Bedroom Furniture Market Size

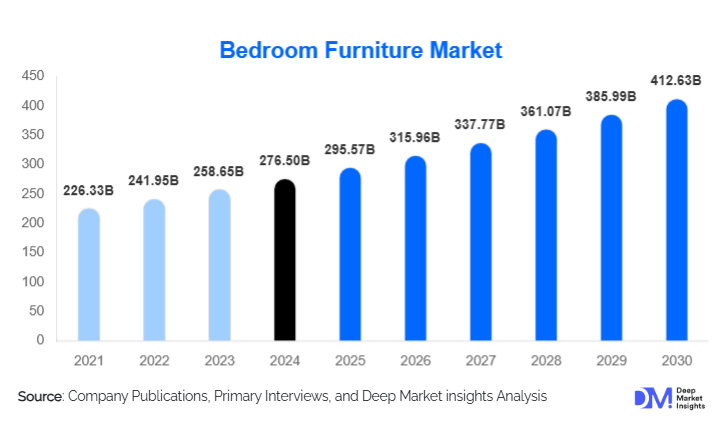

According to Deep Market Insights, the global bedroom furniture market size was valued at USD 276.5 billion in 2024 and is projected to grow from USD 295.57 billion in 2025 to reach USD 412.63 billion by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). The bedroom furniture market growth is primarily driven by rising urbanization, increasing residential construction, and growing demand for premium, modular, and multifunctional furniture. The rapid expansion of the middle class in emerging economies, along with the shift toward e-commerce–enabled furniture purchasing, is further accelerating global market expansion.

Key Market Insights

- Beds remain the dominant product category, contributing approximately 37% of global revenues, as consumers prioritize mattress support, comfort, and bedroom centerpiece design.

- Asia-Pacific leads the global market, driven by large-scale housing development and expanding urban middle-class populations in China and India.

- Solid and engineered wood furniture accounts for the largest share, supported by durability, aesthetic appeal, and sustainability certifications.

- Online retail is rapidly gaining traction, supported by AR/VR-enabled shopping, direct-to-consumer brands, and improved last-mile logistics.

- Growing preference for premium, smart, and multifunctional furniture is fueling innovation in lighting-integrated headboards, storage beds, and modular wardrobes.

- Sustainability is becoming a differentiator, with rising demand for eco-certified, responsibly sourced, and recyclable materials.

Latest Market Trends

Smart & Technology-Integrated Bedroom Furniture

The market is witnessing a significant rise in furniture integrated with smart features such as LED ambient lighting, wireless charging ports, adjustable bed bases, and embedded audio systems. Manufacturers are combining design with technology to appeal to consumers seeking comfort, convenience, and modern aesthetics. AR-enabled visualizers, AI-driven décor recommendations, and digital room planning tools are emerging as standard components of the shopping journey. These innovations are especially appealing to tech-savvy millennials who prioritise personalised and connected living spaces.

Sustainable & Eco-Friendly Furniture Gaining Prominence

Growing environmental awareness is shifting preferences toward sustainably sourced wood, recycled materials, and low-VOC finishes. Manufacturers are adopting FSC-certified timber, water-based adhesives, and circular production models to reduce environmental impact. Furniture rental and refurbishment programs are becoming popular in North America and Europe, providing cost-effective and eco-conscious alternatives. Brands increasingly emphasise carbon-neutral manufacturing, responsible sourcing, and transparent supply chains as critical value propositions for environmentally conscious consumers.

Bedroom Furniture Market Drivers

Rapid Urbanisation and Rising Home Ownership

Accelerating urban development, particularly in Asia-Pacific and Latin America, is driving demand for new residential units and, subsequently, bedroom furniture. As more individuals move to cities and form nuclear households, the need for modular, space-saving, and affordable furniture continues to rise. Government-backed housing programs in countries such as China and India further boost market volumes by expanding accessible home ownership.

Premiumization and Lifestyle Upgrades

Consumers are increasingly willing to invest in high-quality, aesthetically appealing, and multifunctional bedroom furniture. Growing disposable income, especially among younger professionals, has intensified demand for premium materials, minimalist designs, and contemporary bedroom sets. Luxury and semi-luxury brands are gaining traction by offering curated collections, designer collaborations, and customizable furniture systems that blend comfort with modern design sensibilities.

Market Restraints

Volatility in Raw Material Prices

The cost of wood, metal, upholstery, and adhesives has fluctuated significantly due to supply chain disruptions, deforestation regulations, and global trade policies. These cost variations increase production expenses, reduce manufacturer margins, and force retail price adjustments that can dampen demand. Import-dependent markets face added challenges due to freight charges and tariff fluctuations, complicating long-term cost planning.

Long Replacement Cycles

Bedroom furniture is durable and replaced infrequently, typically every 7–12 years, depending on product type. This long lifecycle limits repeat purchase frequency, making market growth heavily reliant on new housing developments and large-scale renovation cycles. Mature markets in North America and Europe are particularly affected due to saturated household penetration and slower refurbishment rates.

