Anti-Mould Paint Market Size

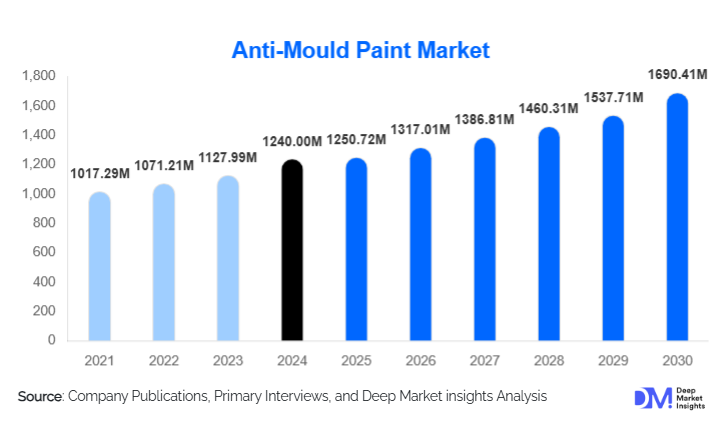

According to Deep Market Insights, the global anti-mould paint market size was valued at USD 1,240.00 million in 2024 and is projected to grow from USD 1,305.72 million in 2025 to reach USD 1,690.41 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The market growth is driven by the rising awareness of indoor air quality, increasing construction activities across residential and commercial sectors, and growing adoption of eco-friendly and low-VOC coatings designed to prevent microbial growth on walls and surfaces.

Key Market Insights

- Rising demand for moisture-resistant coatings is fueling the adoption of anti-mould paints, especially in humid and coastal regions.

- Green building trends are boosting demand for low-odor, eco-certified, and water-based anti-mould formulations.

- Residential applications dominate the market, driven by home renovation trends and health-conscious consumer behavior.

- Asia-Pacific leads the global market share due to rapid urbanization, large-scale infrastructure development, and high humidity levels in the region.

- Technological innovation, including the use of nano-silver and anti-microbial additives, is enhancing product performance and durability.

- Major paint manufacturers are expanding their product portfolios through sustainable formulations and region-specific product lines.

Latest Market Trends

Eco-Friendly and Low-VOC Paint Formulations

Consumers and builders are increasingly prioritizing paints that are both effective against mould and environmentally safe. Water-based anti-mould paints with low or zero VOC emissions are becoming the industry standard. These formulations align with global sustainability regulations and green certification programs such as LEED. Manufacturers are introducing bio-based resins, anti-bacterial agents derived from natural sources, and odor-free solutions that cater to both residential and commercial environments. This shift toward non-toxic, sustainable paints is expected to significantly influence market demand over the next decade.

Integration of Smart Coating Technologies

Technological advancements are enabling smart paint formulations capable of responding to environmental changes. Some anti-mould coatings now feature self-cleaning, moisture-sensing, and UV-resistant properties, extending surface life and reducing maintenance costs. Nanotechnology-based additives are increasingly used to enhance antimicrobial effectiveness and surface adhesion. This innovation-driven trend appeals to modern construction projects that prioritize both aesthetics and longevity, particularly in commercial spaces, healthcare facilities, and educational institutions.

Anti-Mould Paint Market Drivers

Rising Health Awareness and Indoor Air Quality Concerns

Growing awareness of the health risks associated with mould exposure, such as respiratory issues and allergies, is propelling the market. Governments and health organizations are issuing stricter guidelines for indoor hygiene, especially in public infrastructure, hospitals, and schools. As a result, consumers are increasingly investing in anti-mould paints as part of preventive health measures. This factor is particularly prominent in developed markets like North America and Europe, where the emphasis on indoor air quality continues to strengthen.

Growth in Residential Construction and Renovation

The expansion of residential construction, coupled with rising renovation spending, is a key driver for the anti-mould paint market. Homeowners are prioritizing products that offer both aesthetic appeal and functional protection against moisture damage. Bathroom, kitchen, and basement applications are especially significant, where high humidity often leads to fungal growth. The surge in urban housing projects across the Asia-Pacific and the Middle East further strengthens long-term market prospects.

Market Restraints

High Cost of Advanced Formulations

Premium anti-mould paints incorporating advanced additives such as nano-silver particles or antimicrobial agents are relatively expensive compared to traditional coatings. This price disparity limits adoption among cost-sensitive consumers in developing economies. Additionally, higher production and R&D costs associated with eco-friendly formulations can restrain profitability for smaller manufacturers.

Limited Awareness in Emerging Markets

Despite rising global demand, awareness of anti-mould paints remains limited in several developing regions. In rural and semi-urban areas, consumers often rely on conventional wall coatings without protective properties. Lack of education on the health impacts of mould and insufficient marketing outreach continue to restrict market penetration in such regions.

Anti-Mould Paint Market Opportunities

Rising Demand in Commercial and Institutional Buildings

Hospitals, schools, hotels, and office spaces are increasingly adopting anti-mould paints as part of their maintenance and hygiene protocols. This growing institutional demand presents a strong opportunity for manufacturers to develop durable, washable, and quick-drying coatings suited for large-scale application. Partnerships with commercial builders and interior design firms are expected to further expand B2B market reach.

Product Innovation and Customization

Innovations in color durability, texture, and anti-fungal technology are creating differentiation opportunities. Paint producers are also offering customized formulations designed for specific climates, such as high-humidity coastal areas or cold regions prone to condensation. Digital tools like augmented reality paint preview apps and online product customization are enhancing customer engagement and brand loyalty.

