Avalanche Transceiver Market Size

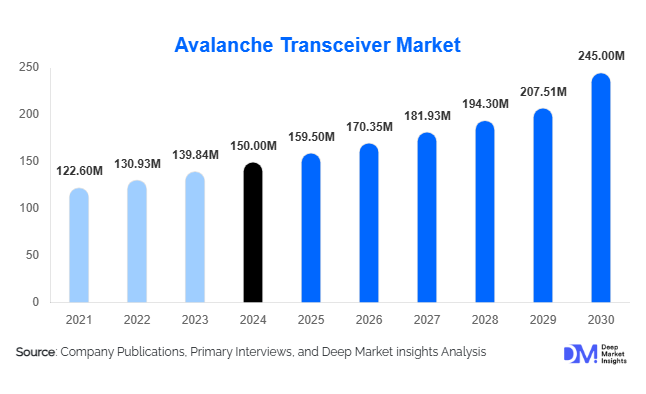

According to Deep Market Insights, the global avalanche transceiver market size was valued at USD 150 million in 2024 and is projected to grow from USD 159.5 million in 2025 to reach USD 245 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The avalanche transceiver market growth is primarily driven by the rising popularity of backcountry skiing and snowboarding, stringent safety regulations in avalanche-prone regions, and continuous technological advancements in digital and multi-antenna transceivers.

Key Market Insights

- Digital multi-antenna transceivers dominate the market, offering faster and more accurate victim detection than analog devices.

- Europe leads globally, holding around 40–45% of market share in 2024, supported by high adoption rates in Alpine and Scandinavian countries.

- Asia-Pacific is the fastest-growing region, fueled by increasing investments in ski resorts in China, Japan, South Korea, and India.

- Recreational users account for nearly 70% of demand, but professional rescue teams and guided expeditions are the fastest-growing end-use segments.

- Online sales channels are rising rapidly, accounting for nearly half of global transactions in 2024 as brands focus on D2C models.

- Premium transceivers with advanced features such as multiple burial detection, GPS, and Bluetooth connectivity are expanding market value.

Latest Market Trends

Technology-Driven Transceiver Innovation

Avalanche transceiver manufacturers are investing in digital signal processing, GPS integration, and multi-antenna systems to improve search speed, accuracy, and user experience. Triple-antenna transceivers are now widely adopted by professional users and are becoming standard in high-end recreational devices. Integration with mobile apps for group checks, firmware updates, and training simulations is enhancing device usability and ensuring readiness before expeditions. Features like Bluetooth connectivity and advanced UI designs are attracting younger and tech-savvy users.

Growing Awareness and Regulatory Push

Governments and ski resorts across Europe and North America are increasingly mandating avalanche safety gear, including transceivers, for access to backcountry terrain. Insurance companies and mountaineering organizations also emphasize certified devices, which have significantly boosted adoption rates. Training programs, safety campaigns, and rescue demonstrations are expanding awareness, driving higher demand among recreational users.

Avalanche Transceiver Market Drivers

Rising Winter Sports Participation

Global participation in skiing, snowboarding, and mountaineering continues to grow, particularly in North America, Europe, and the Asia-Pacific. The rising trend of adventure tourism and backcountry exploration has created a steady demand for avalanche safety equipment, with transceivers seen as an essential survival tool.

Technological Advancements

Multi-antenna technology, digital signal processing, and integration with mobile platforms have transformed the avalanche transceiver market. These features enhance user confidence, reduce search times, and significantly improve survival chances, boosting adoption among both recreational and professional users.

Regulatory Support & Safety Awareness

In avalanche-prone regions, regulations and resort policies mandate or strongly encourage transceiver use. Safety campaigns and NGO-led programs are raising awareness about avalanche risks, creating a demand pull that complements technological innovation.

Market Restraints

High Costs of Premium Devices

Premium digital transceivers with advanced features remain expensive, limiting affordability for casual users in emerging markets. Entry-level analog devices are cheaper but offer reduced accuracy and functionality, which can hinder adoption where budgets are constrained.

