Automatic Bottle Opener Market Size

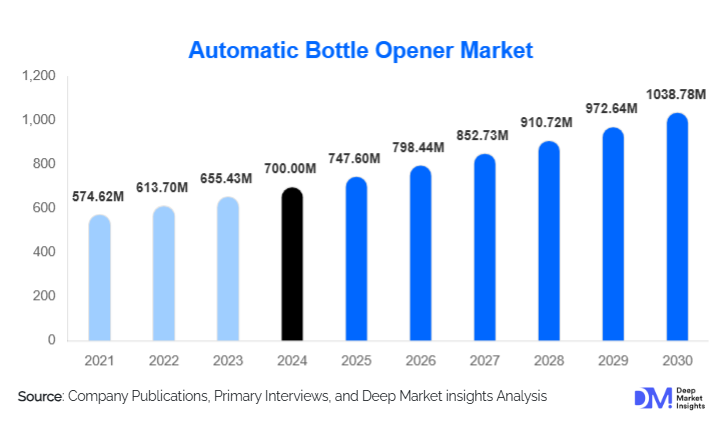

According to Deep Market Insights, the global automatic bottle opener market size was valued at USD 700 million in 2024 and is projected to grow from USD 747.60 million in 2025 to reach USD 1,038.78 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for convenience, the increasing adoption of smart home gadgets, and the growing popularity of bottled beverages across residential, hospitality, and gifting segments worldwide.

Key Market Insights

- Residential households dominate demand, with consumers seeking ergonomic, cordless, and premium-designed openers for convenience and gifting purposes.

- Technological integration is accelerating, including rechargeable batteries, LED indicators, and smart-home compatibility, enhancing user experience and driving adoption.

- North America leads the global market, supported by high disposable incomes, a mature beverage culture, and strong e-commerce penetration.

- Asia-Pacific is the fastest-growing region, fueled by rising urban middle-class incomes, growing craft beer and wine consumption, and increasing adoption of modern kitchen appliances.

- Premiumization and gift-market opportunities are expanding, with high-end and designer openers targeting affluent consumers and lifestyle-conscious buyers.

- Export-driven demand is rising, with manufacturers in Asia supplying key markets in North America and Europe, supported by e-commerce and global distribution networks.

What are the latest trends in the automatic bottle opener market?

Smart and Connected Openers

Manufacturers are increasingly introducing IoT-enabled automatic bottle openers compatible with smart home hubs such as Alexa and Google Home. App-controlled models allow users to monitor battery status, track usage, and even receive alerts for maintenance. The integration of voice-activated and touch-sensitive features is appealing to tech-savvy consumers who seek convenience, while also expanding the potential for premium and luxury offerings. Connectivity also opens opportunities for data-driven customer engagement and targeted marketing in the home appliance segment.

Premiumization and Design-Focused Products

The gift and lifestyle market is fueling demand for premium openers crafted from stainless steel, aluminum, and designer materials. Limited-edition, branded, or aesthetic-focused openers are becoming increasingly popular for weddings, housewarmings, and corporate gifting. The emphasis on sleek design, high-quality packaging, and ergonomic usability helps brands differentiate and capture higher margins, particularly in North America and Europe.

What are the key drivers in the automatic bottle opener market?

Growing Demand for Convenience

Consumers increasingly value time-saving and effortless solutions in the kitchen. Automatic openers remove the manual effort and risk of traditional openers, appealing especially to residential households, bars, and restaurants. Cordless and rechargeable models enhance mobility, making the devices suitable for both home entertaining and commercial applications. This convenience factor remains the strongest driver of adoption globally.

Rising Bottled Beverage Consumption

The surge in global consumption of wine, craft beer, soft drinks, and other bottled beverages is driving automatic bottle opener demand. Bars, pubs, and restaurants, particularly in North America and Europe, are increasingly investing in automatic openers to improve service efficiency, while households seek ease of use for personal consumption. The craft beer and premium wine markets are particularly significant contributors to growth.

Technological Advancements

Advances in motorized mechanisms, rechargeable battery technology, quiet operation, and ergonomic design are improving the reliability and usability of automatic bottle openers. These innovations are making devices more affordable and appealing, while smart-home integrations provide additional functionality. The trend towards cordless, lightweight, and app-connected openers is expected to continue, stimulating market expansion.

What are the restraints for the global market?

High Price Sensitivity

Automatic bottle openers are generally more expensive than traditional manual openers, which can limit adoption among cost-conscious consumers. Particularly in emerging markets, price-sensitive buyers may prefer affordable manual options, impacting market penetration. Premium models may face slow uptake unless their perceived value justifies the cost.

Durability and Maintenance Concerns

Reliance on motors, batteries, and electronic components introduces concerns about longevity and maintenance. Device failure, battery degradation, or repair needs can reduce consumer confidence. Users may also be cautious about safety risks such as overheating or malfunction, potentially slowing adoption in residential and hospitality sectors.

What are the key opportunities in the automatic bottle opener market?