Product Type Insights

Water-based anti-mould paints dominate the market, driven by low-VOC regulations, ease of use, and consumer preference for eco-friendly solutions. Their low odor, fast-drying nature, and DIY suitability make them particularly popular across residential and retail channels, especially in developed markets with strict environmental standards. Manufacturers are expanding product lines with low-VOC and odorless variants to meet certified sustainability requirements.

Solvent-based formulations continue to serve heavy-duty and exterior applications where water resistance and long-term durability are critical, such as in industrial, marine, or humid outdoor environments. However, this segment faces regulatory headwinds due to rising VOC emission restrictions, prompting gradual market share migration toward advanced waterborne and hybrid alternatives.

Powder and specialty coatings represent a niche but growing segment in industrial settings requiring high chemical and corrosion resistance, such as food processing or pharmaceutical facilities. These products provide long service life and superior adhesion, aligning with operational performance standards.

Bio-based and eco-friendly paints are the fastest-growing premium category, supported by institutional procurement policies and corporate sustainability goals. Green-certified paints using natural binders or bio-based resins are being increasingly specified in schools, hospitals, and commercial projects. Their higher margins and alignment with “healthy building” trends ensure sustained growth momentum.

Application Insights

Interiors, particularly bathrooms, kitchens, and basements, remain the leading application area, as these high-moisture environments present the greatest risk of mould growth. Consumers are willing to pay a premium for targeted anti-mould bathroom paints that offer washability and long-lasting protection. Post-pandemic health consciousness and home-improvement spending are further fueling this demand.

Exterior applications are expanding, driven by weatherproofing and façade maintenance cycles in humid and coastal climates. Builders increasingly specify exterior anti-mould coatings to reduce algae and fungal growth on facades, extending repaint cycles and lowering maintenance costs. Industrial and specialty applications are growing as performance-based procurement becomes standard in hygiene-critical sectors such as pharmaceutical, food processing, and water infrastructure. Here, chemical resistance and longevity drive specification-based contract wins, particularly for certified antimicrobial formulations that meet global standards.

Distribution Channel Insights

Professional and contractor-led distribution channels account for a major share of market revenue, particularly across new construction and retrofit projects. High-value institutional and commercial contracts prefer certified anti-mould coatings sourced through professional networks and B2B partnerships. Builder and architect specifications increasingly favor low-VOC and biocide-approved paints for compliance with building regulations.

Retail, DIY, and e-commerce channels are witnessing rapid growth, especially in developed economies where homeowners are actively engaged in renovation and maintenance. Online platforms provide accessibility and competitive pricing while enabling brands to highlight certifications, performance data, and sustainability features. The growing popularity of “healthy home” campaigns is boosting consumer-oriented sales through both physical and digital retail formats.

| By Product Type | By Active Technology / Mechanism | By Application | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing regional market for anti-mould paints, supported by rapid urbanization, massive construction and renovation activity, and humid/tropical climates. Countries such as China, India, Indonesia, and Malaysia are leading consumers due to expanding residential infrastructure and government housing programs. Rising awareness of mould prevention and a growing middle-class population with improving purchasing power further support sustained demand. Government-led green building mandates and energy-efficient construction initiatives are also driving the adoption of eco-certified coatings.

Europe

Europe remains a mature but steadily advancing market driven by stringent environmental standards, building codes, and chemical regulations. High adoption rates in the U.K., Germany, France, and Scandinavia are fueled by demand for breathable, low-VOC coatings compatible with energy-efficient retrofits that increase building airtightness. The region’s emphasis on sustainability and occupant health continues to encourage innovation in biocide-free and vapor-permeable formulations. Established R&D ecosystems and active EU regulatory oversight ensure ongoing modernization of anti-mould technologies.

North America

North America shows strong, consistent growth underpinned by increased focus on indoor air quality (IAQ), high professional renovation expenditure, and strict VOC compliance standards. The U.S. market benefits from widespread awareness of health risks associated with mould, along with high rates of home renovation and remodeling. Institutional and commercial buildings increasingly specify low-VOC and antimicrobial paints to meet health and safety certification requirements. Canada’s humid climate in certain provinces also supports the use of moisture-resistant coatings in residential basements and bathrooms.

Latin America

Latin America is emerging as a promising market for anti-mould paints, supported by growing middle-class home-improvement trends and increasing awareness of mold-related health concerns in humid regions. Countries such as Brazil, Mexico, and Colombia are leading adopters, particularly in coastal and urbanized zones with high moisture levels. While affordability remains key, the region shows rising interest in premium and mid-tier anti-mould coatings among urban homeowners and hospitality operators. International paint brands are expanding retail presence and awareness campaigns to strengthen market penetration.

Middle East & Africa (MEA)

The Middle East & Africa region is witnessing steady growth potential backed by infrastructure development, hospitality investments, and rising awareness of indoor climate challenges. High humidity and condensation issues in coastal cities, coupled with large-scale commercial projects in GCC nations, drive demand for high-performance interior and exterior coatings. Retrofit and maintenance markets in older urban buildings represent a growing secondary opportunity. Energy-efficient and anti-condensation paints are also gaining interest in new smart city developments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Anti-Mould Paint Market

- AkzoNobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- DuluxGroup Ltd.

- Asian Paints Ltd.

- Kansai Paint Co., Ltd.

- Jotun Group

- Berger Paints India Ltd.

- Benjamin Moore & Co.

Recent Developments

- In August 2025, AkzoNobel launched a new range of bio-based anti-mould paints under its Dulux brand, featuring low-VOC and high humidity resistance technology.

- In June 2025, Nippon Paint introduced an antimicrobial wall coating series in India, combining mould resistance with air-purifying properties for residential interiors.

- In March 2025, PPG Industries expanded its production capacity in Southeast Asia to meet growing demand for protective and decorative coatings in tropical markets.