Apatite Gemstones Market Size

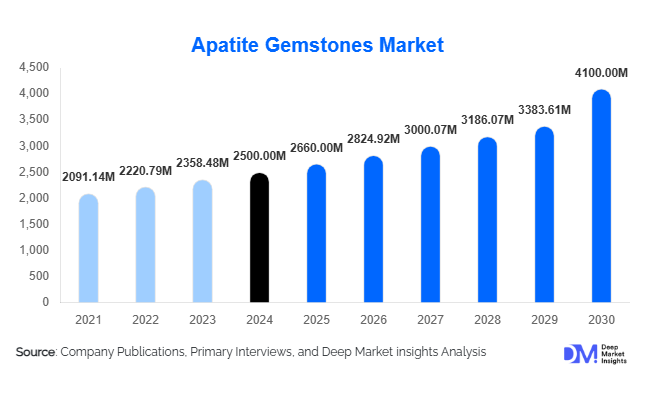

According to Deep Market Insights, the global Apatite Gemstones Market size was valued at USD 2,500 million in 2024 and is projected to grow from USD 2,660 million in 2025 to reach USD 4,100 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for colored gemstones, the increasing popularity of metaphysical and healing crystals, and advancements in gemstone treatments enhancing Apatite’s aesthetic appeal and durability.

Key Market Insights

- Blue Apatite remains the most sought-after gemstone color, commanding a market share of approximately 40% in 2024 due to its vibrant hue and collector preference.

- Jewelry applications dominate, with custom-made rings, necklaces, and earrings increasingly featuring Apatite for its unique colors and metaphysical properties.

- Online retail channels are emerging as the fastest-growing distribution avenue, providing global accessibility and convenience for gemstone buyers.

- Asia-Pacific is an emerging growth region, led by India and China, driven by growing awareness and rising disposable incomes.

- Technological adoption, including gemstone treatment innovations and digital sales platforms, is reshaping consumer engagement and expanding market reach.

Latest Market Trends

Rising Popularity of Colored and Healing Gemstones

Consumers increasingly favor gemstones that offer unique colors and metaphysical benefits. Apatite’s wide color spectrum, ranging from blue and green to violet, has positioned it as a preferred choice among collectors and wellness enthusiasts. The growing trend of healing crystals has further enhanced Apatite’s visibility, particularly in markets such as North America and Europe, where consumers integrate gemstones into meditation, wellness, and home décor practices. Retailers and online marketplaces are leveraging these trends by offering treated and enhanced Apatite varieties, increasing market penetration and consumer awareness.

Technological Advancements in Gemstone Treatments

Innovations in gemstone treatment technologies, including color enhancement and clarity improvements, are broadening Apatite’s application potential. These treatments improve durability, making Apatite more suitable for jewelry while preserving its natural aesthetic appeal. Online platforms now enable customers to select treated or natural Apatite stones with detailed quality certifications, elevating consumer confidence and driving sales. Enhanced imaging, AI-based grading, and augmented reality tools for virtual jewelry try-ons are further improving the purchasing experience.

Apatite Gemstones Market Drivers

Increasing Consumer Awareness

Rising awareness about Apatite’s vibrant colors and metaphysical properties is fueling demand. Social media, wellness influencers, and gemstone education platforms are introducing Apatite to a broader audience, increasing interest in both jewelry and crystal therapy applications.

Expansion of Online Retail Channels

Online marketplaces and direct-to-consumer platforms have made Apatite gemstones accessible worldwide. The ease of comparison shopping, global shipping options, and availability of certified stones have accelerated market growth, particularly among millennial and Gen Z buyers who prefer digital purchasing.

Customization and Personalized Jewelry Trends

Growing interest in bespoke jewelry has increased demand for unique gemstones like Apatite. Consumers are increasingly seeking one-of-a-kind designs, driving the incorporation of Apatite into rings, necklaces, and earrings with custom cuts and color choices.

Market Restraints

Low Hardness Limiting Jewelry Use

Apatite’s relatively low Mohs hardness makes it prone to scratches and damage, limiting its use in high-wear jewelry such as rings and bracelets. This characteristic restricts broader adoption in certain applications, particularly in markets favoring durable stones.

