Artificial Marble Products Market Size

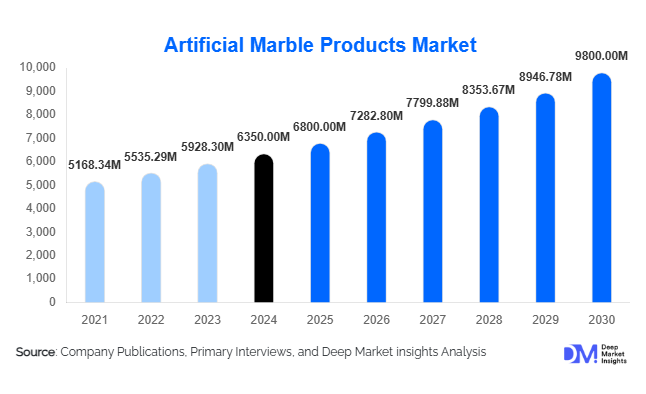

According to Deep Market Insights, the global artificial marble products market size was valued at USD 6,350 million in 2024 and is projected to grow from USD 6,800 million in 2025 to reach USD 9,800 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for cost-effective and aesthetically appealing alternatives to natural marble, rising urbanization, and robust construction activities across residential, commercial, and infrastructure sectors worldwide.

Key Market Insights

- Artificial marble is increasingly preferred for residential and commercial interiors, offering durability, low maintenance, and design flexibility compared to natural marble.

- Technological advancements such as CNC engraving and 3D printing allow for customizable and intricate designs, expanding adoption in luxury and high-end applications.

- APAC is the fastest-growing region, with China and India leading demand due to rapid urbanization, infrastructure projects, and rising middle-class consumption.

- North America and Europe remain key markets, driven by renovations, premium residential projects, and export-driven demand from APAC producers.

- Sustainability trends are driving interest in artificial marble products incorporating recycled aggregates and low-emission resins.

- Distribution channels are diversifying, with direct sales, retail networks, and e-commerce platforms enabling wider market penetration and accessibility.

Latest Market Trends

Eco-Friendly and Sustainable Artificial Marble

Manufacturers are increasingly focusing on environmentally friendly production by integrating recycled aggregates and low-VOC resins. This approach aligns with rising green building initiatives and consumer preference for sustainable materials. Products with eco-certifications are gaining traction in both residential and commercial sectors. Some companies are also exploring closed-loop recycling of production waste, enhancing cost efficiency while reducing environmental impact. Sustainability initiatives are further supported by government policies in regions such as APAC and Europe, promoting the adoption of eco-friendly construction materials in new infrastructure projects.

Technological Advancements in Manufacturing

Emerging technologies, such as CNC-based surface finishing, 3D printing for custom patterns, and advanced resin formulations, are revolutionizing artificial marble production. These technologies allow manufacturers to offer premium, intricately designed surfaces with minimal material wastage. Customizable color, texture, and finish options cater to high-end residential and commercial demand, while standardized production lines help achieve cost efficiency for bulk orders. The integration of automation is also reducing labor costs and improving production consistency, making artificial marble more competitive against natural stone alternatives.

Artificial Marble Products Market Drivers

Cost-Effectiveness Compared to Natural Marble

Artificial marble offers similar aesthetics to natural marble at a fraction of the cost, making it attractive for large-scale construction and residential renovations. Its ease of installation, low maintenance, and resistance to wear and staining further enhance its value proposition, supporting market growth in both emerging and developed regions.

Rapid Urbanization and Real Estate Development

Growing urban populations in APAC, MEA, and LATAM drive residential construction, commercial real estate projects, and public infrastructure development. Artificial marble is increasingly used in flooring, wall cladding, countertops, and decorative surfaces. Rising disposable income and demand for premium interiors further fuel adoption, particularly in luxury apartments and office spaces.

Innovation in Resin-Based and Custom Designs

Manufacturers are leveraging advanced resin formulations and CNC or 3D-printed designs to deliver customizable, high-performance products. These innovations allow differentiation in competitive markets, particularly in premium residential and commercial applications. Customization options have strengthened brand positioning and opened new revenue streams in high-end interior design projects.

Market Restraints

Fluctuating Raw Material Costs

Artificial marble production relies on resins, mineral fillers, and pigments. Price volatility in raw materials can affect profitability and lead to inconsistent pricing, posing challenges for manufacturers, especially smaller players with limited procurement capacity.

