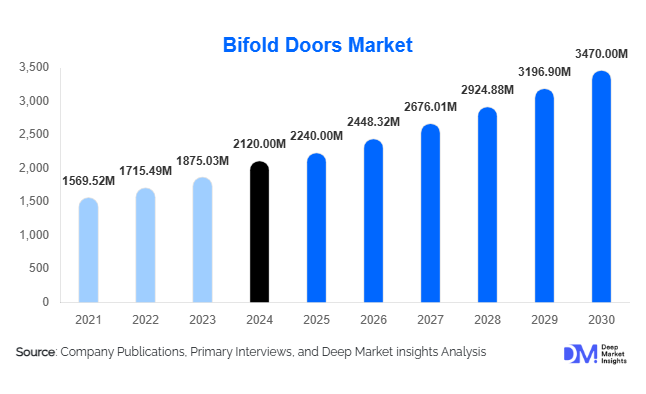

According to Deep Market Insights, the global bifold doors market size was valued at USD 2,120 million in 2024 and is projected to grow from USD 2,240 million in 2025 to reach USD 3,470 million by 2030, expanding at a CAGR of 9.3% during the forecast period (2025–2030). The bifold doors market growth is primarily driven by increasing urbanization, rising demand for space-saving interior solutions, and growing adoption of energy-efficient and aesthetic home and commercial designs worldwide.

Key Market Insights

- Residential construction and home renovation activities are driving bifold door adoption, as homeowners increasingly prefer open-plan living spaces and seamless indoor-outdoor transitions.

- Energy efficiency and smart home integration are pushing manufacturers to innovate bifold doors with better insulation, automated opening systems, and sustainable materials.

- North America dominates the bifold doors market due to the rising construction of modern residential and commercial properties and the growing replacement demand for traditional doors.

- Europe is the fastest-growing region, driven by stringent building codes for energy efficiency, modern architectural trends, and increased adoption of high-end bifold door solutions in premium homes.

- Asia-Pacific is emerging as a key growth market, led by urban housing expansion in China, India, and Southeast Asian countries.

- Technological innovation, including lightweight aluminum frames, thermal insulation, and smart automation, is reshaping the bifold doors market globally.

Latest Market Trends

Energy-Efficient and Smart Bifold Doors

Manufacturers are increasingly focusing on energy efficiency by offering bifold doors with high-performance insulation, low-emissivity glass, and durable aluminum or UPVC frames. Smart bifold doors with automated opening, remote control access, and integration with home IoT systems are gaining traction. These innovations appeal to environmentally conscious homeowners and commercial projects seeking green building certifications. Growing government incentives for energy-efficient construction in Europe, North America, and the Asia-Pacific further accelerate this trend, encouraging adoption in both new constructions and renovation projects.

Premium Aesthetic Designs

Modern architectural trends emphasizing minimalism and seamless indoor-outdoor living are increasing the demand for premium bifold door designs. Multi-panel folding systems, frameless glass options, and customizable finishes are appealing to high-end residential and commercial buyers. Bifold doors are increasingly being integrated with patios, gardens, and office spaces to create visually expansive interiors. The rising popularity of open-concept living spaces and smart urban layouts is driving a shift from traditional hinged doors to bifold systems in luxury and mid-tier projects.

Bifold Doors Market Drivers

Growing Urbanization and Housing Developments

The increasing urban population worldwide is driving residential and commercial construction. Bifold doors are preferred for apartments, townhouses, and office spaces due to their space-saving and flexible design. Rising disposable income and modernization of urban architecture are further fueling demand for high-quality bifold door systems. Smart housing projects in North America, Europe, and the Asia-Pacific are incorporating bifold doors to enhance aesthetics and functionality.

Rising Renovation and Retrofit Activities

Homeowners are replacing traditional doors with bifold systems to improve natural lighting, ventilation, and indoor-outdoor connectivity. Renovation projects in mature markets, such as Europe and North America, are significantly contributing to market growth. Commercial retrofits in hospitality, office, and retail spaces are also driving demand, with a focus on modern, functional, and visually appealing doors.

Technological Innovations and Material Advancements

Advanced materials like aluminum, UPVC, and reinforced timber are making bifold doors more durable, lightweight, and energy-efficient. Integration of smart home technologies and automated opening systems enhances convenience and security, increasing adoption among tech-savvy consumers. Lightweight folding mechanisms and corrosion-resistant hardware are reducing maintenance needs and improving longevity, which is highly valued in premium residential and commercial applications.

Market Restraints

High Initial Cost

Premium bifold doors with advanced materials and smart features involve a significant upfront investment. This limits accessibility for budget-conscious consumers, especially in emerging markets. The higher cost compared to traditional doors can slow adoption in price-sensitive regions despite long-term energy savings and functional advantages.

Installation and Maintenance Complexity

Proper installation of multi-panel bifold doors requires skilled labor and precise alignment, increasing installation time and costs. Maintenance of hardware, tracks, and seals is critical to ensure smooth operation and longevity. Lack of skilled technicians in certain regions can restrict market penetration and pose challenges for large-scale deployment in commercial projects.