Limited Awareness in Emerging Markets

Despite growing global demand, Apatite remains relatively unknown in emerging markets. Limited marketing, lack of educational campaigns, and minimal local availability are hindering adoption in regions like Africa and parts of Latin America.

Market Opportunities

Expansion in Wellness and Metaphysical Segments

The increasing popularity of healing crystals and wellness-focused lifestyles presents substantial opportunities for Apatite. Integrating Apatite into meditation, spiritual, and home décor applications can tap into a growing consumer base seeking holistic benefits alongside aesthetic appeal.

Growth in Emerging Markets

Regions such as Asia-Pacific and Latin America show untapped potential for Apatite gemstones. Rising disposable incomes, online retail expansion, and increased consumer education provide opportunities for new entrants and existing players to expand market presence.

Technological Innovations in Treatment and Sales

Advancements in gemstone treatment and online sales platforms can enhance the durability and appeal of Apatite. Companies leveraging AI-based grading, AR try-on features, and enhanced treatment techniques can differentiate their offerings and expand global reach.

Product Type Insights

Blue Apatite dominates the market, accounting for 40% of total sales in 2024 due to its high collector demand and vibrant color. Green and violet Apatite are also gaining traction in niche jewelry and metaphysical applications, supported by enhanced color treatments and rising consumer awareness.

Application Insights

Jewelry remains the leading application segment, with increasing use in rings, pendants, and earrings. The wellness and metaphysical segment is rapidly growing, as Apatite is integrated into healing crystals, meditation, and spiritual practices. Decorative and collector applications also contribute to market demand, particularly in developed regions.

Distribution Channel Insights

Online platforms, including dedicated gemstone websites and direct-to-consumer channels, dominate sales by offering global access and certified stones. Traditional jewelry stores remain important, particularly for luxury buyers seeking physical inspection and personalized consultations. Online channels are expanding rapidly, offering treatment verification, virtual try-on, and international shipping, which has enhanced market reach.

End-Use Insights

The jewelry industry accounts for the largest end-use demand for Apatite gemstones, followed by wellness and decorative applications. Rapid growth is observed in the wellness and metaphysical segment, particularly in North America and Europe. Export demand is increasing, with key importing countries including the U.S., Germany, and Japan. Rising interest in bespoke jewelry and wellness-focused products supports market expansion and higher-value sales.

| By Product Type | By Application | BY Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for approximately 35% of the global Apatite market in 2024. The U.S. is the dominant country, driven by high consumer awareness, wellness trends, and a robust jewelry market. Online retail penetration further accelerates growth, with blue Apatite being highly favored.

Europe

Europe represents around 30% of the 2024 market. Germany and the U.K. are key markets, supported by strong demand for colored gemstones and wellness applications. The region is also experiencing steady growth in metaphysical and decorative uses of Apatite.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by India and China. Increasing disposable incomes, growing jewelry and wellness markets, and awareness campaigns contribute to the rapid adoption of Apatite gemstones.

Latin America

Brazil and Mexico are key players, with growing interest in colored gemstones for jewelry and decorative purposes. Market penetration remains moderate but is expected to rise due to export and online retail opportunities.

Middle East & Africa

The Middle East shows growing demand for luxury and wellness applications, while Africa remains a key supply region, particularly Madagascar and Morocco, supporting global exports of Apatite gemstones.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Apatite Gemstones Market

- Himalaya Gems

- Gandhara Gems

- Gemfields

- Colors of Nature

- Stones International

- Rare Gems Co.

- Exotic Minerals

- Global Gemstone Company

- Natural Stone Traders

- Precious Earth Gems

- BlueStone Gems

- Crystal Gemstone Shop

- GemSource International

- Elite Gem Traders

- Vibrant Gems Pvt. Ltd.

Recent Developments

- In March 2025, Gandhara Gems launched a new line of treated blue Apatite gemstones for jewelry and metaphysical applications, enhancing durability and color vibrancy.

- In January 2025, Gemfields expanded its Apatite sourcing operations in Madagascar, increasing global export capacity and supply chain efficiency.

- In November 2024, Colors of Nature introduced AI-powered online grading and certification for Apatite gemstones, improving consumer trust and digital sales engagement.