Antibacterial Products Market Size

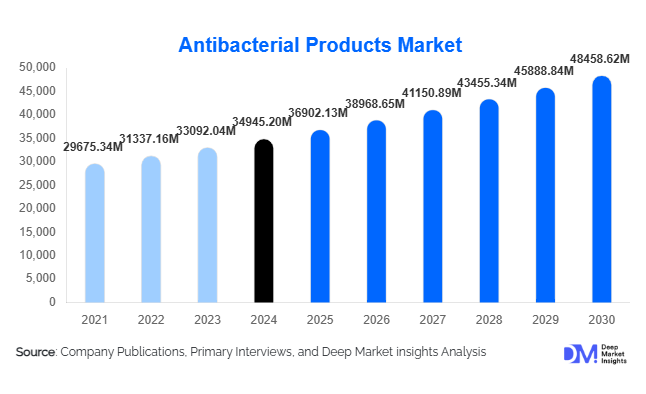

According to Deep Market Insights, the global antibacterial products market size was valued at USD 34,945.20 million in 2024 and is projected to grow from USD 36,902.13 million in 2025 to reach USD 48,458.62 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). Market growth is primarily driven by sustained hygiene awareness, expanding healthcare infrastructure, rising incidence of healthcare-associated infections, and increasing adoption of antibacterial solutions across household, institutional, and industrial applications.

Key Market Insights

- Surface cleaners and disinfectants remain the dominant product category, driven by healthcare, commercial, and institutional sanitation requirements.

- Alcohol-based antibacterial formulations lead active ingredient adoption, favored for rapid efficacy and broad-spectrum antimicrobial action.

- Asia-Pacific holds the largest and fastest-growing regional share, supported by urbanization, government sanitation initiatives, and rising middle-class consumption.

- Healthcare facilities account for the highest application-based demand, reflecting stringent infection control regulations worldwide.

- Bio-based and natural antibacterial products are gaining traction, supported by regulatory scrutiny on synthetic chemicals and shifting consumer preferences.

- E-commerce and direct-to-consumer channels are reshaping distribution, improving product accessibility and price transparency globally.

What are the latest trends in the antibacterial products market?

Shift Toward Bio-Based and Sustainable Antibacterial Solutions

Manufacturers are increasingly transitioning toward plant-based, biodegradable, and naturally derived antibacterial agents to comply with tightening regulatory frameworks and evolving consumer expectations. Ingredients such as essential oils, silver ions, and botanical extracts are replacing controversial chemicals in personal care and household products. Sustainability-driven innovation is also extending to recyclable packaging and low-water formulations, enabling companies to command premium pricing while enhancing brand credibility. This trend is particularly pronounced in Europe and North America, where regulatory agencies are actively restricting the use of certain synthetic antibacterial compounds.

Expansion of Long-Lasting and Advanced Antimicrobial Technologies

Technological advancements such as nano-silver coatings, antimicrobial polymers, and extended-release disinfectants are transforming product performance standards. These innovations are gaining adoption in healthcare facilities, public infrastructure, textiles, and transportation systems, where prolonged antimicrobial protection is critical. Smart antibacterial coatings for high-touch surfaces and antimicrobial-treated fabrics for uniforms and medical textiles are emerging as high-growth niches, expanding the market beyond traditional liquid and gel-based products.

What are the key drivers in the antibacterial products market?

Sustained Post-Pandemic Hygiene Awareness

Global hygiene behavior has undergone a structural shift, with frequent handwashing and surface disinfection becoming embedded in daily routines. Households, workplaces, and public facilities continue to maintain elevated consumption levels of antibacterial soaps, disinfectants, and wipes compared to pre-2020 benchmarks. This behavioral change has stabilized baseline demand and reduced market volatility.

Rising Healthcare Infrastructure and Infection Control Spending

Hospitals, clinics, diagnostic laboratories, and long-term care facilities are expanding globally, particularly in emerging economies. Infection prevention and control protocols mandate regular use of antibacterial products, driving consistent institutional demand. Healthcare-grade disinfectants and antimicrobial coatings represent high-margin segments benefiting from regulatory compliance requirements and recurring procurement contracts.