Integration with Smart Home Systems

IoT-enabled and app-controlled openers present significant growth opportunities. Voice-activated and connected devices align with the broader smart-kitchen ecosystem, appealing to tech-savvy urban consumers. These products can also offer usage tracking, maintenance alerts, and integration with smart refrigerators or wine storage units, enhancing value propositions.

Expansion in Emerging Markets

Asia-Pacific and Latin America offer high growth potential, driven by rising disposable incomes, urbanization, and increasing adoption of western-style bottled beverages. Manufacturers can target mid-range and entry-level products to capture emerging households and hospitality businesses, while premium models can serve affluent consumers in urban centers.

Premium and Gift Market Growth

Luxury openers made from high-quality materials and designer finishes cater to gifting and lifestyle demand. Limited editions, co-branding with wine companies, and aesthetic innovations allow companies to differentiate products, enhance margins, and target affluent consumers globally. Packaging and design-led differentiation are increasingly important for expanding market share in this segment.

Product Type Insights

Cordless automatic bottle openers dominate the market, accounting for 55% of the 2024 market. Cordless models offer portability, ease of use, and flexibility, appealing to residential consumers, gift buyers, and hospitality professionals alike. Mid-range models are particularly popular, balancing affordability with reliable performance, while premium variants focus on design and smart features. Corded or plug-in openers represent a smaller share, primarily used in commercial settings requiring continuous operation.

Bottle Type Insights

Beer bottles remain the leading segment, accounting for 48% of the global market in 2024. Crown-cap beer bottles are highly common, particularly in North America and Europe, where craft beer and premium bottled beverages are popular. Wine bottle openers are also growing steadily due to rising home wine consumption and gifting trends. Soda and soft drink applications are smaller but provide niche opportunities, especially in household and office use.

Application Insights

Residential use dominates the market, representing 60% of the 2024 market, driven by convenience, gifting, and lifestyle trends. Commercial applications, including bars, pubs, restaurants, hotels, and catering services, contribute significantly to demand, especially in regions with high craft beer and wine consumption. The gift segment continues to expand as premium openers become popular for weddings, corporate gifting, and lifestyle purposes. Office and institutional applications remain niche but offer steady demand for beverage service convenience.

Distribution Channel Insights

Online retail channels dominate, leveraging e-commerce platforms and direct-to-consumer websites for convenience, variety, and access to reviews. Offline retail includes specialty kitchenware stores, mass retailers, and hospitality suppliers, which continue to serve traditional buyers. E-commerce growth has been particularly strong in North America and Europe, while emerging markets increasingly adopt online purchasing for convenience and access to premium products. B2B distribution to bars, restaurants, and hotels remains significant for commercial demand.

| By Product Type | By Bottle Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for 35–40% of global demand in 2024. The U.S. and Canada lead adoption, driven by high disposable incomes, mature beverage culture, and strong e-commerce penetration. Cordless and premium openers are particularly popular, with significant uptake in residential and hospitality segments. Growth is expected to continue, supported by lifestyle trends, gifting demand, and smart-home integration.

Europe

Europe accounts for 25–30% of the market, with Germany, France, the U.K., Italy, and Spain as major contributors. Premium and designer openers are particularly popular, supported by strong wine culture and gifting trends. Hospitality and commercial adoption are significant, especially in urban centers. The region is seeing growth in smart-home compatible products and sustainable designs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, South Korea, and Australia. Rising middle-class income, urbanization, and growing consumption of bottled beverages are accelerating demand. Both mid-range and premium openers are gaining traction, supported by increasing e-commerce adoption and smart-kitchen trends.

Latin America

Latin America represents 5–8% of the market, with Brazil, Mexico, and Argentina as key markets. Adoption is driven by urban consumers and the growing F&B sector, although cost sensitivity limits broader penetration. Premium gifting and lifestyle trends are emerging as niche opportunities.

Middle East & Africa

MEA accounts for 3–7% of global demand. The UAE, Saudi Arabia, Qatar, South Africa, and Nigeria are key markets. Growth is supported by luxury hospitality, gifting culture, and premium lifestyle adoption. While market penetration remains limited compared to developed regions, affluent consumers and hospitality-driven demand are expected to grow steadily.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Automatic Bottle Opener Market

- Zwilling

- Beneno

- Brabantia

- Cuisinart

- Ivation

- Kikkerland

- Oster

- Ozeri

- Peugeot

- Pulltex

- Rabbit

- Secura

- Tyzine

- Wine Enthusiast

- Chef Craft

Recent Developments

- In 2025, Zwilling launched a new cordless, rechargeable automatic bottle opener with an LED indicator and ergonomic design targeting premium home users.

- In early 2025, Cuisinart introduced a smart-app-connected wine opener for the U.S. and European markets, integrating with voice assistants.

- In mid-2024, Brabantia expanded its premium gifting line, releasing designer openers with stainless steel and brushed-aluminum finishes, aimed at weddings and corporate gifts.