Beauty and Wellness Market Size

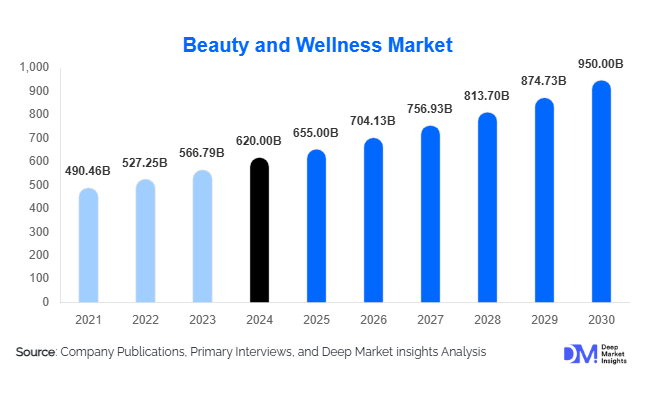

According to Deep Market Insights, the global beauty and wellness market size was valued at USD 620 billion in 2024 and is projected to grow from USD 655 billion in 2025 to reach USD 950 billion by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness about personal grooming and wellness, rising demand for organic and clean beauty products, and the rapid expansion of wellness services globally.

Key Market Insights

- Skincare and wellness products are witnessing a shift toward organic, cruelty-free, and sustainable formulations, reflecting the growing environmental and health consciousness among consumers.

- Haircare and personal grooming services are expanding, driven by rising disposable incomes and increasing focus on aesthetics and self-care across both genders.

- Online retail channels dominate, leveraging AI-based recommendations, virtual try-ons, and subscription models to enhance consumer engagement.

- Asia-Pacific is emerging as the fastest-growing regional market, led by rising middle-class affluence in India and China.

- North America remains a mature market, with high penetration of premium and luxury beauty products driving stable demand.

- Integration of digital technologies, including wellness apps, AI-based diagnostics, and teleconsultation services, is reshaping consumer interaction with beauty and wellness offerings.

Latest Market Trends

Rising Preference for Organic and Sustainable Products

Consumers are increasingly seeking clean, sustainable, and eco-friendly beauty and wellness products. Organic skincare, plant-based cosmetics, and non-toxic haircare formulations are gaining popularity, particularly among millennials and Gen Z. This trend has prompted major brands to reformulate offerings, obtain certifications for organic and cruelty-free products, and highlight transparency in ingredient sourcing. Social media platforms amplify consumer demand by showcasing lifestyle-conscious consumption and environmentally responsible practices. Retailers and e-commerce platforms are now curating specialized sections for clean beauty, enabling consumers to easily access premium, eco-friendly options.

Digital and AI Integration in Beauty Services

Emerging technologies are being adopted to enhance beauty and wellness experiences. AI-powered skincare diagnostics, virtual makeup try-ons, and personalized nutrition and wellness apps are reshaping consumer engagement. Teleconsultation platforms allow consumers to receive professional guidance remotely, while wearable wellness devices track health and beauty metrics. E-commerce platforms are increasingly integrating AR tools and AI-driven recommendation engines, providing tailored shopping experiences that improve customer satisfaction and loyalty. Digital engagement is particularly strong among younger demographics, who value immersive and interactive solutions.

Beauty and Wellness Market Drivers

Rising Health and Beauty Consciousness

Consumers worldwide are increasingly prioritizing wellness and self-care. Skincare, haircare, and nutrition-based wellness products are in high demand due to growing awareness about aging, sun protection, and preventive health measures. The expanding middle-class population in emerging economies, coupled with higher disposable incomes, has fueled the consumption of premium beauty and wellness products. This trend is further supported by social media influencers and celebrity endorsements, enhancing product visibility and desirability.

Growth of E-commerce and Direct-to-Consumer Channels

The expansion of online retail and mobile commerce has been a significant driver of market growth. Consumers are adopting digital-first shopping habits, aided by AI recommendations, virtual try-ons, and subscription models. E-commerce also allows brands to target niche markets, offer personalized products, and expand internationally without heavy investments in physical stores. Emerging markets are witnessing a particularly strong shift to digital platforms, increasing accessibility to premium and mid-range products alike.

Rising Demand for Wellness Services

Fitness, spa, and holistic wellness services are seeing robust growth. Urbanization, high-stress lifestyles, and awareness of mental health are driving demand for yoga, meditation, fitness, and spa services. Wellness retreats and integrated beauty-wellness experiences are increasingly popular, combining skincare treatments, nutrition guidance, and relaxation therapies. This convergence of beauty and wellness enhances customer experience and expands revenue opportunities for service providers.

