Antioxidant Cosmetic Products Market Size

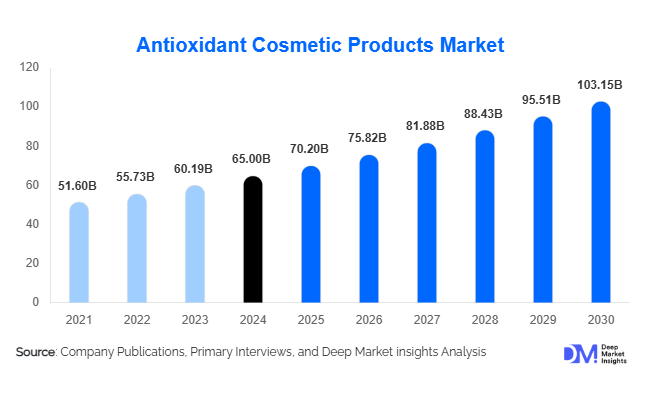

According to Deep Market Insights, the global antioxidant cosmetic products market was valued at USD 65 billion in 2024 and is projected to grow from USD 70.20 billion in 2025 to reach USD 103.15 billion by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The market growth is driven by increasing consumer awareness of oxidative stress, the rising demand for natural and clean-label cosmetics, and strong innovation in active ingredient technologies such as botanical and biotech-derived antioxidants.

Key Market Insights

- Skin care products dominate the market, accounting for about 60% of total revenues due to strong consumer preference for antioxidant-rich facial creams, serums, and moisturizers.

- Natural and botanical antioxidants hold nearly two-thirds of the global share, reflecting the shift toward clean beauty, transparency, and sustainable sourcing.

- Asia-Pacific leads the global market with approximately 38% share in 2024, supported by robust demand from China, Japan, South Korea, and India.

- Online and D2C channels are rapidly expanding, with beauty brands leveraging influencer marketing and e-commerce for global reach.

- Innovation in biotech and marine-derived antioxidants is transforming the product landscape, offering enhanced efficacy and stability.

- Premium and luxury cosmetic segments are growing fastest as consumers prioritize efficacy, safety, and ingredient authenticity over price.

Latest Market Trends

Shift Toward Clean-Label and Natural Antioxidants

Consumers are increasingly skeptical of synthetic additives and turning toward natural or plant-derived antioxidants such as vitamin C, polyphenols, green tea extract, and resveratrol. This has accelerated R&D investments in botanical sourcing, fermentation-based extraction, and sustainable raw material cultivation. Brands are positioning their antioxidant claims within “clean beauty” frameworks, emphasizing safety, transparency, and environmental responsibility. The clean-label trend is also fostering collaborations between cosmetic formulators and agricultural producers to ensure traceable supply chains and consistent quality.

Biotechnology Integration and Encapsulation Technologies

Advanced biotechnological methods are redefining antioxidant cosmetic formulations. Encapsulation and microemulsion systems are improving ingredient delivery and stability, reducing degradation from light and oxygen exposure. Marine-derived antioxidants and enzymatic actives such as coenzyme Q10 and glutathione are gaining popularity for their superior absorption and performance. These technological advancements are enabling brands to create multi-functional cosmetics that combine antioxidant protection with hydration, brightening, and anti-aging effects, enhancing perceived value and user satisfaction.

Antioxidant Cosmetic Products Market Drivers

Rising Awareness of Environmental and Oxidative Damage

Increased exposure to UV radiation, pollution, and blue light from digital devices is driving demand for cosmetics that offer protection and repair. Consumers are prioritizing preventive skincare routines, seeking products formulated with powerful antioxidants capable of neutralizing free radicals and reducing premature aging. This awareness is strongest among urban populations and younger demographics embracing “skinimalism” with high-efficacy products.

Premiumization and Functional Beauty Demand

Consumers are upgrading from basic cosmetics to scientifically backed formulations with proven antioxidant actives. This premiumization trend supports higher margins for brands while fueling innovation. Anti-aging, pollution defense, and skin barrier restoration products are in high demand across global beauty markets. Functional beauty, combining skincare with makeup such as antioxidant-enriched foundations or lip care is a major driver of cross-category expansion.

Digital Commerce and Influencer Marketing

The proliferation of beauty influencers and e-commerce has transformed consumer engagement. Social media platforms allow brands to communicate the scientific efficacy of antioxidant ingredients through storytelling, before-and-after visuals, and educational campaigns. Direct-to-consumer (D2C) channels are allowing emerging brands to penetrate global markets quickly, fostering competition and product diversification.

Market Restraints

High Cost and Stability Issues of Natural Actives

Natural antioxidants often face formulation challenges due to sensitivity to light and heat, requiring costly stabilization technologies. Limited supply and high extraction costs increase product pricing, which restricts affordability in mass-market categories. Maintaining consistent efficacy across production batches also poses challenges for manufacturers.

