Avalanche Airbag Backpack System Market Size

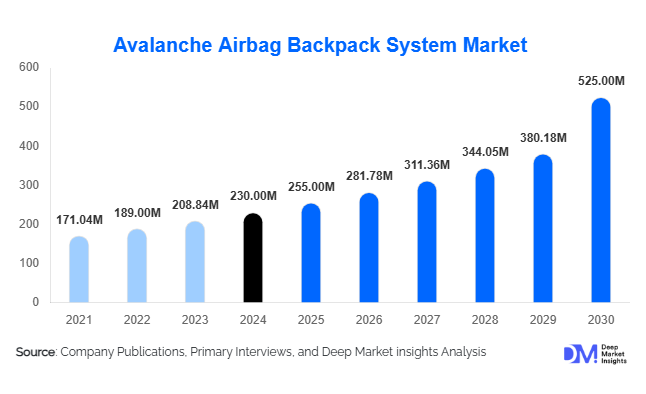

According to Deep Market Insights, the global avalanche airbag backpack system market size was valued at USD 230 million in 2024 and is projected to grow from USD 255 million in 2025 to reach USD 525 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing participation in backcountry skiing and snowboarding, growing awareness of avalanche safety, technological innovations in airbag deployment systems, and rising adventure tourism globally.

Key Market Insights

- Refillable and hybrid airbag systems are becoming the preferred choice, offering sustainable and reusable deployment solutions for both recreational and professional users.

- Automatic sensor-based deployments are gaining traction, enhancing safety and reliability for novice and professional winter sports enthusiasts alike.

- North America dominates the market, with high adoption in the U.S. and Canada due to widespread winter sports culture and safety awareness.

- Europe is the second-largest market, driven by Alpine regions such as Switzerland, Austria, and France, with strong regulations and safety norms encouraging adoption.

- Asia-Pacific is the fastest-growing region, led by ski tourism development in China, Japan, and South Korea, combined with rising middle-class disposable incomes.

- Online and direct-to-consumer distribution channels, along with e-commerce platforms, are increasingly driving accessibility and convenience for global customers.

Latest Market Trends

Technologically Advanced Airbag Systems

Manufacturers are integrating innovative deployment mechanisms, including automatic sensors, electric fans, and hybrid systems, to improve safety and reliability. Multi-deploy electric fan systems allow repeated use without cartridge replacement, while automatic activation reduces the risk of user error. GPS connectivity, mobile integration, and real-time monitoring are emerging in premium segments, appealing to tech-savvy winter sports enthusiasts. These trends are also driving premiumization, with higher-priced units incorporating smart features for professionals and rescue teams.

Eco-Friendly and Reusable Designs

There is a growing focus on sustainability, with reusable and refillable airbags preferred over disposable cartridges. High-performance fabrics such as Cordura, ripstop, and eco-friendly synthetics are being adopted to reduce environmental impact. Brands are emphasizing lightweight and ergonomic designs that reduce user fatigue while maintaining durability and safety, attracting both recreational users and professionals who spend extended periods in backcountry or avalanche-prone areas.

Avalanche Airbag Backpack System Market Drivers

Rising Participation in Backcountry and Winter Sports

With more enthusiasts venturing into off-piste skiing, snowboarding, and mountaineering, the need for avalanche safety equipment is growing rapidly. Adventure tourism expansion, ski resort development, and backcountry guiding services are key factors driving adoption. Casual users increasingly view airbags as essential safety gear rather than optional equipment, fueling consistent market growth.

Technological Innovations Enhancing Safety

Advanced deployment systems, including automatic sensors, hybrid mechanisms, and electric fan technology, improve user confidence and reliability. Lightweight and ergonomic designs, coupled with digital connectivity for real-time tracking and monitoring, enhance appeal for both recreational and professional users. Continuous innovation differentiates brands, driving consumer preference for technologically superior backpacks.

Government and Safety Awareness Initiatives

Governments, alpine associations, and rescue organizations are promoting safety norms and public awareness campaigns. Safety certifications, training programs, and awareness initiatives encourage adoption among recreational users, guided tour operators, and professional rescue teams. Policies emphasizing risk mitigation and personal safety also drive market demand globally.

Market Restraints

High Cost of Premium Airbag Backpacks

Premium avalanche airbag backpacks, particularly those with automatic sensors or electric fan systems, are expensive. Initial purchase costs, maintenance, and recurring expenses such as cartridge refills can be prohibitive for casual users and emerging markets. High pricing restricts broader adoption and may slow growth among price-sensitive consumers.

Limited Awareness in Emerging Markets

Many regions have low penetration due to a lack of familiarity with avalanche risks and airbag technology. Perceived complexity, concerns over deployment reliability, and insufficient training can deter potential users. Manufacturers must invest in education, safety campaigns, and product demonstrations to overcome these barriers.

