Architectural Coatings Market Size

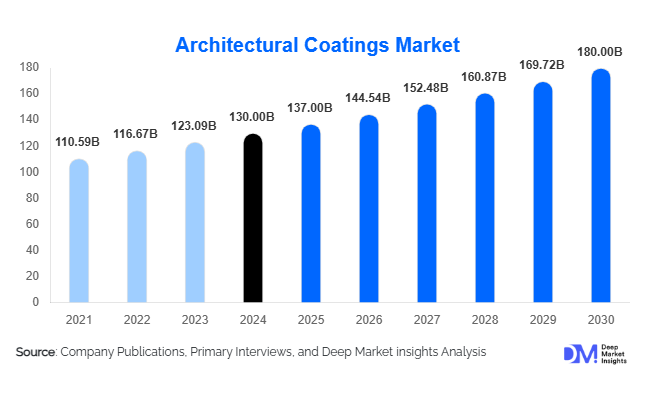

According to Deep Market Insights, the global architectural coatings market size was valued at USD 130 billion in 2024 and is projected to grow from USD 137 billion in 2025 to reach USD 180 billion by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The architectural coatings market growth is primarily driven by increasing urbanization, rising residential and commercial construction activities, and growing demand for eco-friendly, low-VOC, and technologically advanced coatings that enhance both aesthetics and protection of buildings worldwide.

Key Market Insights

- Water-based and emulsion coatings dominate global demand, offering low-VOC alternatives and ease of application for residential and commercial interiors.

- Advanced functional coatings, such as anti-microbial, thermal-insulating, and self-cleaning paints, are gaining traction in commercial and public infrastructure projects.

- Asia-Pacific leads market growth, with China and India accounting for a substantial share due to urbanization, affordable housing schemes, and government infrastructure investments.

- North America and Europe maintain significant market share, driven by renovation projects and sustainability-focused regulations encouraging eco-friendly coatings.

- Technological integration, including smart coatings and eco-friendly formulations, is reshaping product innovation and consumer adoption patterns globally.

- Export-driven demand, particularly from countries like Germany, the USA, and China, is shaping the global supply chain for premium architectural coatings.

Latest Market Trends

Shift Toward Eco-Friendly and Low-VOC Coatings

Increasing awareness of environmental impact and government regulations is driving the adoption of low-VOC and water-based coatings. These formulations reduce harmful emissions, making them the preferred choice for residential and commercial applications. Manufacturers are investing in R&D to enhance durability, color retention, and functional benefits such as anti-microbial and thermal-insulating properties. Demand is especially high in Europe and North America, where strict environmental norms and consumer preference for sustainable products dominate buying decisions. Retail and specialty stores are the primary distribution channels, while online platforms are gradually emerging as key channels for environmentally conscious buyers.

Functional and Smart Coatings Adoption

The industry is increasingly embracing coatings that offer additional benefits beyond aesthetics. Anti-fungal, self-cleaning, thermal-insulating, and fire-retardant paints are becoming more mainstream, particularly in commercial buildings and public infrastructure projects. The trend aligns with rising interest in smart construction and green building initiatives. Functional coatings not only improve building longevity but also reduce maintenance costs, making them appealing for developers and contractors globally. Technological innovations, such as nano-coatings and energy-efficient finishes, are expected to further differentiate products in the market.

Architectural Coatings Market Drivers

Rapid Construction Growth in Emerging Economies

Urbanization and government housing schemes in countries like India, China, and Brazil are driving robust demand for architectural coatings. Residential construction alone accounted for nearly 46% of the 2024 market, highlighting the significant role of new housing projects. Government investments in affordable housing and commercial developments further boost opportunities for coatings manufacturers, particularly for mid- to premium-tier products. Rising disposable incomes and consumer preference for aesthetically appealing interiors also fuel market growth in emerging regions.

Increasing Environmental Awareness

Global emphasis on sustainability has led to widespread adoption of low-VOC and water-based coatings. Regulatory compliance and consumer demand for eco-friendly solutions are prompting manufacturers to innovate and expand their green product portfolios. This driver is especially pronounced in Europe and North America, where energy-efficient and environmentally sustainable building practices are mandated for new constructions. The trend has created opportunities for premium and functional coatings that combine safety, aesthetics, and durability.

Technological Advancements and Product Innovation

Advanced coatings, including self-cleaning, anti-microbial, and thermal-insulating paints, are gaining popularity in commercial and infrastructure applications. These products not only enhance building performance but also provide long-term cost savings through reduced maintenance. The adoption of smart coatings aligns with the increasing integration of green building and energy-efficiency standards. Manufacturers investing in research and development are positioned to capture higher market share by offering differentiated, value-added products.

Market Restraints

Volatile Raw Material Prices

Fluctuating costs of resins, solvents, and pigments affect manufacturing expenses and pricing strategies. High dependence on imported raw materials in some regions exposes manufacturers to exchange rate risks and supply chain disruptions. Such volatility can impact profitability, especially for mid- and small-sized companies competing on price-sensitive products.

