Baby Shampoo and Conditioner Market Size

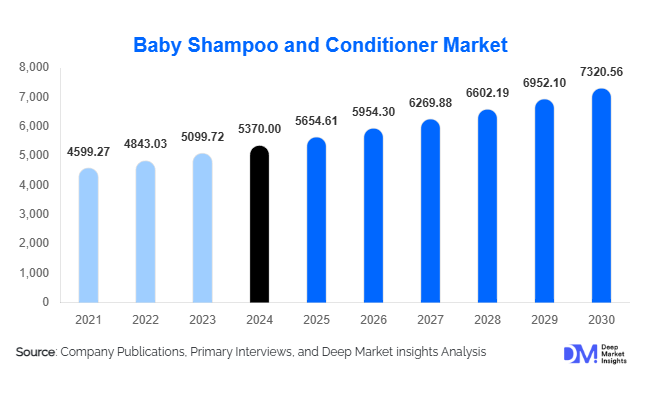

According to Deep Market Insights, the global baby shampoo and conditioner market size was valued at USD 5,370 million in 2024 and is projected to grow from USD 5,654.61 million in 2025 to reach USD 7,320.56 million by 2032, expanding at a CAGR of 5.3% during the forecast period (2025–2032). The market growth is primarily driven by increasing parental awareness of infant hygiene, the growing preference for natural and organic formulations, and the rising availability of baby care products through online retail channels.

Key Market Insights

- Natural and organic baby hair care products are gaining rapid traction as parents increasingly avoid products with parabens, sulfates, and artificial fragrances.

- North America dominates the market, supported by high spending on premium baby care and the presence of established brands such as Johnson & Johnson and Procter & Gamble.

- Asia-Pacific is the fastest-growing regional market, driven by rising birth rates, increasing disposable incomes, and the growing popularity of international baby brands in India and China.

- Online distribution channels are expanding rapidly, with e-commerce platforms and D2C brand websites boosting accessibility and product visibility.

- Product innovation, including tear-free, pH-balanced, and hypoallergenic formulations, is strengthening consumer trust and brand loyalty.

- Celebrity-endorsed and dermatologist-recommended baby care lines are emerging as key marketing trends among millennial and Gen Z parents.

Latest Market Trends

Surge in Demand for Natural and Plant-Based Formulations

Consumers are increasingly choosing baby shampoos and conditioners made with natural ingredients such as aloe vera, coconut oil, chamomile, and calendula. The shift toward chemical-free products is fueled by growing concerns about synthetic additives and their potential effects on infant skin. Manufacturers are responding with plant-based, dermatologically tested, and cruelty-free options, often accompanied by eco-friendly packaging. This trend is particularly strong in developed markets such as the U.S., Germany, and the U.K., where sustainability and clean labeling influence purchasing decisions.

Premiumization and Brand Differentiation

Brands are increasingly focusing on premium baby hair care lines featuring organic certifications, dermatological testing, and clinical safety claims. Companies such as Mustela and Chicco have expanded their product portfolios to target high-income parents willing to pay more for verified safety and quality. Limited-edition collections, scented variants, and combination packs (shampoo plus conditioner) are gaining traction as part of premium positioning strategies.

Baby Shampoo and Conditioner Market Drivers

Growing Awareness of Infant Hygiene and Safety

Global campaigns promoting infant hygiene and personal care have significantly raised awareness of the importance of gentle, specialized hair care products. Healthcare professionals and pediatricians increasingly recommend mild, tear-free shampoos that maintain scalp health and prevent dryness. Social media and parenting forums further amplify this awareness, making baby hygiene products an essential purchase across both developed and emerging economies.

Rise of E-Commerce and Digital Parenting Communities

The digital transformation of retail is a major catalyst for baby shampoo and conditioner sales. Parents increasingly purchase baby care products online due to the convenience of doorstep delivery, availability of discounts, and access to reviews. E-commerce platforms such as Amazon, Walmart, and FirstCry are expanding product assortments and offering subscription models, while digital parenting influencers play a vital role in shaping brand perceptions and purchase decisions.

Market Restraints

High Price of Organic and Premium Products

The cost of certified organic ingredients and sustainable packaging often makes natural baby hair care products significantly more expensive than synthetic alternatives. This price sensitivity can limit adoption in low- and middle-income regions, where consumers may prioritize affordability over premium attributes. The cost barrier remains a challenge for expanding the market beyond urban and upper-income demographics.

Regulatory and Formulation Challenges

Manufacturers face stringent regulations related to baby cosmetics and personal care formulations. Compliance with international safety standards, testing protocols, and ingredient transparency increases production complexity. Differences in regional regulations, such as those between the EU, the U.S., and the Asia-Pacific, further complicate formulation strategies and slow down new product launches.

