Basketball Gear Market Size

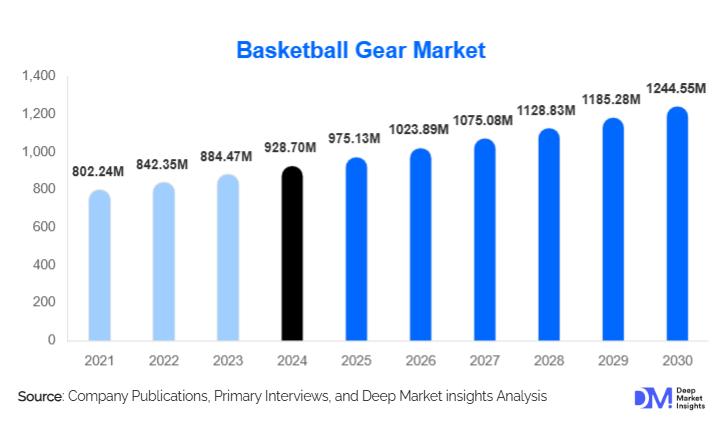

According to Deep Market Insights, the global basketball gear market size was valued at USD 928.7 million in 2024 and is projected to grow from USD 975.13 million in 2025 to reach USD 1,244.55 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). Growth is driven by rising global participation in basketball, expanding home-court installations, increasing youth and school-level sports engagement, and the rapid integration of smart and connected basketball equipment.

Key Market Insights

- Basketballs remain the dominant product segment, accounting for over 50% of market revenue due to high replacement frequency and universal necessity across all skill levels.

- Offline retail channels command nearly 75% of total sales, driven by consumer preference for hands-on evaluation of gear.

- North America accounts for approximately 41–42% of the global market, driven by a strong basketball culture and extensive retail distribution networks.

- Asia-Pacific is the fastest-growing region, supported by youth participation programs, developing sports infrastructure, and rising disposable incomes.

- Smart and sensor-integrated basketballs are emerging as a high-value niche, appealing to performance-oriented athletes and digital-native consumers.

- Home fitness and residential basketball setups have surged, with portable hoop systems becoming a core demand driver.

What are the latest trends in the basketball gear market?

Smart and Connected Basketball Equipment Accelerating Adoption

Technological integration is transforming the basketball gear landscape. Smart basketballs embedded with motion sensors, Bluetooth connectivity, and advanced analytics are increasingly adopted by training academies, competitive athletes, and recreational players seeking performance data. These tools track metrics such as shot arc, spin rate, and dribble patterns, offering personalized training insights. Smart backboards and app-connected hoop systems are also gaining momentum, enabling real-time feedback, gamified training, and remote coaching. This trend is reshaping training ecosystems and elevating gear preferences toward data-driven performance enhancement.

Rise of Home-Court and Residential Basketball Installations

Consumers worldwide are investing in home-based basketball setups as part of broader fitness and recreation trends. Portable, adjustable, and in-ground hoop systems are becoming increasingly popular for backyards, driveways, and residential complexes. This shift gained traction due to hybrid work lifestyles and interest in at-home sports facilities. The expansion of home-court demand is also boosting sales of supporting gear such as basketballs, training kits, shooting aids, protective equipment, and performance wear.

What are the key drivers in the basketball gear market?

Growing Global Participation in Basketball

Basketball participation is rising across professional, amateur, and recreational levels. Growth in school sports programs, increased establishment of community leagues, and expanding fan engagement with global leagues such as the NBA are stimulating consistent demand for gear. As access to sports facilities improves and awareness of health and fitness increases, basketball remains one of the most inclusive and widely adopted sports worldwide.

Material Innovation and Technological Advancement

Advancements in materials, including composite leather, high-durability rubber, breathable fabrics, and ergonomic protective gear, have improved product quality and longevity. Coupled with smart gear innovations, manufacturers are introducing premium equipment that offers superior performance and user experience. These innovations drive higher average selling prices and strengthen consumer loyalty toward premium brands.

Expansion of Youth and Institutional Sports Programs

Schools, colleges, and training academies represent a major demand engine, purchasing hoops, basketballs, apparel, and accessories in bulk. Government-supported youth sports initiatives, public infrastructure spending, and mandatory physical education requirements contribute to steady, recurring demand. Developing markets in Asia and Latin America are especially witnessing a surge in institutional investments in basketball facilities.

What are the restraints for the global market?

Volatility in Raw Material Prices

The basketball gear supply chain is closely tied to rubber, synthetic polymers, composite fibers, metal frames, and textile materials. Fluctuations in raw material prices due to supply disruptions or global inflationary pressures directly affect manufacturing costs and retail pricing. This introduces margin pressures for manufacturers and price sensitivity in budget-conscious markets.

Fragmented Distribution and Channel Limitations

While online retail is growing, a large proportion of basketball gear sales still rely on offline specialty stores. Smaller brands often face challenges securing shelf space, maintaining inventory cycles, and competing with established brands with extensive retail networks. Channel fragmentation and high retailer markups can slow the expansion of emerging players and limit price competitiveness.

