Bamboo Flooring Market Size

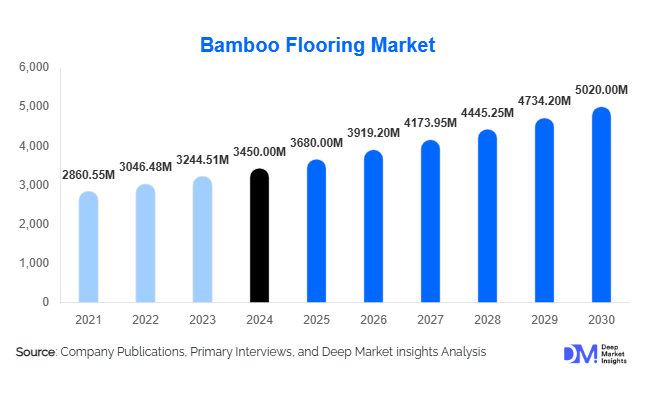

According to Deep Market Insights, the global bamboo flooring market size was valued at USD 3,450 million in 2024 and is projected to grow from USD 3,680 million in 2025 to reach USD 5,020 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The bamboo flooring market growth is primarily driven by rising demand for sustainable and eco-friendly building materials, increasing urban residential and commercial renovations, and growing adoption of strand woven bamboo for its durability and premium appeal.

Key Market Insights

- Sustainability and eco-conscious construction are driving demand, as builders and consumers increasingly prefer renewable, low-impact flooring materials.

- Strand-woven bamboo dominates globally, offering high durability and a premium aesthetic, particularly for high-traffic residential and commercial applications.

- Asia-Pacific remains the leading production hub, with China and India contributing the majority of global exports.

- North America and Europe lead consumption, driven by urban housing growth, renovation projects, and green building regulations.

- Technological advancements such as waterproof coatings, scratch resistance, and automated production are enhancing product appeal and market penetration.

- Online distribution channels are expanding, allowing manufacturers to reach global customers directly, complementing traditional offline retail presence.

Latest Market Trends

Premium and Durable Flooring Adoption

Strand-woven bamboo and natural bamboo products are gaining traction due to their superior strength and aesthetic appeal. Consumers increasingly prefer these materials for both residential and commercial spaces, as they offer longer lifespans compared to traditional hardwood or laminate flooring. Renovation and remodeling trends, particularly in North America and Europe, are reinforcing the shift toward premium bamboo products, while carbonized bamboo is increasingly used for darker, decorative finishes.

Technological Integration Enhancing Product Performance

Advancements such as moisture-resistant coatings, UV-stabilized finishes, and automated production lines are improving both durability and visual appeal. Emerging technologies also include environmentally friendly adhesives, bamboo strand treatments, and precision-engineered planks for easy installation. These innovations are supporting the growth of mid-to-high-end segments and enabling manufacturers to compete with conventional hardwood alternatives.

Bamboo Flooring Market Drivers

Rising Demand for Sustainable Building Materials

Growing environmental awareness and the adoption of green construction practices are fueling bamboo flooring demand. With bamboo being a rapidly renewable resource, it aligns with LEED certifications and eco-conscious consumer preferences. Residential developers, commercial property owners, and hospitality chains increasingly prioritize bamboo to reduce carbon footprints and meet sustainability goals.

Urban Renovations and Residential Growth

Increasing urban housing projects and home renovation initiatives, especially in North America, Europe, and parts of APAC, are driving new installations of bamboo flooring. Its aesthetic appeal, durability, and eco-friendly credentials make it a preferred choice for both modern apartments and premium villas.

Export and Production Advantages from APAC

China and India dominate bamboo production, providing cost-effective exports to North America, Europe, and emerging markets. Strong supply chains, combined with government initiatives supporting bamboo cultivation and processing, have enabled these countries to meet global demand efficiently.