Bedroom Furniture Market Opportunities

Expansion of Smart, Modular & Multifunctional Furniture

Compact urban living spaces are creating strong demand for storage beds, modular wardrobes, foldable furniture, and integrated smart features. Brands that innovate in space optimisation, such as beds with lift-up storage, customizable closet systems, and modular bedside units, are well-positioned to capture fast-growing consumer segments. This opportunity is especially significant in Asia-Pacific and Europe, where small apartments dominate urban housing.

Growth of Sustainable & Circular Furniture Models

Opportunities are expanding for brands offering eco-friendly and circular furniture solutions. Refurbished, rental, and buy-back models are gaining traction among environmentally conscious consumers and younger demographics unwilling to commit to long-term furniture ownership. Manufacturers implementing recycled materials, low-waste production, and sustainable certifications can achieve stronger market differentiation and long-term brand loyalty.

Product Type Insights

Beds dominate the market, driven by the need for high-quality sleep solutions and continual innovation in designs, materials, and storage functionality. Wardrobes and closets represent the second-largest segment, fueled by the rising popularity of modular and customizable wardrobe systems. Dressers, nightstands, and other bedroom accessories contribute steadily to overall market value, especially in coordinated bedroom set purchases. Upholstered and technologically integrated products are gaining popularity across premium segments.

Application Insights

The residential sector accounts for the majority of demand, supported by owner-occupied homes and rental apartments. Commercial applications, such as hotels, serviced apartments, student housing, and senior living facilities, are expanding rapidly due to shorter furniture replacement cycles and rising investment in hospitality infrastructure. The increasing preference for furnished rental units is further boosting demand for mid-range and durable bedroom furniture.

Distribution Channel Insights

Offline retail remains dominant due to consumer preference for physically evaluating large furniture items. Furniture showrooms, specialty stores, and big-box retailers capture significant market share. However, online retail is the fastest-growing channel, supported by improved delivery logistics, AR-based product visualization, and direct-to-consumer brands offering cost advantages. Hybrid and omnichannel models are becoming increasingly common, with brands using physical stores as experience centers while driving final purchases online.

End-Use Insights

Owner-occupied residential homes represent the largest end-use segment, accounting for over 60% of global demand. Rental housing is the fastest-growing segment, as younger, mobile populations increasingly prefer flexible and modular furniture solutions. Institutional buyers, including hotels, hostels, senior living facilities, and student housing, are contributing significantly to volume-based growth due to recurring refurbishment requirements.

Age Group Insights

Consumers aged 31–50 years constitute the largest purchasing segment due to higher disposable income and active engagement in home furnishing. Young adults (18–30) drive strong demand for affordable, modular, and rental furniture. Older demographics (51+) contribute significantly to premium and luxury furniture segments, prioritizing durability, aesthetic appeal, and ergonomic designs.

| By Product Type | By Material | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately one-quarter of the global market, supported by high disposable incomes, robust e-commerce infrastructure, and strong demand for premium furniture. Renovation spending and home improvement trends continue to drive category growth, especially in the U.S. and Canada.

Europe

Europe exhibits stable demand, supported by strong preferences for sustainable, minimalist, and high-quality furniture. Markets such as Germany, the U.K., France, and Italy lead regional sales. Growing environmental regulations are accelerating the shift toward eco-friendly materials and circular furniture models.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing market, driven by rapid urbanization, large housing projects, and expanding middle-class consumption in China and India. Japan and South Korea contribute to premium furniture demand, while Southeast Asia is emerging as a major manufacturing and consumption hub.

Latin America

Brazil, Mexico, and Argentina represent the key markets, supported by growing urban populations and rising consumer spending. Despite economic fluctuations, mid-range furniture demand remains strong, particularly for modular and affordable bedroom sets.

Middle East & Africa

Growth in GCC nations is driven by luxury housing projects, high-income consumers, and demand for premium international brands. In Africa, rising urbanization in South Africa, Kenya, and Nigeria supports increasing adoption of modern bedroom furniture, though the market remains price-sensitive.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bedroom Furniture Market

- Inter IKEA Group

- Ashley Furniture Industries, Inc.

- La-Z-Boy Incorporated

- Nitori Co., Ltd.

- Williams-Sonoma, Inc.

- Godrej Interio

- Hülsta-Werke Hüls GmbH

Recent Developments

- In March 2025, IKEA expanded its sustainable bedroom collection globally, introducing FSC-certified solid wood furniture and modular storage systems targeting urban consumers.

- In January 2025, Ashley Furniture announced major investments in U.S. manufacturing facilities to enhance automation and reduce lead times for custom bedroom furniture.

- In November 2024, Nitori Co., Ltd. launched a new range of compact, multifunctional bedroom solutions tailored for small apartments in Japan and Southeast Asia.