Bamboo Siding Market Size

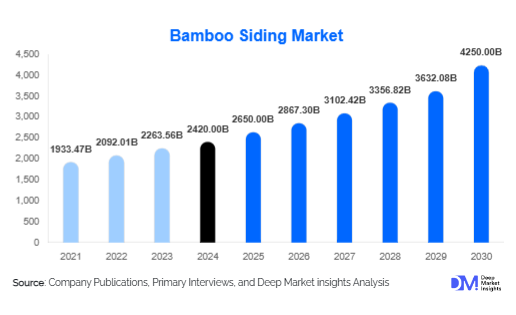

According to Deep Market Insights, the global bamboo siding market size was valued at USD 2,420 million in 2024 and is projected to grow from USD 2,650 million in 2025 to reach USD 4,250 million by 2030, expanding at a CAGR of 8.2% during the forecast period (2025-2030). The bamboo siding market growth is primarily driven by the rising adoption of sustainable construction materials, government emphasis on eco-friendly infrastructure, and the increasing consumer preference for aesthetically appealing yet durable siding alternatives.

Key Market Insights

- Bamboo siding is gaining momentum as a sustainable alternative to hardwood and vinyl cladding, driven by the global shift toward green building certifications such as LEED and BREEAM.

- Asia-Pacific dominates the bamboo siding industry, with China and India being the largest producers and consumers due to abundant bamboo resources and government-backed eco-construction initiatives.

- North America remains the fastest-growing market, driven by rising demand for eco-conscious residential construction and a growing renovation market.

- Technological innovations in engineered bamboo siding (laminated, strand-woven, and composite panels) are expanding applications in commercial and institutional projects.

- Residential end-use leads global demand, accounting for more than 55% of market share in 2024, fueled by homeowners seeking affordable and stylish exteriors.

- Export-driven demand is surging, with China, Vietnam, and Indonesia emerging as leading exporters of bamboo siding to Europe and North America.

What are the latest trends in the bamboo siding market?

Eco-Certification Driving Adoption

Governments and developers are increasingly prioritizing eco-certified construction materials. Bamboo siding, being renewable and rapidly regenerative, is benefiting from initiatives like “green building credits” in developed economies. Builders adopting bamboo siding receive points toward certifications such as LEED, WELL, and EDGE. This has positioned bamboo siding as a premium, environmentally responsible material of choice for modern construction projects.

Engineered Bamboo Products Expanding Market Reach

Engineered bamboo siding products, such as strand-woven and laminated panels, are gaining traction due to their superior strength, termite resistance, and uniform finish. These innovations address traditional concerns about bamboo durability and expand usage beyond residential homes into commercial and institutional spaces. Manufacturers are investing in heat-treated and resin-bonded bamboo solutions to enhance weather resistance, broadening the material’s applicability in colder and wetter climates.

Digital Distribution Channels Gaining Traction

E-commerce and direct-to-consumer platforms are transforming bamboo siding distribution. Leading manufacturers are listing engineered bamboo panels on global platforms and collaborating with specialized construction retailers online. This trend is enabling small contractors and DIY homeowners to access bamboo siding easily, expanding the customer base beyond traditional offline sales channels.

What are the key drivers in the bamboo siding market?

Growing Demand for Sustainable Building Materials

Global awareness about climate change and the construction sector’s carbon footprint is accelerating bamboo siding adoption. As bamboo absorbs CO₂ at a higher rate compared to timber and regrows rapidly, it is increasingly being promoted as a sustainable alternative to hardwood siding. Rising urbanization and the green housing movement are major contributors to this demand surge.

Cost Competitiveness Compared to Hardwood

Bamboo siding offers a price advantage over traditional hardwood products, making it attractive for both residential and commercial users. Bamboo’s rapid harvest cycle of 3-5 years, compared to 20-50 years for hardwoods, ensures steady supply and price stability. This makes bamboo siding a practical choice in cost-sensitive markets across Asia-Pacific and Latin America.

Supportive Government Regulations and Incentives

Policies promoting eco-friendly construction are accelerating bamboo siding adoption. For instance, tax rebates, subsidies for green buildings, and restrictions on illegal logging in Asia and Europe have indirectly fueled bamboo-based product demand. China’s “Green Building Action Plan” and India’s “Eco-Niwas Samhita” have particularly boosted bamboo siding applications in residential and public projects.

What are the restraints for the global market?

Durability Concerns and Moisture Sensitivity

Despite advancements, bamboo siding faces skepticism regarding long-term durability, especially in regions with high humidity and rainfall. Without proper treatment, bamboo is prone to swelling, cracking, and insect infestation. This restrains widespread adoption in cold and damp regions where consumers prefer composite or fiber cement siding.

Fragmented Supply Chain

The global bamboo siding market suffers from an unstructured supply chain. While Asia-Pacific dominates production, quality inconsistencies and a lack of global standardization hinder exports. Smaller players struggle to meet international certifications, leading to higher dependency on large-scale producers and limiting scalability for smaller entrants.