Market Restraints

Price Sensitivity

Bamboo flooring, especially premium strand-woven variants, remains costlier than traditional hardwood or laminate flooring. This price differential can limit adoption in price-sensitive regions and among mid-segment residential buyers.

Durability and Moisture Concerns

While strand-woven bamboo is highly durable, other bamboo types may be prone to moisture damage, warping, or scratches in high-humidity environments. This limits their application in certain industrial or tropical regions, creating adoption challenges for manufacturers.

Bamboo Flooring Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in countries such as India, Brazil, and Southeast Asia are driving residential and commercial demand. Manufacturers can capture these markets with cost-effective, durable, and visually appealing bamboo flooring solutions, positioning themselves for long-term growth.

Technological Advancements and Product Innovation

Investments in waterproofing, scratch-resistant coatings, automated production, and smart flooring solutions (IoT integration) offer significant differentiation. Companies adopting these innovations can appeal to premium consumers while increasing global competitiveness.

Product Type Insights

Strand woven bamboo dominates globally, accounting for 55% of the market in 2024. Its superior strength, suitability for high-traffic areas, and premium appearance make it the preferred choice for both residential and commercial applications. Horizontal and vertical bamboo types remain niche but are gaining popularity for aesthetic and decorative applications.

Material Insights

Natural bamboo leads with a 60% market share in 2024 due to its eco-friendly properties and authentic wood-like appearance. Carbonized bamboo is used mainly in decorative applications, offering darker finishes but slightly lower durability.

Application Insights

Residential applications dominate, representing 50% of the market. Commercial use, including offices, hotels, and retail spaces, is growing steadily at a CAGR of 7.2%, supported by the need for durable and sustainable flooring. Industrial and public spaces, including hospitals and airports, are emerging niches benefiting from high-durability strand woven flooring.

Distribution Channel Insights

Offline retail accounts for 65% of global sales in 2024, as consumers prefer inspecting quality and grain patterns. Online channels are growing rapidly, offering convenience, direct manufacturer sales, and wider geographic reach.

| By Product Type | By Construction Type | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 30% of the global market in 2024, led by the U.S. (25%) and Canada (5%). Growth is driven by urban housing renovations, eco-conscious consumer behavior, and strong green building adoption. Strand-woven bamboo is particularly popular in residential and commercial renovations.

Europe

Europe accounts for 20% of the market, with Germany (10%) and the U.K. (8%) leading demand. Premium residential projects and sustainable commercial developments support market growth. Younger demographics in Western Europe are increasingly adopting eco-friendly flooring options.

Asia-Pacific

APAC is the largest production hub and export center, with China and India dominating supply. APAC holds approximately 35% of the global market share in 2024. India is the fastest-growing market (7% CAGR) due to rising residential and commercial construction and government initiatives supporting bamboo cultivation.

Latin America

Latin America represents 5% of the global market, with Brazil and Argentina driving adoption. Urban housing projects and growing awareness of eco-friendly materials support moderate growth (5.5% CAGR).

Middle East & Africa

MEA holds 3% of global demand. UAE and South Africa lead adoption in luxury and commercial projects, supported by high-income populations and government-backed sustainable building policies. Intra-African demand is also emerging for urban infrastructure projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bamboo Flooring Market

- Cali Bamboo

- Teragren

- Smith & Fong Co.

- Plyboo

- Moso International

- Bamboo Hardwoods

- EcoFusion

- Ambient Bamboo Floors

- Bamboo Flooring Solutions

- Greenply Industries

- Timberland Bamboo

- Kährs Group

- Floor & Décor

- Gascogne Flooring

- Armstead Timber

Recent Developments

- In March 2025, Cali Bamboo expanded its North American distribution network, introducing new waterproof and scratch-resistant bamboo flooring lines.

- In February 2025, Teragren launched a carbon-neutral, strand-woven bamboo product line targeting premium residential and commercial projects in Europe and the U.S.

- In January 2025, Moso International partnered with Indian manufacturers to enhance export capacity and integrate advanced moisture-resistant technologies for global markets.