Ayurvedic Products Market Size

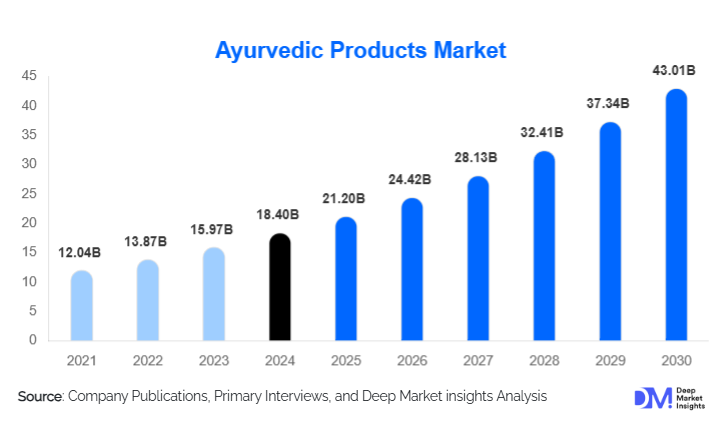

According to Deep Market Insights, the global Ayurvedic Products market size was valued at USD 18.4 billion in 2024 and is projected to grow from USD 21.20 billion in 2025 to reach USD 43.01 billion by 2030, expanding at a CAGR of 15.2% during the forecast period (2025–2030). The market growth is primarily driven by rising health and wellness awareness, growing adoption of herbal and chemical-free personal care products, and the increasing penetration of e-commerce platforms facilitating global distribution.

Key Market Insights

- Herbal supplements and nutraceuticals dominate the product landscape, accounting for around 35% of the global market in 2024, driven by rising lifestyle diseases and preventive healthcare trends.

- Tablets and capsules lead the form segment, representing 42% of the market, due to ease of use, standardization, and strong consumer acceptance in both urban and semi-urban areas.

- E-commerce platforms are increasingly shaping distribution, capturing 30% of the market as convenience, wider variety, and personalized offerings attract millennial and Gen Z consumers.

- The healthcare and wellness end-use segment is the largest, contributing 40% of the market, as Ayurvedic therapies and hospital integration gain traction globally.

- Asia-Pacific is the fastest-growing region, led by India and China, due to rising disposable incomes, urbanization, and growing wellness awareness.

- Technological adoption, including AI-driven personalized wellness recommendations, telemedicine consultations, and subscription-based health platforms, is driving market innovation and consumer engagement.

Latest Market Trends in the Ayurvedic Products

Rising Demand for Preventive Healthcare

Consumers are increasingly prioritizing preventive health measures, fueling demand for herbal supplements, immunity boosters, and functional foods. Ingredients like Ashwagandha, Turmeric, and Triphala are becoming mainstream due to their scientifically backed benefits. Companies are developing modernized formulations, fortified nutraceuticals, and blended herbal teas, making Ayurvedic products more appealing to younger demographics in North America and Europe.

Digital and E-Commerce Integration

Online platforms are revolutionizing the Ayurvedic products market, allowing consumers to access global products directly. AI-driven recommendations, subscription models, and tele-wellness consultations are gaining popularity. Influencer-led marketing and social media campaigns are further driving adoption among millennial and Gen Z consumers, contributing to online retail dominance.

Functional Foods and Personal Care Adoption

The fusion of Ayurveda with functional foods, beverages, and personal care products is a key trend. Consumers increasingly prefer chemical-free skincare, herbal haircare, and fortified drinks. This trend is particularly strong in Europe and North America, where certified and clinically validated Ayurvedic products command a premium.

Market Drivers

Health & Wellness Awareness

Rising consumer consciousness regarding chemical-free, natural, and preventive healthcare is a key driver. The growing prevalence of lifestyle diseases has amplified demand for herbal supplements and Ayurvedic therapies, boosting market expansion across both developed and emerging economies.

Government Initiatives & Policy Support

Programs like India’s AYUSH initiative and “Make in India” support production, R&D, and global export of Ayurvedic products. These initiatives incentivize infrastructure development, enhance product quality, and facilitate international collaborations, encouraging manufacturers to expand globally.

Technological Advancements & Product Innovation

Integration of AI, telemedicine, and digital health platforms has enabled personalized Ayurvedic solutions. Companies are innovating with ready-to-consume formulations, fortified nutraceuticals, and eco-friendly packaging, enhancing consumer engagement and driving growth in premium segments.

