Baby Rompers Market Size

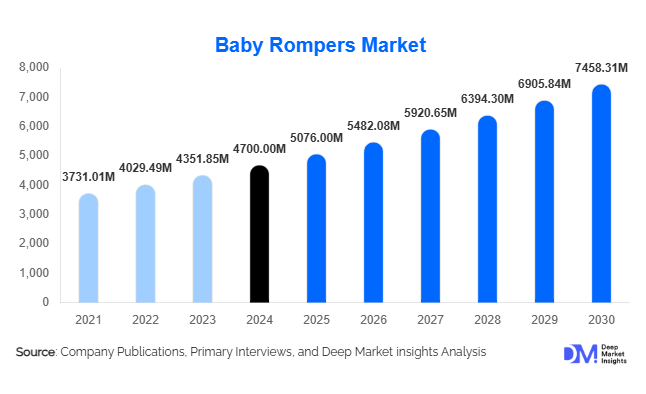

According to Deep Market Insights, the global Baby Rompers Market size was valued at USD 4,700 million in 2024 and is projected to grow from USD 5,076.00 million in 2025 to reach USD 7,458.31 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The baby rompers market growth is primarily driven by rising parental disposable income, increasing preference for organic and comfortable fabrics, expansion of e-commerce channels, and growing adoption of licensed and premium infant apparel globally.

Key Market Insights

- Premiumization and sustainable fabrics are gaining traction, with organic cotton and bamboo blends increasingly preferred by health- and eco-conscious parents.

- E-commerce and D2C channels dominate, allowing brands to offer wider SKU ranges, subscription models, and personalized product recommendations.

- Asia-Pacific leads in volume demand, particularly China and India, driven by urbanization, rising middle-class income, and organized retail expansion.

- North America remains a high-value market, with strong adoption of organic, premium, and licensed rompers, particularly in the U.S.

- Licensing and character-based designs are increasingly popular, boosting average selling prices and repeat purchase frequency.

- Technological adoption in manufacturing and supply chain, including automated sewing, fabric traceability, and D2C personalization, is reshaping market efficiency and product differentiation.

Latest Market Trends

Sustainability and Organic Fabric Adoption

Manufacturers are increasingly producing baby rompers using certified organic cotton, bamboo blends, and low-impact dyes. This trend aligns with parental concerns about skin sensitivity, infant health, and environmental sustainability. Many brands now highlight GOTS or OEKO-TEX certifications and use eco-friendly packaging, appealing to environmentally conscious buyers. Premium and mid-market tiers are benefiting most, as parents are willing to pay higher prices for certified products.

Digital & E-commerce Driven Growth

Online platforms, brand D2C websites, and marketplaces are now the primary purchase channels for baby rompers. Parents prefer the convenience, wider variety, and subscription-based models that digital channels offer. Personalized recommendations, size guides, and influencer marketing are increasingly influencing purchasing decisions. E-commerce enables faster product launches, seasonal collections, and integration of licensed character designs to enhance consumer engagement.

Baby Rompers Market Drivers

Rising Disposable Income & Parental Spending

Increasing household incomes, particularly in Asia-Pacific and Latin America, have resulted in higher per-child spending on apparel. Parents prioritize comfort, quality, and safety, which drives demand for mid-market and premium baby rompers. Frequent outfit changes for infants ensure repeat purchases, supporting overall market growth.

Premiumization and Licensed Collections

Licensed character rompers, designer baby apparel, and themed collections are growing in popularity. Parents increasingly choose branded or themed products that combine style, comfort, and perceived value. This trend boosts ASPs and market profitability, particularly in North America, Europe, and APAC urban centers.

Growing E-commerce & Direct-to-Consumer Channels

E-commerce has expanded reach, improved convenience, and allowed brands to gather valuable consumer insights. Subscription boxes, personalized kits, and online promotions are enhancing repeat purchase behavior. Digital-first strategies help smaller players scale quickly while supporting high-margin premium segments.

Market Restraints

Raw Material Price Volatility

Fluctuating cotton and textile prices impact production costs. While premium segments can absorb some cost increases, value-tier manufacturers face margin pressures. Supply-chain disruptions and logistics challenges may further affect timely delivery and inventory management.

High Competition in the Value Segment

The mass-market rompers segment is highly competitive, with multiple private labels, retail chains, and international brands competing on price. This leads to thinner margins and intense price competition, limiting growth potential in the lower-priced segment.

