Automatic Baby Swing Market Size

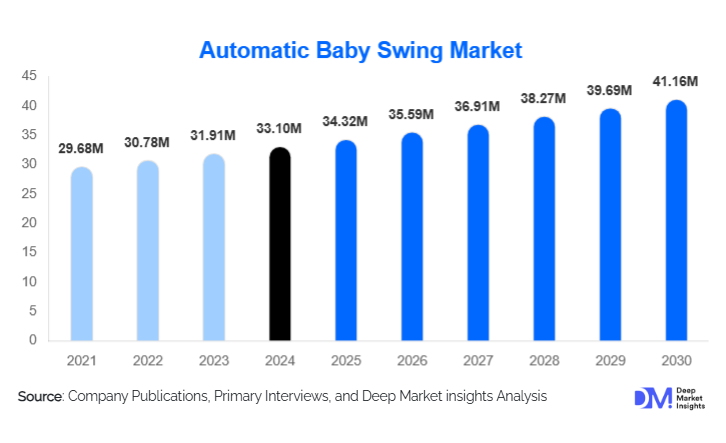

According to Deep Market Insights, the global automatic baby swing market size was valued at USD 33.1 million in 2024 and is projected to grow from USD 34.32 million in 2025 to reach USD 41.16 million by 2030, expanding at a CAGR of 3.7 during the forecast period (2025–2030). Market growth is driven by increasing adoption of smart childcare devices, rising disposable income among young parents, and growing awareness of infant safety and comfort. The integration of technology such as Bluetooth, app connectivity, and automated motion controls is further enhancing consumer demand globally.

Key Market Insights

- Technologically advanced baby swings with smart features are gaining popularity, offering automated rocking, music integration, and sleep monitoring functions that cater to modern parents’ preference for convenience and infant well-being.

- Rising dual-income households are boosting demand for time-saving childcare products, particularly in urban areas where working parents seek automated solutions to soothe infants.

- North America dominates the market, driven by high disposable income, advanced retail infrastructure, and a strong focus on premium baby products in the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, fueled by rising birth rates in India and China, increasing urbanization, and the expansion of e-commerce channels facilitating access to baby care products.

- Europe remains a mature market, with growing preference for eco-friendly, energy-efficient, and ergonomically designed baby swings in countries such as Germany, the U.K., and France.

- Technological integration, including AI-assisted swinging patterns and smartphone-controlled operations, is enhancing user convenience and enabling differentiation among manufacturers.

What are the latest trends in the automatic baby swing market?

Smart and App-Connected Baby Swings

Smart swings with app connectivity are transforming the market. Parents can remotely control swing speed, monitor baby sleep patterns, and play soothing music via smartphone applications. Such integration appeals strongly to tech-savvy millennial and Gen Z parents seeking convenience and peace of mind. In addition, AI-powered sensors that detect baby motion and adjust swinging intensity are increasingly being incorporated, improving product value and safety. These features are driving higher adoption in both developed and emerging markets.

Eco-Friendly and Energy-Efficient Swings

Consumer preference is shifting toward sustainable baby products. Manufacturers are introducing swings made from recyclable materials, low-power motors, and non-toxic components to appeal to environmentally conscious buyers. The trend is especially strong in Europe and North America, where regulatory frameworks encourage the use of eco-certified baby products. Energy efficiency and low noise levels are also key considerations, enhancing consumer trust and product adoption.

What are the key drivers in the automatic baby swing market?

Growing Dual-Income Families

With increasing numbers of dual-income households worldwide, there is a greater reliance on automated childcare solutions. Automatic baby swings reduce the burden on working parents, allowing them to multitask while ensuring infant comfort and safety. This driver is particularly strong in urbanized regions such as North America, Europe, and parts of the Asia-Pacific.

Rising Adoption of Smart Baby Products

Parents are increasingly embracing technology-driven baby products for monitoring, convenience, and enhanced care. Features like motion sensors, app connectivity, and multi-speed swinging are becoming standard expectations, driving the premium segment of the market. Retailers are leveraging online platforms to highlight these innovations, boosting overall market growth.

Increasing Awareness of Infant Safety and Comfort

Parents are prioritizing products that support healthy sleep and soothe infants effectively. Automatic baby swings reduce stress on caregivers while providing consistent motion patterns designed for infant comfort. Certifications for safety standards (ASTM, EN 16232) are influencing purchase decisions, particularly in North America and Europe, where regulatory compliance drives consumer trust.