Market Restraints

Regulatory Hurdles

Differences in regulatory standards across countries delay international market entry. Approval processes, labeling, and safety compliance present challenges for manufacturers, limiting rapid global expansion.

Raw Material Dependency & Price Volatility

Reliance on herbs sourced from limited regions exposes companies to supply chain disruptions and fluctuating raw material prices. Seasonal variations, pest infestations, and climate change impact production costs, affecting overall profit margins.

Ayurvedic Products Market Opportunities

Expansion in Emerging Markets

Regions like APAC, LATAM, and the Middle East present untapped potential due to rising disposable incomes, urbanization, and growing wellness awareness. Products like functional beverages and herbal supplements are in high demand, providing new revenue streams for manufacturers.

Technological Integration

Leveraging AI-driven health apps, e-commerce personalization, and subscription-based wellness services enables companies to reach a broader audience. Telemedicine and digital consultations further enhance the adoption of Ayurvedic products in global markets.

Government & Regulatory Support

Policy frameworks encouraging export, manufacturing, and research of Ayurvedic products create growth opportunities. Incentives, grants, and global certification facilitation enable companies to expand in international markets while maintaining quality standards.

Product Type Insights

Herbal supplements and nutraceuticals lead the market globally, accounting for 35% of 2024 revenue. Growing preventive health awareness, rising lifestyle diseases, and increasing disposable income in developed markets are key contributors. Personal care and cosmetic products are also expanding due to demand for chemical-free skincare and haircare solutions.

Form Insights

Tablets and capsules dominate with 42% of the market share, favored for convenience, standardized dosing, and consumer acceptance. Oils and tonics remain popular in traditional and wellness-focused segments, while powders and gels are niche products for targeted therapeutic or cosmetic applications.

Distribution Channel Insights

E-commerce platforms account for 30% of global sales due to convenience, wider product variety, and personalized recommendations. Retail stores continue to serve core urban markets, while hospitals and wellness centers play a key role in the healthcare segment.

End-Use Insights

The healthcare & wellness segment accounts for 40% of global market share. Growth is fueled by hospital integration, wellness centers, and spa applications. Personal care and functional food industries are emerging applications, driving export demand to Europe and North America. Functional beverages and immunity supplements are projected to grow at a 9–10% CAGR globally.

| By Product Type | By Distribution Channel | By End User |

|---|---|---|

|

|

|

Regional Insights

North America

North America contributes 25% of the global market. The U.S. and Canada are major consumers of herbal supplements and personal care products, driven by health-conscious urban populations and high disposable income. Demand is strongest in immunity boosters and functional foods.

Europe

Europe accounts for 20% of the market, with Germany, the U.K., and France leading demand for clinically validated and certified products. Eco-friendly, chemical-free, and organic Ayurvedic products are preferred, driving growth in nutraceuticals and personal care applications.

Asia-Pacific

APAC is the fastest-growing region, representing 30% of the market. India remains the production hub, while China and Japan are emerging consumers. Urbanization, rising disposable incomes, and wellness awareness drive the adoption of herbal supplements, functional beverages, and personal care products.

Middle East & Africa

This region contributes 15% of the market, led by the UAE, Saudi Arabia, and South Africa. Imports from India dominate, particularly in wellness products and spa therapies, driven by high-income consumers and luxury hospitality demand.

Latin America

Latin America accounts for 10% of the market, with Brazil and Mexico as key consumers. Demand is emerging in herbal supplements and personal care, particularly among affluent consumers seeking wellness and chemical-free products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ayurvedic Products Market

- Dabur

- Patanjali Ayurved

- Himalaya Wellness

- Baidyanath

- Zandu

- Emami Ltd

- Kerala Ayurveda

- Organic India

- Vicco Laboratories

- Charak Pharma

- SD Pharma

- Arya Vaidya Sala

- Maharishi Ayurveda

- Forest Essentials

- Kama Ayurveda

Recent Developments

- In May 2025, Dabur launched a new range of fortified herbal supplements targeting global immunity and wellness markets, expanding exports to North America and Europe.

- In April 2025, Patanjali Ayurved introduced digital tele-wellness consultation services, integrating AI-driven personalized health recommendations.

- In February 2025, Himalaya Wellness expanded its e-commerce presence across Europe, offering certified chemical-free personal care products with online subscription models.