Baby Teething Wipes Market Size

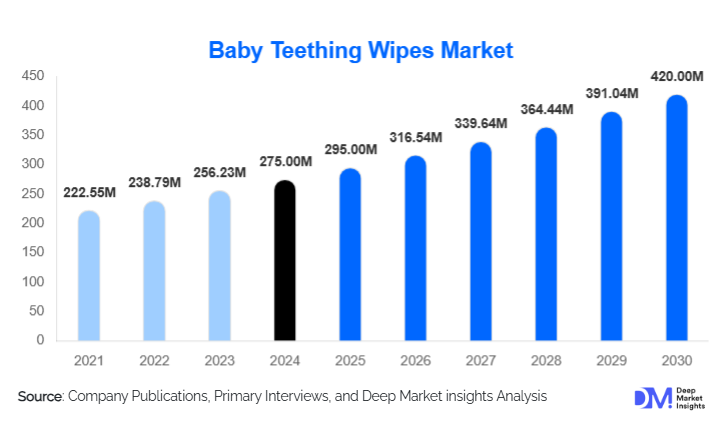

According to Deep Market Insights, the global baby teething wipes market size was valued at USD 275 million in 2024 and is projected to grow from USD 295 million in 2025 to reach USD 420 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The market growth is driven by rising awareness of infant oral hygiene, increasing demand for natural and organic formulations, and the rapid expansion of online retail channels catering to baby care products worldwide.

Key Market Insights

- Rising parental focus on oral hygiene and safety has made baby teething wipes a preferred alternative to traditional oral care methods for infants.

- Organic and herbal formulations dominate new product launches, as consumers increasingly demand alcohol-free, chemical-free wipes with natural ingredients such as aloe vera and chamomile.

- North America leads the global market, driven by high consumer awareness and premium baby care brands.

- Asia-Pacific is the fastest-growing region, supported by expanding middle-class populations, urbanization, and e-commerce penetration.

- Innovation in biodegradable and sustainable packaging is transforming the competitive landscape, aligning with global eco-friendly consumer trends.

- Online retail channels now account for nearly half of total sales, with subscription-based delivery models gaining strong traction post-pandemic.

Latest Market Trends

Shift Toward Natural and Organic Formulations

Manufacturers are increasingly developing baby teething wipes using plant-based, hypoallergenic, and toxin-free ingredients. Parents are seeking safe oral care solutions for infants, preferring wipes infused with natural extracts such as xylitol, chamomile, and aloe vera. This trend has resulted in premiumization, with organic variants commanding price premiums of up to 25% over conventional wipes. Companies are obtaining organic certifications and marketing these products as dermatologist-tested and pediatrician-approved, helping build strong brand loyalty among conscious consumers.

Eco-Friendly Packaging and Biodegradable Materials

The market is witnessing a rapid transition toward eco-friendly, biodegradable, and recyclable packaging. Manufacturers are introducing resealable pouches and refillable containers designed to reduce plastic use and improve product shelf life. Leading players are also leveraging QR-code-enabled packaging for authenticity verification and consumer engagement. The convergence of sustainability and convenience is emerging as a defining factor in purchasing decisions, especially in developed markets such as the U.S., U.K., and Germany.

Baby Teething Wipes Market Drivers

Increasing Awareness of Infant Oral Hygiene

Growing parental understanding of early oral hygiene in long-term dental health is a primary driver of market growth. Teething wipes help remove sugar residues and bacteria, preventing oral infections and ensuring gum comfort during teething. Awareness campaigns by pediatric associations and healthcare providers have amplified this trend globally, particularly in urban areas with higher education and disposable income levels.

Rising E-commerce Penetration and D2C Brands

The surge in online retail has opened new avenues for both established brands and emerging startups. E-commerce now accounts for over 40% of market revenue, with baby-care platforms like Amazon, Walmart, and specialty e-stores driving visibility and access. Direct-to-consumer (D2C) brands are leveraging influencer marketing and subscription-based models to engage millennial parents, resulting in repeat purchases and stronger brand retention.

Innovation in Sustainable Manufacturing

Advances in biodegradable wipe materials and eco-certified production processes are strengthening competitiveness. Companies adopting environmentally responsible practices are gaining regulatory and consumer favor. Sustainable production not only meets compliance requirements but also enhances brand image, aligning with global trends toward responsible consumption and climate-friendly packaging.

Market Restraints

High Price Sensitivity in Emerging Economies

Despite growing awareness, affordability remains a barrier in developing markets. Organic and premium baby teething wipes are priced significantly higher than regular baby wipes, restricting adoption among price-sensitive consumers. Companies are addressing this challenge by offering smaller packaging units and localized pricing strategies.

Regulatory and Safety Compliance Challenges

Manufacturers face stringent regulations for infant care products, with differing standards across regions. Compliance with FDA (U.S.), CE (EU), and ISO hygiene certifications often increases testing costs and delays product launches. Startups and smaller manufacturers face hurdles in scaling due to the complex approval process for baby oral products.