Baby Rompers Market Opportunities

Expansion of Premium & Organic Lines

Growing demand for organic, hypoallergenic, and certified fabrics presents opportunities for manufacturers and new entrants. Premiumization allows brands to command higher ASPs and differentiate in competitive markets. Subscription boxes and personalized kits provide recurring revenue and higher customer lifetime value.

Emerging Market Penetration

Asia-Pacific and parts of Latin America are high-growth regions due to rising urbanization, expanding organized retail, and increasing middle-class spending. Localized designs, affordable premium lines, and partnerships with regional e-commerce platforms enable new entrants and existing players to capture market share efficiently.

Technological Integration & Product Innovation

Adoption of advanced fabrics (temperature-regulating, anti-odor, antibacterial) and automated manufacturing improves efficiency, product quality, and margin. D2C personalization tools, AI-driven size recommendations, and supply chain traceability further enhance competitiveness and consumer loyalty.

Product Type Insights

Footed rompers dominate globally, accounting for 28% of the 2024 market, due to high demand in the 0–6 months age group and popularity in gifting. Mid-market and premium variants include organic cotton options and licensed prints, driving higher ASPs. Footless and short-sleeve rompers grow in warmer regions, while long-sleeve variants are preferred in cooler climates.

Application Insights

Retail purchases by households dominate, complemented by gifting and registry-based demand. Institutional demand from hospitals and childcare centers is small but steady. Emerging applications include subscription boxes, rental models for designer rompers, and circular economy initiatives for eco-conscious consumers, enabling new revenue streams.

Distribution Channel Insights

E-commerce / D2C platforms hold the largest share (35%), enabling personalized offerings, direct marketing, and subscription models. Specialty retail stores, department stores, and supermarkets complement physical sales. Social media marketing, influencer collaborations, and online brand communities increasingly influence buying behavior.

End-User Insights

Households represent the primary end-users, with frequent repeat purchases for infants aged 0–24 months. Gifting and baby registry channels are growing, especially for premium and licensed rompers. Hospitals and childcare centers require standardized bulk orders. Subscription services targeting new parents and age-graded deliveries are emerging as high-growth end-use channels.

| By Product Type | By Material | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 26% of the 2024 market (USD 1,222 million), led by the U.S. Premium and licensed rompers are highly sought after. E-commerce and specialty retailers dominate distribution. Consumers favor organic fabrics, safe closures, and character-themed designs.

Europe

Europe accounts for 22% (USD 1,034 million). Countries such as the U.K., Germany, and France show strong demand for organic, certified fabrics. Regulatory compliance, sustainability, and mid-to-premium pricing dominate consumer choices.

Asia-Pacific

Asia-Pacific is the largest volume market (33%, USD 1,551 million), with China and India driving demand. Rapid urbanization, rising incomes, and online retail expansion support market growth. Footed and unisex rompers are particularly popular, and mid-market and premium segments are growing fastest.

Latin America

Latin America accounts for 10% (USD 470 million). Brazil and Mexico are major contributors. Value and mid-market rompers dominate, with e-commerce growth supporting increased access to premium options.

Middle East & Africa

MEA accounts for 9% (USD 423 million). GCC countries (UAE, Saudi Arabia) favor premium and licensed rompers, while African markets such as Nigeria and South Africa are driven by volume demand and mid-tier affordability. Intra-regional trade and local production are slowly expanding market presence.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baby Rompers Market

- Carter’s, Inc.

- H&M Group

- Inditex (Zara)

- Gap Inc.

- The Children’s Place

- Fast Retailing (Uniqlo)

- Mayoral Group

- PVH Corp.

- Bestseller Group

- Mothercare

- Petit Bateau

- Li & Fung

- Babyshop

- Other regional multi-brand manufacturers

- Local South-Asian manufacturers supplying private labels

Recent Developments

- In Q1 2025, Carter’s launched a premium organic cotton romper line across North America, featuring licensed characters and enhanced fabric safety standards.

- In Q2 2025, H&M introduced a D2C subscription box for newborn rompers, integrating personalized designs and sustainable fabrics.

- In Q3 2025, Inditex expanded its Zara Kids line in APAC with mid-market rompers and age-graded collections targeting growing middle-class families in China and India.