Auto-Scrubber Market Size

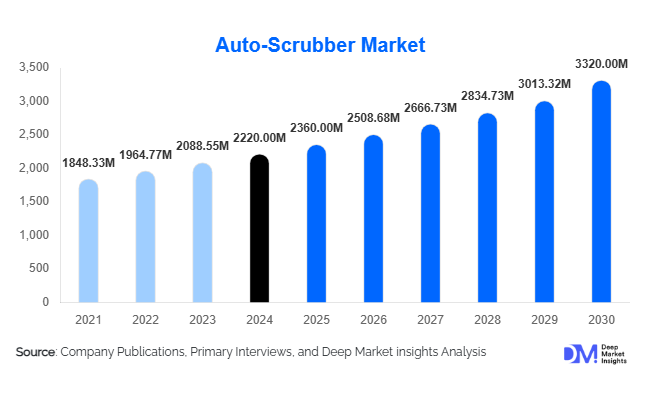

According to Deep Market Insights, the global auto-scrubber market size was valued at USD 2,220 million in 2024 and is projected to grow from USD 2,360 million in 2025 to reach USD 3,320 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for automated and efficient cleaning solutions across commercial, industrial, and healthcare facilities, coupled with technological innovations such as autonomous operation, battery efficiency, and IoT integration.

Key Market Insights

- Automated cleaning solutions are gaining traction as facilities seek labor optimization, hygiene consistency, and operational efficiency.

- Battery-powered and robotic auto-scrubbers are expanding globally, providing energy efficiency, reduced human intervention, and suitability for large-scale applications.

- North America dominates the market, driven by high adoption in commercial and industrial facilities and stringent hygiene regulations.

- Asia-Pacific is the fastest-growing region, supported by rapid industrialization, urbanization, and investments in public infrastructure.

- Europe continues to invest heavily in advanced cleaning technology, driven by regulatory standards and commercial facility expansion.

- Technological adoption, including autonomous scrubbers, IoT-enabled monitoring, and predictive maintenance, is reshaping operational efficiency and service models.

Latest Market Trends

Shift Towards Autonomous and Smart Cleaning Solutions

Auto-scrubber manufacturers are increasingly integrating autonomous navigation and smart monitoring technologies. Robotic scrubbers equipped with sensors, AI-powered navigation, and IoT connectivity are gaining adoption in airports, hospitals, and large commercial spaces. These solutions not only reduce labor dependency but also improve cleaning accuracy, water efficiency, and operational tracking. Predictive maintenance systems allow facility managers to schedule maintenance proactively, minimizing downtime. The trend reflects a broader shift toward Industry 4.0-inspired smart cleaning technologies and aligns with sustainability goals by reducing energy and water usage.

Eco-Friendly and Energy-Efficient Cleaning Solutions

Battery-powered and low-water-consumption auto-scrubbers are increasingly preferred due to rising environmental awareness and ESG compliance among organizations. Innovations in brush technology, battery life, and water recycling systems allow for greener operations. Companies integrating eco-friendly designs gain a competitive advantage, especially in healthcare and education sectors, where sustainability standards are becoming mandatory. This trend also enhances the market’s appeal to multinational corporations seeking compliance with corporate social responsibility and environmental targets.

Auto-Scrubber Market Drivers

Rising Hygiene and Safety Standards

The need for consistently clean environments across healthcare, commercial, and industrial facilities is a key growth driver. Hospitals, airports, hotels, and offices require automated cleaning to prevent infections and ensure operational efficiency. The post-pandemic emphasis on hygiene has accelerated demand for reliable, high-performance auto-scrubbers capable of maintaining sanitary standards.

Labor Cost Optimization

Increasing wages and labor shortages in developed markets have prompted facility managers to adopt ride-on and robotic scrubbers. These solutions minimize human intervention, reduce staffing costs, and improve cleaning consistency. Organizations seeking ROI-driven operations are investing in automation to balance cost and productivity.

Technological Advancements

Innovations such as IoT-enabled monitoring, predictive maintenance, and autonomous navigation are boosting market adoption. These technologies allow real-time usage tracking, energy efficiency monitoring, and reduced downtime, enhancing the overall operational effectiveness of cleaning solutions.

Market Restraints

High Initial Investment

Advanced ride-on and robotic auto-scrubbers require substantial upfront investment, which limits adoption among small businesses and in emerging markets. While the machines offer long-term efficiency, the initial cost barrier is a significant restraint to widespread market penetration.