Avalanche Airbag Backpack System Market Opportunities

Emerging Winter Sports Markets in Asia-Pacific and Latin America

Rapid ski resort development and adventure tourism growth in Asia-Pacific (China, Japan, South Korea) and Latin America (Chile, Argentina) present untapped demand. Affordability-focused models, local assembly, and partnerships with tour operators can increase market penetration. Rising middle-class income and adventure tourism awareness further amplify these opportunities.

Integration of Smart Technology

Smart avalanche airbag backpacks with GPS, mobile connectivity, sensor-based auto-deployment, and real-time monitoring are increasingly appealing. New entrants and existing players can differentiate themselves by incorporating IoT capabilities and predictive safety alerts, targeting both recreational enthusiasts and professional users who demand high reliability.

Regulatory Support and Safety Mandates

Government policies, alpine safety regulations, and institutional mandates can drive higher adoption, particularly for guided tours, professional rescue teams, and commercial operations. Subsidies, awareness programs, and insurance-linked incentives provide opportunities for market expansion, encouraging the adoption of airbags as standard safety equipment.

Product Type Insights

Refillable gas canister systems dominate the market due to reusability, cost efficiency, and environmental benefits. Disposable cartridge systems are declining in share but remain relevant for budget-conscious users. Electric fans and hybrid systems are experiencing rapid growth due to multi-deploy capability and enhanced safety features, particularly among professional users. Manual deployment backpacks continue to hold a significant share due to reliability and cost-effectiveness, but automatic and sensor-based systems are growing faster in adoption rates.

Application Insights

Skiing, particularly backcountry and off-piste, is the largest application, accounting for nearly half of the market. Snowboarding and mountaineering are other key applications, with increasing participation driving demand for advanced safety backpacks. Rescue and professional operations use specialized premium packs with multiple deployments and integrated sensors. Adventure tourism and scientific expeditions represent emerging niche applications, expanding the scope of usage beyond recreational activities.

Distribution Channel Insights

Online platforms, including e-commerce websites and direct-to-consumer brand stores, are increasingly important for market growth, offering convenience and broader reach. Specialty outdoor and snow sports retailers continue to serve premium and mid-range segments. Resorts and tour operator partnerships are emerging as key channels, particularly for rental services and guided backcountry tours. Social media and influencer-driven marketing campaigns are boosting awareness and engagement among younger demographics.

End-User Insights

Recreational winter sports enthusiasts are the largest end-user segment, accounting for over 50% of the market. Professional guides, rescue teams, and commercial tour operators represent a smaller but high-value segment, favoring premium and technologically advanced backpacks. Rental and adventure tourism services are driving adoption in regions with emerging ski infrastructure, particularly in Asia-Pacific and Latin America.

Age Group Insights

Users aged 25–45 years represent the largest market share, combining risk awareness with disposable income. Younger users (18–25) are adopting mid-range and entry-level backpacks, often influenced by social media trends. Older users (46–65+) prioritize premium, reliable, and ergonomic designs, particularly for professional or guided use. Safety-conscious adults in emerging markets form a growing demographic seeking affordable yet reliable airbag backpacks.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 35–40% of the global market, driven by strong winter sports culture, safety awareness, and high disposable incomes. The U.S. leads in both recreational and professional adoption, while Canada’s alpine regions show high demand for advanced airbag systems. Customized solutions, premium packs, and guided tour packages support steady growth.

Europe

Europe represents 30–35% of the market, dominated by Alpine countries including Switzerland, Austria, France, and Italy. Regulatory standards, high participation in winter sports, and strong retail networks encourage adoption. Sensor-based and hybrid systems are increasingly preferred, and European brands dominate manufacturing and innovation globally.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, Japan, South Korea, and emerging markets such as India. Ski resort expansion, adventure tourism, and rising middle-class income fuel demand. Premium and mid-range models are gaining traction, supported by e-commerce platforms and partnerships with local operators.

Latin America

Latin America has a smaller share (3–5%), primarily in Chile and Argentina. Adventure tourism and limited ski resort infrastructure are key drivers. Outbound travel to North America and Europe also boosts demand. Growth potential exists as ski and mountaineering culture develops.

Middle East & Africa

While Middle East markets such as the UAE and Qatar have niche demand, Africa itself sees adoption largely for professional and expedition use rather than recreational. Regional infrastructure development and specialized safety equipment imports support a limited but growing market presence.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Avalanche Airbag Backpack System Market

- ABS Protection GmbH

- Mammut Sports Group

- Black Diamond

- Backcountry Access

- Ortovox

- ARVA

- Scott Sports

- Osprey Packs

- The North Face

- Dakine

- Mystery Ranch

- Millet

- Motorfist

- Salewa

- BCA

Recent Developments

- In January 2025, ABS Protection GmbH launched a next-generation hybrid airbag system with automatic sensors and electric fan multi-deploy capability for professional and recreational users.

- In March 2025, Mammut Sports Group introduced a sustainable line of backpacks using recycled materials and refillable gas canister systems, targeting environmentally-conscious consumers.

- In June 2025, Black Diamond expanded its sensor-based airbag backpack series into the Asia-Pacific region, partnering with local distributors to meet growing demand in emerging winter sports markets.