Barcode Printer Market Size

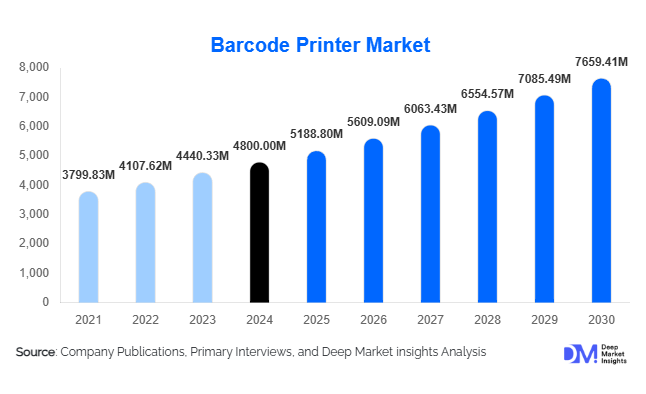

According to Deep Market Insights, the global barcode printer market size was valued at USD 4,800.00 million in 2024 and is projected to grow from USD 5,188.80 million in 2025 to reach USD 7,659.41 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for automation in manufacturing and logistics, the expansion of e-commerce and retail sectors, and increasing adoption of advanced printing technologies, including mobile, wireless, and industrial-grade barcode printers for traceability and supply chain optimization.

Key Market Insights

- Industrial and heavy-duty barcode printers dominate globally, accounting for approximately 66% of the 2024 market, due to high adoption in manufacturing, warehousing, and logistics applications requiring durable and high-volume printing solutions.

- Thermal transfer printing technology leads with around 38% market share, owing to its versatility, durability, and ability to print high-quality codes on multiple substrates for diverse industrial and retail applications.

- North America is the largest regional market (30% share in 2024), supported by high levels of automation, advanced logistics infrastructure, and early adoption of mobile and connected printers.

- Asia-Pacific is the fastest-growing region, driven by expanding manufacturing hubs, e-commerce growth, and government initiatives in digitalization and smart supply chain programs, particularly in India, China, and Southeast Asia.

- Healthcare, retail, and logistics industries are key end-users, increasingly adopting barcode printers for serialization, inventory tracking, and compliance with regulatory standards.

- Technological integration, including wireless connectivity, IoT-enabled printers, and cloud-based label management systems, is enhancing operational efficiency and enabling real-time supply chain monitoring.

Latest Market Trends

Industrial Automation and Smart Supply Chain Integration

Barcode printers are becoming central to automated manufacturing and smart logistics systems. Companies are integrating industrial printers with warehouse management systems (WMS) and manufacturing execution systems (MES) to enable real-time labeling, track-and-trace, and improved inventory accuracy. Mobile and wireless printers are being deployed in field operations, retail, and healthcare to provide on-demand printing and seamless integration into IoT-enabled environments. Adoption of cloud-based labeling solutions is also increasing, allowing centralized management of print jobs across multiple locations.

Shift Toward Mobile and Wireless Printing

Portable barcode printers are witnessing strong adoption in retail, logistics, and field service operations. The demand is driven by e-commerce fulfillment centers, last-mile delivery services, and in-store shelf labeling applications. Bluetooth, Wi-Fi, and cellular-enabled printers enable real-time connectivity, reduce operational downtime, and enhance workforce mobility. Integration with mobile applications and scanning devices ensures that barcode printing is increasingly on-the-go, enhancing efficiency and reducing errors in labeling processes.

Barcode Printer Market Drivers

Rapid Growth in E-commerce and Retail Automation

The e-commerce boom has created a critical need for fast, accurate labeling of packages and products. Barcode printers are vital for managing inventory, shipments, returns, and retail shelf tags. The omnichannel retail trend has further intensified the demand for high-speed industrial and mobile printers capable of producing high-quality barcodes in large volumes, facilitating seamless logistics and customer experience.