Seasonality and Limited Awareness

The market remains highly seasonal, peaking during winter months in ski regions. In developing markets, a lack of awareness about avalanche risks and limited training infrastructure act as barriers to widespread adoption.

Avalanche Transceiver Market Opportunities

Expansion in Emerging Winter Tourism Markets

Countries like China, India, and South Korea are investing heavily in ski resorts and winter sports infrastructure. This creates strong growth opportunities for avalanche transceiver suppliers through resort partnerships, rental pools, and government safety programs.

Integration with Smart Technologies

Opportunities lie in developing hybrid transceivers with app integration, GPS mapping, group connectivity, and AI-enhanced search algorithms. These innovations cater to tech-savvy consumers and professional users seeking improved safety and usability.

Public Safety & Rescue Organization Demand

Rescue agencies, military units, and professional mountaineering guides require highly reliable transceivers. Supplying this segment provides long-term institutional contracts and recurring demand, often at premium pricing tiers.

Product Type Insights

Digital multi-antenna transceivers dominate the global market with nearly 65% share in 2024. Their superior accuracy and usability drive widespread adoption among recreational and professional users. Analog devices are declining but remain in demand in cost-sensitive markets. Premium devices are expanding value share as professional rescue teams and affluent adventurers prioritize advanced features.

Application Insights

Recreational use is the largest application segment, accounting for 70% of market demand in 2024. However, professional use by ski patrols, rescue teams, and military units is growing at the fastest rate due to heightened safety standards. Guided expeditions and rental services also drive demand in tourism-heavy regions.

Distribution Channel Insights

Online sales accounted for nearly 45% of market value in 2024, driven by convenience, price transparency, and brand-owned digital platforms. Specialty outdoor retailers remain important in mature markets, while ski resorts and rental shops provide critical access points for first-time or casual users.

End-User Insights

Individual recreational users dominate demand, but institutional buyers resorts, rescue organizations, and military agencies, are increasing their market share. Rental services are especially critical in emerging ski regions, lowering barriers for occasional users while ensuring compliance with safety mandates.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe accounted for 40–45% of global market share in 2024, led by Alpine nations such as Switzerland, Austria, France, and Italy. Strict safety regulations, strong winter sports culture, and premium product adoption support Europe’s dominance. Growth remains steady, supported by replacement demand for digital devices.

North America

North America held about a 25–30% share in 2024. The U.S. and Canada drive demand through large-scale winter sports industries, expanding backcountry tourism, and professional rescue use. Strong distribution networks and high consumer awareness support continued growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding a 10–15% share in 2024 but expected to grow rapidly due to China’s and Japan’s rising winter sports markets. Government investments, rising disposable incomes, and new ski resort development drive adoption, particularly in China, Japan, South Korea, and India.

Latin America

Demand is modest, centered in Chile and Argentina, where mountaineering and skiing are popular in the Andes. Growth potential exists through guided adventure tourism, though economic constraints limit widespread adoption.

Middle East & Africa

Minimal current demand, with purchases largely from military, research groups, and high-altitude adventure tourism. However, the Middle East’s rising outbound tourism and Africa’s ski resorts present niche opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Avalanche Transceiver Market

- Ortovox

- Backcountry Access (BCA)

- Mammut Sports Group AG

- Black Diamond Equipment

- Arva Equipment

- PIEPS GmbH

- Barryvox

- Grivel

- Petzl

- CAMP Safety

- G3 Genuine Guide Gear

- K2 Sports

- Ferrino

- Millet Mountain Group

- Decathlon (Quechua brand)

Recent Developments

- In March 2025, Mammut launched an upgraded Barryvox digital transceiver with advanced multiple burial detection and extended battery life.

- In February 2025, Ortovox announced a new line of professional-grade triple-antenna transceivers aimed at rescue organizations in Europe.

- In January 2025, Backcountry Access (BCA) introduced an app-connected beacon system enabling group safety checks and firmware updates.