Competition from Natural Stone and Quartz Surfaces

High-end projects may continue to prefer natural marble, granite, or quartz for aesthetic or brand reasons. This preference limits growth potential in luxury segments, requiring manufacturers to differentiate through design, sustainability, and cost-efficiency strategies.

Artificial Marble Products Market Opportunities

Infrastructure and Urban Development Projects

Expanding urban infrastructure, smart cities, airports, hospitals, and metro stations provide large-scale opportunities for artificial marble in flooring, wall cladding, and decorative applications. Government tenders and private-sector projects offer long-term contracts, incentivizing manufacturers to scale production and invest in advanced technology for high-quality output.

Customization and Technological Integration

The adoption of CNC and 3D printing allows manufacturers to offer premium, tailor-made products with intricate patterns, textures, and colors. This capability creates opportunities in luxury residential and commercial projects, enabling differentiation and premium pricing. Emerging technologies also allow rapid prototyping and design flexibility, catering to evolving customer preferences and aesthetic trends.

Product Type Insights

Slabs dominate the product type segment, accounting for approximately 45% of the 2024 market. Their large surface area and seamless installation make them ideal for countertops, wall panels, and flooring in both residential and commercial spaces. The trend toward open-plan interiors and large decorative surfaces has further reinforced the dominance of slabs over modular tiles and other subtypes. Tiles remain important for modular designs and renovations, particularly in residential bathrooms and smaller spaces.

Application Insights

Residential applications represent the largest end-use segment (40% of the market), with high demand in kitchens, bathrooms, flooring, and decorative wall panels. Commercial applications, including hotels, offices, and retail spaces, are expanding due to growing interest in aesthetic yet durable surfaces. Infrastructure projects such as airports, hospitals, and metro stations are emerging as key growth areas, particularly in APAC and MEA, where public investments are significant. New applications include laboratory countertops and customized furniture, extending market reach beyond traditional sectors.

Distribution Channel Insights

Direct sales dominate (50% of total sales), particularly for large-scale commercial and infrastructure projects. Retail networks, including specialty stores and home improvement centers, are popular for residential consumers seeking smaller slabs or tiles. E-commerce platforms are growing rapidly, enabling buyers to order customized slabs and tiles, compare designs, and access delivery and installation services. Increasing digitalization in the construction supply chain is further enhancing channel efficiency.

| By Product Type | By Resin Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America held 25% of the global market in 2024. The U.S. and Canada drive demand due to urban renovations, high-end residential interiors, and export-imports of premium artificial marble from APAC. Rising preference for low-maintenance, aesthetic surfaces and sustainable materials strengthens market adoption. High disposable income supports demand for premium slabs and customized designs.

Europe

Europe accounts for 22% of the global market, led by Germany, Italy, and the U.K. Sustainable construction trends, luxury renovations, and government initiatives promoting eco-friendly materials fuel market growth. Premium interior projects are the key adoption area, while customization and design flexibility further enhance product appeal.

Asia-Pacific

APAC is the fastest-growing region (8% CAGR) due to China (15% share) and India’s rapid urbanization and infrastructure development. Expanding middle-class incomes, high-rise residential projects, and commercial development drive adoption. Increasing exports to North America and Europe also contribute significantly to growth.

Latin America

Brazil, Argentina, and Mexico are the primary contributors, with rising residential and commercial construction projects. Outbound investment in high-end materials is emerging, particularly in Brazil, which is gradually adopting artificial marble for urban development.

Middle East & Africa

The UAE and Saudi Arabia drive demand for luxury interiors in hotels, offices, and public buildings. Africa, as a source of construction materials and regional production hubs, supports both domestic and export markets. Government-backed infrastructure projects are enhancing growth opportunities across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Artificial Marble Products Market

- Cosentino

- RAK Ceramics

- Levantina

- Polycor

- SmartStone

- Almar

- Evershine

- Technistone

- Caesarstone

- MSI Surfaces

- Hanwha L&C

- Elegant Marble

- Vicostone

- Lantian Stone

- Noble Surface

Recent Developments

- In March 2025, Cosentino expanded its eco-friendly artificial marble production line in China, incorporating recycled aggregates and low-VOC resin technology.

- In January 2025, RAK Ceramics launched a premium slab collection targeting high-end residential and commercial interiors across Europe and North America.

- In December 2024, SmartStone introduced advanced CNC-based customized designs, enabling intricate patterns and high-quality finishes for luxury projects.