Expansion of Manufacturing and Industry 4.0 Initiatives

Manufacturing companies are increasingly adopting automated assembly lines, smart factories, and Industry 4.0 solutions. Barcode printers are essential for part tracking, in-process labeling, and finished goods identification, enabling efficient supply chain management. Industrial-grade printers provide the durability and speed required for these high-volume environments, supporting operational excellence and regulatory compliance.

Regulatory Compliance and Traceability Requirements

Stringent regulations in healthcare, pharmaceuticals, food & beverages, and public sector operations mandate traceability and serialization. Barcode printers that support high-resolution printing, variable data encoding, and multi-substrate labeling help companies meet these requirements efficiently. Compliance drives demand for advanced printing technologies capable of generating durable and accurate labels under diverse environmental conditions.

Market Restraints

High Costs of Industrial Printers

Heavy-duty barcode printers and associated integration solutions involve significant upfront costs, limiting adoption among small and medium-sized enterprises. Additionally, many organizations continue using legacy systems, delaying printer replacement cycles and slowing market penetration.

Consumable and Compatibility Challenges

Printer performance depends on ribbon, label media, and substrate compatibility. Variations in requirements across industries, coupled with a lack of standardization in interfaces and media types, can hinder deployment. Technical fragmentation and integration challenges may slow adoption rates, particularly for advanced industrial and mobile printing solutions.

Barcode Printer Market Opportunities

Emerging Markets and Government Infrastructure Initiatives

Emerging economies such as India, China, and Southeast Asia are investing in smart logistics, warehouse modernization, and digital supply chain initiatives. Government programs like "Make in India" and smart-city initiatives boost demand for barcode printers across manufacturing, retail, and public sector applications. New entrants and established players can tap these high-growth markets by localizing production or partnering with local systems integrators.

Technology Upgrades and Mobile Printing Adoption

Organizations are upgrading legacy printers to mobile, wireless, and IoT-enabled devices. These solutions support real-time tracking, on-demand printing, and cloud-based label management. Companies focusing on rugged mobile printers, integrated software, and value-added services have an opportunity to capture recurring revenue from hardware, consumables, and software subscriptions.

Integration with Smart Supply Chain and Regulatory Compliance

Advanced barcode printers integrated with ERP, WMS, and MES systems enable enhanced traceability, compliance, and operational efficiency. Regulatory mandates in pharmaceuticals, food safety, and public sector asset tracking create opportunities for high-resolution, multi-substrate printers. Vendors can offer bundled solutions, including software and services, to differentiate in competitive markets.

Product Type Insights

Industrial/heavy-duty barcode printers dominate the global market, representing approximately 66% of the 2024 market. Their high durability, speed, and ability to handle high-volume printing make them ideal for demanding environments such as manufacturing, logistics, and large-scale retail operations. The leading driver for this segment is their robustness and efficiency, enabling uninterrupted operations in harsh conditions and streamlining supply chain management. Desktop and POS printers remain widely adopted by small businesses and front-office applications due to their cost-effectiveness and compact design, which allow essential labeling capabilities without significant space or capital investment. Meanwhile, mobile/portable printers are gaining rapid traction in field service, logistics, and healthcare sectors because of their portability and real-time on-site printing capabilities, enhancing operational flexibility and workforce efficiency.

Printing Technology Insights

Thermal transfer printers lead the market with an estimated 38% share in 2024. The key driver for thermal transfer technology is its ability to produce durable, high-resolution labels that withstand extreme environmental conditions, making it indispensable in manufacturing, logistics, healthcare, and food processing applications. Direct thermal printers, on the other hand, are favored for simplified operation and lower operational costs, eliminating the need for ribbons or ink and proving ideal for short-term labeling tasks such as receipts, shipping labels, and temporary asset tagging. Inkjet and laser barcode printing technologies are niche segments, adopted in specialized environments requiring high precision or unique label formats.

