Bamboo Toothbrush Market Size

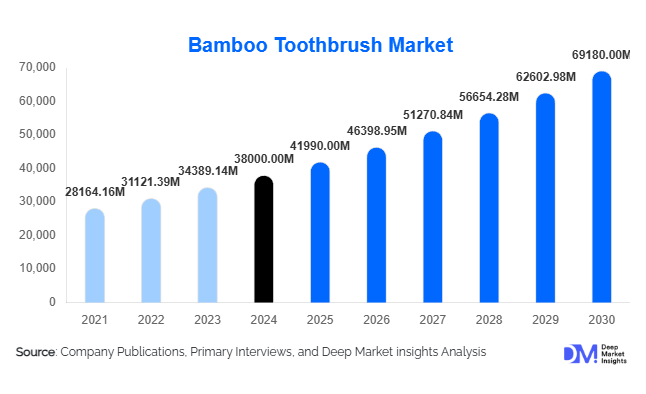

According to Deep Market Insights, the global bamboo toothbrush market size was valued at USD 38,000.00 million in 2024 and is projected to grow from USD 41,990.00 million in 2025 to reach USD 69,180.00 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The bamboo toothbrush market growth is primarily driven by increasing environmental awareness, regulatory bans on single-use plastics, and the rising adoption of sustainable oral care products among health-conscious consumers.

Key Market Insights

- Growing demand for eco-friendly oral care products is propelling the transition from plastic to bamboo toothbrushes across both developed and emerging economies.

- Manual bamboo toothbrushes dominate the global market with around 70% share in 2024, supported by affordability and wide retail penetration.

- North America leads the global market with approximately 40% market share in 2024, followed closely by Europe with 28%.

- Asia-Pacific is the fastest-growing region, supported by large-scale bamboo cultivation, cost-effective production, and strong export potential.

- Technological advancements in biodegradable bristles and compostable packaging are expanding the market’s long-term growth prospects.

- Direct-to-consumer (D2C) and subscription models are revolutionizing distribution, offering convenience and eco-conscious branding.

Latest Market Trends

Rising Consumer Shift Toward Sustainable Oral Care

Global consumers are increasingly prioritizing sustainability in their daily hygiene routines. Bamboo toothbrushes, made from renewable and biodegradable bamboo, are gaining traction as replacements for plastic alternatives. Brands are promoting these products as part of zero-waste lifestyle movements, using minimal packaging and carbon-neutral shipping. Retailers, pharmacies, and supermarkets now dedicate shelf space to eco-friendly oral care products, reflecting their transition from niche to mainstream consumption. This shift aligns with broader sustainability trends influencing the personal care and wellness sectors globally.

Emergence of Subscription-Based and Online Retail Models

Digitalization is transforming how consumers purchase oral care products. Subscription-based bamboo toothbrush delivery models are becoming increasingly popular, ensuring timely replacement every few months and reducing consumer effort. Online channels and D2C websites enable small and mid-sized eco-brands to scale globally without traditional retail dependencies. Influencer marketing and social media campaigns are also amplifying brand visibility among eco-conscious and younger consumers, driving awareness and loyalty in this competitive market.

Bamboo Toothbrush Market Drivers

Increasing Awareness of Plastic Pollution

The global movement against plastic waste is a key driver of the bamboo toothbrush market. Consumers and policymakers alike recognize the harmful environmental impact of traditional plastic toothbrushes, which take over 400 years to decompose. Bamboo, a fast-growing, renewable resource, offers a biodegradable alternative. As more consumers embrace sustainable lifestyles, demand for bamboo toothbrushes continues to surge, especially in markets with high environmental literacy and regulatory restrictions on single-use plastics.

Supportive Government Regulations and Green Policies

Governments across North America, Europe, and the Asia-Pacific are actively implementing bans and restrictions on non-recyclable plastics, thereby accelerating demand for biodegradable alternatives. Programs like the EU Single-Use Plastics Directive, India’s “Make in India,” and China’s “Made in China 2025” are promoting domestic production and consumption of eco-friendly products. These initiatives are fostering an environment conducive to bamboo toothbrush manufacturing, export, and sustainable supply-chain expansion.

Growing Adoption in Hospitality and Institutional Channels

Hotels, airlines, and corporate organizations are increasingly integrating bamboo toothbrushes into their sustainability initiatives. Hospitality chains are replacing plastic amenities with eco-certified bamboo alternatives to enhance brand image and meet corporate social responsibility goals. This institutional demand represents a steady, high-volume channel for manufacturers and significantly contributes to overall market expansion.

Market Restraints

Higher Production and Retail Costs

Despite growing popularity, bamboo toothbrushes remain more expensive than plastic variants due to higher costs of raw materials, manufacturing, and sustainable packaging. This cost disparity restricts mass-market adoption, particularly in price-sensitive regions. Achieving economies of scale, optimizing production processes, and establishing local supply chains are crucial to reducing costs and broadening consumer reach.

