Aspherical Lens Market Size

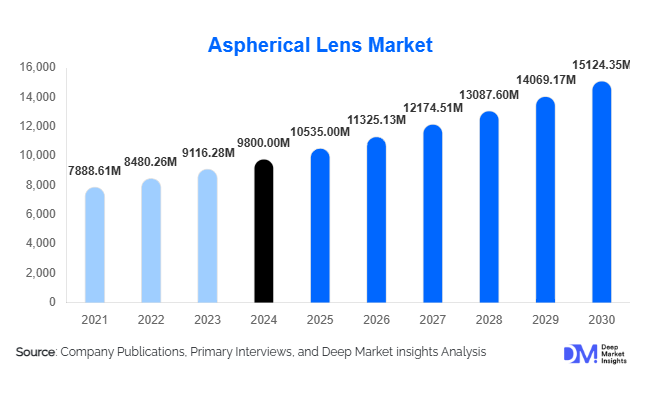

According to Deep Market Insights, the global aspherical lens market size was valued at USD 9,800 million in 2024 and is projected to grow from USD 10,535.00 million in 2025 to reach USD 15,124.35 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The aspherical lens market growth is primarily driven by increasing integration of high-precision optics in smartphones, LiDAR systems, medical imaging, and industrial automation. Rising adoption of lightweight, compact optical assemblies and continuous technological innovations in precision glass molding are further accelerating global demand.

Key Market Insights

- Aspherical glass lenses dominate the market, accounting for nearly 67% of revenue in 2024 due to their superior optical quality and stability.

- Asia-Pacific leads the global market with about 56% share in 2024, driven by high manufacturing concentration in China, Japan, and South Korea.

- Precision glass molding technology holds the largest manufacturing share (44%), enabling cost-efficient high-volume production.

- Automotive and medical imaging applications represent the fastest-growing segments, fueled by ADAS integration and diagnostic innovation.

- Wafer-level and hybrid lens fabrication techniques are emerging, allowing miniaturized optics for AR/VR and wearable devices.

- Competitive intensity is moderate, with the top five players, Canon, Nikon, Zeiss, HOYA, and AGC, holding 35–40% market share.

Latest Market Trends

Growing Demand for Automotive LiDAR and ADAS Optics

Automotive manufacturers are integrating multiple optical sensors for advanced driver assistance and autonomous driving. Aspherical lenses enable wide-angle, high-precision imaging with minimal aberration, making them indispensable in LiDAR and camera systems. The growing emphasis on safety regulations, vehicle automation, and enhanced visibility systems has spurred global OEMs to source precision-molded glass lenses. This trend is reinforced by the mass production of electric and autonomous vehicles across Asia and Europe, further boosting aspherical optics demand.

Hybrid and Wafer-Level Lens Fabrication

Recent advances in hybrid glass-polymer molding and wafer-level microlens manufacturing are transforming cost and scalability in optics production. These innovations allow for ultra-compact lens arrays suitable for smartphones, AR/VR headsets, and medical micro-imaging tools. Hybrid lenses balance the durability of glass with the flexibility of polymer, achieving both precision and lightweight design. Manufacturers investing in wafer-scale processes are gaining a competitive advantage through reduced material waste, improved yield, and seamless integration into semiconductor production lines.

Aspherical Lens Market Drivers

Miniaturization in Consumer Electronics

Smartphones and tablets now feature multiple high-resolution camera modules that demand thinner and lighter optical assemblies. Aspherical lenses reduce aberrations and component count, enabling compact camera systems. This has made them standard in premium and mid-range smartphones, driving significant volume demand globally.

Automotive Sensor Integration

The rapid proliferation of ADAS and LiDAR systems has positioned aspherical lenses as a core component in automotive vision technology. Their ability to provide wide fields of view and superior image clarity enhances detection accuracy in safety systems, fueling adoption by major OEMs and Tier-1 suppliers worldwide.

Advances in Optical Manufacturing Technology

Precision glass molding and free-form lens production have significantly lowered manufacturing costs while improving consistency. These advancements, coupled with automation and AI-based surface inspection, are driving broader adoption of aspherical lenses in diverse applications, including medical, aerospace, and industrial imaging.

Market Restraints

High Manufacturing Cost and Complexity

Producing aspherical lenses requires expensive tooling, precision alignment, and sophisticated metrology systems. High defect rates during molding or polishing increase costs, limiting entry for small and mid-tier manufacturers and constraining price competitiveness in lower-margin consumer applications.

Price Pressure and Technological Substitution

Intense competition in consumer electronics and the availability of software-based image correction reduce reliance on high-end optical components. This price compression, along with short product lifecycles, challenges profitability for lens makers serving high-volume consumer segments.

