Avalanche Air Bags Market Size

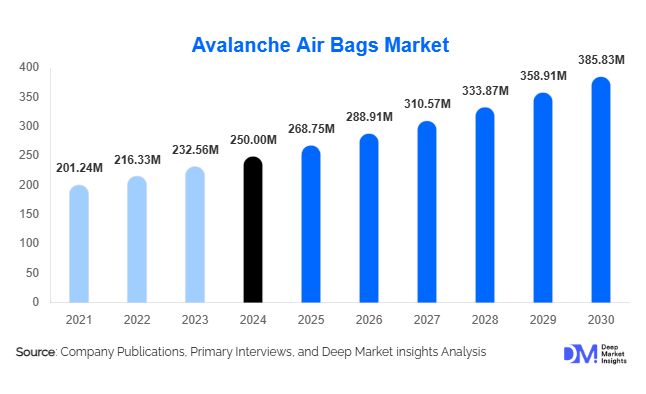

According to Deep Market Insights, the global avalanche air bags market size was valued at USD 250 million in 2024 and is projected to grow from USD 268.75 million in 2025 to reach USD 385.83 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by rising participation in winter sports and backcountry adventure tourism, increasing safety awareness, and technological innovations in airbag systems that improve usability and reliability.

Key Market Insights

- Demand is shifting toward technologically advanced and lighter airbag systems, including electric fan-powered and dual-chamber solutions that improve safety while reducing pack weight.

- Integrated airbag backpacks dominate, providing convenience and optimal ergonomics, preferred over modular or retrofit systems by both recreational and professional users.

- North America leads the market, driven by the U.S. and Canada due to a high prevalence of winter sports, strong consumer awareness, and established distribution networks.

- Europe remains a major market, particularly Alpine countries like Switzerland, Austria, France, and Italy, with high adoption of premium and dual-chamber airbag systems.

- Asia-Pacific is the fastest-growing region, fueled by expanding ski resorts, adventure tourism, and rising disposable incomes in countries such as China, Japan, and India.

- Professional and rental segments, including ski patrols, resorts, and guided back-country tours, are increasing demand for reliable and reusable airbag systems.

Latest Market Trends

Technological Advancements Driving Adoption

Manufacturers are increasingly integrating electric fan-powered inflation, dual-chamber designs, and modular, lightweight backpacks. These innovations allow rapid deployment, enhanced safety, and reusable operation, making airbag systems more appealing for both recreational users and professional rescue teams. The trend toward “smart” systems with potential integration of sensors and mobile applications is also emerging, enabling users to monitor avalanche risk and facilitate rescue operations.

Expansion into Emerging Adventure Markets

Asia-Pacific and Latin America are witnessing growing interest in winter sports and backcountry skiing. Ski resorts in China, India, Japan, and Chile are introducing new guided tours and rental fleets equipped with airbag systems. Export-driven demand from established European and North American manufacturers supports adoption in these emerging markets. The increasing availability of rental models in resorts helps lower the barrier to entry for first-time users, promoting broader adoption.

Avalanche Air Bags Market Drivers

Rising Winter Sports and Back-Country Adventure Participation

With more enthusiasts engaging in skiing, snowboarding, and split-boarding in off-piste terrain, there is a higher awareness of avalanche risks. Consumers are willing to invest in safety equipment such as airbag systems to mitigate life-threatening hazards, driving market growth globally.

Innovation and Product Enhancement

Advanced airbag systems featuring lighter packs, dual chambers, electric fan activation, and modular integration enhance safety, usability, and reliability. This drives adoption across both recreational and professional segments. Multi-deploy systems and ergonomic backpack designs further improve convenience, reinforcing growth.

Increased Safety Awareness and Resort Support

Guided tours, ski patrols, and resorts are increasingly emphasizing avalanche airbag use through mandatory recommendations, rentals, or promotions. Educational campaigns and insurance incentives in certain regions further enhance awareness and adoption.

Market Restraints

High Cost and Maintenance Requirements

Airbag systems are relatively expensive, with entry-level models around USD 500 and premium dual-chamber/electric fan systems exceeding USD 800. Cartridge replacement, battery charging, and occasional maintenance add to costs, limiting adoption in price-sensitive markets.

