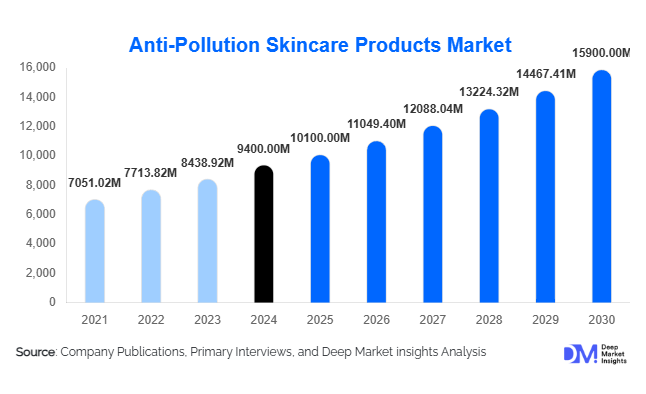

Anti-Pollution Skincare Products Market Size

According to Deep Market Insights, the global anti-pollution skincare products market size was valued at USD 9,400 million in 2024 and is projected to grow from USD 10,100 million in 2025 to reach USD 15,900 million by 2030, expanding at a CAGR of 9.4% during the forecast period (2025–2030). Market growth is driven by rising consumer awareness of urban pollution’s impact on skin health, continuous innovation in active ingredients, and expanding digital-first distribution channels that cater to younger, eco-conscious demographics.

Key Market Insights

- Growing awareness of air pollution’s impact on skin ageing is fueling demand for daily-use cleansers, mists, and moisturizers with barrier-repair and antioxidant actives.

- Ingredient innovation, including encapsulated antioxidants, microbiome-supporting formulations, and polymer-based pollutant shields, is reshaping product pipelines.

- E-commerce and D2C brands are emerging as the fastest-growing distribution channels, enabling education-driven storytelling and subscription models.

- Premium/luxury brands retain market leadership by offering scientifically validated formulations and clean-label claims, particularly in Europe and North America.

- The Asia-Pacific region remains the largest and fastest-growing market, driven by K-beauty and J-beauty innovations and a consumer focus on brightening and pigmentation control.

What are the latest trends in the anti-pollution skincare products market?

Personalized and Tech-Integrated Skincare

Brands are integrating pollution-sensing wearable devices, AQI-linked skincare recommendations, and AI-powered skin diagnostic tools to deliver personalized regimens. Subscription-based skincare models, paired with digital consultations, are gaining traction among urban professionals and younger demographics, offering both convenience and long-term brand loyalty.

Clean Label and Sustainable Formulations

Consumer preference is shifting toward clean, plant-based formulations with eco-friendly packaging. Dermatologically tested, fragrance-free, and low-toxicity claims are particularly strong in Europe, where regulatory standards drive higher scrutiny. Brands adopting circular packaging, refillable bottles, and transparent supply chains are attracting environmentally conscious consumers worldwide.

What are the key drivers in the anti-pollution skincare products market?

Rising Urban Air Pollution Awareness

Global consumers are increasingly aware of the harmful effects of particulate matter (PM2.5), nitrogen oxides, and ozone on skin. Links to premature ageing, pigmentation, and barrier dysfunction are driving strong demand for protective skincare solutions. Education campaigns by dermatologists and influencers have amplified awareness, especially in metropolitan regions.

Ingredient and Formulation Innovation

Advances in antioxidants (vitamin C derivatives, niacinamide), barrier-repair ceramides, and microbiome-supporting actives have increased both efficacy and consumer trust. The use of encapsulation technologies has improved delivery and stability, making products more compelling for science-driven consumers.

What are the restraints for the global market?

Scientific Validation Gaps and Regulatory Scrutiny

Despite rising demand, consumer skepticism remains due to inconsistent clinical validation of anti-pollution claims. Regulatory authorities in the EU and North America are increasing scrutiny of marketing claims, requiring stronger data and limiting exaggerated messaging. This slows down smaller brands that lack resources for robust trials.

What are the key opportunities in the anti-pollution skincare industry?

Personalized and Wearable-Integrated Solutions

Opportunities lie in integrating skincare with digital ecosystems, including wearable devices that measure local pollution levels and recommend real-time product use. Subscription-based, hyper-personalized regimens are expected to capture long-term consumer loyalty. This model allows brands to differentiate themselves and extend lifetime customer value.

Product Type Insights

The anti-pollution skincare products market can be segmented into cleansers, serums/ampoules, creams & moisturizers, masks/peels, sunscreens, mists, and eye care. Creams and moisturizers dominate, accounting for 34% of market share in 2024, as consumers seek daily-use products offering barrier repair and long-term protection. Multifunctional formulations that combine SPF and antioxidants are particularly successful, reflecting demand for convenience and value. Serums & ampoules are the fastest-growing sub-segment, supported by consumer perception of higher efficacy and the ability to deliver patented, science-driven actives.

