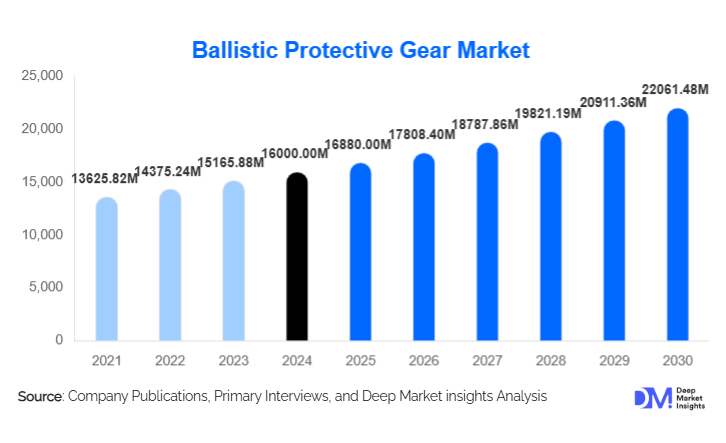

Ballistic Protective Gear Market Size

According to Deep Market Insights, the global ballistic protective gear market size was valued at USD 16,000.00 million in 2024 and is projected to grow from USD 16,880.00 million in 2025 to reach USD 22,061.48 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The ballistic protective gear market growth is primarily driven by rising global defense and internal security spending, increasing geopolitical tensions, modernization of soldier systems, and growing adoption of lightweight, high-performance armor solutions across military and law enforcement agencies.

Key Market Insights

- Military and defense applications dominate demand, accounting for more than half of global ballistic protective gear consumption due to ongoing infantry modernization programs.

- Lightweight composite and UHMWPE-based armor systems are rapidly replacing traditional steel armor, improving mobility and endurance.

- North America leads the global market, supported by sustained U.S. defense budgets and domestic manufacturing capabilities.

- Asia-Pacific is the fastest-growing region, driven by large-scale procurement programs in China, India, and South Korea.

- Law enforcement and internal security segments are growing faster than military demand due to urban security threats and civil unrest.

- Compliance with NIJ and NATO standards remains a critical differentiator for global manufacturers.

What are the latest trends in the ballistic protective gear market?

Shift Toward Lightweight and Modular Armor Systems

The ballistic protective gear market is witnessing a strong shift toward lightweight and modular armor designs. Modern body armor systems are increasingly engineered using UHMWPE, advanced ceramics, and hybrid composites that significantly reduce weight while maintaining or improving ballistic performance. Modular vests and plate carriers allow users to adjust protection levels based on threat environments, enhancing operational flexibility. This trend is particularly prominent among NATO forces and urban law enforcement units, where mobility and comfort are mission-critical.

Integration of Smart and Multi-Threat Protection Technologies

Manufacturers are increasingly integrating smart technologies into ballistic protective gear, including impact sensors, health monitoring systems, and compatibility with soldier communication platforms. Multi-threat protection, combining ballistic, stab, fragmentation, and blast resistance in a single system, is becoming a standard requirement in new procurement contracts. These innovations are reshaping procurement criteria and allowing suppliers to command premium pricing.

What are the key drivers in the ballistic protective gear market?

Rising Global Defense and Security Spending

Escalating geopolitical tensions, border conflicts, and asymmetric warfare have led governments worldwide to prioritize soldier survivability. Defense budgets increasingly allocate funds for personal protection systems, including helmets, body armor, and ballistic shields. Large-scale modernization programs in the U.S., Europe, and Asia-Pacific are a primary growth driver.

Urban Warfare and Internal Security Threats

The growing prevalence of urban combat, terrorism, and civil unrest has significantly increased demand for ballistic protective gear among law enforcement and homeland security agencies. Police forces are upgrading legacy armor to lightweight, concealable systems suitable for extended wear during patrol and riot control operations.

What are the restraints for the global market?

High Cost and Long Procurement Cycles

Advanced ballistic protective gear, particularly ceramic and hybrid systems, involves high production and certification costs. Government procurement processes are lengthy, often delaying revenue realization and increasing working capital requirements for manufacturers.

Raw Material Price Volatility

Fluctuations in the prices of aramid fibers, ceramics, and UHMWPE significantly impact manufacturing costs. Raw materials account for up to 45% of total production costs, creating margin pressure in the absence of long-term supply contracts.

What are the key opportunities in the ballistic protective gear industry?

Soldier Modernization and Localization Programs

National initiatives such as “Make in India,” U.S. defense industrial base funding, and European rearmament programs are creating long-term opportunities for manufacturers willing to localize production and transfer technology. These programs often span multiple years and ensure stable demand.

Expansion of Civilian and Private Security Markets

Rising demand from private security firms, journalists, infrastructure protection agencies, and licensed civilians is opening new high-margin market segments. Lightweight and concealable armor designed for non-military users is expected to expand rapidly, particularly in North America and Latin America.

Product Type Insights

Ballistic body armor dominates the market, accounting for approximately 42% of global revenue in 2024, driven by mandatory issuance to military and police forces. Ballistic helmets represent a significant and growing segment due to head injury mitigation requirements in modern combat. Ballistic plates and shields are witnessing steady growth, particularly among special forces and tactical law enforcement units.

Material Type Insights

UHMWPE-based armor systems lead the market with nearly 34% share, owing to their superior strength-to-weight ratio and corrosion resistance. Ceramic composites are widely used in hard armor applications, while aramid fibers remain relevant in soft armor due to cost efficiency and proven performance. Hybrid composites combining multiple materials are gaining traction for multi-threat protection.

End-Use Insights

The defense and military segment accounts for approximately 55% of global demand, supported by large-scale infantry modernization programs. Law enforcement and internal security represent the fastest-growing end-use segment, expanding at over 9% CAGR. Private security and civilian applications are emerging as high-margin niches with shorter procurement cycles.

Distribution Channel Insights

Direct government contracts dominate distribution, contributing over 60% of market revenue. Defense OEMs and system integrators play a critical role in bundled procurement programs, while commercial distributors and e-commerce channels serve civilian-legal markets. Localization requirements increasingly favor suppliers with domestic manufacturing presence.

| By Product Type | By Material Type | By Protection Level | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global ballistic protective gear market, led by the United States. Continuous defense spending, advanced R&D capabilities, and replacement demand underpin regional dominance.

Europe

Europe holds around 24% market share, driven by NATO commitments and increased defense budgets in countries such as the U.K., Germany, France, and Poland. Eastern Europe is a key growth sub-region due to heightened security concerns.

Asia-Pacific

Asia-Pacific represents about 22% of the market and is the fastest-growing region, with demand driven by China, India, South Korea, and Australia. Border tensions and modernization programs are key growth drivers.

Latin America

Latin America accounts for roughly 6% of global demand, supported by law enforcement modernization and private security growth in Brazil, Mexico, and Colombia.

Middle East & Africa

The Middle East & Africa region contributes approximately 10% of global demand, with strong procurement from Saudi Arabia, Israel, and the UAE due to ongoing security challenges.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Ballistic Protective Gear Industry

- Honeywell International

- DuPont

- Avon Protection

- Point Blank Enterprises

- Safariland Group

- Rheinmetall Defence

- BAE Systems

- ArmorSource

- MKU Limited

- CoorsTek Defense

- Elbit Systems

- Gentex Corporation

- Survitec Group

- NP Aerospace

- Revision Military