Market Opportunities

Expansion of Organic and Ayurvedic Product Lines

The growing consumer inclination toward holistic and natural products presents an opportunity for brands to introduce herbal and Ayurvedic baby shampoos and conditioners. India, in particular, offers high potential for growth due to its cultural familiarity with herbal products and the success of brands like Himalaya and Dabur. Globally, the incorporation of botanical ingredients with proven benefits is expected to differentiate brands and capture eco-conscious consumer segments.

Personalized Baby Care Solutions

As personalization gains prominence in skincare and beauty, baby care brands are exploring customized solutions based on hair type, scalp sensitivity, and environmental factors. Subscription services offering tailored kits with shampoo, conditioner, and body wash based on a baby’s age or skin condition are emerging as an attractive proposition. Such innovations strengthen customer engagement and retention, especially among digitally active parents.

Product Type Insights

Baby shampoos account for the majority of market revenue, driven by their frequent usage and essential role in infant hygiene. Tear-free, hypoallergenic, and pH-balanced formulations are standard across leading brands. Baby conditioners, while representing a smaller segment, are growing steadily as parents become more aware of hair nourishment and detangling benefits. Combination products 2-in-1 shampoo and conditioner formats are increasingly popular for their convenience, especially in markets such as North America and Europe.

Application Insights

Household use remains the dominant application segment, supported by recurring demand from families with infants and toddlers. Institutional applications, such as hospitals, childcare centers, and maternity wards, are also contributing to growth due to bulk purchases and partnerships with healthcare product suppliers. Travel-friendly packaging formats, including sachets and mini bottles, are expanding the market across on-the-go applications.

Distribution Channel Insights

Offline retail, including supermarkets, pharmacies, and baby specialty stores, continues to hold a significant share due to consumer trust in physical inspection and brand familiarity. However, online channels are growing at the fastest rate, driven by the rise of e-commerce platforms, social media marketing, and the availability of subscription-based delivery services. Direct-to-consumer (D2C) channels are also gaining prominence as brands invest in their own digital storefronts and influencer partnerships.

| By Product Type | By Ingredient Nature | By Distribution Channel | By Price Range | By End User Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a dominant position in the baby shampoo and conditioner market, supported by high consumer spending power, well-established retail infrastructure, and strong brand loyalty. The U.S. is the largest contributor, with premium organic products gaining substantial traction. The region also leads in innovation, with brands introducing allergen-free and dermatologist-tested lines backed by clinical research.

Europe

Europe represents a mature but steadily growing market, with strong regulatory frameworks ensuring product safety. Demand for vegan, cruelty-free, and eco-certified baby shampoos is rising rapidly. The U.K., Germany, and France are key markets, where sustainability-conscious parents prefer brands using biodegradable packaging and ethically sourced ingredients.

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth during the forecast period, fueled by high birth rates, increasing disposable incomes, and rapid urbanization. Countries such as China and India are witnessing significant expansion in online retail and local manufacturing. Domestic brands are competing with international players by offering affordable, natural, and regionally inspired baby care formulations.

Latin America

In Latin America, the baby shampoo and conditioner market is growing steadily, driven by expanding urban populations and improved access to branded baby products. Brazil and Mexico lead the region, with increasing adoption of premium and imported products. Promotional campaigns emphasizing dermatological safety are supporting market penetration among young parents.

Middle East & Africa

The Middle East and Africa market is developing rapidly, supported by population growth, rising healthcare awareness, and government efforts to regulate baby hygiene products. The UAE, Saudi Arabia, and South Africa represent high-potential markets where premium international brands dominate, while local manufacturers are focusing on affordable, gentle formulations for mass-market consumers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baby Shampoo and Conditioner Market

- Johnson & Johnson Services, Inc.

- The Himalaya Drug Company

- Procter & Gamble Co.

- Beiersdorf AG

- Chicco (Artsana Group)

- Unilever plc

- Mustela (Laboratoires Expanscience)

- California Baby

- Babyganics

- Burt’s Bees Baby

Recent Developments

- In July 2025, Johnson & Johnson announced the expansion of its baby care range with a new line of naturally derived shampoos made from renewable plant-based ingredients.

- In March 2025, The Himalaya Drug Company launched an Ayurvedic baby hair care series containing hibiscus and fenugreek extracts, targeting eco-conscious Indian consumers.

- In January 2025, Mustela introduced a biodegradable packaging initiative for its baby shampoo and conditioner products in Europe, aligning with EU sustainability directives.