What are the key opportunities in the basketball gear industry?

Technology-Integrated Performance Training Gear

As athletes and recreational players increasingly seek data-backed improvements, smart training systems offer a major revenue opportunity. Integrating AI, motion tracking, and mobile apps into basketballs, gloves, wearable bands, and hoop systems enables real-time feedback and shareable performance analytics. Manufacturers that partner with tech companies or develop proprietary platforms can unlock premium pricing and subscription-based digital services.

Emerging Basketball Markets and Institutional Partnerships

Rapid growth in school-level adoption, urban recreational centers, and organized leagues in Asia-Pacific, the Middle East, and Latin America presents new expansion avenues. Manufacturers can collaborate with governments, federations, and schools to supply gear under long-term contracts. As sports infrastructure improves, the need for certified hoops, backboards, and bulk basketball purchases is expected to surge.

Product Type Insights

Basketballs dominate the product landscape, comprising over 50% of total market revenue due to their universal need, frequent replacement cycles, and extensive use across recreational, school, and professional settings. Apparel and footwear follow as key categories, driven by brand-driven innovation and athlete endorsements. Hoops and backboards represent a high-value segment, particularly fueled by home-court installations and institutional purchases. Protective gear and training accessories are rapidly evolving with ergonomic designs and smart technology integrations, appealing strongly to youth and competitive athletes.

Application Insights

Recreational and amateur basketball remains the largest application segment globally, supported by widespread participation in community leagues and home-based play. Competitive basketball, including high school, collegiate, and professional leagues, drives demand for high-performance balls, apparel, and protective gear. Institutional applications are growing rapidly, with schools and training centers purchasing bulk gear and standardized equipment for organized training programs. Home-use applications are experiencing strong momentum due to lifestyle changes and rising adoption of portable hoop systems.

Distribution Channel Insights

Offline retail, including specialty sports stores and mass merchandisers, accounts for nearly 75% of total sales, benefiting from tactile evaluation and strong brand presence. Online channels, including D2C brand websites and marketplaces, are rapidly gaining share due to convenience, product variety, and digital marketing. Institutional procurement channels represent a stable, high-volume segment, supplying schools, clubs, and academies with standardized gear packages. Subscription-based rental programs for training equipment and digital coaching platforms are emerging as new-age distribution models.

End-User Insights

Amateur and recreational users account for the largest share of demand, driven by casual play, neighborhood courts, and personal training. Home users form the fastest-growing end-user category, driven by household fitness investments and urban lifestyle trends. Professional players, though a smaller segment, contribute significantly to premium gear adoption and brand visibility. Schools, colleges, and community centers represent a high-volume institutional base with increasing budgets for sports infrastructure and athlete development programs.

| By Product Type | By End User | By Distribution Channel | By Material Type | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market with around 41–42% share in 2024. The U.S. dominates due to strong grassroots basketball culture, high disposable income, and widespread home-court installation trends. Demand is further supported by the influence of the NBA and robust retail ecosystems offering premium gear.

Europe

Europe is a steadily growing market, particularly across Germany, France, Spain, and the U.K. The region benefits from expanding school sports programs, recreational leagues, and rising youth participation. Sustainability-oriented gear and mid-range products are gaining traction among European consumers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, propelled by rising middle-class incomes, expanding school sports infrastructure, and strong basketball fan culture in China, India, Japan, and the Philippines. Affordable basketballs, portable hoops, and training aids are especially popular among youth populations. Governments in Southeast Asia are also investing in public sports facilities, further boosting demand.

Latin America

Latin America is showing increasing adoption, particularly in Brazil, Mexico, and Argentina. Growth is driven by urban recreational centers, community sports programs, and international basketball exposure. Mid-range apparel and entry-level basketballs dominate consumer preference due to cost considerations.

Middle East & Africa

MEA markets are witnessing rising interest in basketball, supported by school sports initiatives and investments in recreational infrastructure in the UAE, Saudi Arabia, South Africa, and Nigeria. While smaller in share compared to other regions, MEA’s long-term growth potential is strong due to youth-driven demand and increasing sports partnerships.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Basketball Gear Market

- Nike

- Wilson Sporting Goods

- Rawlings Sporting Goods

- Under Armour

- Spalding

- Adidas

- Puma

- Molten

- New Balance

- Li-Ning

- ANTA Sports

- Mizuno

- ASICS

- McDavid

- Baden Sports

Recent Developments

- In 2025, several major brands expanded their smart basketball product lines, integrating AI-driven analytics and advanced sensor technologies to support personalized training.

- In 2025, Wilson and Spalding announced strategic partnerships with youth sports academies across Asia to supply official training gear and develop grassroots basketball programs.

- In 2025, Nike introduced a new range of eco-conscious basketball apparel and performance footwear featuring recycled materials and enhanced durability.