Bed and Breakfast Accommodation Market Size

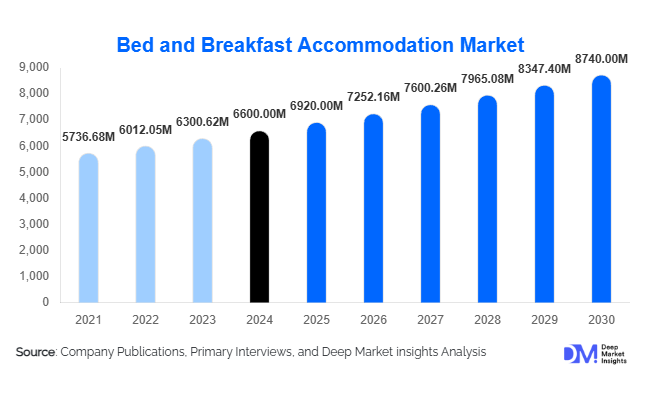

According to Deep Market Insights, the global bed and breakfast accommodation market size was valued at USD 6,600.00 million in 2024 and is projected to grow from USD 6,920.00 million in 2025 to reach USD 8,740.00 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). The growth of the B&B market is driven by the rising popularity of personalized lodging experiences, increasing demand for heritage and boutique stays, and the growing adoption of digital booking platforms that empower small property owners to reach global travelers directly.

Key Market Insights

- Rising demand for authentic, local travel experiences is fueling the popularity of independent B&B stays over standardized hotel chains.

- Digital transformation through platforms such as Airbnb, Booking.com, and Vrbo has democratized access for small-scale operators.

- Eco-conscious travel is reshaping B&B operations, with a growing shift toward sustainable materials, solar energy, and local sourcing.

- Europe dominates the global market due to its well-established tourism infrastructure and abundance of heritage properties.

- Asia-Pacific represents the fastest-growing regional segment, driven by expanding domestic tourism in India, China, and Southeast Asia.

- Technological integration, including AI-enabled pricing, chatbots, and smart-room systems, is transforming guest experience management.

Latest Market Trends

Rise of Boutique and Experiential B&Bs

Travelers increasingly prefer boutique bed and breakfast properties that offer personalized service, local storytelling, and curated aesthetics. Many B&Bs now focus on unique design themes, such as countryside charm, coastal minimalism, or urban vintage, to differentiate themselves. The integration of cultural experiences like farm-to-table dining, artisan workshops, or local walking tours enhances guest satisfaction and retention. This trend reflects the broader shift toward “experience over accommodation,” where B&Bs act as gateways to local culture.

Smart Technology and Digital Personalization

B&B operators are adopting smart technologies to streamline operations and enhance guest convenience. Contactless check-ins, digital room keys, voice-controlled amenities, and AI-driven recommendation engines are becoming increasingly common. Cloud-based management systems enable owners to automate booking, payment, and customer communication processes efficiently. Personalized upselling through guest data analytics, such as recommending local attractions or breakfast preferences, improves overall experience and drives repeat business.

Market Drivers

Growth of Domestic and Short-Stay Tourism

The rise of weekend getaways, remote work flexibility, and regional tourism has boosted demand for B&B stays. Travelers seek affordable yet high-quality accommodation options offering homely comfort. Governments and tourism boards promoting rural and heritage tourism have further supported market expansion, especially in North America and Europe. This short-stay trend aligns with the B&B model, which caters to travelers seeking authentic, community-oriented lodging.

Shift Toward Sustainable and Responsible Travel

Consumers are prioritizing eco-friendly accommodation options, prompting B&B owners to integrate green practices such as waste reduction, energy efficiency, and local sourcing. Certification programs like Green Key and LEED for hospitality are gaining traction among independent operators. The trend supports environmental goals while enhancing brand reputation and attracting environmentally conscious travelers.

