Augmented Reality (AR) Gaming Market Size

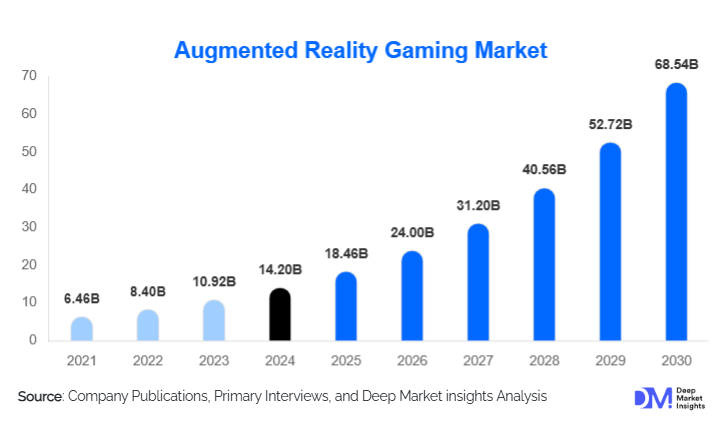

According to Deep Market Insights, the global augmented reality (AR) gaming market size was valued at USD 14.2 billion in 2024 and is projected to grow from USD 18.46 billion in 2025 to reach USD 68.54 billion by 2030, expanding at a strong CAGR of 30% during the forecast period (2025–2030). Market growth is driven by rapid adoption of AR-enabled devices, rising demand for immersive and location-based gaming, advancements in 5G and cloud rendering, and increasing consumer appetite for interactive real-world digital experiences.

Key Market Insights

- Smartphone AR dominates as the most accessible device type, making up the largest share of the AR gaming market thanks to its ubiquity and low entry barrier.

- In-app purchase (IAP) monetization leads in AR gaming, where players frequently spend on virtual goods, power-ups, and cosmetic upgrades.

- Location-based and real-world AR games are the most popular genre, driving engagement by blending physical exploration with digital play.

- Consumer entertainment remains the core end-user segment, accounting for the largest portion of AR gaming revenue as individuals play on mobile and at home.

- North America is the largest regional market, fueled by strong smartphone adoption, high spending power, and mature game-development ecosystems.

- Asia-Pacific is emerging as the fastest-growing region, with nations like China and India undergoing rapid growth due to mobile-first gaming culture and infrastructure investments.

What are the latest trends in the AR gaming market?

Location-Based Social Gaming Explosion

AR game developers are increasingly designing experiences that overlay digital game mechanics onto physical environments, turning cities, parks, and public spaces into game worlds. This trend is being fueled by improved geospatial technologies, highly accurate GPS tracking, and more sophisticated AR tools. Players can now interact socially in real time while exploring real-world locations, creating powerful word-of-mouth and viral growth loops. Brands and local businesses are capitalizing on this trend to run AR-based scavenger hunts, promotions, and city tours, creating novel partnerships that monetize foot traffic and engagement.

Gamified Fitness and Health in AR

The fusion of AR and fitness is powering a new genre in which workouts become playful and immersive. AR fitness games motivate people to move, walk, run, stretch, or exercise by embedding exercise routines in engaging, game-like narratives. These experiences appeal not just to gamers but to wellness-driven consumers seeking fun and motivation in their fitness routines. Insurance firms, gyms, and health platforms are starting to integrate AR gamified wellness programs, offering incentive-based models and social sharing of fitness achievements.

Persistent Worlds and Cloud-Powered AR

Advancements in cloud rendering and edge computing are ushering in persistent, multi-player AR environments that feel alive even when individual players are offline. Thanks to low-latency 5G and stronger cloud infrastructure, developers are creating real-time, shared AR universes where players can leave digital content in physical locations, collaborate, and compete. This trend is strengthening retention, enabling live-ops (in-game events, updates), and making AR gaming more dynamic and socially engaging.

What are the key drivers in the AR gaming market?