What are the key opportunities in the bamboo siding industry?

Integration with Smart & Modular Construction

Modular housing and prefabricated buildings are rapidly gaining traction, particularly in urban and disaster-relief contexts. Bamboo siding’s lightweight yet durable nature makes it an ideal material for prefab applications. Companies integrating smart housing technologies with bamboo-based exterior solutions can unlock significant demand, particularly in fast-developing Asian and African regions.

Export Potential to Europe and North America

Europe’s push toward “carbon-neutral construction” by 2030 and North America’s eco-friendly housing boom present lucrative opportunities for bamboo siding exporters. Bamboo-rich countries like China, Vietnam, and Indonesia can strengthen trade ties by offering competitively priced, certified siding panels. Establishing robust export networks and meeting EU/US quality standards will be critical in leveraging this growth opportunity.

Technological Innovation in Composite Bamboo

Innovations in composite bamboo, where fibers are reinforced with resins and polymers, are creating siding solutions that outperform traditional wood and vinyl. Fire-retardant, waterproof, and termite-resistant composite bamboo siding products are expected to attract commercial builders who prioritize long-term durability. This segment could become the fastest-growing within the overall bamboo siding market.

Product Type Insights

Strand-woven bamboo siding is the leading product type globally, accounting for 35% of the 2024 market share. Its superior strength, moisture resistance, and aesthetic versatility make it highly preferred for both residential and commercial construction. Horizontal bamboo siding is popular in North America for modern architectural styles, while vertical siding dominates APAC residential markets. Carbonized finishes are trending due to their durability and dark aesthetic appeal, appealing to high-end residential and luxury hospitality projects.

Application Insights

Residential applications dominate the bamboo siding market, accounting for 45% of 2024 demand. Single-family homes and multi-family apartments are the largest contributors, driven by eco-conscious homeowners and renovation projects. Commercial applications, including hotels, offices, and retail outlets, represent 30% of the market, benefiting from premium finishes and durability. Institutional projects, such as schools and hospitals, are growing steadily due to increasing awareness of sustainable building materials. Public infrastructure projects offer emerging opportunities, particularly in the Asia-Pacific region, where government spending on parks, pavilions, and community spaces is rising.

Distribution Channel Insights

Direct sales from manufacturers account for 40% of global demand, particularly in large-scale construction projects. Retail and offline distribution, including home improvement stores and specialty outlets, represent 35%, catering to smaller residential and commercial projects. Online platforms and e-commerce channels are growing rapidly, offering ease of comparison, transparent pricing, and direct delivery, particularly in developed regions like North America and Europe. Subscription-based and B2B e-commerce models are emerging as new distribution avenues.

| By Product Type | By Treatment/Finish | By End-Use Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global bamboo siding market with 40% of the 2024 market share. China and India are key contributors, driven by urbanization, government initiatives promoting green construction, and growing demand for durable, aesthetic siding options. Southeast Asian countries are emerging as growth hubs due to rising residential and commercial development. Fastest-growing countries include India and Vietnam, projected to expand at over 10% CAGR during 2025-2030.

North America

North America accounts for 25% of the 2024 market share, with the U.S. leading due to high adoption of sustainable building practices, luxury renovations, and government incentives for green materials. Canada is also witnessing steady growth, particularly in residential applications. The region benefits from high awareness, advanced manufacturing techniques, and premium pricing acceptance, supporting long-term market expansion.

Europe

Europe is growing steadily, led by Germany, the U.K., and France, driven by sustainability mandates, eco-conscious architects, and renovation projects in urban centers. Adoption of engineered bamboo siding for commercial and luxury residential buildings is increasing. Scandinavian countries are exploring modular and prefinished products for rapid deployment in residential construction.

Latin America

Brazil, Argentina, and Mexico are the primary markets in LATAM. Growth is emerging as affluent homeowners and premium resorts increasingly prefer bamboo siding for aesthetic and eco-friendly benefits. Adoption is slower than APAC due to cost sensitivity and limited awareness.

Middle East & Africa

South Africa and the UAE are key markets, focusing on luxury residential and hospitality projects. Urban developments in the UAE and Saudi Arabia are driving moderate growth, supported by high-income buyers and green building initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gym Software Market

- Teragren

- Moso International

- Bambeco

- Smith & Fong Co.

- EcoTimber

- Goodwood Bamboo

- BM Innovation

- Bamboo Living

- Carlsbad Bamboo

- Global Bamboo Resources

- Yongkang Bamboo Products

- Jiangsu Bamboo Corp.

- Zhejiang Bamboo Co.

- Greenply Industries

- BamWood

Recent Developments

- In March 2025, Teragren launched a new strand-woven bamboo siding line with enhanced moisture resistance for coastal applications.

- In February 2025, Moso International opened a new automated bamboo panel production facility in Vietnam to cater to APAC demand.

- In January 2025, Bambeco introduced modular prefinished bamboo siding systems for North American residential construction.