Beech Wood Market Size

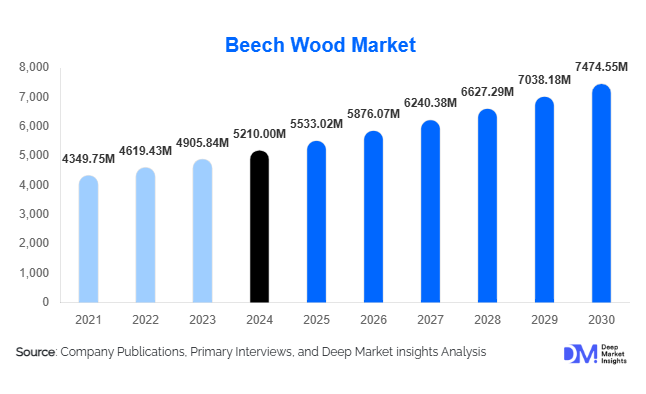

According to Deep Market Insights, the global beech wood market size was valued at USD 5,210 million in 2024 and is projected to grow from USD 5,533.02 million in 2025 to reach USD 7,474.55 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is primarily driven by the increasing use of beech wood in furniture manufacturing, interior design, and flooring applications, along with its rising adoption in sustainable construction and eco-friendly product lines.

Key Market Insights

- Growing preference for sustainable and renewable materials in furniture and home décor is fueling demand for beech wood due to its strength, versatility, and aesthetic appeal.

- Europe dominates global production and consumption of beech wood, with major supply from Germany, France, and Eastern European countries.

- Asia-Pacific is the fastest-growing region, driven by increasing investments in woodworking industries across China, India, and Vietnam.

- Engineered wood and hybrid beech-based materials are emerging as alternatives for modern interiors and modular furniture.

- Technological advancements in wood processing, including precision drying and automated machining, are enhancing beech wood quality and production efficiency.

Latest Market Trends

Rise of Sustainable Furniture and Interior Design

Manufacturers are increasingly integrating beech wood into eco-friendly and certified furniture collections. The trend toward minimalist, Scandinavian-style interiors has accelerated demand for light-colored, smooth-grained woods like beech. Leading brands are also prioritizing FSC-certified wood sourcing to appeal to environmentally conscious consumers. The use of reclaimed and recycled beech wood in furniture and décor products is growing, aligning with circular economy principles and green building certifications.

Expansion of Engineered Beech Products

Engineered beech products such as laminated veneer lumber (LVL) and cross-laminated timber (CLT) are gaining popularity in construction and furniture manufacturing. These products offer higher durability, dimensional stability, and design flexibility compared to traditional sawn timber. Increasing adoption in modular housing, commercial interiors, and premium cabinetry applications is driving this segment’s growth. Technological innovation in wood adhesives and coatings further supports the long-term performance of engineered beech materials.

Beech Wood Market Drivers

Increasing Demand from the Furniture Industry

Beech wood’s strength, fine grain, and uniform texture make it one of the most preferred hardwoods for furniture production. The rise of residential and commercial real estate projects globally is boosting demand for wooden furniture and interiors. Manufacturers favor beech wood for its ease of bending and machining, making it ideal for chairs, tables, and cabinets. Growing consumer preference for natural, durable, and aesthetic furniture pieces further accelerates market growth.

Growing Focus on Sustainable Construction

The global push toward sustainable building practices is increasing the use of beech wood as a renewable and biodegradable construction material. CLT panels made from beech are being adopted in green building projects across Europe. Architects and developers are using beech wood in interior paneling, flooring, and acoustic elements due to its durability and aesthetic versatility. Government incentives for low-carbon construction materials are expected to further drive demand during the forecast period.

Market Restraints

Price Volatility and Supply Constraints

Fluctuating raw material prices and limited availability of high-quality beech logs pose significant challenges to manufacturers. Factors such as forest management regulations, weather conditions, and supply chain disruptions affect production costs. The dependency on European forests for global supply also makes the market vulnerable to regional policy changes and transportation barriers.