Device Proliferation

The widespread adoption of AR-capable devices, smartphones, tablets, and increasingly, smart glasses and head-mounted displays, is a primary driver of market expansion. The falling cost of entry-level hardware and improvements in performance make it easier for a broad consumer base to access AR gaming. As more users own capable devices, the addressable gaming audience grows significantly.

5G and Cloud Infrastructure Maturity

The global rollout of 5G networks and the growth of edge-cloud computing infrastructure enable real-time, low-latency AR experiences. Developers are no longer constrained by the processing power of individual devices and can offload rendering tasks to the cloud. This frees up devices to deliver high-fidelity graphics and persistent world features, thereby enhancing engagement and scalability.

Social & Immersive Interaction Demand

Gamers today increasingly seek experiences that blend social interaction with immersive, real-world exploration. AR gaming satisfies this by providing shared experiences in physical spaces, social AR gaming, competitive multiplayer outings, and co-created content. This social element drives repeated engagement and retention, making AR gaming not just a solo pastime but a shared activity.

What are the restraints for the global market?

Privacy, Safety & Mapping Risks

Many AR games rely on location data, camera access, and detailed mapping of real-world spaces, which raises significant privacy and regulatory concerns. Players may be reluctant to share sensitive data, and regulators may impose stricter rules around geospatial tracking. In addition, physical safety risks (e.g., accidents while playing outdoors) remain a serious concern for developers and authorities alike, potentially slowing mass adoption.

High Cost & Fragmented Hardware

While entry via smartphones is affordable, premium AR hardware, such as head-mounted displays and smart glasses, is still costly and fragmented across manufacturers. The diversity of platforms, SDKs, and device capabilities complicates development and cross-compatibility. High production and R&D costs for hardware also limit rapid scaling, slowing the adoption of immersive AR experiences beyond mobile.

What are the key opportunities in the AR gaming industry?

Smart City & Location-Based Gamification

As cities invest in smart infrastructure and urban planners look for novel engagement models, AR gaming can be deeply embedded into urban life. City authorities and tourism boards can partner with AR developers to build gamified tours, AR-powered public art, and interactive wayfinding systems. Such initiatives not only drive local economic activity but also deepen civic engagement and tourism appeal. For AR gaming companies, this represents a B2B opportunity to license software, host branded events, and co-create persistent AR experiences tied to public infrastructure.

Health & Wellness Gamified AR

The booming wellness sector provides fertile ground for AR game providers. Fitness gamification via AR can partner with sportswear brands, health insurers, and wellness platforms to encourage physical activity through game mechanics. Developers can build subscription-based AR fitness games or incentive-driven reward systems tied to healthy behavior. As individuals and insurers increasingly invest in preventive health, AR games can uniquely combine entertainment with measurable wellness outcomes.

Enterprise and Commercial Venues Adoption

Commercial venues – such as theme parks, malls, event spaces, hotels, and tourism hotspots – represent a huge opportunity for AR game integration. These venues can offer AR experiences as part of their attractions: interactive scavenger hunts, AR-themed events, and branded storytelling. AR companies can offer turnkey solutions (games-as-a-service) for venues, enabling flexible monetization through licensing, ticketing, or brand tie-ups. Moreover, government-led tourism and smart-city programs may subsidize such gamified experiences to boost footfall and engagement.

Product Type Insights

Within the AR gaming market, mobile AR games (smartphones/tablets) dominate due to their accessibility and reach, offering a low-cost entry for a broad consumer base. Head-mounted displays (HMDs) and smart glasses are gaining traction for more immersive and dedicated experiences, especially among early adopters and hardcore gamers. Meanwhile, projected or spatial AR systems (room-scale projections) are emerging in location-based entertainment venues, enabling highly interactive, large-area gaming experiences. These product types cater to different use cases, casual, social, and venue-based, and collectively drive the overall market.

Application (Genre) Insights

Location-based AR games remain the most dominant genre, using real-world mapping and GPS to anchor gameplay. Marker-based AR games (using QR codes or beacons) are common in educational or event-driven contexts. Mixed-reality hybrid games are rising, combining persistent digital worlds with physical interaction. Additionally, fitness/health AR games (play-to-move), RPG/adventure, and casual puzzle AR genres are all expanding as developers innovate with cross-disciplinary content.