End-Use Insights

Manufacturing remains the largest end-user segment (33.5% market share in 2024), driven by the need for asset tracking, in-line labeling, and automated identification to support Industry 4.0 initiatives. Retail & e-commerce and logistics & warehousing are the fastest-growing segments, fueled by global expansion of online shopping, fulfillment centers, and omnichannel retail strategies. Healthcare and pharmaceuticals are emerging as significant markets due to serialization and regulatory compliance requirements, increasing adoption of advanced barcode printers to ensure traceability, patient safety, and accurate inventory management. Drivers for these industries include automation integration, error reduction, and efficiency improvements in supply chain operations.

| By Product Type | By Printing Technology | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for approximately 30% of global demand in 2024. The market is primarily driven by robust technological infrastructure, early adoption of automation, and advanced logistics and manufacturing frameworks. The U.S. leads regional demand, supported by strong e-commerce growth, healthcare compliance requirements, and widespread integration of mobile and industrial barcode printers into smart supply chain systems. Technological advancements, such as IoT-enabled and cloud-connected printers, further reinforce market growth by enabling real-time data tracking and operational efficiency across manufacturing and distribution networks.

Europe

Europe demonstrates strong barcode printer adoption, particularly in Germany, the U.K., and France. Growth is fueled by industrial automation, regulatory compliance, and modern retail solutions requiring robust labeling capabilities. Western Europe dominates demand due to its mature industrial base and high automation adoption, while Eastern Europe is rapidly emerging as a growth market with increasing manufacturing and logistics modernization. Drivers include rising investment in smart factory initiatives, regulatory mandates for traceability, and digital transformation in retail operations.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Southeast Asia, with India experiencing a 13% CAGR in barcode printer demand from 2024 to 2030. Regional growth is propelled by rapid industrialization, expansion of retail and e-commerce sectors, and government initiatives promoting digital supply chains and smart manufacturing. Key drivers include high adoption of automated labeling systems, cost-efficient printing solutions for emerging businesses, and modernization of logistics and warehouse operations to meet global standards.

Latin America

Brazil, Mexico, and Argentina are key markets in Latin America. While growth remains moderate compared to APAC, modernization of manufacturing and logistics sectors, combined with rising e-commerce adoption, is accelerating demand for barcode printers. Drivers include increasing retail automation, government incentives for industrial digitization, and the rising need for efficient product labeling to support growing consumer markets.

Middle East & Africa

MEA shows emerging demand, with the Gulf countries, particularly the UAE and Saudi Arabia, driving growth through investments in logistics, industrial, and food & beverage sectors. Africa continues to serve as a production and usage hub for industrial printers, particularly in manufacturing and distribution centers. Regional growth is supported by government-led infrastructure projects, modernization of warehouse and retail operations, and increasing adoption of automated labeling technologies to streamline supply chains and ensure compliance with industry standards.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Barcode Printer Market

- Zebra Technologies Corporation

- Honeywell International Inc.

- Canon Inc.

- Toshiba Tec Corporation

- SATO Holdings Corporation

- Avery Dennison Corporation

- Oki Electric Industry Co., Ltd

- Dascom Holdings Ltd

- Printronix

- TSC Auto ID Technology Co., Ltd

- Brother Industries Ltd

- Citizen Systems Europe GmbH

- Godex International Co., Ltd

- Bixolon Co., Ltd

- Apogee Industries Inc.

Recent Developments

- In 2025, Zebra Technologies launched a new series of mobile printers with IoT-enabled cloud connectivity for real-time inventory tracking in warehouses and retail operations.

- In 2025, Honeywell International expanded its industrial printer portfolio in APAC, targeting manufacturing and logistics sectors with rugged and high-speed labeling solutions.

- In 2025, Canon Inc. introduced next-generation thermal transfer printers capable of multi-substrate printing for pharmaceutical serialization and food packaging applications.