Antibacterial LED Panel Light Market Size

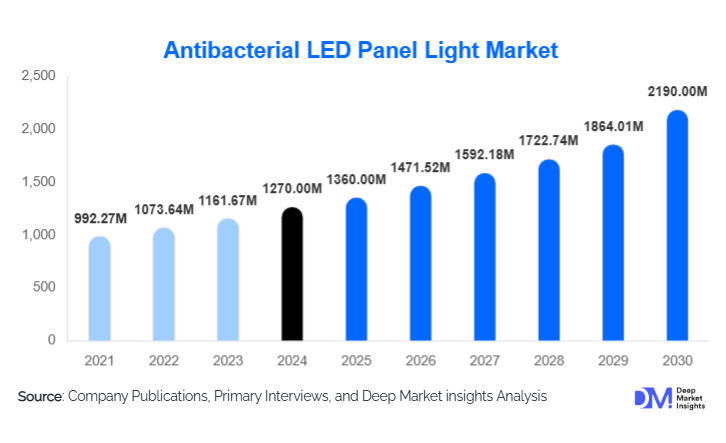

According to Deep Market Insights, the global Antibacterial LED Panel Light Market was valued at USD 1,270 million in 2024 and is projected to grow from USD 1,360 million in 2025 to reach USD 2,190 million by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). The market’s growth is driven by the rising emphasis on hygiene-focused lighting in healthcare, commercial, and residential environments, coupled with increasing demand for energy-efficient illumination systems that integrate antimicrobial technologies. Rapid advancements in nanotechnology-based coatings and smart lighting systems are further enhancing the adoption of antibacterial LED panel lights across global markets.

Key Market Insights

- Growing demand in healthcare and cleanroom applications as hospitals, clinics, and pharmaceutical facilities adopt antibacterial lighting to reduce infection risks.

- Integration of nanotechnology and silver-ion coatings in LED panels enhances antibacterial performance and product durability.

- Smart lighting systems with antibacterial functionality are gaining traction in commercial offices, retail, and educational environments.

- Asia-Pacific dominates global production due to strong manufacturing ecosystems in China, Japan, and South Korea.

- Europe and North America lead in adoption owing to stringent hygiene regulations and early implementation of health-centric building standards.

- Rising public infrastructure spending in smart city projects is promoting large-scale installations of antibacterial lighting solutions in public facilities.

Latest Market Trends

Integration of Antimicrobial Nanocoatings

Manufacturers are increasingly deploying silver-ion and titanium dioxide nanocoatings in LED panel lights to provide continuous antimicrobial action. These coatings actively inhibit the growth of bacteria, mold, and fungi on lamp surfaces, extending product longevity while maintaining illumination quality. This innovation is becoming a standard specification in healthcare and food service lighting. Research efforts are also focused on hybrid materials that combine photocatalytic activity with UV-based disinfection for superior antibacterial performance.

Smart and IoT-Enabled Lighting Adoption

Smart antibacterial LED panels with IoT integration are revolutionizing lighting management. Through motion sensors, real-time monitoring, and cloud connectivity, facilities can automate antibacterial lighting schedules and track environmental hygiene metrics. These systems are being deployed in smart hospitals, airports, and office complexes as part of broader health and safety modernization programs. The combination of germicidal efficacy and data-driven lighting control is driving next-generation product adoption.

Energy Efficiency and Green Building Certifications

The antibacterial LED panel light market is aligning with global sustainability initiatives. Products that combine high lumen efficacy with low energy consumption are increasingly specified for LEED, BREEAM, and WELL-certified projects. Manufacturers are emphasizing recyclable materials, reduced carbon footprints, and energy-optimized drivers, ensuring that antibacterial lighting contributes to both human well-being and environmental goals.

Antibacterial LED Panel Light Market Drivers

Heightened Hygiene Awareness Post-Pandemic

The COVID-19 pandemic reshaped hygiene standards globally, accelerating the adoption of antibacterial technologies in lighting. Hospitals, schools, and workplaces have become major demand centers for these solutions. The emphasis on pathogen-free environments continues to drive long-term demand, especially in public infrastructure and transportation hubs where hygiene is critical.

Rising Energy Efficiency Regulations

Governments worldwide are promoting energy-efficient lighting to reduce emissions and energy costs. Antibacterial LED panel lights, with their dual benefits of disinfection and low power consumption, align perfectly with these regulations. Subsidies for energy-efficient retrofitting and public building upgrades are fueling installations across Asia, Europe, and the Middle East.

Technological Advancements in Photocatalytic and UV-Integrated LEDs

Recent advances in UV-A and UV-C integrated LED panels have expanded applications beyond illumination to surface sterilization. Photocatalytic titanium dioxide coatings activated by light provide continuous bacterial decomposition, enabling maintenance-free hygiene. These hybrid products are witnessing rapid adoption in hospitals and pharmaceutical manufacturing units.

Market Restraints

High Initial Installation Cost

Advanced antibacterial LED systems often involve higher initial costs due to specialized coatings and integrated technologies. Small and medium enterprises face budget constraints that limit large-scale adoption, particularly in emerging economies where traditional lighting still dominates.