Market Restraints

High Product Costs

Premium automatic baby swings remain expensive, limiting adoption among price-sensitive consumers, particularly in emerging markets. High costs associated with advanced features such as Bluetooth connectivity and AI-assisted motion can be a barrier for low- to mid-income households.

Regulatory and Safety Compliance Challenges

Manufacturers must comply with stringent safety standards, which vary across regions. Non-compliance risks product recalls, impacting brand reputation, and limiting market expansion. Safety concerns regarding improper usage, battery safety, and material toxicity also act as restraints to growth.

What are the key opportunities in the automatic baby swing market?

Expansion in Emerging Markets

Countries in Asia-Pacific, Latin America, and the Middle East present untapped potential. Rising birth rates, urbanization, and growing disposable income in India, China, Brazil, and GCC nations are driving demand for convenient infant care solutions. Establishing a strong e-commerce presence and localized marketing strategies can accelerate adoption in these regions.

Integration with Smart Home Ecosystems

Opportunities exist to integrate automatic baby swings with smart home devices, including voice assistants, home automation systems, and IoT-enabled monitoring. Such connectivity allows parents to control swings remotely, enhancing convenience and creating a premium segment that commands higher margins.

Eco-Friendly and Sustainable Product Innovations

Manufacturers can capitalize on the trend of environmentally conscious parenting by introducing swings made from sustainable materials, energy-efficient motors, and non-toxic finishes. Certifications like FSC wood approval or low-energy usage labels can differentiate products and drive market share, particularly in Europe and North America.

Product Type Insights

Motorized/automatic swings dominate the market, accounting for 55% of the 2024 market share. These swings lead due to convenience, programmable motion settings, and enhanced safety features compared to manual swings. Cradle-style swings follow, favored for compact design and portability, particularly in urban households. The trend of multi-function swings with built-in music, vibration, and night-light features is accelerating, contributing to higher revenue per unit.

Application Insights

The primary application remains residential use, representing 70% of the 2024 market. Commercial use in daycare centers, pediatric clinics, and infant therapy centers is emerging as a growth segment. Export-driven demand is rising, with North America, Europe, and the Asia-Pacific leading as top importers of high-end automatic swings, reflecting a growing global market footprint.

Distribution Channel Insights

E-commerce platforms account for nearly 45% of total sales, enabling convenient access to premium products, real-time reviews, and competitive pricing. Offline retail through specialty baby stores, hypermarkets, and brand-exclusive outlets remains significant, particularly in Europe and North America. Direct-to-consumer strategies via brand websites are gaining traction as manufacturers aim to control pricing and improve margins.

End-Use Insights

Households with infants represent the largest end-use segment, contributing to approximately 75% of the 2024 market. Rapid urbanization, dual-income families, and lifestyle convenience are driving growth. Daycare centers and infant therapy facilities are emerging as additional end-use segments, creating new demand for commercial-grade swings. Exports to developed countries remain significant, highlighting the market’s global reach and cross-border growth potential.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global market. The U.S. is the primary driver due to high consumer purchasing power, awareness of infant safety, and preference for smart baby products. Canada follows with steady growth. Adoption of smart, connected, and multi-functional swings is particularly strong in urban and suburban areas.

Europe

Europe represents 25% of the global market, led by Germany, the U.K., and France. Eco-friendly designs, safety certification, and premium pricing are key growth factors. Younger parents are increasingly adopting automated swings integrated with smart home technology.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by India and China, with increasing disposable income, rising birth rates, and expansion of online retail channels. Urban households are adopting high-end swings for convenience and infant well-being.

Latin America

Brazil, Mexico, and Argentina are leading markets, with gradual adoption fueled by rising middle-class awareness of infant care solutions. E-commerce platforms are facilitating market penetration in these countries.

Middle East & Africa

The GCC nations, particularly the UAE and Saudi Arabia, are witnessing increased adoption due to high-income families and a preference for premium baby products. Africa is still nascent, with growth opportunities primarily in urban centers of South Africa and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Automatic Baby Swing Market

- Fisher-Price

- Graco

- 4moms

- Chicco

- Ingenuity

- Bright Starts

- Evenflo

- Joie

- BabyBjörn

- Summer Infant

- Kolcraft

- Skip Hop

- Nuna

- Rockabye Baby

- Hauck

Recent Developments

- In March 2025, 4moms launched an AI-enabled baby swing with automated soothing patterns and smartphone integration, enhancing remote monitoring and convenience.

- In February 2025, Fisher-Price introduced a sustainable baby swing line made from recyclable plastics and low-energy motors for the European market.

- In January 2025, Graco expanded its e-commerce distribution in Asia-Pacific, targeting India and China with localized digital marketing campaigns.