Aspherical Lens Market Opportunities

Expansion in Automotive and LiDAR Applications

With ADAS penetration increasing globally, automotive manufacturers are integrating multiple cameras and sensors per vehicle. Aspherical lenses providing precision, compactness, and durability will see surging demand across LiDAR, night vision, and rear-view systems. Collaborations between lens makers and automotive Tier-1 suppliers are expected to create significant revenue opportunities through 2030.

AR/VR and Wearable Optics Innovation

The rising adoption of augmented and virtual reality devices presents vast opportunities for lightweight, high-performance optics. Aspherical lenses improve the field-of-view and reduce distortion in head-mounted displays. Manufacturers developing ultra-thin free-form lenses can cater to next-generation wearable and mixed-reality platforms.

Localization of Optics Manufacturing

Governments promoting local production under initiatives such as “Make in India” and “Made in China 2025” are fostering domestic optical manufacturing. This regionalization trend enables cost advantages, reduced import dependency, and enhanced export potential for regional players investing in high-precision molding and assembly facilities.

Product Type Insights

Glass aspherical lenses dominate with around 67% market share in 2024, preferred for superior optical accuracy, thermal stability, and scratch resistance. Plastic aspherical lenses are gaining ground in low-cost applications like smartphone modules and VR optics due to their lightweight properties and scalability. Hybrid lenses, combining polymer flexibility with glass clarity, are emerging as a growth category for automotive and AR applications, balancing performance and production efficiency.

Technology Insights

Precision glass molding remains the leading technology, holding about 44% share in 2024, driven by mass production of consistent, high-quality lenses. Grinding and polishing retain significance in custom, high-end optics for medical and defense applications, while wafer-level fabrication is emerging as the fastest-growing technology due to its role in micro-optical systems for sensors and AR/VR devices.

Application Insights

Smartphone and tablet camera modules accounted for 37% of the aspherical lens market in 2024, driven by multi-camera adoption. Automotive systems are projected to grow fastest, fueled by LiDAR and ADAS integration. Medical imaging and industrial optics follow as key value-generating segments with strong long-term prospects, especially for precision diagnostics and laser-based inspection systems.

End-Use Industry Insights

Consumer electronics held 44% of market revenue in 2024, owing to large-scale smartphone and camera production. Automotive and medical end-use industries are growing rapidly, driven by optical sensor integration and diagnostic equipment demand. Emerging sectors such as AR/VR, drones, and robotics are expected to provide new revenue streams as aspherical optics enable smaller, lighter, and smarter imaging systems.

| By Product Type | By Application | By End-Use Industry | By Manufacturing Process | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global aspherical lens market with a 56% share in 2024, led by China, Japan, and South Korea. The region benefits from strong electronics manufacturing ecosystems, optical component supply chains, and government-backed industrial expansion. China is the largest producer and exporter, while Japan remains a hub for high-precision optical innovation. India is emerging rapidly, supported by electronics manufacturing initiatives and rising domestic demand.

North America

North America contributes about 22% of global revenue, driven by demand for high-end optics in medical imaging, aerospace, and autonomous vehicles. The U.S. leads regional growth through investments in LiDAR technology, AR/VR devices, and advanced R&D in optical materials and nanofabrication.

Europe

Europe accounts for approximately 16% of the global market, with Germany, the U.K., and France at the forefront of automotive and industrial optics manufacturing. Growth is supported by leading optical research institutions and the increasing production of imaging systems for industrial automation and healthcare.

Latin America

Latin America holds a modest share of 3–4%, with growth driven by emerging automotive assembly and electronics industries in Brazil and Mexico. Local manufacturing is limited, but import-based supply supports regional demand for optical sensors and imaging systems.

Middle East & Africa

The region represents about 3% of the market, mainly focused on defense, surveillance, and infrastructure applications. Countries such as the UAE and Saudi Arabia are investing in optical technologies as part of broader industrial diversification initiatives, while South Africa leads regional adoption in security and industrial imaging.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Aspherical Lens Market

- Canon Inc.

- Nikon Corporation

- Carl Zeiss AG

- HOYA Corporation

- AGC Inc.

- Largan Precision Co., Ltd.

- Sunny Optical Technology Group

- Panasonic Holdings Corporation

- Calin Technology Co., Ltd.

- Tokai Optical Co., Ltd.

- Essilor Luxottica

- Schneider Optics Inc.

- Asphericon GmbH

- Edmund Optics Inc.

- Thorlabs Inc.

Recent Developments

- In July 2025, Nikon Corporation expanded its glass molding facility in Thailand to boost aspherical lens capacity for automotive optics.

- In May 2025, Canon Inc. announced new hybrid glass-polymer aspherical lenses designed for AR/VR headsets, improving optical performance and reducing lens thickness by 20%.

- In March 2025, HOYA Corporation introduced a high-precision molding line for medical imaging lenses, targeting endoscopic and diagnostic equipment manufacturers.

- In January 2025, AGC Inc. partnered with a European automotive Tier-1 supplier to co-develop LiDAR lenses for advanced driver assistance systems.