Limited Awareness in Residential Applications

While awareness is high in institutional and commercial settings, residential consumers remain largely unaware of the benefits of antibacterial LED lighting. This awareness gap is a significant restraint to mass-market penetration, especially in price-sensitive regions.

Antibacterial LED Panel Light Market Opportunities

Expansion into Smart Healthcare Infrastructure

Hospitals are increasingly integrating smart antibacterial lighting systems that can adjust brightness and disinfection cycles automatically. Government investments in healthcare infrastructureparticularly in India, the Middle East, and Southeast Asiaare creating a lucrative opportunity for manufacturers. These installations not only enhance hygiene but also improve operational efficiency through energy savings and automation.

Public Infrastructure Modernization

Urban development projects are incorporating antibacterial lighting into airports, metro stations, and government buildings. The trend is being accelerated by national health safety regulations and sustainable urban design frameworks. Governments are allocating budgets for clean-lighting retrofits, providing long-term opportunities for market players involved in public tenders.

Integration with IoT and Building Management Systems (BMS)

Combining antibacterial LEDs with IoT platforms and AI-driven BMS is creating high-value opportunities. These integrations enable real-time monitoring of light performance, energy use, and bacterial activity, enhancing both facility safety and efficiency. Players developing plug-and-play smart modules compatible with standard BMS protocols are poised to gain significant market share.

Segmental Analysis

By Type

Surface-Mounted LED Panels held the largest market share of 46% in 2024. Their versatility, ease of installation, and widespread adoption across hospitals and commercial offices drive their dominance. Suspended and recessed variants are also gaining traction in architectural and aesthetic applications, but remain secondary in volume.

By Technology

Silver-Ion Coated LEDs accounted for 41% of the market in 2024. Silver ions are proven antimicrobial agents and are being extensively adopted due to long-lasting efficacy and cost-efficiency compared to UV-integrated LEDs. Photocatalytic coatings, though more advanced, still face scalability challenges in mass production.

By Wattage

30–50W Panels dominated the wattage category with a 38% market share in 2024, balancing optimal brightness with low power usage. They are ideal for mid-sized rooms in hospitals, offices, and retail outlets. Higher wattage panels are seeing increased use in industrial and airport facilities.

By End-Use

Healthcare facilities represented the leading end-use segment, capturing 33% of global revenue in 2024. Growing adoption in patient wards, ICUs, and laboratories continues to be the primary driver, supported by government hygiene mandates and hospital renovation programs.

End-Use Analysis

Healthcare remains the dominant end-use segment, driven by infection control requirements. The market for antibacterial LED panel lights in hospitals and clinics reached USD 420 million in 2024 and is projected to grow at a CAGR of 9.5% through 2030. Commercial offices and educational institutions are emerging secondary adopters, emphasizing clean and healthy work environments. The hospitality industry is also integrating these solutions in guest rooms and dining areas to enhance hygiene perception. Additionally, the expansion of semiconductor cleanrooms, biotech labs, and pharmaceutical plants is boosting demand from industrial users. Export-driven demand is notable in Europe and the Middle East, where hygiene compliance and indoor air quality standards are more stringent.

| By Type | By Technology | By Mounting Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounted for 38% of the global market share in 2024, led by China, Japan, and South Korea. Robust LED manufacturing infrastructure, coupled with cost advantages and rapid adoption of smart hospital projects, makes APAC the largest producer and exporter of antibacterial LED panel lights. China alone contributed 22% of global production. India is expected to be the fastest-growing market in the region, expanding at a CAGR of 10.1% through 2030 due to smart city programs and healthcare upgrades.

Europe

Europe held a 27% market share in 2024, driven by demand from Germany, France, and the U.K. Stringent hygiene regulations in the food processing and healthcare sectors, along with EU energy efficiency directives, support strong market penetration. Scandinavian countries are also witnessing the adoption of antibacterial LEDs in public schools and offices as part of green building initiatives.

North America

The North American market, representing 23% of global demand, benefits from early adoption of UV-integrated and IoT-enabled antibacterial lighting in healthcare and corporate environments. The U.S. remains the largest market in this region, with several public hospitals implementing antibacterial lighting retrofits. Canada’s clean-building initiatives are further expanding market potential.

Middle East & Africa

The Middle East is emerging as a high-growth region with large-scale smart hospital projects in Saudi Arabia and the UAE. Africa, particularly South Africa and Egypt, is gradually adopting antibacterial lighting for public health and educational infrastructure. Combined, the region is projected to grow at a CAGR of 9.3% during 2025–2030.

Latin America

Latin America’s market is in early stages, led by Brazil and Mexico. Rising investments in healthcare modernization and hospitality refurbishment are key growth drivers. The region is anticipated to achieve a CAGR of 7.2% through 2030, driven by post-pandemic infrastructure upgrades.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Antibacterial LED Panel Light Market

- Signify N.V. (Philips Lighting)

- Panasonic Corporation

- OSRAM GmbH

- Acuity Brands, Inc.

- Havells India Ltd.

- Cree Lighting

- NVC Lighting Technology Corporation

- Zumtobel Group AG

- Everlight Electronics Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Fagerhult Group

- Sharp Corporation

- Opple Lighting Co., Ltd.

- Wipro Lighting

- MLS Co., Ltd.