Active Ingredient Class Insights

Antioxidant complexes such as stabilized vitamin C, vitamin E, and niacinamide lead the anti-pollution skincare products market, supported by strong consumer trust and scientific backing. Barrier-repair actives like ceramides and fatty acids are gaining traction in dermatology-driven formulations, appealing to consumers seeking long-term skin resilience. Pollution-adsorbing clays, botanicals, and polymer films are carving niche adoption, particularly in masks and peels positioned as “reset” rituals. Microbiome-friendly pre- and probiotics are emerging as the next growth frontier, appealing to early adopters and premium buyers.

Skin Concern Insights

Anti-ageing combined with anti-pollution benefits is the largest driver of premium skincare spending, with consumers willing to pay more for products that delay fine lines and wrinkles. Pigmentation control and brightening are critical in APAC and Latin America, where urban pollution exacerbates uneven skin tone. Sensitive skin and inflammation-focused products are gaining traction among urban commuters exposed to daily pollution stressors.

Formulation Type Insights

Natural and clean-label formulations attract eco-conscious buyers but face challenges in proving efficacy. Clinical/cosmeceutical formulations dominate in pharmacy and dermatology channels, reflecting strong consumer trust in science-backed brands. Hybrid K-beauty-inspired formulations, with rapid innovation cycles and influencer-led trends, are fueling APAC leadership in this segment.

Distribution Channel Insights

E-commerce and D2C platforms lead growth, enabling direct consumer education, storytelling, and subscription adoption. Pharmacies and dermatology clinics remain vital for credibility and evidence-based positioning, particularly in Europe and North America. Mass retail drives volume adoption in price-sensitive markets, while professional spas cater to premium consumers seeking experiential skincare.

Price Tier Insights

The premium/luxury segment commands the highest share, with consumers expecting advanced activities and clinical validation. Mid-market products represent the fastest-growing tier, balancing efficacy and affordability, and offering mass adoption potential. Value-tier products serve as entry-level options in emerging markets, typically integrating SPF and basic antioxidants.

Demographic Insights

Working urban adults aged 25–45 are the core demographic, representing the majority of demand. Younger consumers (teens–20s) are driving demand for detox masks and face mists through social media trends. Male grooming is a growing niche, with simplified, multitasking products favored by professionals in urban centers with high pollution levels.

| Product Type | Active Technology / Ingredient Class | Skin Concern / End-Use Benefit | Formulation Type | Price Tier | Demographic / Consumer Group |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounted for 27% of the global anti-pollution skincare products market share in 2024, supported by high consumer willingness to pay for evidence-based skincare. Growth is driven by demand for multifunctional products combining anti-ageing, SPF, and anti-pollution benefits. High e-commerce penetration, dermatologist-backed brands, and influencer marketing are key drivers shaping adoption in this region.

Europe

Europe captured 24% of global revenue in 2024, with regulatory emphasis on clean-label substantiation driving product positioning. Consumers favor scientifically validated and dermatologically tested products, while sustainability initiatives such as eco-friendly packaging enhance appeal. Growth is further supported by rising demand for low-tox, fragrance-free, and allergen-tested formulations.

Asia-Pacific

Asia-Pacific remains the largest and fastest-growing market, accounting for 33% share in 2024. Drivers include rapid urbanization, severe pollution exposure in megacities, and cultural emphasis on beauty and skincare. K-beauty and J-beauty innovation, coupled with strong cross-border e-commerce, continue to accelerate market expansion. Brightening and pigmentation control products are especially popular across China, India, and Southeast Asia.

Latin America

Latin America accounted for 8% of global market revenue in 2024. Growth is led by Brazil and Mexico, supported by a rising middle class, urbanization, and increasing awareness of pollution’s effects on skin. Traditional retail channels remain influential, though online adoption is accelerating. Multifunctional products targeting pigmentation and pollution are a key demand driver.

Middle East & Africa

The Middle East & Africa region represented 8% of the market in 2024. Drivers include urbanization, concerns about dust and sand exposure, and the widespread use of air conditioning that exacerbates indoor pollution. Demand is high for barrier-protective and SPF-heavy formulations. While price sensitivity limits mass adoption in parts of Africa, Gulf countries such as the UAE and Saudi Arabia are strong premium markets for luxury anti-pollution skincare.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The global anti-pollution skincare products market's competitive landscape includes large beauty conglomerates, regional powerhouses, and an expanding set of indie/derm brands. Collectively, top multinational players (L’Oréal, Unilever, Shiseido, Estée Lauder, P&G) capture a substantial portion of global revenue in mainstream channels, while specialist players and startups capture premium niches and local preferences.

Key Players in the Anti-Pollution Skincare Market

- L’Oréal S.A.

- Unilever Plc

- Shiseido Company, Ltd.

- The Estée Lauder Companies Inc.

- Procter & Gamble Co.

- Beiersdorf AG

- Amorepacific Corporation

- Johnson & Johnson

- Kao Corporation

- Natura &Co

- Kose Corporation

- Dr. Jart+ (Estée Lauder)

- Clinique Laboratories (Estée Lauder)

- Herbivore Botanicals

- Innisfree (Amorepacific)

Recent Developments

- April 3, 2025 – BASF introduced natural-based personal care innovations, including biodegradable alternatives for anti-pollution and holistic skin health, at in-cosmetics Global in Amsterdam.