Market Restraints

Fragmented Market and Operational Challenges

The B&B industry remains highly fragmented, dominated by small independent operators with limited scalability. Managing consistent quality, service standards, and compliance with regional hospitality regulations poses challenges. Additionally, fluctuations in tourist arrivals due to seasonality or geopolitical instability can significantly impact revenue streams.

Competition from Alternative Lodging Platforms

Large-scale platforms like Airbnb and serviced apartments increasingly compete with traditional B&Bs, offering similar experiences with greater flexibility. The rise of hybrid models, such as apartment-hotels and boutique hostels, further intensifies competition, pressuring smaller B&Bs to differentiate through personalization and niche marketing.

Market Opportunities

Expansion of Luxury and Heritage B&Bs

The growing appetite for premium, heritage-inspired stays presents an opportunity for upscale B&B conversions of historic estates, manors, and villas. This segment attracts affluent travelers seeking exclusivity and cultural immersion. Operators investing in luxury amenities, such as gourmet breakfasts, private terraces, and spa services, are positioned to capture high-value market share.

Integration of Wellness and Culinary Experiences

Wellness tourism is increasingly intersecting with B&B accommodations. Hosts offering yoga retreats, organic cuisine, and holistic therapies are drawing travelers seeking relaxation and health-focused getaways. Culinary tourism, especially in Europe and the Asia-Pacific, presents further opportunities through cooking classes, farm tours, and locally sourced breakfasts that celebrate regional flavors.

Distribution Channel Insights

Online travel agencies (OTAs) and direct booking websites dominate distribution. Platforms like Airbnb, Booking.com, and Expedia are critical for visibility, while many operators are building independent websites to retain direct control and reduce commission costs. Social media and influencer marketing play a crucial role in attracting younger travelers, while digital review platforms continue to shape booking decisions.

Traveler Type Insights

Couples represent the largest customer segment, driven by romantic getaways and weekend escapes. Solo travelers, particularly digital nomads, increasingly choose B&Bs for comfort and community interaction. Family travelers prefer spacious countryside or farm-style B&Bs offering family suites and child-friendly amenities. Group bookings for events and celebrations are also on the rise, particularly in Europe and North America.

| By Accommodation Type | By Traveler Type | By Distribution Channel | By Application |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe dominates the global B&B market, led by the U.K., France, Italy, and Spain. Historic architecture, strong domestic tourism, and cultural diversity underpin growth. Many European governments support B&B operators through rural development initiatives promoting sustainable tourism.

North America

North America remains a mature market, driven by experiential tourism and strong domestic travel demand in the U.S. and Canada. Boutique B&Bs emphasizing design, heritage, and personalized service continue to attract millennial and Gen X travelers seeking alternatives to hotel chains.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rapid growth in domestic tourism across India, China, Indonesia, and Thailand. Expanding middle-class wealth, coupled with the digitalization of small accommodations, supports robust B&B market expansion.

Latin America

Latin America shows increasing potential, particularly in Mexico, Brazil, and Chile. B&Bs are benefiting from rural and adventure tourism trends, with travelers seeking cultural and natural immersion.

Middle East & Africa

Growth in the Middle East and Africa is driven by cultural tourism and government initiatives promoting small-scale hospitality enterprises. Coastal and desert B&Bs in Morocco, Jordan, and South Africa are emerging as niche attractions offering luxury with local authenticity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bed and Breakfast Accommodation Market

- Airbnb, Inc.

- Booking Holdings Inc.

- Expedia Group

- BedandBreakfast.com

- Vrbo (Expedia Group)

- Innkeeper’s Lodge

- Agoda Company Pte. Ltd.

Recent Developments

- In September 2025, Airbnb announced the launch of its Boutique Retreats Program, aimed at promoting heritage and design-led B&Bs globally.

- In May 2025, Booking.com introduced sustainability badges for B&B operators meeting eco-certification standards, enhancing visibility for green accommodations.

- In March 2025, Expedia Group expanded its B&B listing network across Europe and Asia, integrating AI-powered tools to support small operators with pricing and demand forecasting.