Competition from Alternative Materials

Beech wood faces growing competition from engineered woods, composites, and cheaper alternatives like pine and rubberwood. Synthetic and metal-based furniture options, which offer cost efficiency and lightweight characteristics, are also limiting market penetration in price-sensitive regions. Moreover, high maintenance costs associated with hardwood furniture can discourage budget-conscious consumers.

Market Opportunities

Rising Popularity of Customized and Modular Furniture

The rapid expansion of modular furniture and bespoke interior design trends presents significant opportunities for beech wood manufacturers. Its adaptability to various finishes and shades makes it suitable for customized solutions across residential and commercial spaces. Digital fabrication technologies like CNC machining and 3D modeling are enabling precise and artistic beech wood designs, appealing to high-end consumers and designers.

Expansion in Asia-Pacific Manufacturing Hubs

Asia-Pacific’s growing role as a global furniture production hub offers new opportunities for beech wood exporters. Countries like China, Vietnam, and India are increasingly importing European beech logs and sawn timber to meet domestic and export-oriented furniture demand. Investments in woodworking infrastructure and trade liberalization in these regions are expected to fuel steady market expansion through 2030.

Product Type Insights

Based on product type, the market is segmented into sawn timber, veneers, plywood, and engineered beech products. Sawn timber dominates the market owing to its wide application in furniture and flooring. Engineered beech products are witnessing rapid growth due to their enhanced structural strength and suitability for large-scale construction projects. Veneers and plywood are increasingly used in decorative panels, cabinetry, and interior design projects for their smooth finish and visual appeal.

Application Insights

Furniture manufacturing remains the leading application segment, followed by construction, flooring, and interior design. The growing demand for premium wooden furniture in the residential and hospitality sectors supports strong market performance. In flooring, beech wood is preferred for its hardness, durability, and aesthetic qualities. Applications in joinery, musical instruments, and household utensils also contribute to the market’s diversification.

| By Product Type | By Application | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe dominates the global beech wood market, accounting for over 60% of production and export volume. Germany, France, Poland, and Romania are key contributors, supported by strong forestry management practices and advanced processing infrastructure. Demand is driven by both domestic consumption and exports to Asia and North America. The region’s focus on sustainable forestry and innovation in engineered wood products continues to bolster growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Vietnam. Rising disposable incomes, urbanization, and increasing furniture exports from the region are driving beech wood demand. Governments in the region are encouraging sustainable wood sourcing and investing in furniture manufacturing clusters. The availability of low-cost labor and expanding e-commerce distribution further enhances regional competitiveness.

North America

North America shows steady growth, with rising imports of European beech wood for furniture, flooring, and cabinetry. Increasing consumer inclination toward natural and eco-friendly materials supports demand. The U.S. is the largest market in the region, followed by Canada, where domestic manufacturers are integrating beech wood into luxury and sustainable furniture lines.

Middle East & Africa

Demand in this region is driven by high-end construction projects and luxury furniture imports. Countries such as the UAE and Saudi Arabia are investing heavily in sustainable building materials for residential and commercial projects. Africa, particularly in North African regions, shows emerging potential for local beech wood processing industries as infrastructure and trade networks expand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Beech Wood Market

- Pollmeier Massivholz GmbH & Co. KG

- Euroforest S.A.S.

- Stora Enso Oyj

- Beechwood Timber Ltd.

- James Latham plc

- Danzer Group

- AHEC (American Hardwood Export Council)

Recent Developments

- In August 2025, Pollmeier Massivholz launched a new line of engineered beech wood products targeting sustainable architecture and high-end furniture markets.

- In May 2025, Stora Enso announced its investment in a beech-based CLT production facility in Eastern Europe to expand its sustainable construction portfolio.

- In February 2025, Euroforest S.A.S. partnered with Asian distributors to strengthen its export network for beech wood veneers and sawn timber.