Market Restraints

High Product Pricing and Premium Positioning

Premium skincare, cosmetic, and wellness products remain inaccessible to large segments of consumers in emerging markets due to high pricing. Even mid-tier products can be cost-prohibitive in price-sensitive regions, limiting market penetration. Fluctuating raw material prices and import duties further impact product affordability and profitability.

Regulatory and Compliance Challenges

Stringent regulations governing cosmetic ingredients, labeling, and wellness certifications vary across countries, creating barriers for global expansion. Compliance with multiple standards increases operational costs and may delay product launches. Additionally, differences in regulations for supplements and wellness devices pose challenges for integrated wellness offerings.

Beauty and Wellness Market Opportunities

Expansion in Emerging Markets

Countries in Asia-Pacific (India, China, Southeast Asia) and Latin America (Brazil, Mexico) present immense growth opportunities due to rising urbanization, disposable income, and beauty awareness. Governments are promoting local manufacturing under initiatives like India’s “Make in India” and China’s “Made in China 2025,” supporting industrial expansion and boosting domestic brands. This trend opens avenues for new entrants and multinational brands to establish a strong presence.

Integration of Technology in Wellness Services

AI-powered skincare, teleconsultations, digital wellness platforms, and virtual reality applications in spas are creating new revenue streams. Personalized recommendations, remote diagnostics, and virtual wellness experiences allow brands to reach tech-savvy consumers, enhance engagement, and differentiate offerings. Early adopters of technology in beauty and wellness services can capture significant market share.

Premiumization and Niche Product Launches

There is a growing demand for specialized products targeting men, anti-aging, organic skincare, and wellness supplements. Launching niche and high-value products allows brands to capture dedicated segments willing to pay a premium for efficacy, sustainability, and innovation. Focused marketing and influencer partnerships further enhance brand positioning in these categories.

Product Type Insights

Skincare products dominate the market, accounting for roughly 28% of global market share in 2024. The segment is leading due to rising concerns about skin health, anti-aging, and sun protection, coupled with the surge in organic and premium formulations. Skincare product launches, digital marketing, and celebrity endorsements have bolstered adoption globally. Haircare products follow closely, driven by styling, treatment, and coloring trends.

Service Type Insights

Spa and salon services hold a dominant position with approximately 25% market share, fueled by rising discretionary spending, increasing wellness awareness, and the integration of treatments. Fitness and wellness services are growing at a CAGR of 8.5%, propelled by urban wellness trends, yoga adoption, and holistic health programs.

Distribution Channel Insights

Offline retail remains significant, contributing nearly 45% of revenue in 2024, with specialty stores and salons driving adoption. However, online retail is the fastest-growing channel at over 12% CAGR due to convenience, AI-enabled personalization, and global accessibility. E-commerce is particularly strong in the Asia-Pacific and North America.

Consumer Demographic Insights

Female consumers represent the largest share (60%), though male grooming is growing rapidly. Age group 25–34 is the fastest-growing segment due to high digital adoption and purchasing power. Premium and middle-income segments are key contributors, with increasing penetration of luxury products in emerging economies.

| By Product Type | By Service Type | By Distribution Channel | By Consumer Demographics |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 30% of the global market in 2024, driven by high spending on premium skincare, cosmetics, and wellness services. The U.S. leads the market, supported by a mature e-commerce infrastructure, high disposable income, and strong consumer awareness.

Europe

Europe holds 25% of the market, with Germany, France, and the U.K. leading. Consumers prioritize clean, sustainable, and organic products, and wellness services are growing steadily. Europe is also investing in eco-friendly beauty initiatives and digital wellness services.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India showing strong demand. Rising urbanization, increasing middle-class disposable income, and social media influence are driving growth. The market here is expected to surpass USD 250 billion by 2030, expanding at the highest CAGR globally.

Latin America

Brazil and Mexico are key markets, with increasing premium product adoption. Growth is moderate but steady, driven by rising disposable income and wellness awareness.

Middle East & Africa

The Middle East shows strong demand for luxury products and spa services, led by the UAE and Saudi Arabia. Africa remains smaller in revenue contribution but is growing due to urbanization and expanding wellness awareness.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Beauty and Wellness Market

- L’Oréal

- Unilever

- Procter & Gamble

- Estée Lauder

- Shiseido

- Beiersdorf

- Coty Inc.

- Johnson & Johnson

- Amorepacific

- Henkel AG

- LVMH (Cosmetics division)

- Kao Corporation

- Revlon

- Mary Kay

- Oriflame

Recent Developments

- In March 2025, L’Oréal launched a new organic skincare line targeting eco-conscious consumers globally.

- In April 2025, Unilever expanded its wellness product portfolio in India, focusing on natural and cruelty-free offerings.

- In June 2025, Estée Lauder introduced AI-based personalized skincare diagnostics through its digital platform, enhancing consumer engagement and loyalty.