Incomplete Compostability Due to Nylon Bristles

While bamboo handles are biodegradable, most toothbrushes still feature nylon bristles for performance and durability, limiting full compostability. This issue creates skepticism among environmentally conscious buyers. However, R&D in bio-nylon and bamboo fiber bristles is progressing rapidly, and manufacturers are expected to achieve fully biodegradable products in the near future.

Bamboo Toothbrush Market Opportunities

Government-Led Plastic Ban Initiatives

Stringent global regulations against plastic waste are creating significant opportunities for bamboo toothbrush manufacturers. Countries implementing single-use plastic bans, such as Canada, Germany, and India, are accelerating the adoption of eco-friendly alternatives. Companies that align their production processes with global sustainability standards and certifications can gain a competitive advantage in public procurement and institutional contracts.

Premiumization and Product Innovation

The rise of premium bamboo toothbrushes, featuring ergonomic designs, charcoal-infused bristles, and compostable packaging, represents a major market opportunity. Consumers are increasingly willing to pay higher prices for superior quality and aesthetic design. Manufacturers investing in R&D to develop 100% biodegradable and high-performance products are likely to capture this growing segment.

Emerging Market Expansion and Export Potential

Asia-Pacific countries, particularly China, India, and Vietnam, are becoming global manufacturing hubs due to abundant bamboo resources and low production costs. As Western markets increasingly demand sustainable alternatives, exports from Asia are expected to grow significantly. Government incentives for green manufacturing and expanding e-commerce trade networks further strengthen export potential.

Product Type Insights

Manual bamboo toothbrushes accounted for approximately 70% of global market revenue in 2024. Their widespread availability, affordability, and familiarity among consumers make them the preferred choice. Electric bamboo toothbrushes, though niche, are gaining traction among tech-savvy consumers in premium markets, supported by innovations in replaceable bamboo brush heads and rechargeable handles.

Bristle Type Insights

Soft bristles dominated the market in 2024 with around 60% share, driven by consumer preference for comfort and oral hygiene. Bio-based nylon and charcoal-infused bristles are increasingly adopted to combine performance with sustainability. This trend highlights the balance between user experience and environmental responsibility in product development.

Distribution Channel Insights

Offline retail channels held nearly 60% of the market in 2024, led by supermarkets, pharmacies, and eco-stores. However, online and subscription-based sales are rapidly expanding, driven by digital-first brands leveraging sustainability storytelling and direct-to-consumer engagement models. The e-commerce boom is expected to make online sales the dominant channel by 2030.

End-Use Insights

The adult segment accounted for nearly 78% of the global bamboo toothbrush market in 2024, reflecting strong adoption among environmentally conscious consumers. The children’s segment is expanding quickly as parents seek safer, BPA-free, and chemical-free products for young users. Institutional demand, especially from hospitality, airlines, and healthcare, continues to rise, providing new long-term growth avenues for manufacturers.

| By Bristle Type | By End User | By Distribution Channel | By Handle Type | By Packaging Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America led the bamboo toothbrush market with approximately 40% share in 2024, driven by heightened environmental awareness and advanced retail infrastructure. The United States dominates regional demand, with strong consumer inclination toward sustainable brands and digital-first purchasing behavior. Corporate sustainability initiatives and partnerships with eco-friendly personal care brands are further supporting market growth.

Europe

Europe accounted for about 28% of the global market in 2024, with Germany, the U.K., and France leading demand. Strict EU regulations on single-use plastics and widespread consumer adoption of eco-labeled products have made Europe a mature market for bamboo toothbrushes. The growing retail availability of private-label eco-brands is also boosting market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing approximately 20% of the market in 2024 and projected to grow at over 11% CAGR through 2030. China and India are major manufacturing hubs with vast bamboo resources and increasing domestic consumption. Supportive policies, rising disposable income, and export-oriented production are fueling regional growth.

Latin America

Latin America, led by Brazil and Mexico, accounted for nearly 7% of the market in 2024. The region’s growing middle class and increasing preference for sustainable personal care products are key growth factors. Expansion of online retail platforms and eco-conscious consumer communities is supporting product penetration.

Middle East & Africa

The Middle East & Africa region contributed around 5% of the global market in 2024. Growth is led by high-income countries such as the UAE and Saudi Arabia, where luxury hotels and eco-friendly initiatives are adopting bamboo toothbrushes. In Africa, South Africa shows promising retail demand driven by sustainable living movements and health awareness campaigns.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bamboo Toothbrush Market

- Colgate-Palmolive Company

- The Humble Co.

- Brush with Bamboo

- Bamboo Brush Co.

- The Environmental Toothbrush

- Bamboo India

- Bam&Boo

- BlueRock Products Ltd.

- Mother’s Vault

- Anything But Plastic

- Simply Bamboo

- The Bamboo Brush Society

- Nature & My Limited

- Organic Labs

- The Green Root

Recent Developments

- In March 2025, Colgate-Palmolive expanded its “Smile for Good” bamboo toothbrush line across Europe, using biodegradable packaging and FSC-certified handles.

- In January 2025, The Humble Co. launched a plant-based bristle technology targeting 100% compostability by 2026.

- In October 2024, Bamboo India announced a production expansion under the “Make in India” initiative to meet growing domestic and export demand.