Baby Teething Wipes Market Opportunities

Growing Demand in Emerging Asian Economies

Asia-Pacific, particularly India, China, and Indonesia, offers significant untapped potential. Rising disposable incomes, growing working-parent populations, and increasing access to online baby care stores are accelerating adoption. Local manufacturing supported by government programs such as “Make in India” and “Made in China 2025” is helping international players establish cost-efficient regional production hubs.

Partnerships with Pediatric and Healthcare Networks

Collaboration with pediatricians, hospitals, and dental care institutions represents a key growth opportunity. Endorsements from healthcare professionals enhance product credibility and support mass adoption in both retail and institutional settings. Such alliances also create pathways for bundled infant-care kits and hospital-based promotional programs.

Integration of Technology in Product Design and Packaging

Smart packaging solutions, moisture-lock technology, and antibacterial sealing systems are enhancing product quality and shelf life. QR code-based traceability and digital engagement are helping brands provide usage instructions, authenticity checks, and loyalty rewards, strengthening consumer trust and differentiation in an increasingly competitive market.

Product Type Insights

Disposable baby teething wipes lead the market, accounting for approximately 58% of the global share in 2024. They are preferred due to convenience, portability, and one-time use, ensuring hygiene. Meanwhile, organic and alcohol-free variants are growing fastest, supported by parents’ preference for natural, chemical-free formulations that protect infant gums and oral microbiomes.

Ingredient Type Insights

Herbal and plant-based formulations dominate the market with a 46% share in 2024. These wipes, infused with chamomile, aloe vera, and xylitol, provide safe, soothing relief for teething discomfort. This segment’s CAGR of over 8% is attributed to heightened consumer confidence in toxin-free, naturally derived ingredients.

Packaging Insights

Resealable pouches hold the largest share of around 42% in 2024. These packages maintain moisture integrity and support convenient on-the-go use. Eco-friendly pouches using biodegradable materials are increasingly replacing traditional plastic containers, reinforcing sustainability commitments across brands.

Distribution Channel Insights

Online retail dominates the global market with a 45% revenue share in 2024. Subscription services and loyalty programs are driving repeat purchases. Offline channels such as pharmacies and specialty baby stores remain important in urban markets, particularly for new parents seeking professional recommendations.

Age Group Insights

Babies aged 6–12 months represent the largest consumer segment, accounting for 55% of total market demand. This age group experiences peak teething discomfort, making wipes a preferred hygiene and comfort solution. Demand from toddlers aged 1–3 years is also rising, as parents continue oral hygiene habits beyond initial teething phases.

| By Product Type | By Distribution Channel | By End Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global baby teething wipes market with a 32% share in 2024. The U.S. market is characterized by high awareness of infant hygiene and dominance of premium organic brands. Canada’s growth is supported by eco-friendly product adoption and government-backed health campaigns emphasizing early oral care.

Europe

Europe accounts for 27% of the global market, led by the U.K., Germany, and France. Stringent EU regulations encourage the use of certified natural ingredients, creating high consumer confidence. Sustainability and ethical sourcing are major purchase drivers, with retailers prioritizing eco-certified and cruelty-free baby care brands.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to grow at a CAGR of 8.8% from 2025 to 2030. China and India dominate due to growing online retail penetration and rising middle-class affordability. Japan’s mature baby care market emphasizes product safety and packaging innovation, while Indonesia and Vietnam present emerging opportunities through digital distribution.

Latin America

Latin America holds around 8% market share, with Brazil and Mexico as primary contributors. Expanding retail chains, improved access to imported baby care products, and influencer-led marketing campaigns are key growth enablers across the region.

Middle East & Africa

The Middle East and Africa represent about 7% of global revenue. The UAE and South Africa are leading markets, supported by increasing expatriate populations and growing modern trade networks. Rising awareness through pediatric outreach programs is expected to fuel further expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baby Teething Wipes Market

- The Honest Company

- Johnson & Johnson (Babyganics)

- Pigeon Corporation

- Kimberly-Clark Corporation

- Procter & Gamble

- Chicco (Artsana Group)

- WaterWipes

- Nice-Pak International

- Nuby USA

- Mothercare Plc

- Dr. Brown’s

- Mee Mee

- Little Busy Bodies, Inc. (Boogie Wipes)

- Earth Mama Organics

- Huggies

Recent Developments

- In June 2025, The Honest Company launched a new line of biodegradable baby teething wipes made from plant-based fibers, expanding its eco-friendly product portfolio.

- In March 2025, Pigeon Corporation introduced herbal-infused teething wipes in Japan, targeting safety-conscious parents with pediatrician-endorsed formulations.

- In February 2025, Kimberly-Clark announced the installation of automated, sustainable packaging lines in its Asia-Pacific manufacturing units to reduce its carbon footprint and improve production efficiency.