Maintenance and Technical Complexity

Sophisticated systems require skilled personnel and higher maintenance costs. Lack of trained staff or service infrastructure in certain regions may slow adoption. Additionally, replacement parts for advanced batteries or sensors can be expensive, posing a challenge for smaller organizations or cost-sensitive buyers.

Auto-Scrubber Market Opportunities

Expansion into Emerging Economies

Rapid urbanization, industrialization, and commercial expansion in countries like India, Brazil, and Vietnam create opportunities for mid-range and affordable auto-scrubber solutions. Manufacturers targeting cost-effective, battery-powered, or semi-autonomous models can tap into these growing markets while addressing local operational needs.

Technological Innovation and IoT Integration

IoT-enabled auto-scrubbers offer predictive maintenance, remote monitoring, and optimized cleaning schedules, creating opportunities for subscription-based service models. Robotic solutions and smart analytics allow manufacturers to differentiate products and target high-value clients seeking efficiency and operational insights.

Government Infrastructure Spending

Initiatives such as “Smart Cities” and public infrastructure investments in hospitals, schools, and airports are boosting demand for automated cleaning solutions. Strategic partnerships with contractors and municipalities provide manufacturers opportunities for large-scale deployments and long-term recurring revenue streams.

Product Type Insights

Ride-on auto-scrubbers lead the global market, capturing approximately 45% share in 2024. Their high capacity, labor efficiency, and suitability for industrial and large commercial facilities make them the preferred choice. Walk-behind scrubbers are gaining adoption in small and mid-sized commercial spaces, while robotic and autonomous scrubbers are growing rapidly due to labor-saving advantages and technological appeal in high-end facilities.

Application Insights

Commercial facilities dominate the end-use segment, accounting for 40% of market demand. Hospitals and healthcare centers are adopting robotic and battery-powered solutions to maintain strict hygiene standards. Industrial facilities, warehouses, and logistics centers also require high-capacity ride-on scrubbers. Emerging applications include educational institutions, transportation hubs, and public infrastructure, driving export-oriented demand from North America and Europe to developing regions.

Distribution Channel Insights

Direct sales account for 55% of market adoption, particularly for industrial and healthcare buyers seeking customized solutions and maintenance contracts. Distributor networks and dealers remain relevant for mid-sized businesses, while online sales are growing for smaller, battery-operated scrubbers. Digital marketing and e-commerce are increasingly influencing buyer preferences.

| By Product Type | By Operation Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 35% of the global market, led by the U.S., driven by stringent hygiene standards, advanced infrastructure, and high adoption of robotic and battery-powered scrubbers. Canada shows moderate growth with rising demand in hospitals and commercial facilities.

Europe

Europe accounts for 30% of the market, with Germany and the U.K. leading due to industrial expansion and regulatory hygiene compliance. France and Italy follow closely. The trend is toward energy-efficient, IoT-enabled solutions in commercial and healthcare sectors.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of 7.2%, led by China, India, and Japan. Rapid industrialization, commercial real estate expansion, and public infrastructure investment drive high demand for automated cleaning solutions. Emerging adoption in hospitals and large public spaces further boosts growth.

Latin America

Brazil and Argentina are driving growth, primarily in commercial and industrial applications. While adoption is currently smaller than in developed regions, increasing awareness of operational efficiency and labor savings is expanding demand.

Middle East & Africa

The UAE and Saudi Arabia are leading regional adoption, fueled by high-income commercial facilities and public infrastructure projects. Africa represents growth potential, particularly in healthcare and large-scale commercial cleaning solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Auto-Scrubber Market

- Tennant Company

- Nilfisk

- Karcher

- Hako GmbH

- IPC Eagle

- Diversey, Inc.

- Columbus Cleaning Equipment

- Fimap

- Minuteman International

- Cleanfix Maschinenbau

- Viper Cleaning

- Comac

- Gansow GmbH

- Adiatek

- Taski

Recent Developments

- In March 2025, Tennant Company launched a new autonomous scrubber with IoT-enabled predictive maintenance features for hospitals in North America.

- In January 2025, Nilfisk introduced a high-capacity battery-powered ride-on scrubber for industrial facilities in Europe and APAC.

- In June 2024, Karcher expanded its robotic scrubber portfolio in Asia-Pacific, targeting airports and commercial facilities with automated cleaning solutions.