Distribution Channel Insights

AR games are primarily distributed through mobile app stores (iOS App Store, Google Play), which remain the dominant channels. WebAR (browser-based AR) is also growing, enabling easy access without installation. For venue-based AR experiences, distribution happens via direct licensing to parks, malls, or event organizers, or through B2B platforms tailored to venue operators. Live-ops platforms, subscription models, and branded experiences (sponsored by retailers or tourism boards) are increasingly used to monetize AR gaming content.

User Demographics & Engagement Insights

The majority of AR gamers are young adults (18–35 years), drawn by social play, location-based exploration, and mobile convenience. However, as AR becomes more immersive and fitness-driven, older age groups (35–50) are also showing strong engagement, particularly in wellness AR games. Casual gamers make up a large share, but as hardware adoption grows, hardcore and mixed-reality gamers are increasingly participating in more immersive AR experiences. Geographic penetration is broadening, with early adopters in North America and Europe, and rapidly growing user bases in the Asia-Pacific.

| By Platform Type | By Technology | By Game Genre | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the AR gaming market (approximately 35–40% in 2024). The United States leads due to high smartphone penetration, well-developed game development ecosystems, strong consumer spending, and mature technology infrastructure. Canadian adoption is also growing steadily. The region benefits from active R&D in AR hardware, strong venture funding, and partnerships between game studios and technology firms.

Asia-Pacific

Asia-Pacific is the fastest-growing region in AR gaming. Countries such as China, India, Japan, and Southeast Asian nations are experiencing rapid adoption. In China, rising 5G deployment, a mobile-first gaming culture, and strong local developers are key growth drivers. In India, cheaper smartphones and an expanding youth population are fueling demand. Japan brings high-tech adoption and innovation, while Southeast Asia combines a young demographic with increasing disposable income. By 2030, APAC is expected to account for a very significant portion of global AR gaming revenues.

Europe

Europe’s AR gaming market, accounting for around 20–25% of global value in 2024, is driven by countries such as the U.K., Germany, and France. The region’s strong developer talent, supportive regulation, and consumer willingness to pay for high-quality gaming experiences support growth. European gamers are particularly interested in location-based and socially interactive AR titles, spurred by a culture of public events, tourism, and technology adoption.

Latin America

Latin America is an emerging AR gaming market, led by Brazil, Mexico, and Argentina. Growth is being driven by rising smartphone adoption and a rapidly developing gaming culture. Although device affordability and infrastructure pose challenges, local developers and international studios are increasingly targeting LATAM with mobile AR titles and location-based experiences tailored to regional tastes.

Middle East & Africa

The MEA region is showing nascent but meaningful growth in AR gaming. Key centers include the UAE, Saudi Arabia, South Africa, and Egypt. These markets are investing in smart-city infrastructure, tourism, and entertainment, creating fertile ground for location-based AR experiences. In addition, domestic interest from tech-savvy youth is pushing demand for mobile AR games, while event-driven and venue-based AR concepts are being explored by local operators.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the AR Gaming Market

- Niantic

- Meta Platforms

- Apple

- Microsoft

- Unity Technologies

- Snap Inc.

- Magic Leap

- Qualcomm

- Blippar

- Vuzix

- PTC

- Zappar

- Cluetivity

- Wikitude

Recent Developments

- In 2025, Niantic’s games business was acquired by Scopely in a major deal, underlining the rising value of AR gaming IP and recurring-revenue live-ops.

- Meta continues heavy investment in its Reality Labs division, signaling a long-term commitment to spatial computing despite near-term hardware losses.

- Apple’s Vision Pro is gaining developer traction, with more AR-native games optimized for spatial interactivity and immersive experiences.

- Magic Leap, focused on spatial mapping and enterprise AR, is forming partnerships with gaming studios and location-based venues to deploy large-scale immersive experiences.