Urbanization and Public Sanitation Programs

Government-led sanitation initiatives, particularly in Asia-Pacific, the Middle East, and parts of Africa, are significantly boosting the consumption of antibacterial products. Public transport systems, schools, government buildings, and community healthcare centers are increasingly adopting standardized disinfection practices, creating sustained bulk demand.

What are the restraints for the global market?

Regulatory Restrictions on Antibacterial Ingredients

Stringent regulations governing the use of synthetic antibacterial chemicals increase compliance complexity and reformulation costs for manufacturers. Restrictions on compounds such as triclosan and certain quaternary ammonium agents have forced companies to invest heavily in R&D, impacting profitability for smaller players.

Volatility in Raw Material and Packaging Costs

Fluctuating prices of alcohols, surfactants, and plastic packaging materials pose margin pressures, particularly in price-sensitive consumer segments. Manufacturers must balance cost inflation with competitive pricing, limiting short-term profitability growth.

What are the key opportunities in the antibacterial products industry?

Healthcare and Institutional Grade Product Expansion

The rising burden of hospital-acquired infections presents long-term opportunities for advanced disinfectants, antimicrobial coatings, and high-efficacy formulations. Companies offering compliance-ready, hospital-grade antibacterial solutions can secure long-term procurement contracts and premium pricing.

Emerging Market Penetration Through Localization

Local manufacturing and distribution partnerships in Asia, Africa, and Latin America offer significant growth potential. Localization reduces costs, improves regulatory alignment, and enables companies to address region-specific hygiene challenges, supporting rapid volume expansion.

Product Type Insights

Antibacterial surface cleaners and disinfectants dominate the market, accounting for approximately 32% of global revenue in 2024, driven by institutional and healthcare demand. Antibacterial soaps and hand washes follow closely, supported by sustained household consumption. Personal care antibacterial products such as toothpaste and body washes continue to grow steadily, while antimicrobial textiles and coatings represent an emerging high-growth segment driven by healthcare and industrial applications.

Application Insights

Healthcare and medical facilities represent the largest application segment, contributing nearly 28% of global demand. Household applications remain a strong volume driver, while food processing and commercial facilities are witnessing accelerated adoption due to stricter hygiene regulations. Industrial applications, including antimicrobial coatings for equipment and infrastructure, are gaining importance as manufacturers seek long-lasting hygiene solutions.

Distribution Channel Insights

Retail and supermarket channels dominate distribution with approximately 35% market share, supported by high consumer accessibility. Pharmacies and drug stores maintain strong relevance for healthcare-grade products. Online and e-commerce channels are the fastest-growing, driven by subscription models, bulk purchasing, and direct-to-consumer brand strategies.

End-Use Industry Insights

The healthcare sector represents the fastest-growing end-use industry, with antibacterial product demand exceeding USD 15 billion in 2024 and growing at over 7% CAGR. Food processing and food service industries are also expanding rapidly due to global food safety regulations. New applications in public transportation, sanitation, antimicrobial uniforms, and smart infrastructure coatings are emerging as incremental growth drivers.

| By Product Type | By Active Ingredient | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global antibacterial products market, led by the United States. High per-capita consumption, advanced healthcare infrastructure, and strict sanitation standards support sustained demand.

Europe

Europe holds nearly 24% market share, driven by Germany, the UK, and France. Regulatory focus on sustainable and chemical-safe formulations is accelerating innovation in bio-based antibacterial products.

Asia-Pacific

Asia-Pacific represents the largest regional market with around 30% share and is the fastest-growing region. China and India dominate demand due to urban population growth, public sanitation initiatives, and expanding healthcare access.

Latin America

Latin America is witnessing steady growth, led by Brazil and Mexico, supported by improving healthcare infrastructure and rising household hygiene awareness.

Middle East & Africa

The Middle East & Africa region is expanding steadily, driven by healthcare investments in Saudi Arabia and the UAE, alongside sanitation initiatives across South Africa and other emerging African economies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|