Limited Awareness in Emerging Regions

In developing markets, winter sports culture is still emerging. Limited distribution, lack of rental infrastructure, and low consumer familiarity with avalanche safety systems restrain market expansion, requiring targeted education and marketing efforts.

Avalanche Air Bags Market Opportunities

Emerging Markets and Adventure Tourism Growth

Asia-Pacific and Latin America present high growth potential due to expanding ski resorts, guided back-country tours, and adventure tourism promotion. Localized distribution, training programs, and resort partnerships offer new avenues for revenue generation.

Technological Innovation and Smart Systems

Integration of electric fan inflation, dual-chamber designs, lightweight materials, and potential sensor-based monitoring creates opportunities for product differentiation. Early adopters can target premium segments with advanced features and modular systems suitable for both professional and recreational use.

Professional and Rental Applications

Ski patrols, avalanche rescue teams, and resort rental fleets require high-reliability airbag systems. Bulk procurement, leasing, and rental models offer growth for manufacturers and increase market penetration among casual or first-time backcountry users.

Product Type Insights

Integrated airbag backpacks lead the market, offering optimized ergonomics and ease of use. Modular or removable systems serve niche users seeking flexibility. Single-chamber systems dominate due to cost-effectiveness, while dual-chamber systems are gaining traction among premium and professional users. Medium-sized backpacks (20–35 L) are the preferred choice for most backcountry adventurers, balancing storage with portability.

Application Insights

Recreational skiing represents the largest application segment, accounting for nearly 50% of market share, followed by snowboarding and split-boarding. Professional use in ski patrol and avalanche rescue drives demand for premium systems. Emerging applications include guided back-country tours and winter adventure tourism rentals, expanding market reach.

Distribution Channel Insights

Online platforms, including manufacturer websites and e-commerce marketplaces, account for roughly 40% of market share, offering convenience and wide product access. Specialty outdoor retailers remain key for professional users. Resort-based rental services are increasingly contributing to market growth, particularly in regions with expanding adventure tourism.

End-Use Insights

Back-country skiers and mountaineers are the primary end users, followed by snowboarders and split-boarders. Professional segments, including ski patrols and rescue teams, represent a growing high-value market. Expansion of ski resorts and adventure tourism in the Asia-Pacific and Latin America is creating additional export-driven demand for airbag systems.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 35% of the 2024 market (USD 87.5 million). The U.S. and Canada lead due to established backcountry skiing culture, disposable income, and widespread adoption of premium airbag systems. Resort partnerships and rental fleet expansions are supporting incremental growth.

Europe

Europe represents roughly 30% of the 2024 market (USD 75 million), led by Alpine countries such as Switzerland, Austria, France, and Italy. High awareness of avalanche risks and adoption of premium systems, including dual-chamber and electric fan models, drives market dominance.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a 2024 share of 15–20% (USD 37.5–50 million). Growth is driven by new ski resort infrastructure, adventure tourism, and rising disposable incomes in China, Japan, South Korea, and India. Export demand from Europe and North America supports adoption.

Latin America

Latin America holds a smaller share (5–7% of the 2024 market, USD 12–17.5 million), driven by emerging ski destinations in Chile, Argentina, and Brazil. Interest is growing in adventure and family-oriented skiing experiences, often supported by imported airbag systems.

Middle East & Africa

MEA represents 3–5% of the 2024 market (USD 7.5–12.5 million). Demand is niche, mainly among professional users, expedition teams, and luxury adventure tourism. Intra-African travel and GCC luxury tourists are contributing to incremental growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Avalanche Air Bags Market

- Mammut Sports Group

- ABS Protection GmbH

- Clarus Corporation (Black Diamond)

- Backcountry Access

- SCOTT Sports SA

- Ortovox

- The North Face (VF Corporation)

- Dakine

- Arva Equipment

- Mystery Ranch

- Pieps GmbH

- Deuter

- Millet (Calida Group)

- Osprey Packs

- NIC IMPEX

Recent Developments

- In March 2025, Mammut launched a new dual-chamber electric fan airbag backpack, emphasizing lightweight design and rapid deployment for backcountry skiing.

- In February 2025, ABS Protection GmbH expanded its global rental fleet partnerships with ski resorts across North America and Europe, targeting professional and guided tour segments.

- In January 2025, Clarus Corporation introduced modular airbag systems that can be integrated with multiple backpack sizes, improving usability for both recreational and professional users.