Bifold Doors Market Opportunities

Integration with Smart Homes and IoT

The growing smart home industry offers opportunities for bifold door manufacturers to provide automated and app-controlled solutions. Doors integrated with security systems, climate control, and voice-assisted technologies appeal to tech-savvy homeowners and modern commercial offices. This trend enables differentiation and premium pricing, driving revenue growth for market leaders.

Rising Urban Housing Demand in Asia-Pacific

Rapid urbanization in countries such as China, India, and Indonesia is creating substantial demand for compact, space-saving, and aesthetic bifold doors in residential apartments and high-rise buildings. Government initiatives promoting modern housing developments are further accelerating adoption. This represents a significant growth opportunity for both domestic manufacturers and international players entering the region.

Eco-Friendly and Sustainable Construction Trends

Increasing awareness of sustainability in building projects presents opportunities for bifold door manufacturers to develop energy-efficient and recyclable products. Aluminum and timber bifold doors with low thermal conductivity, combined with double-glazing, are gaining preference. Green building certifications and incentives in Europe, North America, and Asia-Pacific encourage widespread adoption, especially in premium residential and commercial projects.

Product Type Insights

Aluminum bifold doors dominate the market, accounting for approximately 38% of the 2024 market share, due to their durability, lightweight design, and suitability for large-scale installations. Timber bifold doors are preferred in premium residential spaces for aesthetic appeal, while UPVC bifold doors are growing rapidly in mid-tier housing projects due to affordability and low maintenance. Trends indicate that aluminum doors are increasingly integrated with energy-efficient glass panels and smart automation to meet modern building requirements.

Application Insights

Residential applications dominate the bifold doors market, representing 42% of the 2024 market share, driven by renovations and new housing projects in urban centers. Commercial applications, including offices, hotels, and retail spaces, account for 32% of the market, fueled by aesthetic and space-saving design trends. Industrial applications, such as warehouses and factories, are growing at a moderate pace, primarily due to functional folding solutions and cost-effective aluminum systems.

Distribution Channel Insights

Direct sales channels, including manufacturer showrooms and online platforms, account for 45% of global sales, driven by consumer preference for customization and transparent pricing. Specialist distributors and contractors represent 35%, primarily for commercial projects. E-commerce growth is enhancing accessibility, allowing buyers to compare products, check reviews, and access installation services digitally.

End-Use Insights

Residential end-use dominates bifold door demand, particularly in urban apartments and luxury homes, supported by rising disposable income and design preferences for open layouts. Commercial offices and hospitality projects are adopting bifold doors to enhance visual appeal and optimize space utilization. Exports are increasingly driving growth, with Europe and North America importing premium bifold doors from manufacturers in China and Southeast Asia. Residential renovation and smart housing projects are expected to remain the fastest-growing end-use segments over the next five years.

| By Product Type | By Application | By Distribution Channel | By End-Use Segment |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 32% of the global bifold doors market, with the U.S. and Canada driving demand due to urban housing developments, luxury residential renovations, and commercial retrofits. Rising energy-efficiency regulations and growing adoption of smart homes support market growth. U.S. demand alone is estimated at USD 500 million in 2024.

Europe

Europe accounts for 28% of the global market, with the U.K., Germany, and France leading in adoption. Stringent building codes, premium residential projects, and renovation activities contribute to high market penetration. Germany and France are witnessing rapid growth in smart and energy-efficient bifold door installations, particularly in urban apartments and commercial offices.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Japan. Rapid urbanization, high-rise residential developments, and government housing initiatives are fueling demand. China alone accounts for an estimated USD 300 million in 2024, with a strong projected CAGR due to smart housing integration and the modernization of urban infrastructure.

Latin America

Latin America, led by Brazil, Mexico, and Argentina, is witnessing the gradual adoption of bifold doors. Urban residential projects and commercial renovations are driving moderate growth, with a total regional market size of USD 120 million in 2024. Export-import dynamics play a key role, with imports of aluminum and timber bifold doors from Europe and the Asia-Pacific.

Middle East & Africa

MEA markets, particularly the UAE, Saudi Arabia, and South Africa, are experiencing growing adoption in luxury residential, commercial, and hospitality projects. Government incentives for modern urban development and high-rise construction are accelerating demand. Total market size in 2024 is estimated at USD 200 million, with strong growth expected in premium segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bifold Doors Market

- Pella Corporation

- Andersen Corporation

- JELD-WEN Holding, Inc.

- ASSA ABLOY

- Marvin Windows and Doors

- Reynaers Aluminium

- Fletcher Building Limited

- Sakthi Doors

- Schuco International KG

- Centor

- Origin Global

- Sky-Frame

- Kawneer Company

- Norman Aluminum

- Winco Windows

Recent Developments

- In March 2025, Pella Corporation launched a new smart bifold door series with automated climate control integration for North American homes.

- In January 2025, Andersen Corporation introduced aluminum bifold doors with enhanced thermal insulation for European urban apartments.

- In December 2024, JELD-WEN partnered with a Chinese manufacturer to expand high-end bifold door exports to the Asia-Pacific, focusing on premium residential projects.