Regulatory and Claims Complexity

Global cosmetics regulations vary widely, complicating formulation and marketing strategies. Antioxidant-related claims such as “pollution defense” or “free radical protection” require scientific substantiation, increasing R&D and compliance costs. Varying ingredient approval processes and labeling standards in the EU, U.S., and Asia hinder faster time-to-market for novel antioxidant ingredients.

Antioxidant Cosmetic Products Market Opportunities

Emerging Market Expansion

Rising middle-class populations in Asia-Pacific, Latin America, and the Middle East are fueling demand for affordable yet effective antioxidant cosmetics. Localization of ingredients such as Indian turmeric, Korean ginseng, or Amazonian açaí offers regional differentiation and marketing appeal. Investment in regional production and digital marketing can help companies tap this expanding consumer base.

Innovation in Ingredient Technologies

Next-generation antioxidant technologies, including marine peptides, probiotic-derived extracts, and encapsulated vitamin C systems, offer immense potential for differentiation. Biotech-based production reduces dependence on fluctuating botanical supplies, enhances potency, and aligns with clean beauty demands. Ingredient companies investing in patented actives are likely to gain long-term competitive advantages.

Sustainability and Circular Beauty Initiatives

As sustainability becomes a non-negotiable consumer value, brands that integrate eco-friendly sourcing, recyclable packaging, and carbon-neutral manufacturing can enhance brand loyalty. Government incentives for green chemistry and sustainable production also create a favorable environment for innovation. These factors position sustainability as both a market necessity and a growth opportunity.

Product Type Insights

Skin care products account for approximately 60% of the global antioxidant cosmetic market revenues. Facial creams, serums, and moisturizers remain top sellers, driven by high consumer trust in antioxidant-based anti-aging and pollution-defense benefits. Hair care formulations hold around 25% share, supported by new launches of antioxidant-rich shampoos and scalp serums. Color cosmetics enriched with antioxidants, such as lipsticks and foundation, represent a smaller but rapidly growing segment due to consumer preference for multifunctional makeup.

Ingredient Source Insights

Natural and botanical antioxidants lead the market with nearly 65% share in 2024, favored for clean-label positioning and perceived safety. Synthetic antioxidants like BHT and BHA remain relevant for cost efficiency but are losing market share due to regulatory scrutiny. Biotech and marine-derived antioxidants are emerging at a CAGR above 9%, supported by technological advances in fermentation and marine bioprocessing.

Distribution Channel Insights

Offline retail remains the largest distribution channel, representing around 70% of total market value in 2024. Department stores, pharmacies, and beauty specialty outlets drive high-ticket sales. However, online and D2C channels are expanding at double-digit growth rates, driven by influencer-led marketing, subscription beauty boxes, and digital-first product launches. Social commerce and livestream shopping, especially in China and South Korea, are reshaping distribution strategies.

| Product Type | Source Type | Antioxidant Ingredient | Gender | Distribution Channel | End-Use |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

Accounting for approximately 30% of the global market, North America is characterized by strong demand for anti-aging skincare, innovation in biotech-derived actives, and premium beauty retail. The U.S. leads the region, while Canada shows increasing adoption of natural and organic antioxidant cosmetics. Regulatory emphasis on ingredient transparency supports continued market maturity.

Europe

Europe holds nearly a 25% share, driven by high regulatory standards and consumer focus on sustainable beauty. Germany, France, and the U.K. are key markets, while Eastern Europe shows emerging demand for affordable antioxidant skincare. European consumers demonstrate a strong preference for vegan and cruelty-free products with clear provenance.

Asia-Pacific

With around 38% market share, Asia-Pacific is the largest and fastest-growing region. China, Japan, South Korea, and India dominate consumption, supported by dynamic beauty cultures and rapid e-commerce penetration. Rising disposable incomes and interest in preventive skincare fuel double-digit growth in antioxidant cosmetics. K-beauty and J-beauty innovations continue to set global trends in antioxidant formulations.

Latin America

Latin America represents about 5–6% of global revenues, led by Brazil and Mexico. Consumers in these countries are showing increasing interest in botanical ingredients and local natural actives. Economic recovery and rising middle-class spending are expected to drive moderate growth over the forecast period.

Middle East & Africa

The region accounts for approximately 5% of global demand, with GCC countries such as the UAE and Saudi Arabia showing a strong preference for luxury skincare. Africa’s domestic beauty industries are also expanding, driven by locally sourced botanical ingredients and small-scale production targeting export markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Antioxidant Cosmetic Products Market

- BASF SE

- Evonik Industries AG

- Croda International Plc

- Eastman Chemical Company

- Kemin Industries Inc.

- SEPPIC (S.A.)

- DSM-Firmenich

- Wacker Chemie AG

- Clariant AG

- Givaudan

- Ashland Global Holdings Inc.

- Lonza Group AG

- Nexira

- Yasho Industries

- Barentz International BV