High Cost of Premium Coatings

Advanced architectural coatings, such as thermal-insulating and anti-microbial paints, command higher prices compared to conventional paints. This limits adoption in price-sensitive markets, particularly in developing countries. Contractors and homeowners often balance cost versus long-term benefits, which can slow market penetration of technologically advanced solutions.

Architectural Coatings Market Opportunities

Infrastructure and Government Projects

Significant public investments in roads, bridges, airports, and metro systems in Asia-Pacific, Europe, and North America are expanding demand for protective and decorative coatings. Manufacturers can target large tenders with specialized products that meet durability, aesthetic, and functional requirements, such as corrosion resistance and weatherproofing. Government-backed programs create a predictable pipeline of opportunities for both local and multinational players.

Technological Innovation in Eco-Friendly Coatings

There is substantial growth potential in developing low-VOC, water-based, and multifunctional coatings. R&D in nano-coatings, thermal-insulating paints, and anti-microbial solutions enables manufacturers to differentiate products and meet stricter environmental regulations. Companies investing in innovation can gain a competitive edge in premium and commercial segments.

Expansion in Emerging Markets

Rapid urbanization and rising disposable income in India, China, Brazil, and Southeast Asia present major opportunities. Increased residential construction, commercial development, and refurbishment projects create demand for both decorative and protective coatings. Companies entering these markets can capture market share by offering mid- to high-tier products and establishing strong distribution networks.

Product Type Insights

Emulsion/water-based paints dominate with a 55% share of the 2024 market, driven by low VOC content, ease of application, and regulatory compliance. Solvent-based paints are declining due to environmental concerns, while primers, wood coatings, and protective coatings are growing in niche applications such as industrial buildings and high-end residential projects. Powder coatings and advanced functional paints are increasingly adopted for durable exterior and infrastructure applications.

Application Insights

Exterior coatings hold 45% of the market, fueled by new constructions and the refurbishment of commercial and residential buildings. Interior coatings, including decorative emulsions and functional paints, are growing steadily, supported by residential renovation trends and premium aesthetic preferences. Functional coatings such as anti-fungal, self-cleaning, and thermal-insulating products are expanding, particularly in commercial and public infrastructure projects.

Distribution Channel Insights

Retail and specialty stores dominate with a 60% market share, providing easy access for contractors and homeowners. Online platforms are gradually emerging, offering convenient product comparison and access to eco-friendly and premium coatings. Direct B2B sales to large commercial and infrastructure projects remain significant, particularly for high-performance coatings.

End-Use Industry Insights

Residential construction is the leading end-use segment with 46% share of the 2024 market, driven by housing demand in the Asia-Pacific. Commercial construction is rapidly growing, particularly in office buildings, retail, and hospitality sectors. Industrial and institutional projects are adopting functional coatings for durability and safety. New applications in green buildings and smart homes are creating additional demand for technologically advanced coatings.

| By Product Type | By Technology | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 22% of the market in 2024, led by the USA and Canada. Demand is driven by residential renovation, commercial construction, and regulatory compliance with environmental standards. Eco-friendly and low-VOC coatings are increasingly preferred, while infrastructure projects support functional coating adoption. CAGR is projected at 4.8% for 2025–2030.

Europe

Europe holds a 20% market share, with Germany, France, and the UK as key markets. Green building initiatives, environmental regulations, and premium residential construction drive demand. Low-VOC and functional coatings are widely adopted. CAGR is projected at 5.0% for 2025–2030.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of 6.5%. China and India dominate due to urbanization, affordable housing, and government infrastructure projects. Southeast Asian countries like Indonesia and Vietnam are witnessing rising construction activity, creating further demand for decorative and protective coatings. The region accounted for 35% of the market in 2024.

Middle East & Africa

The region contributes 10% of the market, with growth driven by luxury residential and infrastructure projects in the UAE, Saudi Arabia, and South Africa. Government investments in smart city initiatives and public buildings support architectural coatings demand. CAGR is projected at 5.8%.

Latin America

Brazil and Mexico are major markets, with a 13% share in 2024. Residential and commercial construction growth is driving demand for both decorative and protective coatings. CAGR is projected at 5.2%, with emerging interest in functional coatings for infrastructure projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Architectural Coatings Market

- Sherwin-Williams

- PPG Industries

- AkzoNobel

- Nippon Paint Holdings

- BASF SE

- Asian Paints

- RPM International

- Kansai Paint

- Axalta Coating Systems

- Jotun Paints

- Berger Paints

- Hempel

- Valspar

- Benjamin Moore

- Dulux Group

Recent Developments

- In May 2025, Sherwin-Williams expanded its eco-friendly coatings portfolio in North America, introducing new low-VOC and thermal-insulating products for residential and commercial applications.

- In April 2025, AkzoNobel launched advanced self-cleaning and anti-microbial exterior coatings in Europe to meet growing demand from infrastructure and public building projects.

- In February 2025, Nippon Paint introduced a range of water-based decorative paints in the Asia-Pacific region, focusing on sustainable solutions for urban residential housing projects.